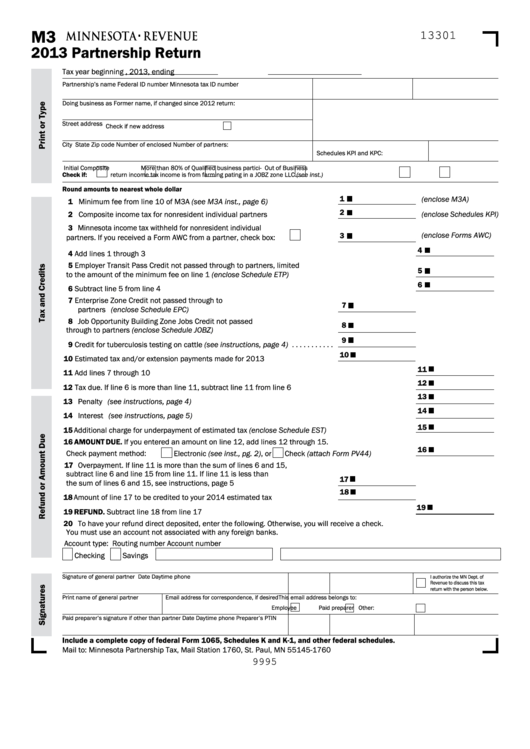

Minnesota Form M3

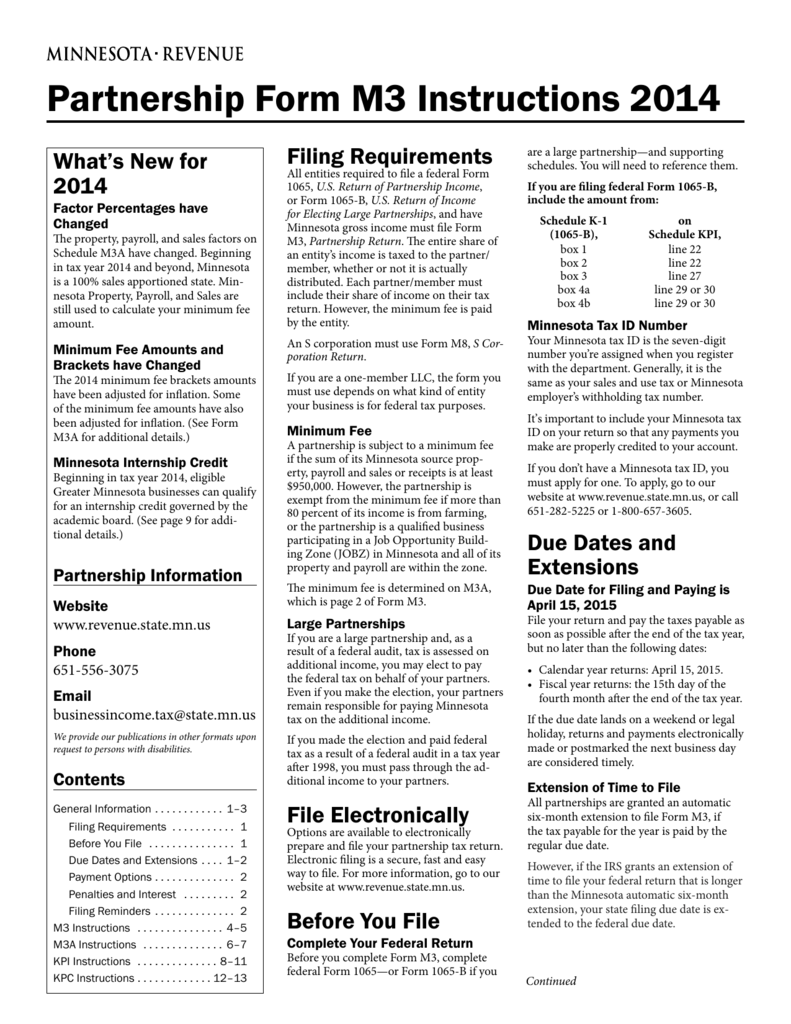

Minnesota Form M3 - Web tax and carries the amount to form m3 minnesota forms and schedules form m3—partnership return schedule m3a—apportionment and minimum fee form. Form m4x, form m8x, form m3x, amended franchise tax return, if you are a corporate partner. Javascript must be enabled to use this site. Web income is generally defined as items of federal adjusted gross income for the qualifying member subject to certain minnesota modifications. Exceptions to the minimum fee a partnership. Web 2009 partnership form m3 instructions stock no. Minnesota partnership tax mail station 1760 st. Return of partnership income, or form 1065‑b, u.s. Web all entities required to file a federal form 1065, u.s. Web request to waive or cancel waiver for taxable life insurance coverage.

Web the minimum fee is determined when you complete form m3, partnership return. Web 2009 partnership form m3 instructions stock no. Return of partnership income, and have minnesota gross income must file form m3, partnership return. Web use fill to complete blank online minnesota department of revenue pdf forms for free. Minnesota partnership tax mail station 1760 st. All entities required to file a federal form 1065, u.s. Web partnership’s name federal id number minnesota tax id number doing business as former name, if changed since 2021 return mailing address. File electronically options are available to electronically prepare and file your partnership tax return. Web partnership’s name federal id number minnesota tax id number doing business as mailing address former name, if changed since 2021 return check if new address. Form m4x, form m8x, form m3x, amended franchise tax return, if you are a corporate partner.

Form m4x, form m8x, form m3x, amended franchise tax return, if you are a corporate partner. Return of partnership income, or form 1065‑b, u.s. Web 2009 partnership form m3 instructions stock no. Web for state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of federal form 1065 and schedules. Once completed you can sign your fillable form or send. Web partnership’s name federal id number minnesota tax id number doing business as mailing address former name, if changed since 2021 return check if new address. Web on the 2021 form m3, for example, the pte tax is reported on line 2, and the amount of that line 2 tax is a (refundable) credit to partners (reported to them on. Web request to waive or cancel waiver for taxable life insurance coverage. Web the minimum fee is determined on m3a, which is page 3 of form m3. Javascript must be enabled to use this site.

Fill Free fillable forms for the state of Minnesota

Web we last updated the partnership return (m3) instructions in february 2023, so this is the latest version of form m3 instructions, fully updated for tax year 2022. Schedule e of partners' federal income tax returns used to report income or losses;. Web to file an amended return, use one of the following: Web a partnership that has taxable minnesota.

Abena DeltaForm M3 Medium PZN 09520416 Eunaxis Medical GmbH

Web use fill to complete blank online minnesota department of revenue pdf forms for free. Minnesota partnership tax mail station 1760 st. Return of partnership income, or form 1065‑b, u.s. Web 2009 partnership form m3 instructions stock no. Web all entities required to file a federal form 1065, u.s.

