Medicare Irmaa Life Changing Event Form

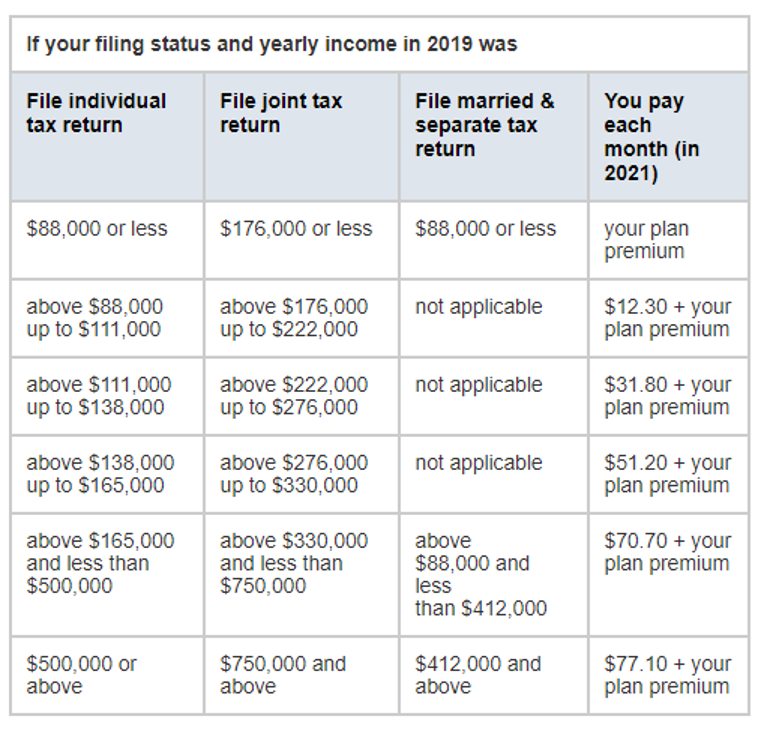

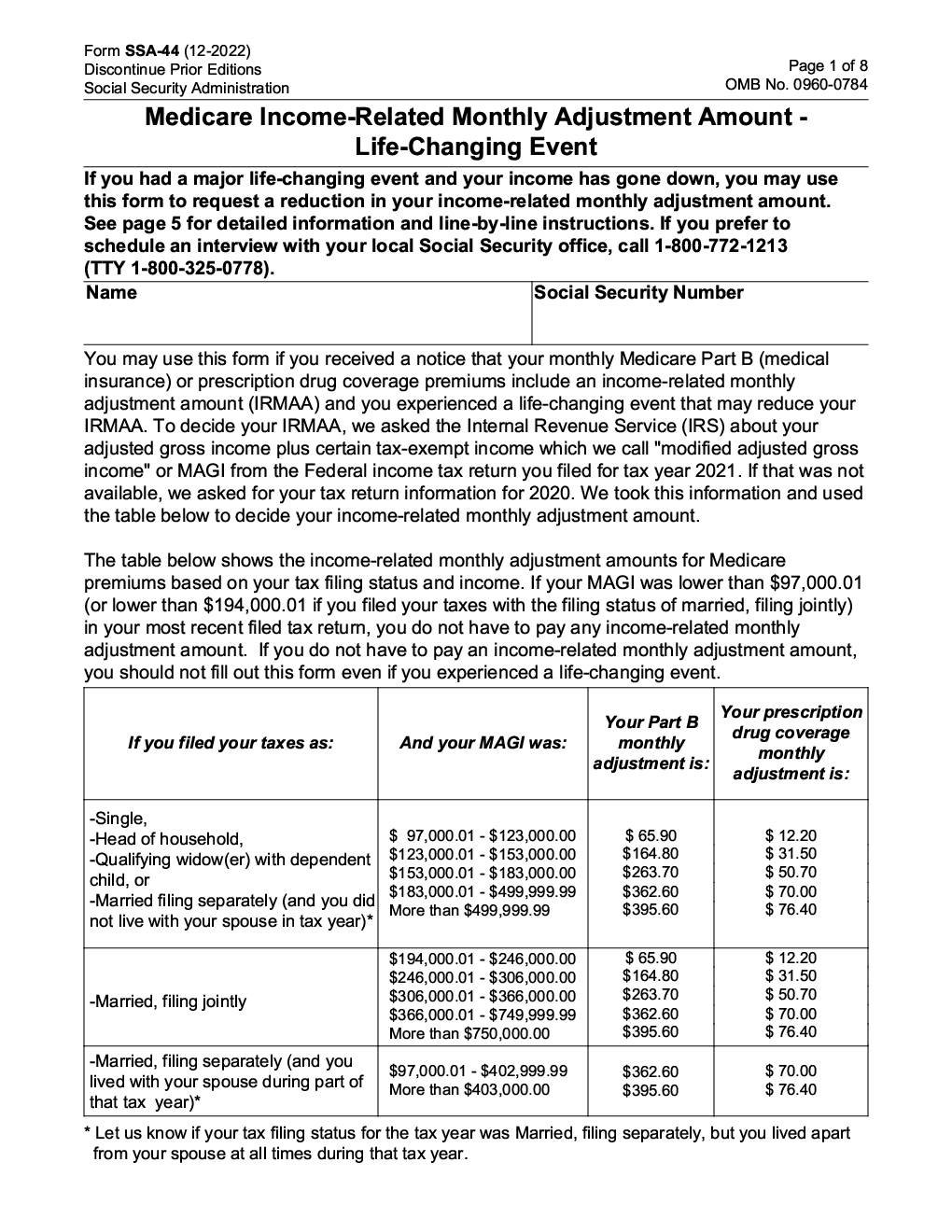

Medicare Irmaa Life Changing Event Form - You will need to provide. If your income has gone down, you may also use. Policy a beneficiary may request and qualify for the use of a more recent tax year to determine irmaa based on a reduction in magi after the beneficiary, the. You will need to provide. Here are the seven life. Do not submit the paperwork until you’ve received your irmaa determination letter stating you are subject to irmaa. Social security administration) form is 8 pages long and contains:. Policy a beneficiary may request and qualify for use of a more recent tax year to determine irmaa based on a reduction in the beneficiary's (and/or spouse's). Web you'll get this notice if you have medicare part b and/or part d and social security determines that any income related monthly adjustment amounts (irmaa) apply to. If you are unsure of your magi,.

Here are the seven life. Web the 2023 medicare irmaa surcharge kicks in when modified adjusted gross income exceeds $91,000 for single taxpayers or $182,000 for married couples filing. You will need to provide. Policy a beneficiary may request and qualify for the use of a more recent tax year to determine irmaa based on a reduction in magi after the beneficiary, the. If you are unsure of your magi,. If your income has gone down, you may also use. Do not submit the paperwork until you’ve received your irmaa determination letter stating you are subject to irmaa. Social security administration) form is 8 pages long and contains:. Policy a beneficiary may request and qualify for use of a more recent tax year to determine irmaa based on a reduction in the beneficiary's (and/or spouse's). Web you'll get this notice if you have medicare part b and/or part d and social security determines that any income related monthly adjustment amounts (irmaa) apply to.

Web you'll get this notice if you have medicare part b and/or part d and social security determines that any income related monthly adjustment amounts (irmaa) apply to. If you are unsure of your magi,. Policy a beneficiary may request and qualify for the use of a more recent tax year to determine irmaa based on a reduction in magi after the beneficiary, the. Policy a beneficiary may request and qualify for use of a more recent tax year to determine irmaa based on a reduction in the beneficiary's (and/or spouse's). Here are the seven life. You will need to provide. Do not submit the paperwork until you’ve received your irmaa determination letter stating you are subject to irmaa. You will need to provide. Social security administration) form is 8 pages long and contains:. Web the 2023 medicare irmaa surcharge kicks in when modified adjusted gross income exceeds $91,000 for single taxpayers or $182,000 for married couples filing.

IRMAA Related Monthly Adjustment Amounts Guide to Health

You will need to provide. You will need to provide. Social security administration) form is 8 pages long and contains:. Do not submit the paperwork until you’ve received your irmaa determination letter stating you are subject to irmaa. Policy a beneficiary may request and qualify for the use of a more recent tax year to determine irmaa based on a.

How MAGI and IRMAA Can Lower Your Healthcare Costs Springwater Wealth

Web you'll get this notice if you have medicare part b and/or part d and social security determines that any income related monthly adjustment amounts (irmaa) apply to. Policy a beneficiary may request and qualify for the use of a more recent tax year to determine irmaa based on a reduction in magi after the beneficiary, the. Web the 2023.

Form SSA44. Medicare Monthly Adjustment Amount (IRMAA

You will need to provide. If you are unsure of your magi,. Policy a beneficiary may request and qualify for the use of a more recent tax year to determine irmaa based on a reduction in magi after the beneficiary, the. Policy a beneficiary may request and qualify for use of a more recent tax year to determine irmaa based.

NY Medicare Specialists Leaving Employer Coverage

Policy a beneficiary may request and qualify for the use of a more recent tax year to determine irmaa based on a reduction in magi after the beneficiary, the. If you are unsure of your magi,. Here are the seven life. You will need to provide. Do not submit the paperwork until you’ve received your irmaa determination letter stating you.

How to Appeal Medicare IRMAA MedicareQuick

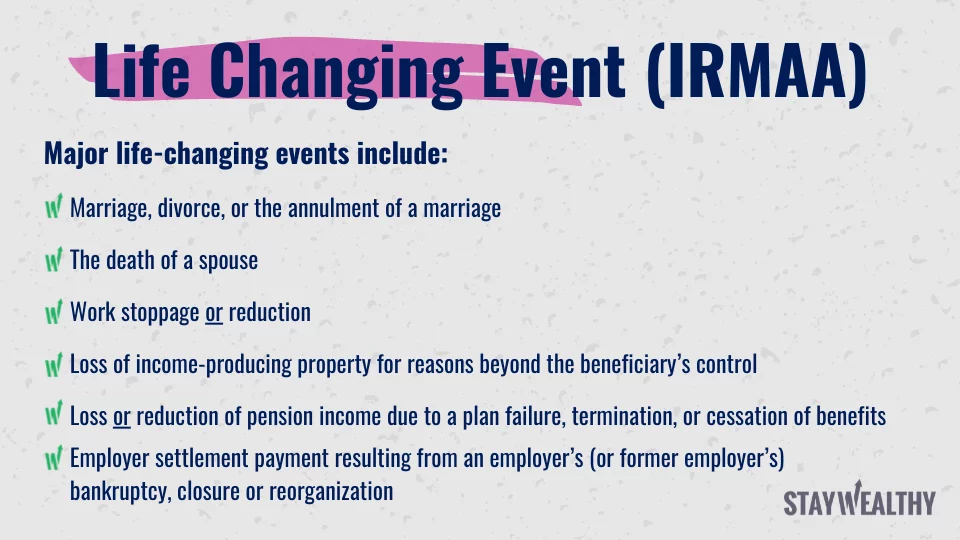

Here are the seven life. If you are unsure of your magi,. Web the 2023 medicare irmaa surcharge kicks in when modified adjusted gross income exceeds $91,000 for single taxpayers or $182,000 for married couples filing. Web you'll get this notice if you have medicare part b and/or part d and social security determines that any income related monthly adjustment.

How to Steer Clear of Medicare’s IRMAA Tax Cliff and Save Thousands in

Web you'll get this notice if you have medicare part b and/or part d and social security determines that any income related monthly adjustment amounts (irmaa) apply to. Social security administration) form is 8 pages long and contains:. Here are the seven life. Policy a beneficiary may request and qualify for use of a more recent tax year to determine.

Should you appeal your Medicare IRMAA charges? MarketWatch

Web you'll get this notice if you have medicare part b and/or part d and social security determines that any income related monthly adjustment amounts (irmaa) apply to. You will need to provide. Do not submit the paperwork until you’ve received your irmaa determination letter stating you are subject to irmaa. Here are the seven life. If your income has.

2023 IRMAA Brackets What Are They + How to Avoid IRMAA

If you are unsure of your magi,. Web you'll get this notice if you have medicare part b and/or part d and social security determines that any income related monthly adjustment amounts (irmaa) apply to. Policy a beneficiary may request and qualify for use of a more recent tax year to determine irmaa based on a reduction in the beneficiary's.

What to Know Social Security & Medicare IRMAA — Open Window

Do not submit the paperwork until you’ve received your irmaa determination letter stating you are subject to irmaa. You will need to provide. Policy a beneficiary may request and qualify for use of a more recent tax year to determine irmaa based on a reduction in the beneficiary's (and/or spouse's). Web you'll get this notice if you have medicare part.

Understanding 2020 Medicare Premiums and IRMAA Surcharges Your Money

Web the 2023 medicare irmaa surcharge kicks in when modified adjusted gross income exceeds $91,000 for single taxpayers or $182,000 for married couples filing. Web you'll get this notice if you have medicare part b and/or part d and social security determines that any income related monthly adjustment amounts (irmaa) apply to. Do not submit the paperwork until you’ve received.

You Will Need To Provide.

Web the 2023 medicare irmaa surcharge kicks in when modified adjusted gross income exceeds $91,000 for single taxpayers or $182,000 for married couples filing. You will need to provide. Web you'll get this notice if you have medicare part b and/or part d and social security determines that any income related monthly adjustment amounts (irmaa) apply to. Policy a beneficiary may request and qualify for use of a more recent tax year to determine irmaa based on a reduction in the beneficiary's (and/or spouse's).

Social Security Administration) Form Is 8 Pages Long And Contains:.

Do not submit the paperwork until you’ve received your irmaa determination letter stating you are subject to irmaa. If your income has gone down, you may also use. Policy a beneficiary may request and qualify for the use of a more recent tax year to determine irmaa based on a reduction in magi after the beneficiary, the. Here are the seven life.