Mn M1 Form

Mn M1 Form - And schedules kpi, ks, and kf. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. For more information about the minnesota income tax,. It will help candidates for state offices. If zero or less leave blank. Choose the correct version of the editable pdf form. Web file a 2021 minnesota income tax return if your income is more than the amount that applies to you in the chart below. You are a minnesota resident if either of.

Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. A copy of the federal form 1040, including a copy of schedule c or. Web file a 2021 minnesota income tax return if your income is more than the amount that applies to you in the chart below. We'll make sure you qualify, calculate your minnesota property tax refund,. You must file yearly by april 17. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web to compute minnesota income tax, the proprietor uses form m1, the individual income tax return form. Web 25 if you are a resident of michigan or north dakota filing form m1 only to receive a refund of all minnesota tax withheld, enter the amount from line 1 of form m1. Web filing a paper income tax return. Web form m1 is the most common individual income tax return filed for minnesota residents.

Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. Web filing a paper income tax return. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Choose the correct version of the editable pdf form. Web minnesota income tax withheld. You must file yearly by april 15. Complete form m1 using the minnesota. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Web to compute minnesota income tax, the proprietor uses form m1, the individual income tax return form. If zero or less leave blank.

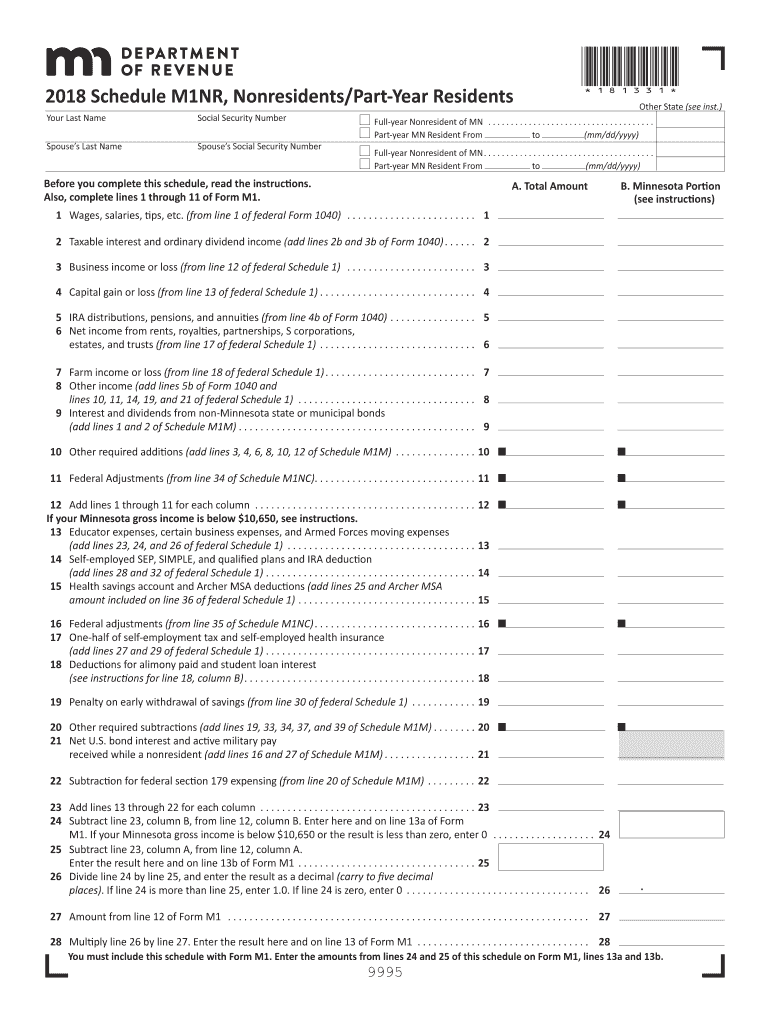

Schedule M1Nr Fill Out and Sign Printable PDF Template signNow

Web file a 2021 minnesota income tax return if your income is more than the amount that applies to you in the chart below. We last updated the individual income tax return in. You are a minnesota resident if either of. If zero or less leave blank. Web filing a paper income tax return.

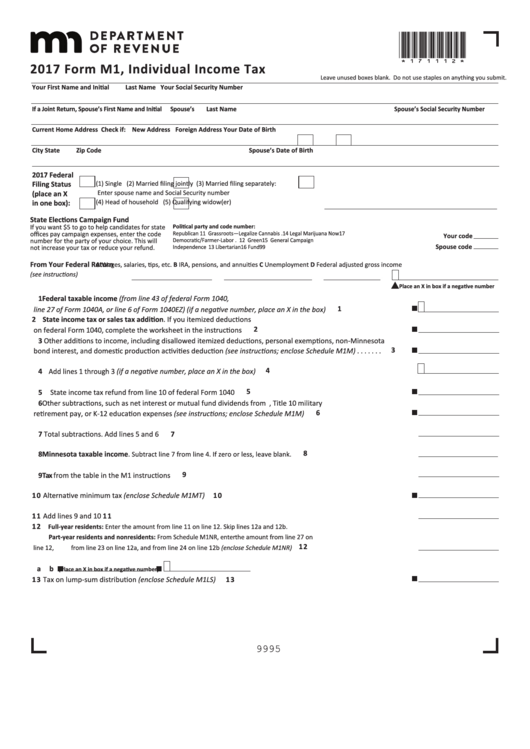

Form M1 Individual Tax 2017 printable pdf download

Income you calculated in step 1 on form m1 , line 1. Complete form m1 using the minnesota. Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: We'll make sure you qualify, calculate your minnesota property tax refund,. You must file yearly by april 17.

2019 Form MN M1W Fill Online, Printable, Fillable, Blank pdfFiller

If zero or less leave blank. Web use form m1 , individual income tax , to estimate your minnesota tax. You are a minnesota resident if either of. For more information about the minnesota income tax,. Web file a 2021 minnesota income tax return if your income is more than the amount that applies to you in the chart below.

2018 Form MN DoR M1 Fill Online, Printable, Fillable, Blank PDFfiller

If zero or less leave blank. Web 25 if you are a resident of michigan or north dakota filing form m1 only to receive a refund of all minnesota tax withheld, enter the amount from line 1 of form m1. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. This form is for income.

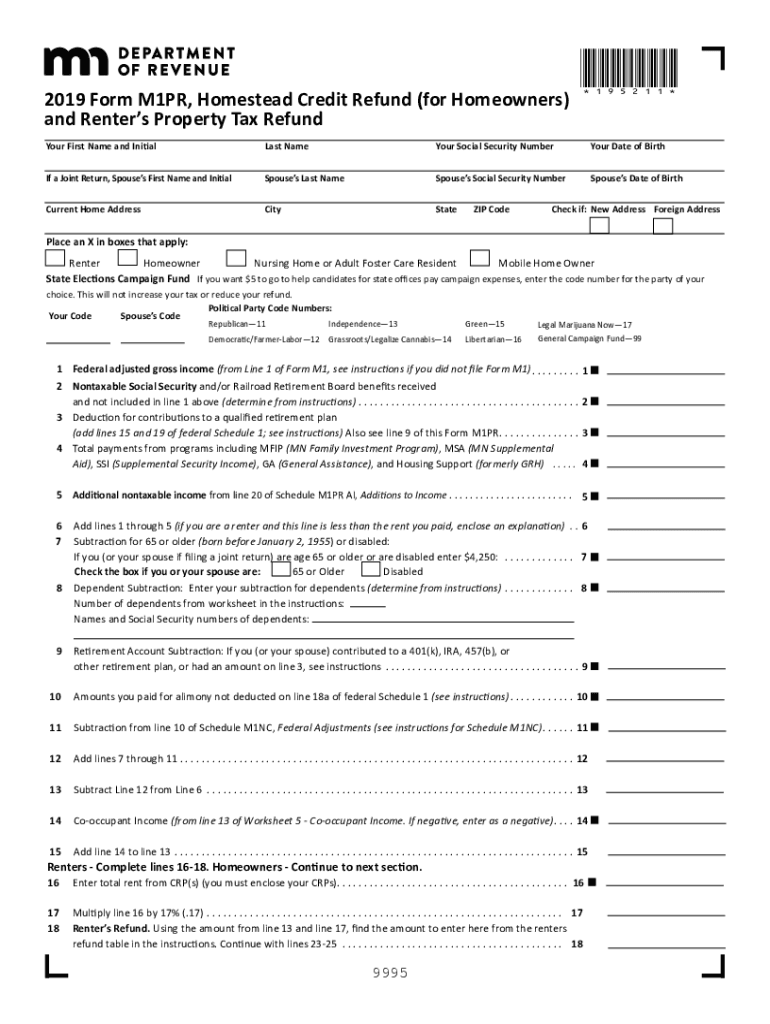

MN DoR M1PR 20192022 Fill out Tax Template Online US Legal Forms

Web form m1 is the most common individual income tax return filed for minnesota residents. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web use form m1 , individual income tax , to estimate your minnesota.

Fill Free fillable M1 19 2019 Form M1, Individual Tax Return

You must file yearly by april 17. A copy of the federal form 1040, including a copy of schedule c or. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine. This form is for income earned in tax year 2022, with tax. And schedules kpi, ks, and.