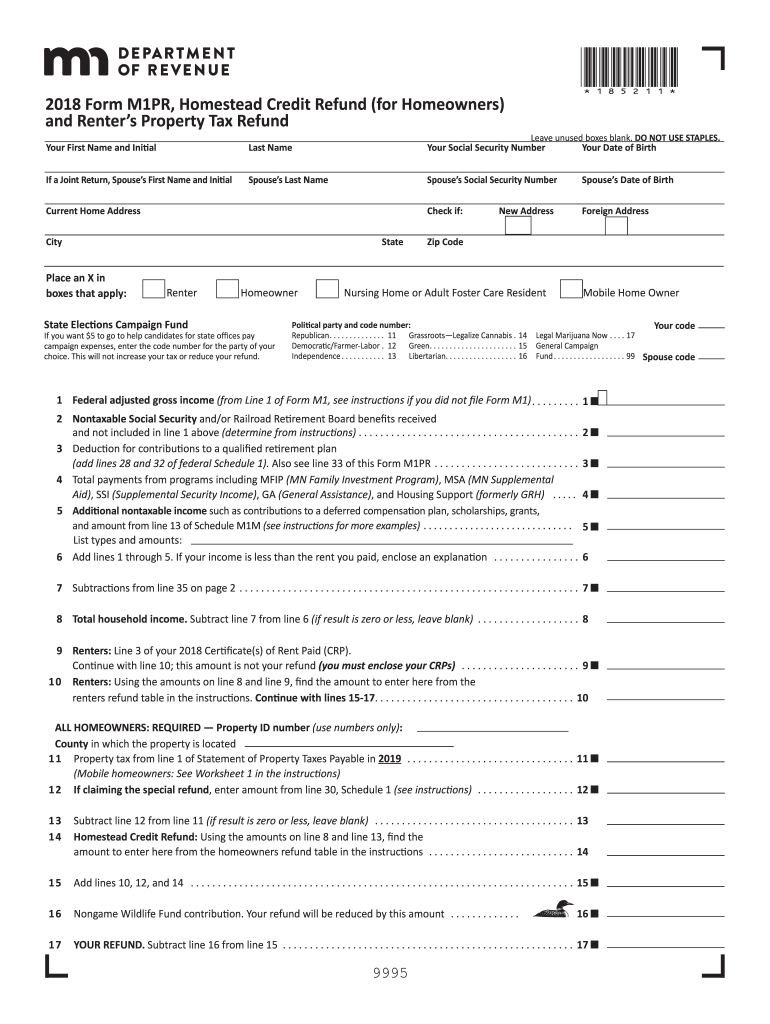

How To File Minnesota Property Tax Refund

Once completed you can sign your fillable form or send. Web income is generally defined as items of federal adjusted gross income for the qualifying member subject to certain minnesota modifications. All entities required to file a federal form 1065, u.s. Minnesota partnership tax mail station 1760 st. Web the minimum fee is determined on m3a, which is page 3.

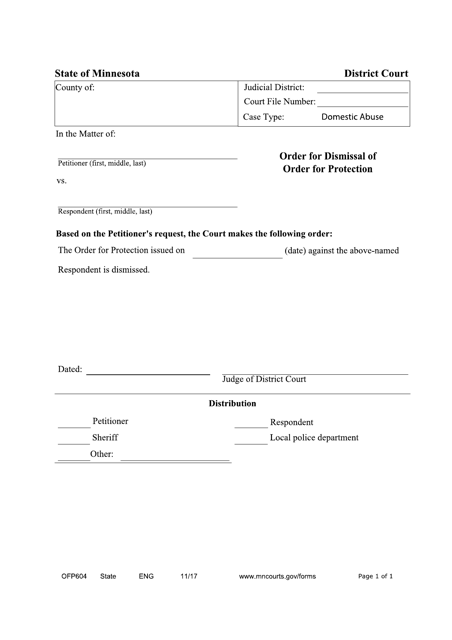

Form OFP604 Download Fillable PDF or Fill Online Order for Dismissal of

Return of partnership income, and have minnesota gross income must file form m3, partnership return. Web for state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of federal form 1065 and schedules. Web we last updated the partnership return (m3) instructions in february 2023, so this is.

5 Frames With a Leica M3 & 90mm f/2.8 Elmarit By Wyatt Ryan 35mmc

Web request to waive or cancel waiver for taxable life insurance coverage. Web for state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of federal form 1065 and schedules. Exceptions to the minimum fee a partnership. Schedule e of partners' federal income tax returns used to report.

