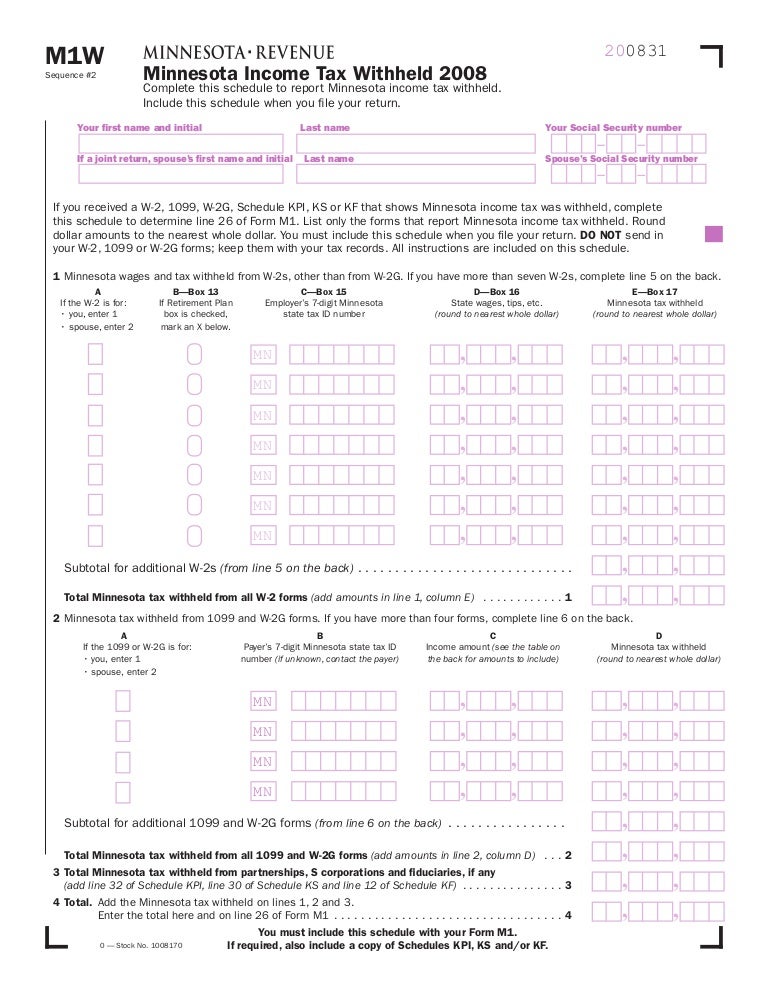

Minnesota Form M1W

Minnesota Form M1W - List all minnesota income tax withheld from your. Your first name and initial last name ifajointreturn,spouse’sfirstnameandinitial your social. Easily fill out pdf blank, edit, and sign them. If you were a nonresident ,. Complete this schedule to report minnesota income tax withheld. Web 2021 schedule m1wfc, minnesota working family credit. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Web 2022 form m1, individual income tax do not use staples on anything you submit. Your first name and initial last name your social security number. This form is for income earned in tax.

When i attempt to file i receive this message: Complete this schedule to report minnesota income tax withheld. Web 2020 schedule m1w, minnesota income tax withheld. List all minnesota income tax withheld from your. Web minnesota income tax withheld. Save or instantly send your ready documents. We last updated minnesota form m1w in december 2022 from the minnesota department of revenue. 12,900 for 2022), you must file form m1 and include schedule. Edit your mn schedule m1w online type text, add images, blackout confidential details, add comments, highlights and more. This form is for income earned in tax.

If the result is less than $12,525 and you had amounts withheld or. Edit your minnesota form m1w online type text, add images, blackout confidential details, add comments, highlights and more. Save or instantly send your ready documents. Sign it in a few clicks draw your. Web minnesota income tax withheld. Web file now with turbotax other minnesota individual income tax forms: Web 2020 schedule m1w, minnesota income tax withheld. 12,900 for 2022), you must file form m1 and include schedule. Web 2020 minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld >. Your first name and initial last name your social security number.