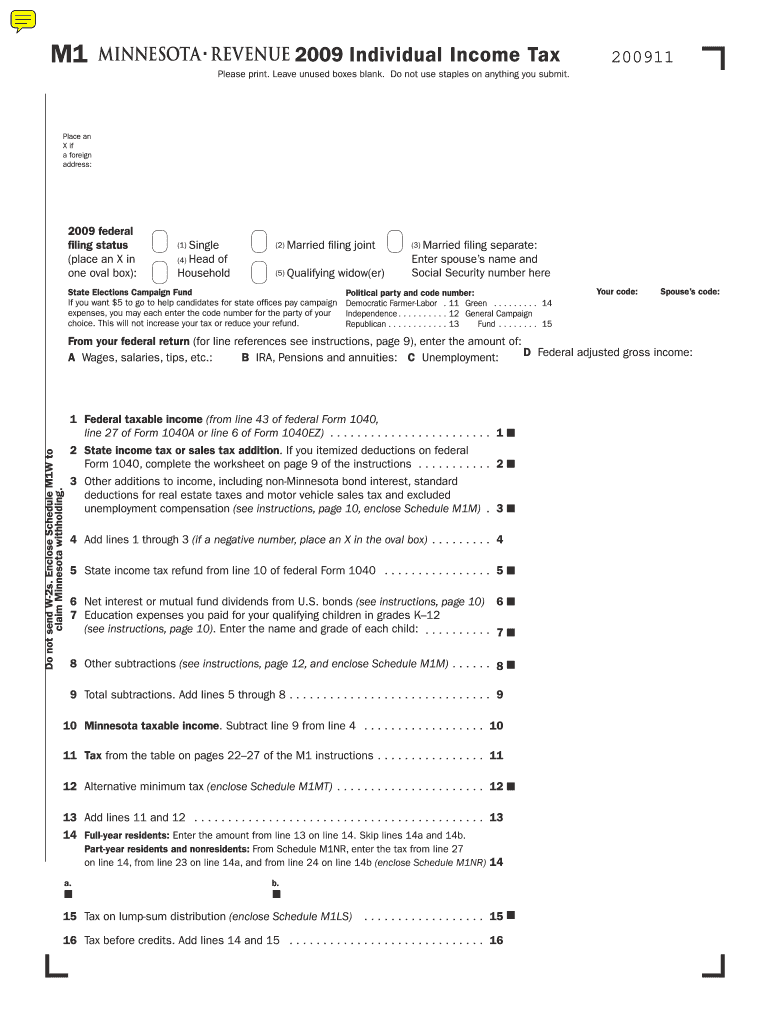

MN DoR M1 2009 Fill out Tax Template Online US Legal Forms

Web file a 2021 minnesota income tax return if your income is more than the amount that applies to you in the chart below. You must file yearly by april 15. Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: Web form m1 is the most.

Fill Free fillable Minnesota Department of Revenue PDF forms

It will help candidates for state offices. Income you calculated in step 1 on form m1 , line 1. Web how it works browse for the minnesota m1 instructions pdf customize and esign mn form m1 instructions send out signed minnesota form m1 instructions or print it rate the mn. Complete form m1 using the minnesota. Choose the correct version.

2012 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

And schedules kpi, ks, and kf. Web form m1 is the most common individual income tax return filed for minnesota residents. Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: You must file yearly by april 17. It will help candidates for state offices.

MN DoR M1 2005 Fill out Tax Template Online US Legal Forms

Web find and fill out the correct minnesota form m1. Web file a 2021 minnesota income tax return if your income is more than the amount that applies to you in the chart below. You must file yearly by april 17. A copy of the federal form 1040, including a copy of schedule c or. Before starting your minnesota income.

Web Form M1 Is The Most Common Individual Income Tax Return Filed For Minnesota Residents.

If zero or less leave blank. We last updated the individual income tax return in. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine. You must file yearly by april 17.

Web Yes, You Can File Your M1Pr When You Prepare Your Minnesota Taxes In Turbotax.

For more information about the minnesota income tax,. 10 tax from the table in. The purpose of form m1 is to determine your tax liability for the state. Income you calculated in step 1 on form m1 , line 1.

Minnesota Individual Income Tax Applies To Residents And Nonresidents Who Meet The State's Minimum Filing Requirements.

Choose the correct version of the editable pdf form. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Complete form m1 using the minnesota. And schedules kpi, ks, and kf.

Web 2022 Form M1Pr, Homestead Credit Refund (For Homeowners) And Renter’s Property Tax Refund Your Date Of Birth (Mm/Dd/Yyyy) State Elections Campaign Fund:

This form is for income earned in tax year 2022, with tax. Web form m1 is the most common individual income tax return filed for minnesota residents. Web file a 2021 minnesota income tax return if your income is more than the amount that applies to you in the chart below. Web use form m1 , individual income tax , to estimate your minnesota tax.