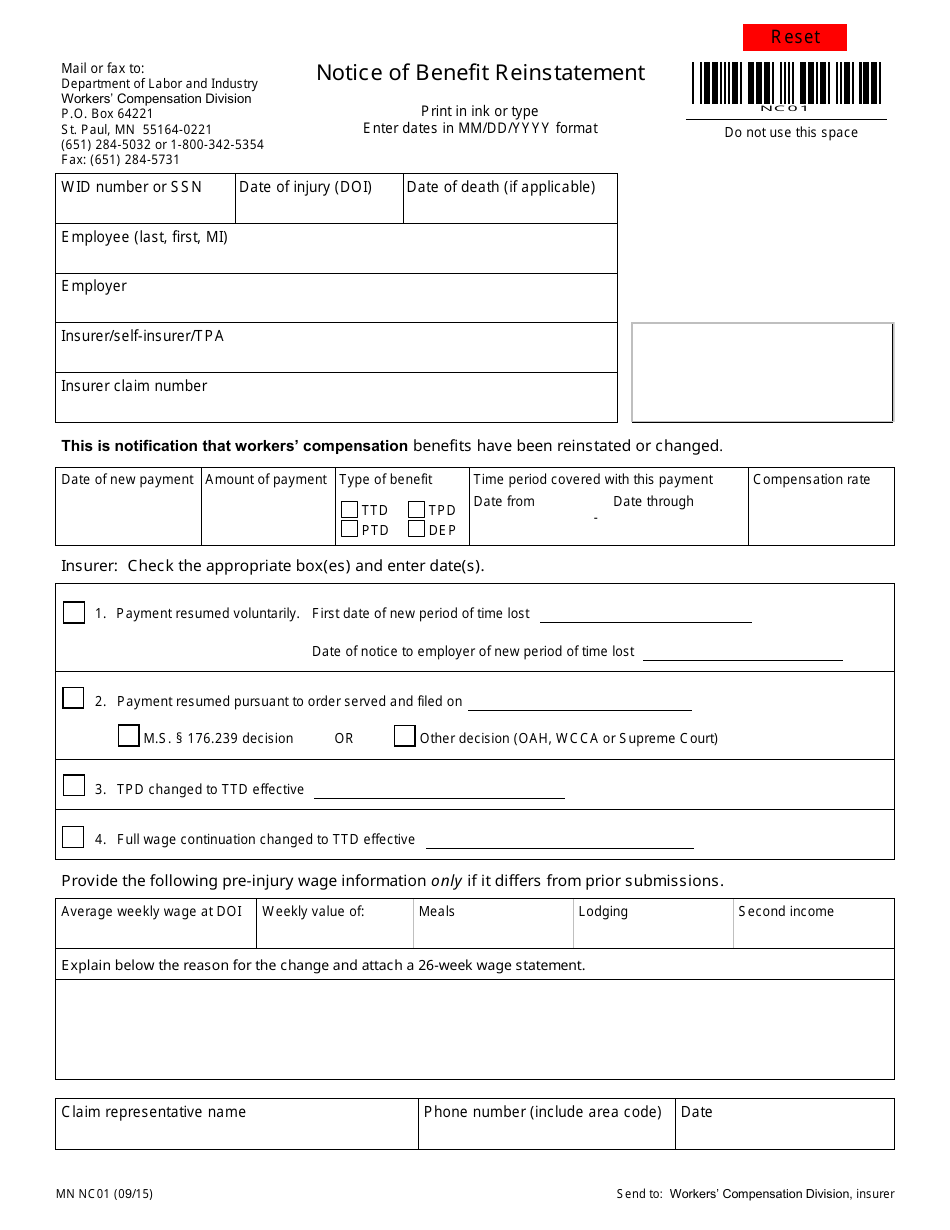

Form MN NC01 Download Fillable PDF or Fill Online Notice of Benefit

Minnesota partnership tax mail station 1760 st. Web forms that need to be filed are federal form 1065 and minnesota form m3; File electronically options are available to electronically prepare and file your partnership tax return. All entities required to file a federal form 1065, u.s. Web partnership’s name federal id number minnesota tax id number doing business as former.

