Md Form 510 Instructions

Md Form 510 Instructions - Pick the template in the library. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. This form may be used if the pte is paying tax only on. Maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. Check here if electing to remit tax on behalf. The special nonresident tax is. In order to use the online system you must meet the. Taxformfinder has an additional 41 maryland income tax forms that you may need, plus all federal income. Web adhere to our simple steps to get your state of maryland form 510 instructions well prepared quickly: Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e.

This form may be used if the pte is paying tax only on. The special nonresident tax is. Web use form 510 as a worksheet. Web adhere to our simple steps to get your state of maryland form 510 instructions well prepared quickly: Web income tax, also file form 510. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Web form 510 is a maryland corporate income tax form. Web fy 2024 strategic goals. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation.

Web income tax, also file form 510. In order to use the online system you must meet the. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. This form may be used if the pte is paying tax only on. Maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. Web file now with turbotax other maryland corporate income tax forms: Web use form 510 as a worksheet. Check here if electing to remit tax on behalf. Web form 510 is a maryland corporate income tax form.

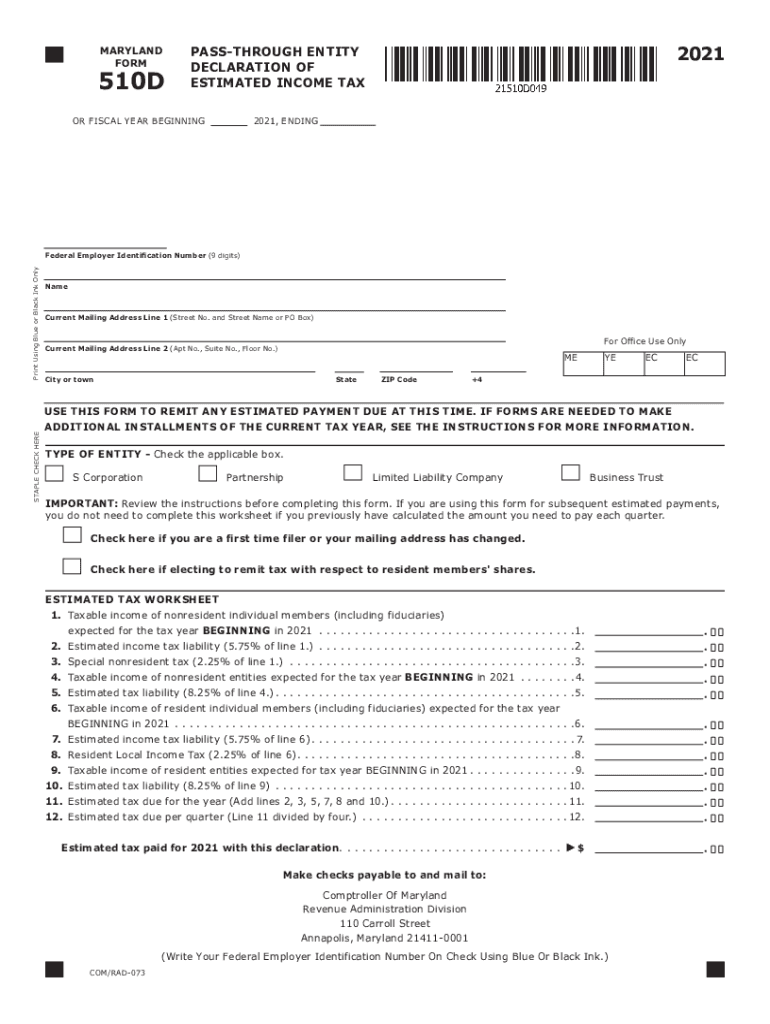

Md 510D Fill Out and Sign Printable PDF Template signNow

Web file now with turbotax other maryland corporate income tax forms: Web adhere to our simple steps to get your state of maryland form 510 instructions well prepared quickly: Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. This form may be used if the pte is paying.

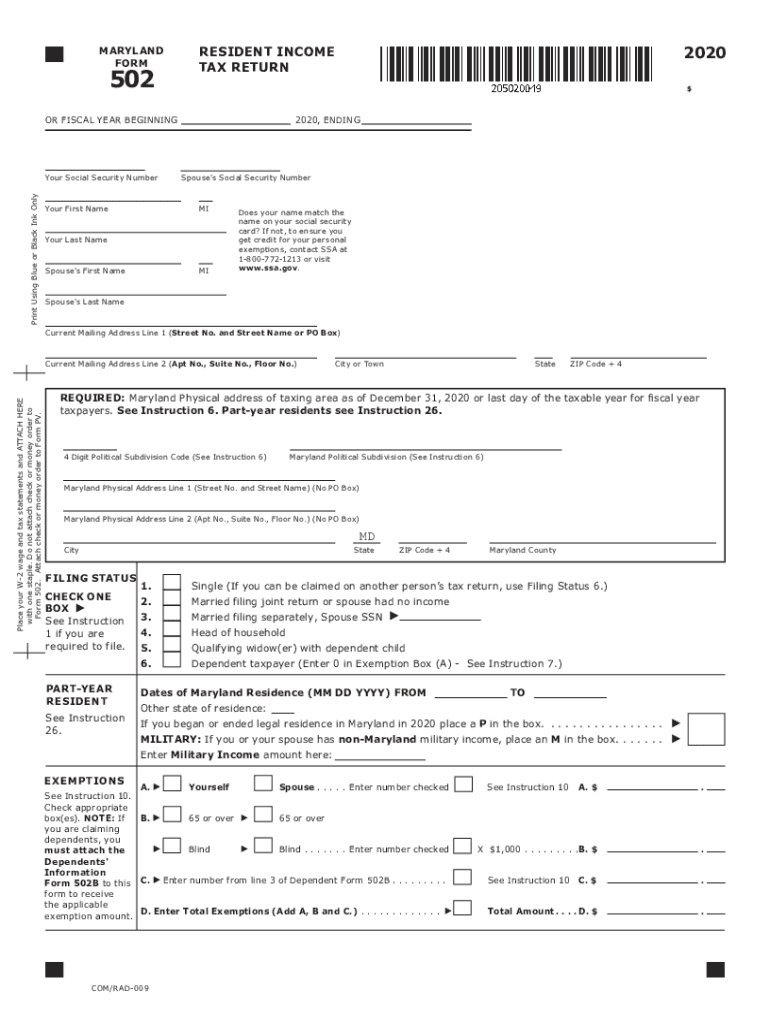

MD Comptroller 502 2020 Fill out Tax Template Online US Legal Forms

Web form 510 is a maryland corporate income tax form. Web adhere to our simple steps to get your state of maryland form 510 instructions well prepared quickly: Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. This form may be used if the pte is paying tax.

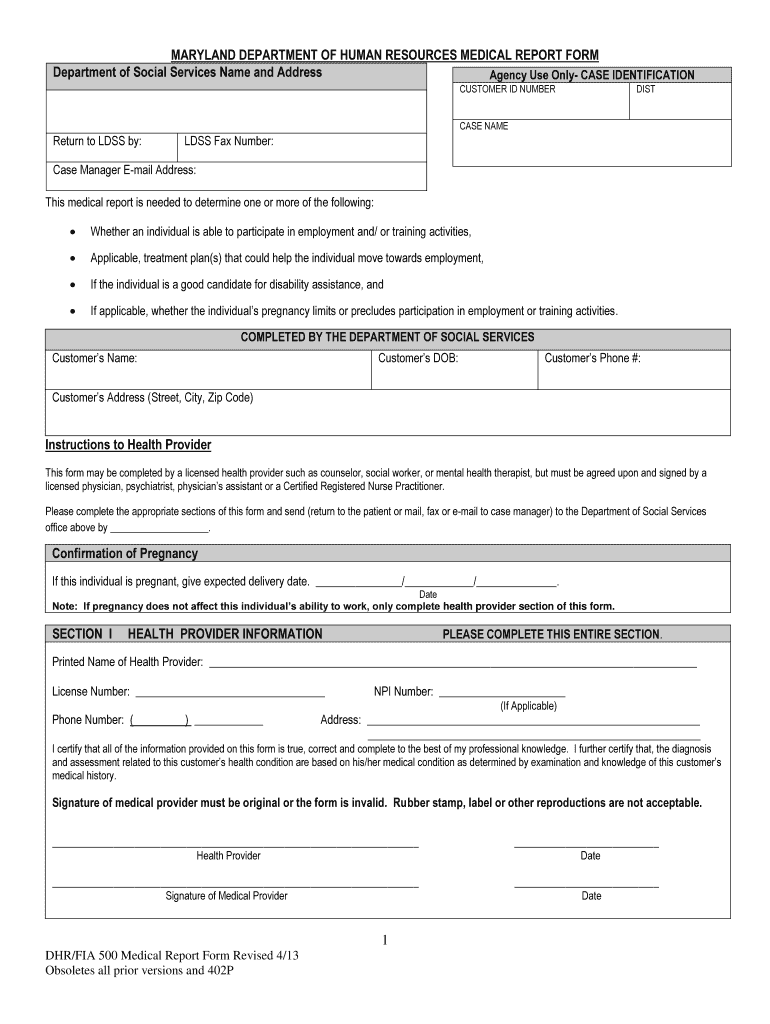

Form 202 Maryland Fill Online, Printable, Fillable, Blank pdfFiller

Web use form 510 as a worksheet. Web adhere to our simple steps to get your state of maryland form 510 instructions well prepared quickly: Web form 510 is a maryland corporate income tax form. Web file now with turbotax other maryland corporate income tax forms: Maryland has a special nonresident tax that the pte must pay on behalf of.

Md Medical Form Fill Out and Sign Printable PDF Template signNow

Web adhere to our simple steps to get your state of maryland form 510 instructions well prepared quickly: Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. Web file.

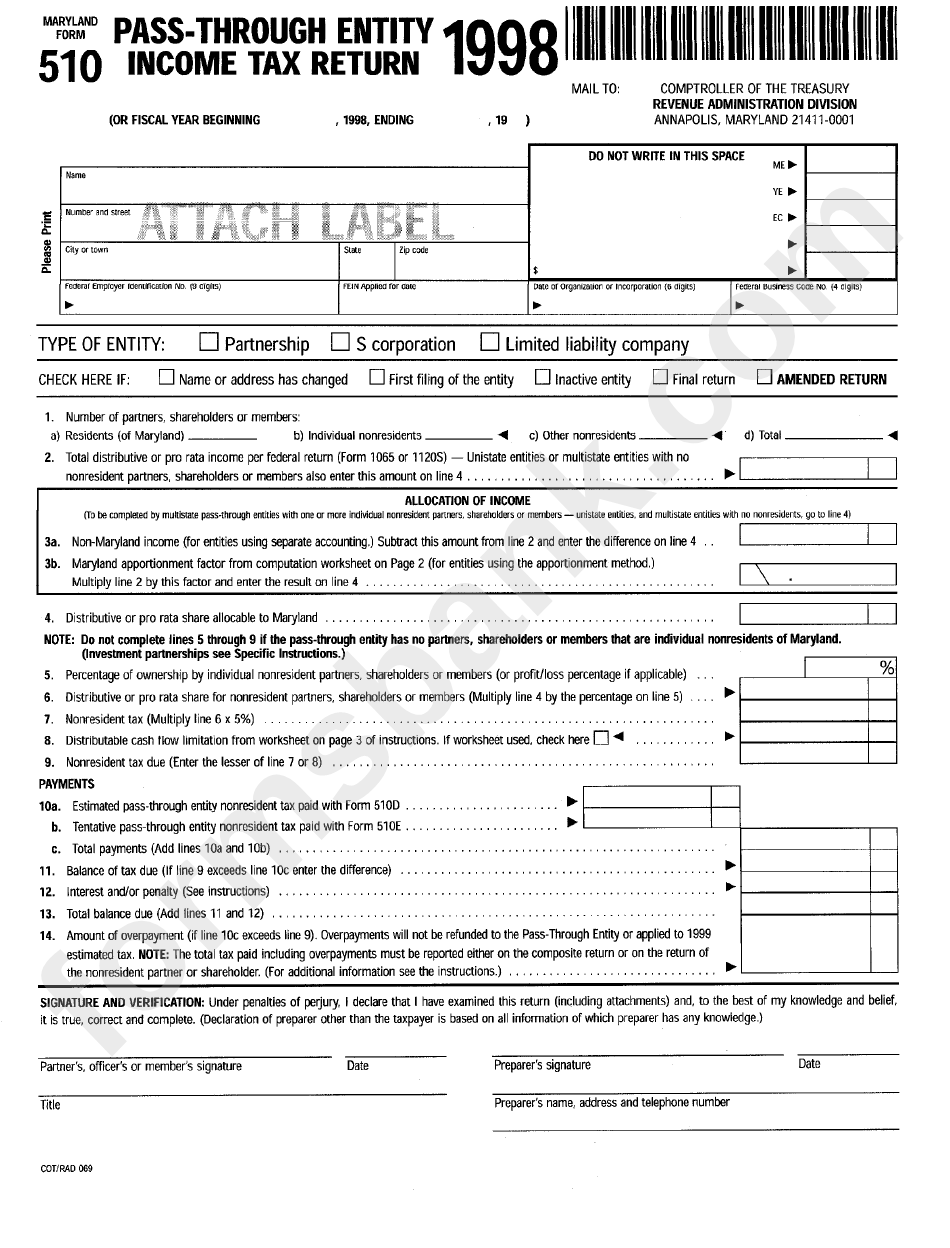

Fillable Maryland Form 510 PassThrough Entity Tax Return

Web use form 510 as a worksheet. The special nonresident tax is. Web adhere to our simple steps to get your state of maryland form 510 instructions well prepared quickly: Maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. In order to use the online system you must.

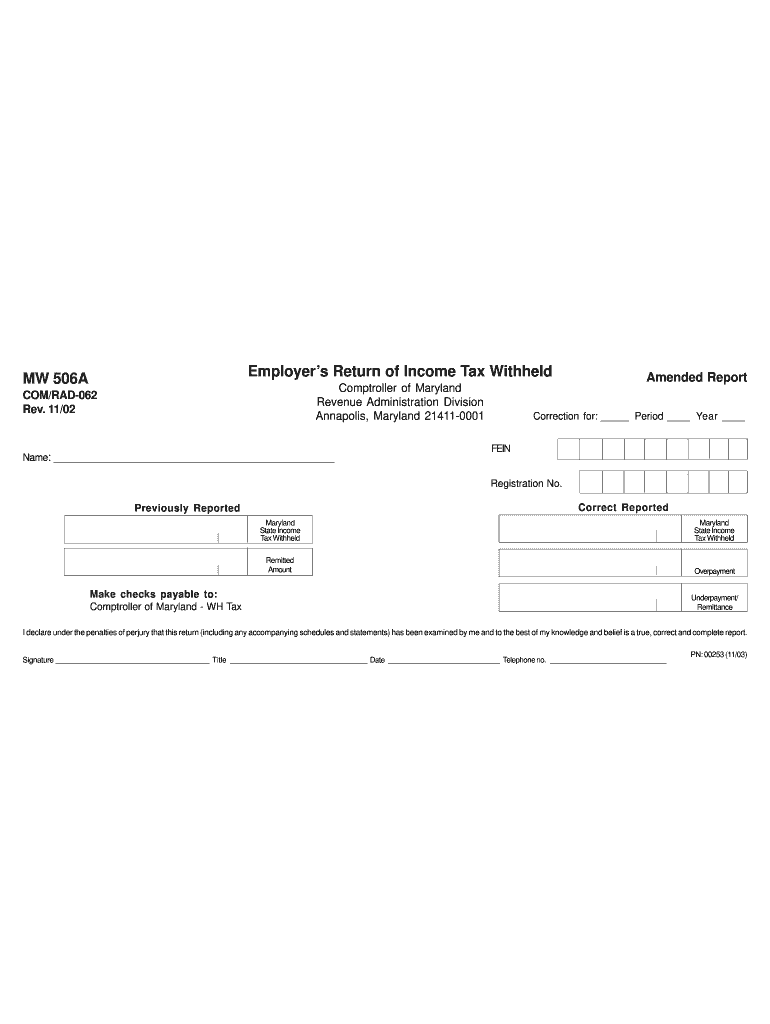

2002 Form MD Comptroller MW506A Fill Online, Printable, Fillable, Blank

Check here if electing to remit tax on behalf. Pick the template in the library. Web use form 510 as a worksheet. Web form 510 is a maryland corporate income tax form. Web file now with turbotax other maryland corporate income tax forms:

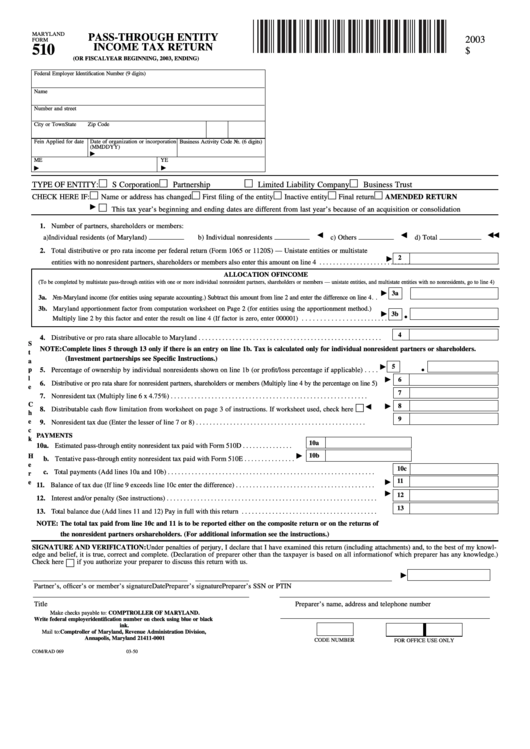

Fillable Form 510 PassThrough Entity Tax Return 2003

Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members.

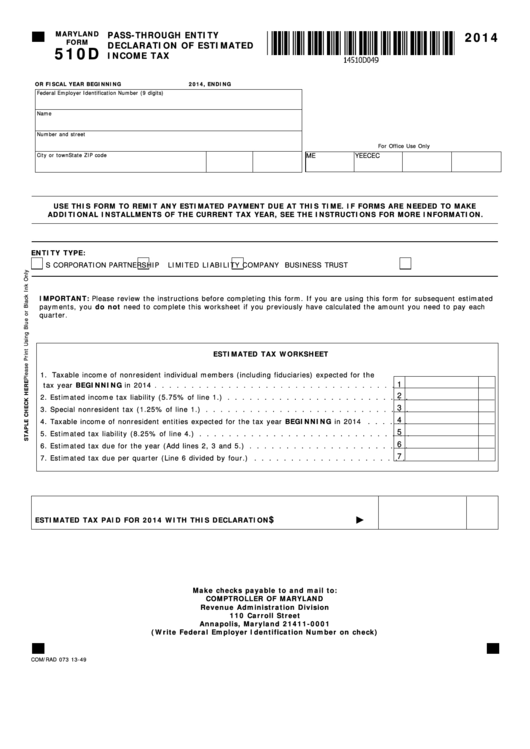

Fillable Maryland Form 510d PassThrough Entity Declaration Of

Taxformfinder has an additional 41 maryland income tax forms that you may need, plus all federal income. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Check here if electing to remit tax on behalf. Pick the template in the library. Web fy 2024 strategic goals.

elliemeyersdesigns Maryland Form 510

This form may be used if the pte is paying tax only on. Web form 510 is a maryland corporate income tax form. In order to use the online system you must meet the. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. The special nonresident tax is.

2017 MD Form 548 Fill Online, Printable, Fillable, Blank pdfFiller

This form may be used if the pte is paying tax only on. Check here if electing to remit tax on behalf. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Taxformfinder has an additional 41 maryland income tax forms that you may need, plus all federal income. Web form.

The Special Nonresident Tax Is.

More about the maryland form 510 tax return we last. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Pick the template in the library. Web income tax, also file form 510.

Web File Now With Turbotax Other Maryland Corporate Income Tax Forms:

Maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. Check here if electing to remit tax on behalf. This form may be used if the pte is paying tax only on. Web use form 510 as a worksheet.

Taxformfinder Has An Additional 41 Maryland Income Tax Forms That You May Need, Plus All Federal Income.

Web fy 2024 strategic goals. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Web form 510 is a maryland corporate income tax form.

Web Adhere To Our Simple Steps To Get Your State Of Maryland Form 510 Instructions Well Prepared Quickly:

In order to use the online system you must meet the.