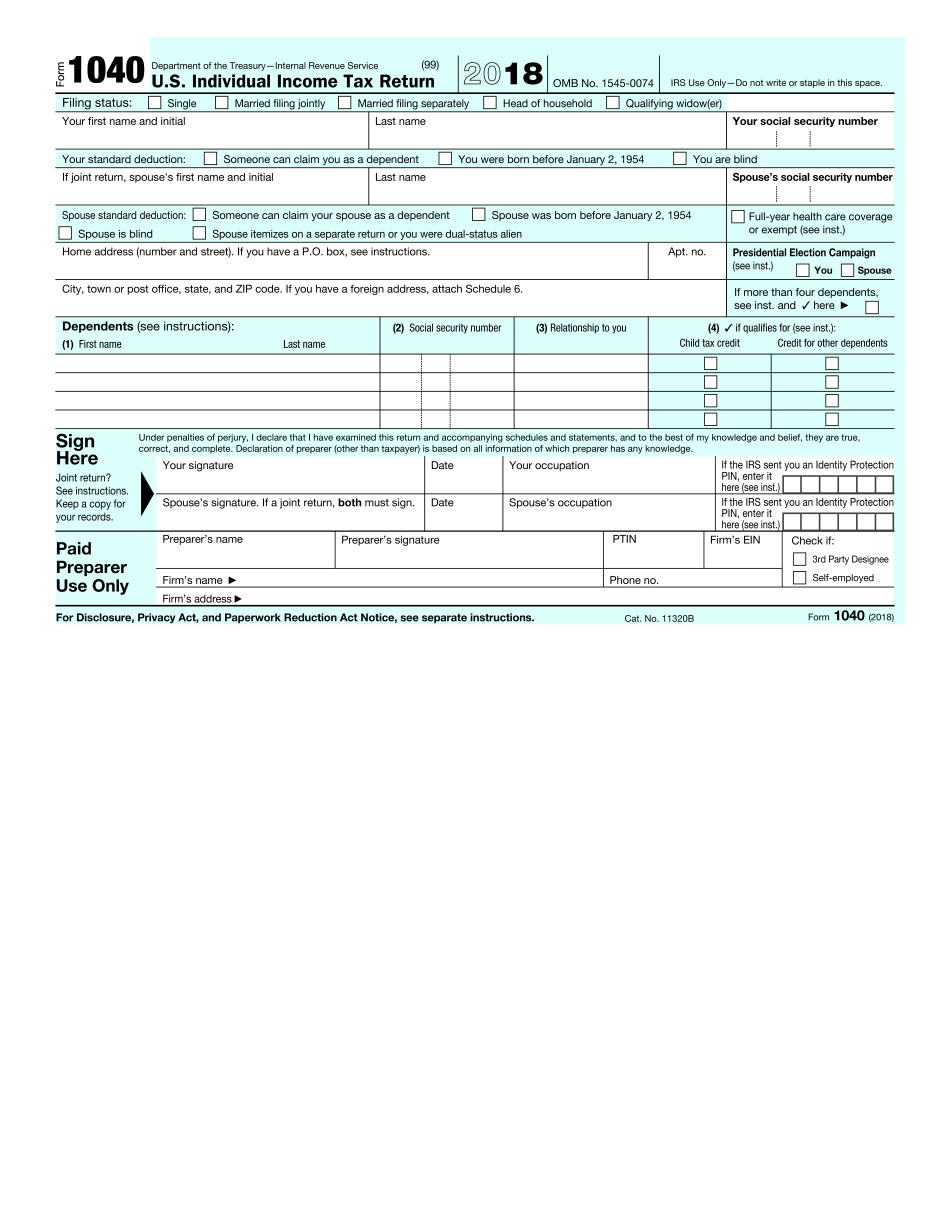

Mo-1040 Form 2021

Mo-1040 Form 2021 - Web how do i select the easiest tax form that satisfies my tax filing needs? Estimated tax declaration for individuals: Single/married (income from one spouse) short form. 2021 miscellaneous income tax credits. Web 2021 individual income tax return. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Check the box at the top of the form. Short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. This is your missouri resident credit. The accuracy, veracity and completeness of material transmitted to us.

