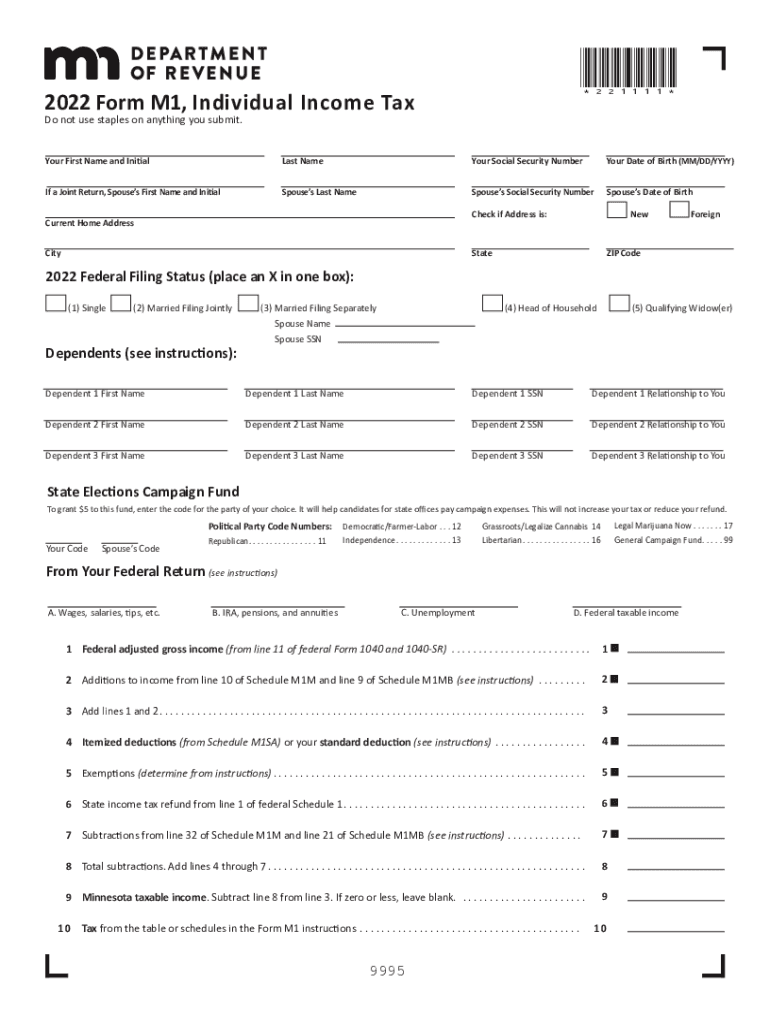

Minnesota Form M1 Instructions

Minnesota Form M1 Instructions - Additions to income from line 10 of schedule m1m and line 9 of schedule m1mb (see. Do not write extra numbers, symbols, or notes on your return, such as decimal. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Use your legal name, not a nickname. Do not use staples on anything you submit. If the total is $12,400 or more, you must file a minnesota income tax return and schedule m1nr. Do not use staples on anything you submit. We will send rebate payments this fall to those who qualify. Leave lines blank if they do not apply to you or if the amount is zero. Web add step 1 and step 2.

Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of. Web filing a paper income tax return. Additions to income from line 10 of schedule m1m and line 9 of schedule m1mb (see. 3/4/22 to file electronically, go to www.revenue.state.mn.us go to www.revenue.state.mn.us to: Round your amounts to the nearest whole dollar. We will send rebate payments this fall to those who qualify. Field_block:node:page:field_paragraph complete form m1 on screen [+] download form m1 , individual income tax. *191111* 2019 federal filing status (place an x in one box):. Web 2021 form m1, individual income tax. Do not write extra numbers, symbols, or notes on your return, such as decimal.

Web 2019 form m1, individual income tax leave unused boxes blank. Do not use staples on anything you submit. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. If the total is $12,400 or more, you must file a minnesota income tax return and schedule m1nr. Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Web filing a paper income tax return. Do not write extra numbers, symbols, or notes on your return, such as decimal. Web add step 1 and step 2. We will send rebate payments this fall to those who qualify. Do not use staples on anything you submit.

Minnesota Tax Table M1 Instructions 2020

Do not use staples on anything you submit. Web filing a paper income tax return. Additions to income from line 10 of schedule m1m and line 9 of schedule m1mb (see. Use your legal name, not a nickname. Web 2019 form m1, individual income tax leave unused boxes blank.

Minnesota Tax Forms Fill Out and Sign Printable PDF Template signNow

Leave lines blank if they do not apply to you or if the amount is zero. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of. Round your amounts to the nearest whole dollar. Use your legal name, not a nickname. Minnesota individual income tax applies to residents and nonresidents who meet the state's.

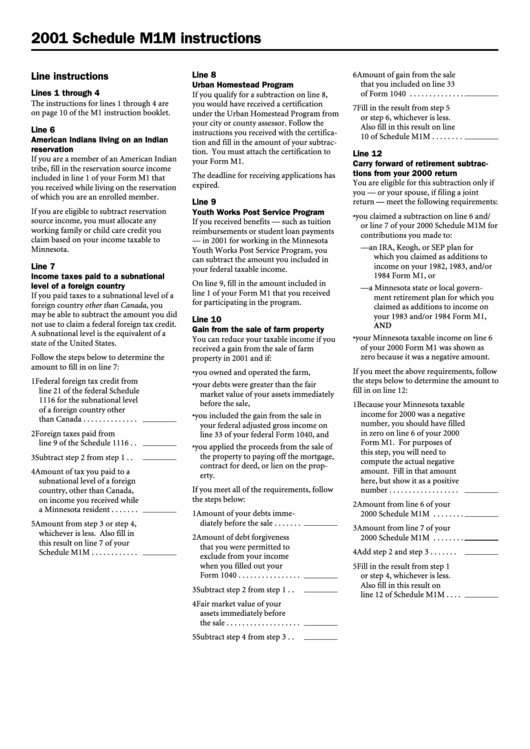

Schedule M1m Instructions 2001 printable pdf download

Web filing a paper income tax return. Web add step 1 and step 2. Do not use staples on anything you submit. Additions to income from line 10 of schedule m1m and line 9 of schedule m1mb (see. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of.

Minnesota tax forms Fill out & sign online DocHub

Field_block:node:page:field_paragraph complete form m1 on screen [+] download form m1 , individual income tax. Leave lines blank if they do not apply to you or if the amount is zero. 3/4/22 to file electronically, go to www.revenue.state.mn.us go to www.revenue.state.mn.us to: Web filing a paper income tax return. Additions to income from line 10 of schedule m1m and line 9.

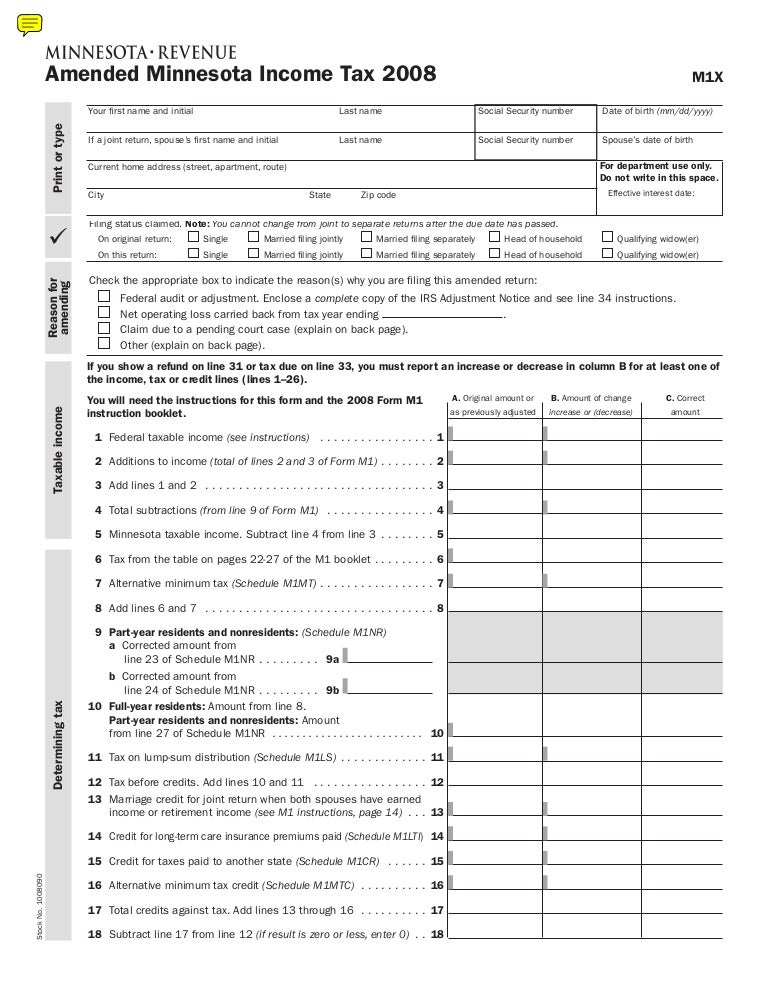

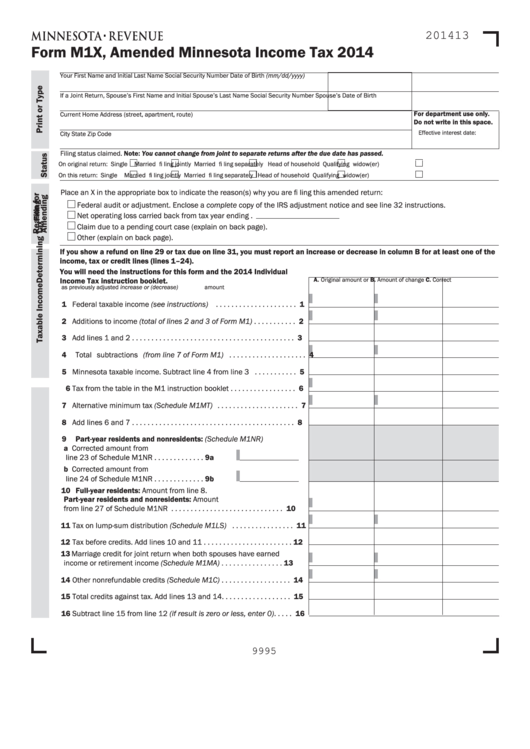

M1X taxes.state.mn.us

Web add step 1 and step 2. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. If the total is $12,400 or more, you must file a minnesota income tax return and schedule m1nr. *191111* 2019 federal filing status (place an x in one box):. Web we last updated the minnesota individual income.

Minnesota Tax Table M1 Instructions 2021

Do not write extra numbers, symbols, or notes on your return, such as decimal. Web 2019 form m1, individual income tax leave unused boxes blank. Web add step 1 and step 2. If the total is $12,400 or more, you must file a minnesota income tax return and schedule m1nr. Before starting your minnesota income tax return ( form m1.

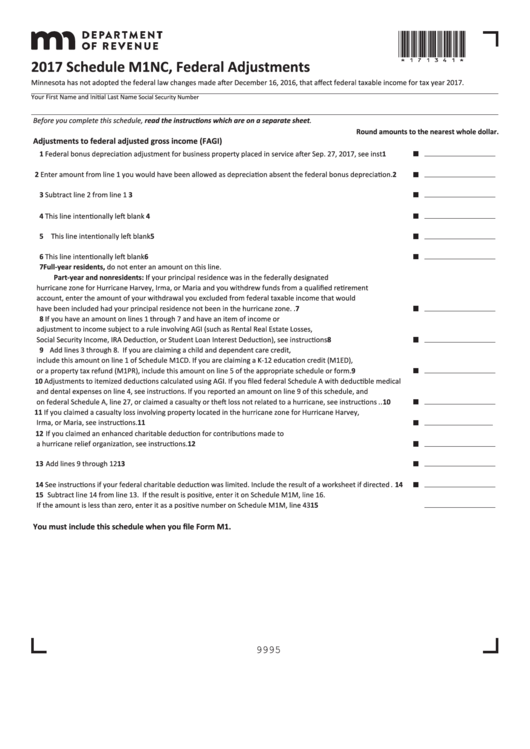

Fillable Schedule M1nc Federal Adjustments 2017 printable pdf download

Do not write extra numbers, symbols, or notes on your return, such as decimal. We will send rebate payments this fall to those who qualify. 3/4/22 to file electronically, go to www.revenue.state.mn.us go to www.revenue.state.mn.us to: Web we last updated the minnesota individual income tax instructions (form m1) in february 2023,. Leave lines blank if they do not apply to.

Minnesota State Tax Table M1

Web add step 1 and step 2. Additions to income from line 10 of schedule m1m and line 9 of schedule m1mb (see. Web 2019 form m1, individual income tax leave unused boxes blank. Use your legal name, not a nickname. Field_block:node:page:field_paragraph complete form m1 on screen [+] download form m1 , individual income tax.