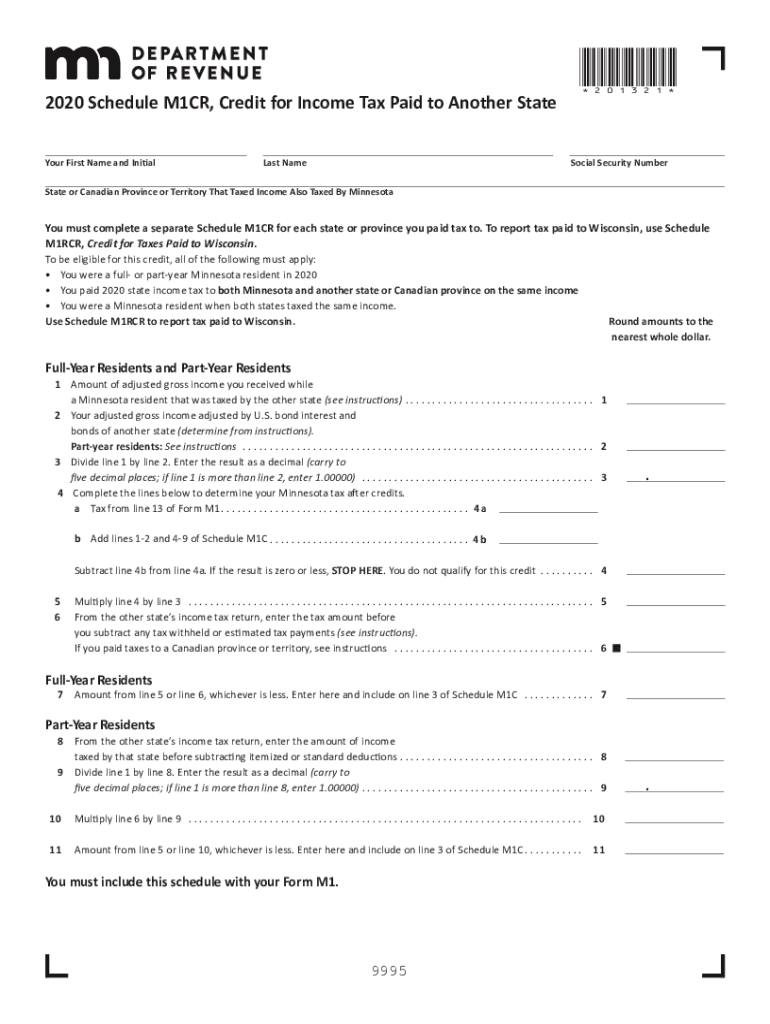

Printable Minnesota Form M1CR Credit For Tax Paid To Another

File electronically options are available to electronically prepare and file your partnership tax return. Form m4x, form m8x, form m3x, amended franchise tax return, if you are a corporate partner. Web forms that need to be filed are federal form 1065 and minnesota form m3; Minnesota partnership tax mail station 1760 st. Return of partnership income, and have minnesota gross.

2009 Form MN DoR ST3 Fill Online, Printable, Fillable, Blank pdfFiller

Web request to waive or cancel waiver for taxable life insurance coverage. Web the minimum fee is determined on m3a, which is page 3 of form m3. Web for state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of federal form 1065 and schedules. For more information,.

Fillable Form M3 Partnership Return Minnesota Department Of Revenue

Minnesota partnership tax mail station 1760 st. For more information, see form m3 instructions. Web to file an amended return, use one of the following: Return of partnership income, and have minnesota gross income must file form m3, partnership return. Javascript must be enabled to use this site.

(Form M3) instructions Minnesota Department of Revenue

Schedule e of partners' federal income tax returns used to report income or losses;. Web the minimum fee is determined when you complete form m3, partnership return. Web income is generally defined as items of federal adjusted gross income for the qualifying member subject to certain minnesota modifications. Web tax and carries the amount to form m3 minnesota forms and.

Web Use Fill To Complete Blank Online Minnesota Department Of Revenue Pdf Forms For Free.

Javascript must be enabled to use this site. All entities required to file a federal form 1065, u.s. Exceptions to the minimum fee a partnership. For more information, see form m3 instructions.

Web A Partnership That Has Taxable Minnesota Gross Income Must File Form M3, Partnership Return, If It’s Required To File One Of The Following Federal Tax Forms:

Web partnership form m3 instructions 2014 filing requirements all entities required to file a federal form 1065, u.s. Web the minimum fee is determined on m3a, which is page 3 of form m3. Minnesota partnership tax mail station 1760 st. Once completed you can sign your fillable form or send.

Web We Last Updated The Partnership Return (M3) Instructions In February 2023, So This Is The Latest Version Of Form M3 Instructions, Fully Updated For Tax Year 2022.

Return of partnership income, or. Web all entities required to file a federal form 1065, u.s. Web income is generally defined as items of federal adjusted gross income for the qualifying member subject to certain minnesota modifications. Schedule e of partners' federal income tax returns used to report income or losses;.

Web Request To Waive Or Cancel Waiver For Taxable Life Insurance Coverage.

Web tax and carries the amount to form m3 minnesota forms and schedules form m3—partnership return schedule m3a—apportionment and minimum fee form. Web partnership’s name federal id number minnesota tax id number doing business as former name, if changed since 2021 return mailing address. Web partnership’s name federal id number minnesota tax id number doing business as mailing address former name, if changed since 2021 return check if new address. Web on the 2021 form m3, for example, the pte tax is reported on line 2, and the amount of that line 2 tax is a (refundable) credit to partners (reported to them on.