Single/married (income from one spouse) short form. See page 4 for extensions. Short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Web individual income tax calculator. Web zip code foreign country name foreign province/state/county foreign postal code presidential election campaign check here if you, or your spouse if filing jointly, want $3. Any information you may lose as a. Web how do i select the easiest tax form that satisfies my tax filing needs? This form is for income earned in tax year 2022, with tax returns due in april. Check the box at the top of the form. Printable missouri state tax forms for the.

The accuracy, veracity and completeness of material transmitted to us. Web how do i select the easiest tax form that satisfies my tax filing needs? Short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Tax deadline is april 18. Web 2021 individual income tax return. Check the box at the top of the form. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. This form is for income earned in tax year 2022, with tax returns due in april. Error in the manner of the input of material transmitted to us. Double check your tax calculation!

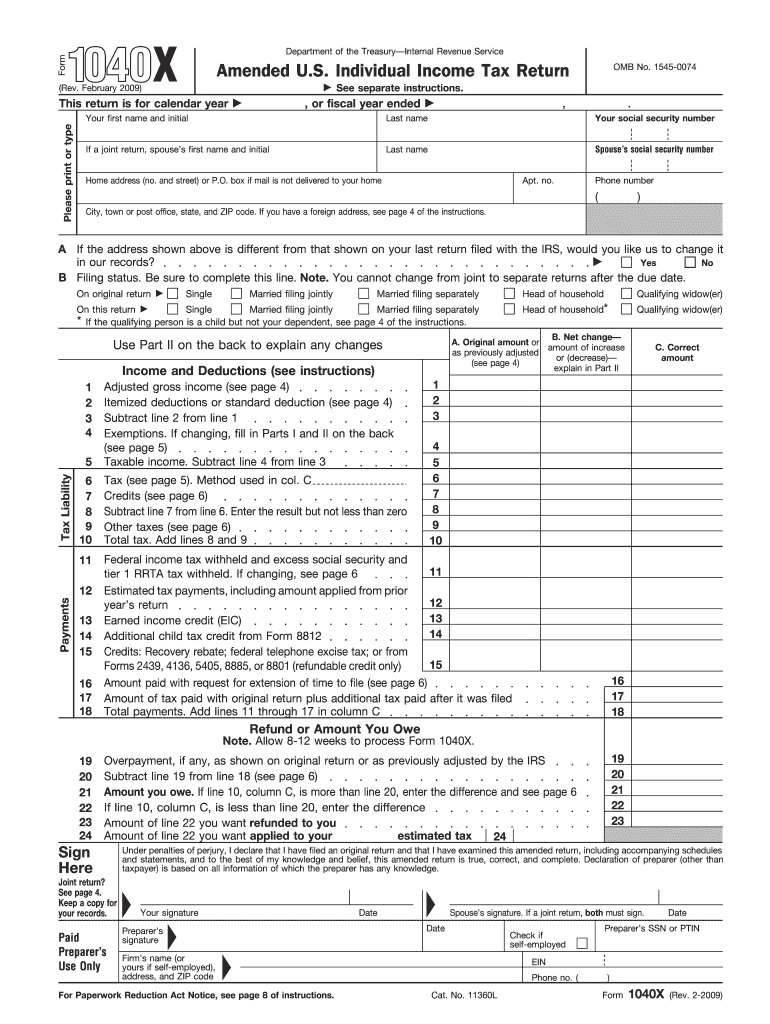

1040x Form Fill Out and Sign Printable PDF Template signNow

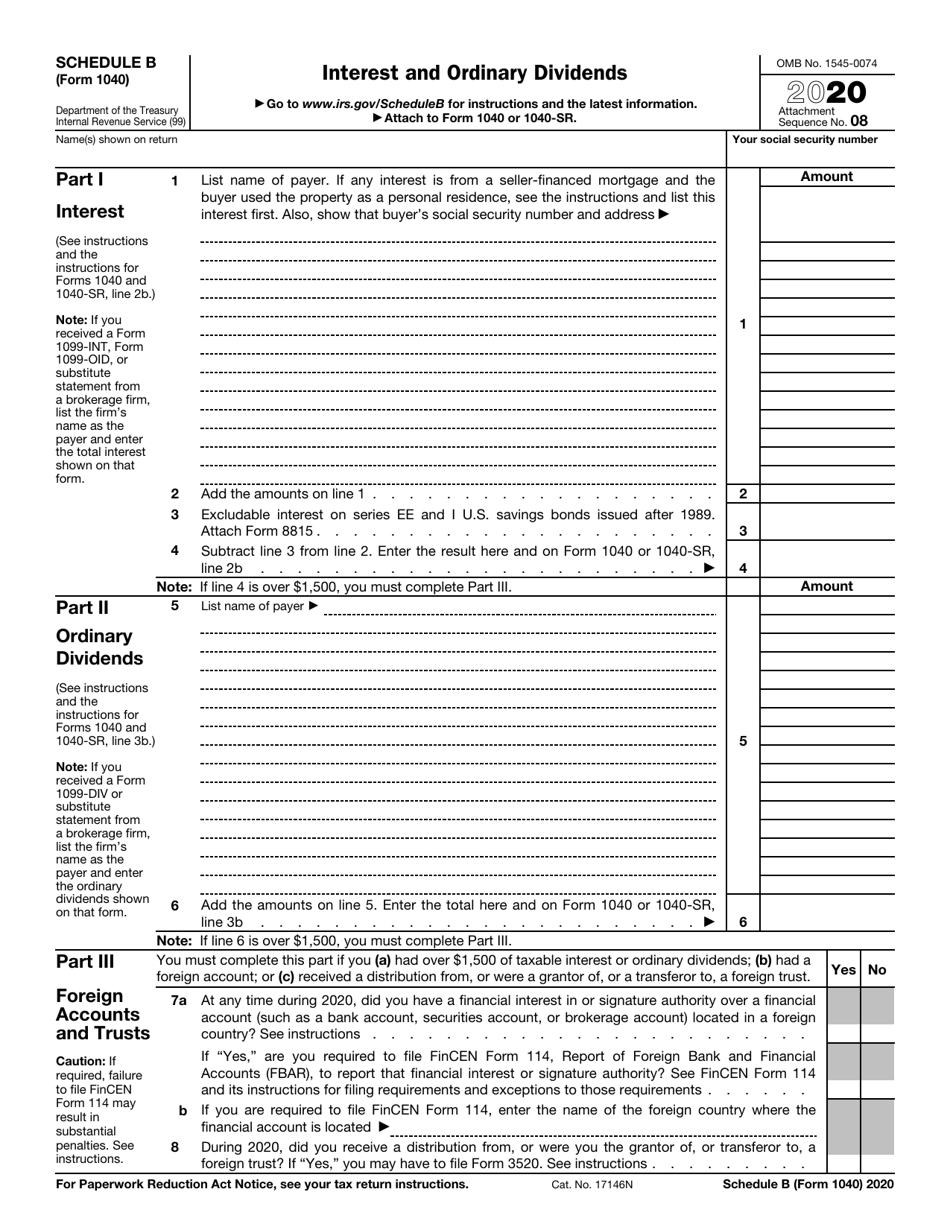

Enter the taxable income from your tax form and we will calculate your tax for you. The accuracy, veracity and completeness of material transmitted to us. Any information you may lose as a. Web how do i select the easiest tax form that satisfies my tax filing needs? 2021 miscellaneous income tax credits.