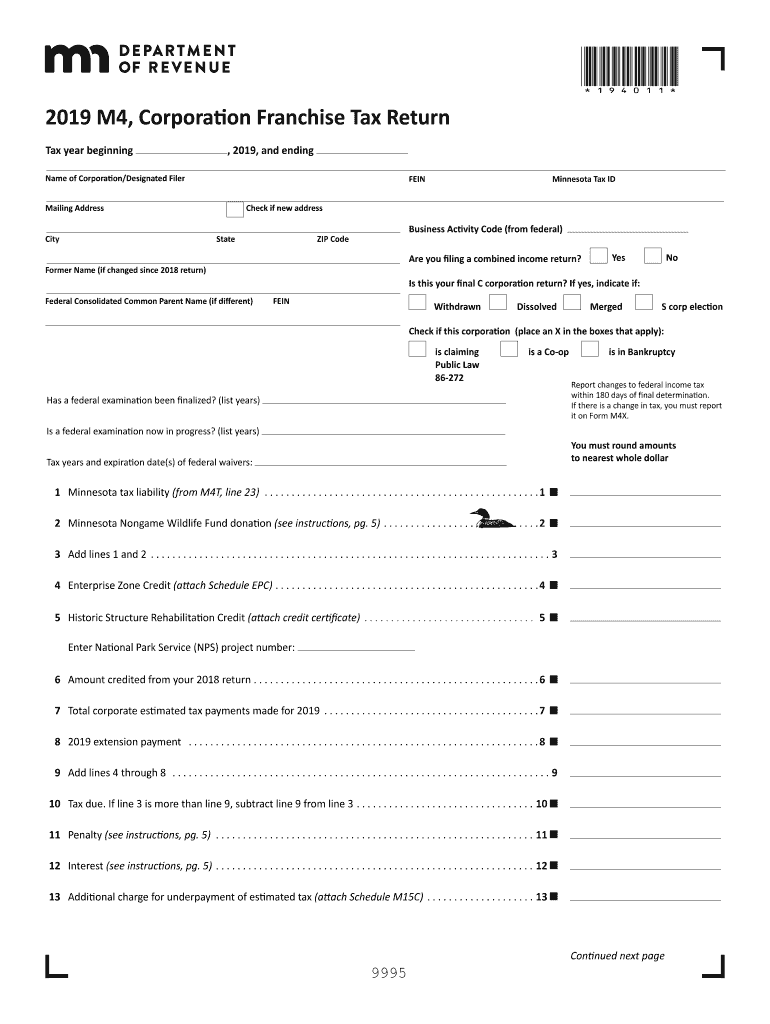

Minnesota M4 Form Fill Out and Sign Printable PDF Template signNow

*191111* 2019 federal filing status (place an x in one box):. Additions to income from line 10 of schedule m1m and line 9 of schedule m1mb (see. Leave lines blank if they do not apply to you or if the amount is zero. Do not use staples on anything you submit. 3/4/22 to file electronically, go to www.revenue.state.mn.us go to.

Minnesota Estimated Payment Voucher 2021 manyways.top 2021

Do not use staples on anything you submit. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023,. Web 2021 form m1, individual income tax. Round your amounts to the nearest whole dollar. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements.

Round Your Amounts To The Nearest Whole Dollar.

Web 2019 form m1, individual income tax leave unused boxes blank. 3/4/22 to file electronically, go to www.revenue.state.mn.us go to www.revenue.state.mn.us to: Leave lines blank if they do not apply to you or if the amount is zero. Web add step 1 and step 2.

Additions To Income From Line 10 Of Schedule M1M And Line 9 Of Schedule M1Mb (See.

Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Do not use staples on anything you submit. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of.

Do Not Write Extra Numbers, Symbols, Or Notes On Your Return, Such As Decimal.

If the result is less than $12,400 and you had amounts withheld or paid estimated tax, file a minnesota income tax. Web 2021 form m1, individual income tax. Use your legal name, not a nickname. *191111* 2019 federal filing status (place an x in one box):.

If The Total Is $12,400 Or More, You Must File A Minnesota Income Tax Return And Schedule M1Nr.

Web filing a paper income tax return. Field_block:node:page:field_paragraph complete form m1 on screen [+] download form m1 , individual income tax. Do not use staples on anything you submit. We will send rebate payments this fall to those who qualify.