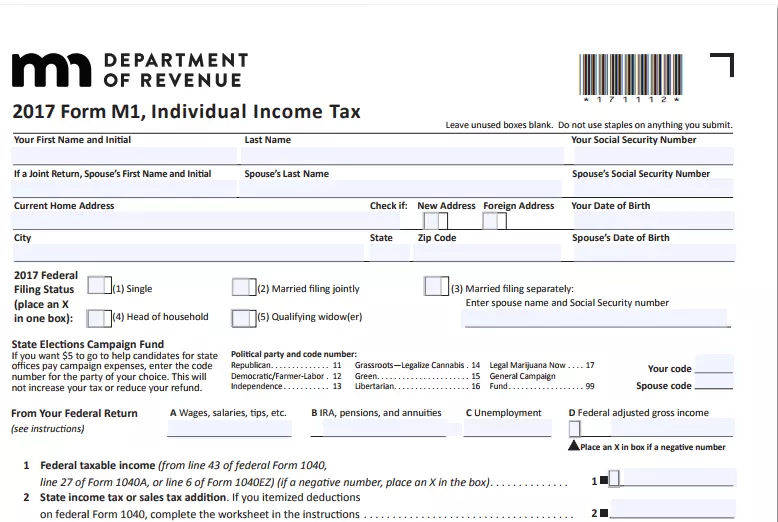

Minnesota Form M1

Web 2022 form m1, individual income tax do not use staples on anything you submit. Sign it in a few clicks draw your. Web file now with turbotax other minnesota individual income tax forms: Taxformfinder has an additional 95 minnesota income tax forms that you may need, plus all federal. Edit your minnesota form m1w online type text, add images,.

Fill Free fillable 2019 Form M1X, Amended Minnesota Tax

Save or instantly send your ready documents. Sign it in a few clicks draw your. Edit your minnesota form m1w online type text, add images, blackout confidential details, add comments, highlights and more. This form is for income earned in tax. If the result is less than $12,525 and you had amounts withheld or.

Sipeed M1/M1W (Lichee Dan) Sipeed Wiki

Include this schedule when you file your return. Ad download or email form m1w & more fillable forms, register and subscribe now! If you were a nonresident ,. Web 2018 m1w, minnesota income tax withheld | minnesota department of revenue. List all minnesota income tax withheld from your.

Minnesota State Tax Table M1

Web form m1w—minnesota income tax withheld form etp—employer transit pass credit form bank direct debit authorization form m1x —amended minnesota income tax. Sign it in a few clicks draw your. Web 2018 m1w, minnesota income tax withheld | minnesota department of revenue. Web file now with turbotax other minnesota individual income tax forms: Easily fill out pdf blank, edit, and.

2018 Form MN DoR M1 Fill Online, Printable, Fillable, Blank PDFfiller

Web 2018 m1w, minnesota income tax withheld | minnesota department of revenue. Ad download or email form m1w & more fillable forms, register and subscribe now! Edit your mn schedule m1w online type text, add images, blackout confidential details, add comments, highlights and more. Web minnesota income tax withheld. Web more about the minnesota form m1w.

Fill Free fillable Minnesota Department of Revenue PDF forms

Web file now with turbotax other minnesota individual income tax forms: Web more about the minnesota form m1w. This form is for income earned in tax. Sign it in a few clicks draw your signature, type. Save or instantly send your ready documents.

Fill Free fillable Minnesota Department of Revenue PDF forms

Edit your minnesota form m1w online type text, add images, blackout confidential details, add comments, highlights and more. If the result is less than $12,525 and you had amounts withheld or. Web form m1w—minnesota income tax withheld form etp—employer transit pass credit form bank direct debit authorization form m1x —amended minnesota income tax. Complete this schedule to report minnesota income.

M1W taxes.state.mn.us

Must report them on your minnesota return ( form m1 , individual income tax ). Web 2020 schedule m1w, minnesota income tax withheld. Edit your minnesota form m1w online type text, add images, blackout confidential details, add comments, highlights and more. Web form m1w—minnesota income tax withheld form etp—employer transit pass credit form bank direct debit authorization form m1x —amended.