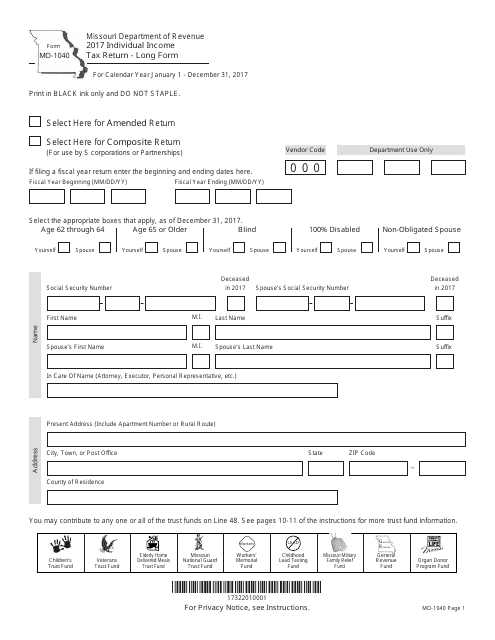

Form MO1040 Download Printable PDF or Fill Online Individual

Web individual income tax calculator. You must file your taxes yearly by april 15. Tax deadline is april 18. For privacy notice, see instructions. The accuracy, veracity and completeness of material transmitted to us.

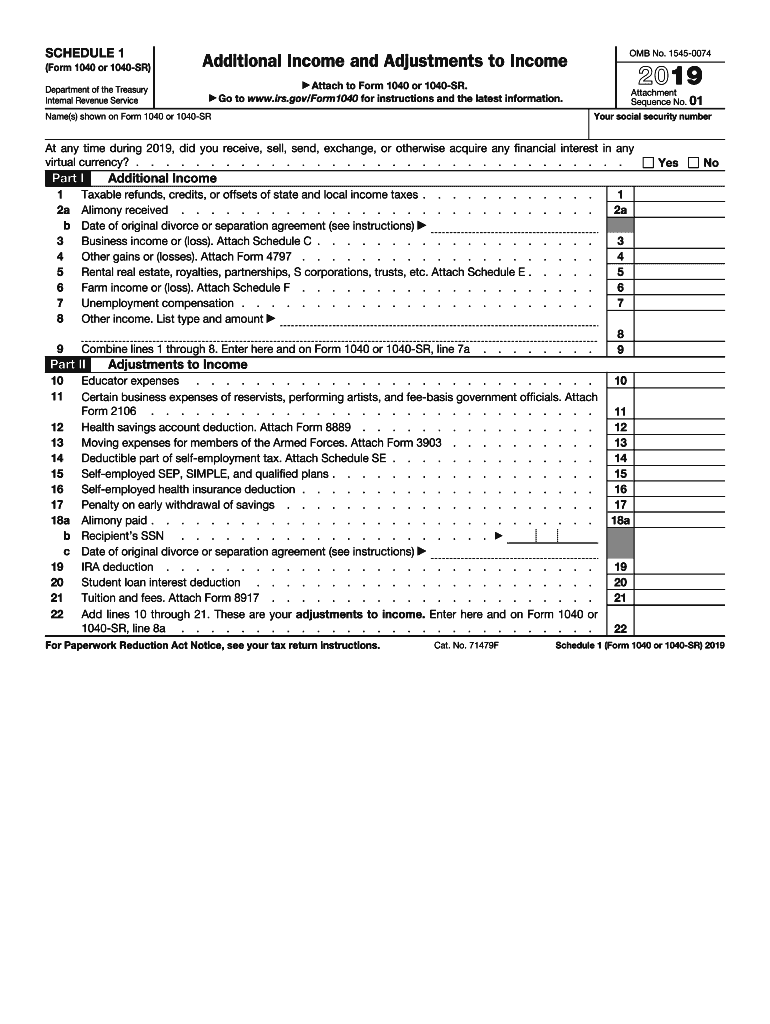

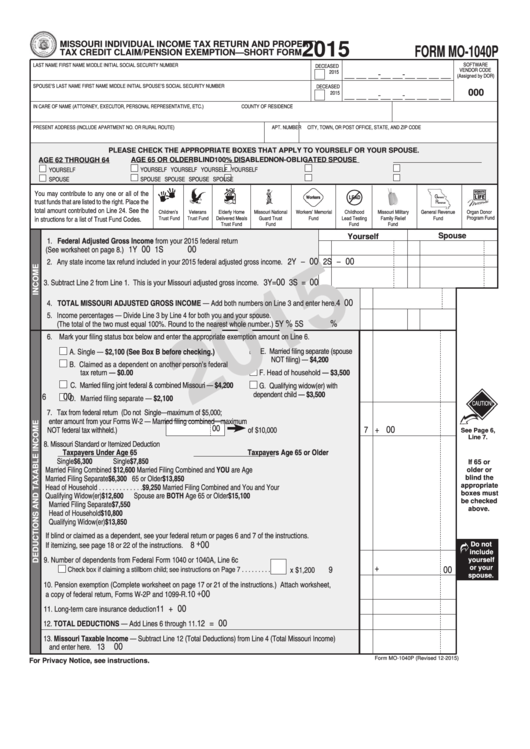

1040 Schedule 1 Fill Out and Sign Printable PDF Template signNow

Double check your tax calculation! Error in the manner of the input of material transmitted to us. You must file your taxes yearly by april 15. Web individual income tax calculator. The accuracy, veracity and completeness of material transmitted to us.

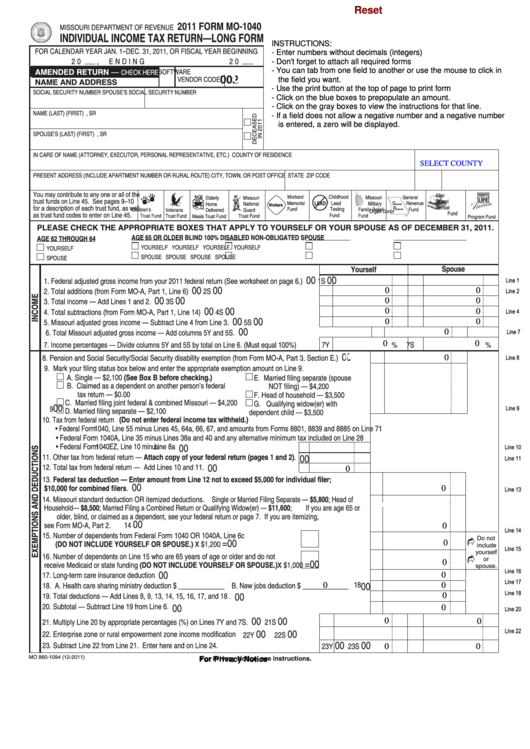

1040 Form 2021 1040 Form

Check the box at the top of the form. Printable missouri state tax forms for the. Web how do i select the easiest tax form that satisfies my tax filing needs? You must file your taxes yearly by april 15. This form is for income earned in tax year 2022, with tax returns due in april.

Irs Fillable Form 1040 Irs Fillable Form 1040 Fillable Online irs

See page 4 for extensions. Double check your tax calculation! Check the box at the top of the form. Web zip code foreign country name foreign province/state/county foreign postal code presidential election campaign check here if you, or your spouse if filing jointly, want $3. 2021 miscellaneous income tax credits.

IRS 1040 2022 Form Printable Blank PDF Online

You must file your taxes yearly by april 15. Printable missouri state tax forms for the. Error in the manner of the input of material transmitted to us. 2021 miscellaneous income tax credits. Single/married (income from one spouse) short form.

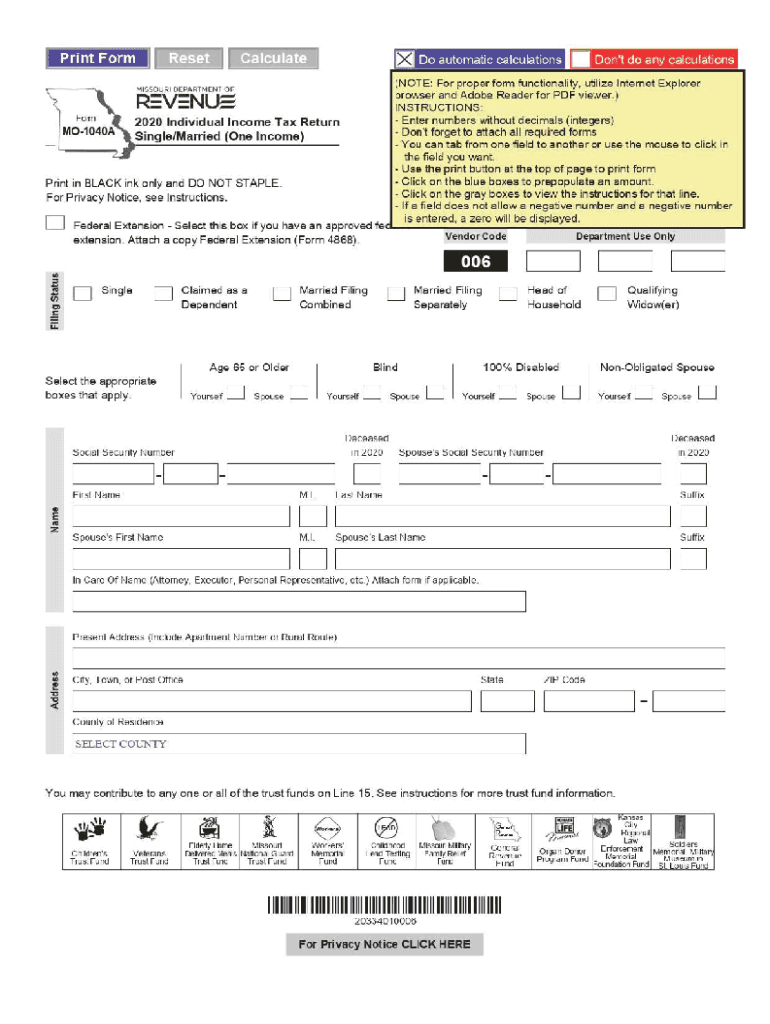

Missouri 1040A Short Form Fill Out and Sign Printable PDF Template

Short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Estimated tax declaration for individuals: This is your missouri resident credit. Enter the taxable income from your tax form and we will calculate your tax for you. 2021 miscellaneous income tax credits.

Form Mo1040p Missouri Individual Tax Return And Property Tax

Any information you may lose as a. 2021 miscellaneous income tax credits. Error in the manner of the input of material transmitted to us. Double check your tax calculation! Enter the taxable income from your tax form and we will calculate your tax for you.

Printable Irs Form 1040 Printable Form 2022

Enter the taxable income from your tax form and we will calculate your tax for you. Short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Web 2021 individual income tax return. See page 4 for extensions. You must file your taxes yearly by april 15.

Irs Fillable Form 1040 / IRS Form 1040ES (NR) Download Fillable PDF or

Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Tax deadline is april 18. Error in the manner of the input of material transmitted to us. See page 4 for extensions. Estimated tax declaration for individuals:

Web Individual Income Tax Calculator.

Check the box at the top of the form. Web zip code foreign country name foreign province/state/county foreign postal code presidential election campaign check here if you, or your spouse if filing jointly, want $3. Web 2021 individual income tax return. The accuracy, veracity and completeness of material transmitted to us.

Any Information You May Lose As A.

Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. This is your missouri resident credit. Enter the taxable income from your tax form and we will calculate your tax for you. Web how do i select the easiest tax form that satisfies my tax filing needs?

Tax Deadline Is April 18.

Estimated tax declaration for individuals: Error in the manner of the input of material transmitted to us. Printable missouri state tax forms for the. Double check your tax calculation!

Single/Married (Income From One Spouse) Short Form.

For privacy notice, see instructions. This form is for income earned in tax year 2022, with tax returns due in april. Short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. See page 4 for extensions.