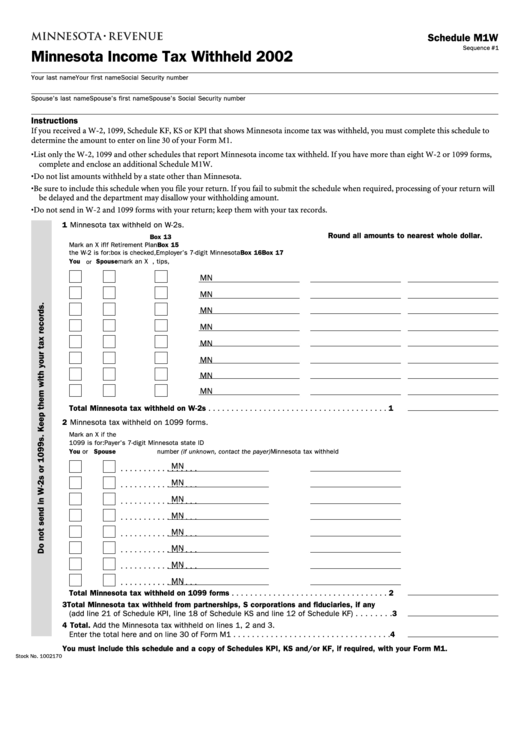

Schedule M1w Minnesota Tax Withheld 2002 printable pdf download

Web 2021 schedule m1wfc, minnesota working family credit. Web 2022 form m1, individual income tax do not use staples on anything you submit. Web 2020 schedule m1w, minnesota income tax withheld. Web if you had minnesota income tax withheld from your income, complete schedule m1w, minnesota income tax withheld. Must report them on your minnesota return ( form m1 ,.

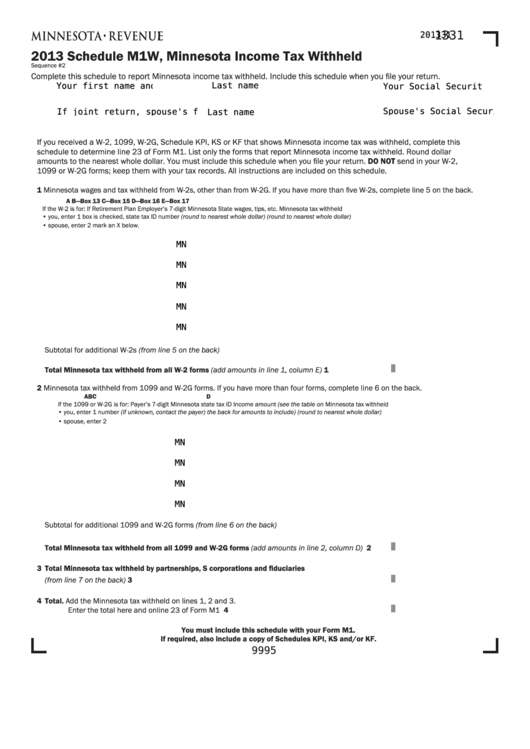

Fillable Schedule M1w Minnesota Tax Withheld 2013 printable

This form is for income earned in tax. We last updated minnesota form m1w in december 2022 from the minnesota department of revenue. Web 2018 m1w, minnesota income tax withheld | minnesota department of revenue. Complete this schedule to report minnesota income tax withheld. Your first name and initial last name your social security number.

Complete This Schedule To Report Minnesota Income Tax Withheld.

If the result is less than $12,525 and you had amounts withheld or. If you were a nonresident ,. Save or instantly send your ready documents. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr.

Your First Name And Initial Last Name Your Social Security Number.

Web if you had minnesota income tax withheld from your income, complete schedule m1w, minnesota income tax withheld. Sign it in a few clicks draw your signature, type. Web 2021 schedule m1wfc, minnesota working family credit. Web 2020 schedule m1w, minnesota income tax withheld.

Web Form M1W—Minnesota Income Tax Withheld Form Etp—Employer Transit Pass Credit Form Bank Direct Debit Authorization Form M1X —Amended Minnesota Income Tax.

Web file now with turbotax other minnesota individual income tax forms: Web more about the minnesota form m1w. Web 2022 form m1, individual income tax do not use staples on anything you submit. Edit your mn schedule m1w online type text, add images, blackout confidential details, add comments, highlights and more.

12,900 For 2022), You Must File Form M1 And Include Schedule.

Edit your minnesota form m1w online type text, add images, blackout confidential details, add comments, highlights and more. Taxformfinder has an additional 95 minnesota income tax forms that you may need, plus all federal. When i attempt to file i receive this message: Web 2020 minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld >.