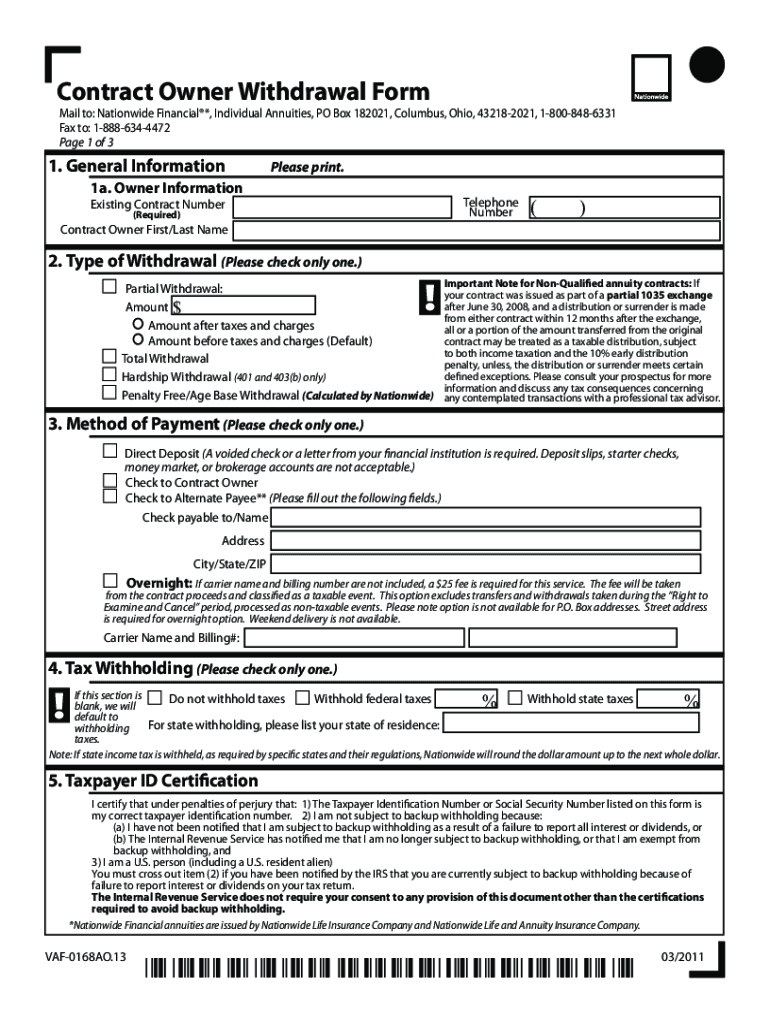

Nationwide Ira Withdrawal Form

Nationwide Ira Withdrawal Form - Popular nationwide forms key person benefits forms find forms to help manage your key person employee benefits. Web log in to your account at nrsforu.com and click “manage account” to locate “withdraw money” or “track withdrawal status”. Roth ira distributions within 5 years may be subject to 10% premature withdrawal penalty. Web find the form you need for your nationwide mutual fund, including iras. Web withdrawal penalty (25% if from a simple ira and within 2 years of the initial simple contribution) in addition to normal income tax for early withdrawal. Web ira transfer form (pdf) use this form to transfer assets from an existing retirement account, such as an ira or 401 (k). Web to provide federal tax withholding direction for all withdrawal requests except systematic distributions lasting more than 10 years enrollment forms enroll in a county plan complete form online print the form (pdf) enroll in a city plan complete form online print the form (pdf) additional forms are available once you log in to your account. Use this form to draft money from your bank account into your nationwide annuity contract. Save time and file a claim online. State taxes will be withheld where applicable.

Web ira transfer form (pdf) use this form to transfer assets from an existing retirement account, such as an ira or 401 (k). Web download and print the nationwide form you need. Do not use this form to take annuity withdrawals from your contract. Web log in to your account at nrsforu.com and click “manage account” to locate “withdraw money” or “track withdrawal status”. Key person forms mutual fund account forms Web withdrawal penalty (25% if from a simple ira and within 2 years of the initial simple contribution) in addition to normal income tax for early withdrawal. Use this form to draft money from your bank account into your nationwide annuity contract. Web find the form you need for your nationwide mutual fund, including iras. Please complete sections a, c, and e. Save time and file a claim online.

Roth ira distributions within 5 years may be subject to 10% premature withdrawal penalty. Beneficiary payout form for ira assets(pdf) use this form to transfer account ownership to a beneficiary or to make a distribution, or distributions, in the event an ira account owner is deceased. F home f work f cell Key person forms mutual fund account forms C home c work c cell Web ira transfer form (pdf) use this form to transfer assets from an existing retirement account, such as an ira or 401 (k). Web sum or systematic withdrawal lasting less than 10 years 20% of the taxable portion of the distribution paid to you will be withheld for federal income taxes. Popular nationwide forms key person benefits forms find forms to help manage your key person employee benefits. Web to provide federal tax withholding direction for all withdrawal requests except systematic distributions lasting more than 10 years enrollment forms enroll in a county plan complete form online print the form (pdf) enroll in a city plan complete form online print the form (pdf) additional forms are available once you log in to your account. Web log in to your account at nrsforu.com and click “manage account” to locate “withdraw money” or “track withdrawal status”.

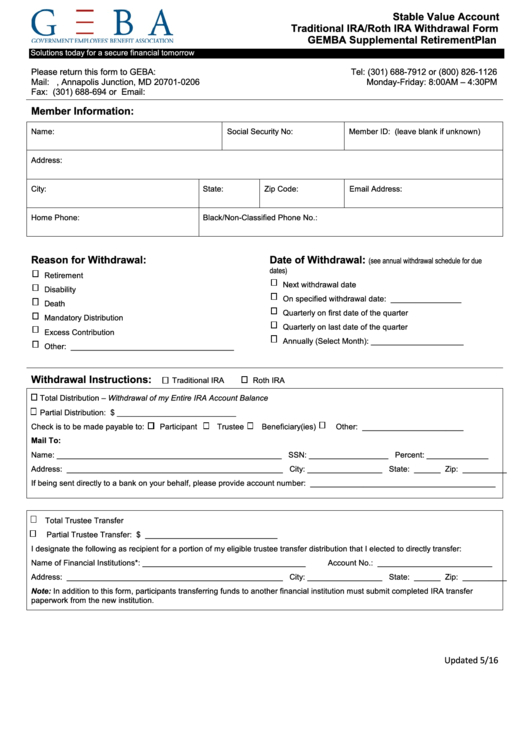

Fillable Stable Value Account Traditional Ira/roth Ira Withdrawal Form

Web find the form you need for your nationwide mutual fund, including iras. Account options form for all accounts add or update banking information add or update automatic investment, withdrawal and exchange plans manage how distributions are delivered manage how statements, tax forms and regulatory materials are delivered account. Want to submit your form online? Log in to your account..

Nationwide Ira Withdrawal Form Universal Network

C home c work c cell Web log in to your account at nrsforu.com and click “manage account” to locate “withdraw money” or “track withdrawal status”. Web withdrawal penalty (25% if from a simple ira and within 2 years of the initial simple contribution) in addition to normal income tax for early withdrawal. Key person forms mutual fund account forms.

Ira Withdrawal Authorization Form Universal Network

Web ira transfer form (pdf) use this form to transfer assets from an existing retirement account, such as an ira or 401 (k). Key person forms mutual fund account forms Do not use this form to take annuity withdrawals from your contract. F home f work f cell Web to provide federal tax withholding direction for all withdrawal requests except.

How to Avoid IRA Early Withdrawal Penalties in a Divorce Daphne Law Blog

Popular nationwide forms key person benefits forms find forms to help manage your key person employee benefits. Web withdrawal penalty (25% if from a simple ira and within 2 years of the initial simple contribution) in addition to normal income tax for early withdrawal. Key person forms mutual fund account forms Beneficiary payout form for ira assets(pdf) use this form.

Ira Withdrawal Authorization Form 20202021 Fill and Sign Printable

Save time and file a claim online. C home c work c cell Web roth − you pay taxes now and will be eligible for tax free withdrawals if the the withdraw is made at five years or more after the january 1 of the first year that a roth contribution was made to the ira and the withdrawal was.

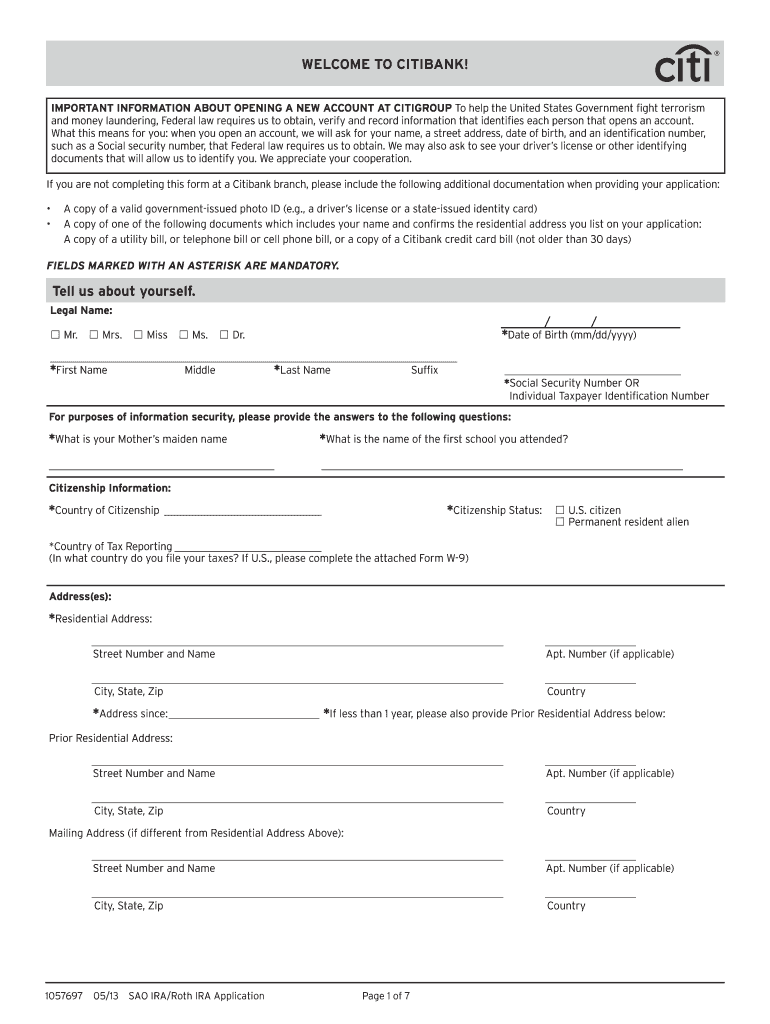

Citibank Ira Withdrawal Form 20202022 Fill and Sign Printable

Web ira transfer form (pdf) use this form to transfer assets from an existing retirement account, such as an ira or 401 (k). Roth ira distributions within 5 years may be subject to 10% premature withdrawal penalty. Web roth − you pay taxes now and will be eligible for tax free withdrawals if the the withdraw is made at five.

Nationwide Annuity Withdrawal Form Fill Out and Sign Printable PDF

Web find the form you need for your nationwide mutual fund, including iras. F home f work f cell Popular nationwide forms key person benefits forms find forms to help manage your key person employee benefits. Save time and file a claim online. Do not use this form to take annuity withdrawals from your contract.

11 Ways to Avoid the IRA Early Withdrawal Penalty

72(t) substantially equal periodic payments. Web log in to your account at nrsforu.com and click “manage account” to locate “withdraw money” or “track withdrawal status”. Want to submit your form online? Web ira transfer form (pdf) use this form to transfer assets from an existing retirement account, such as an ira or 401 (k). Web to provide federal tax withholding.

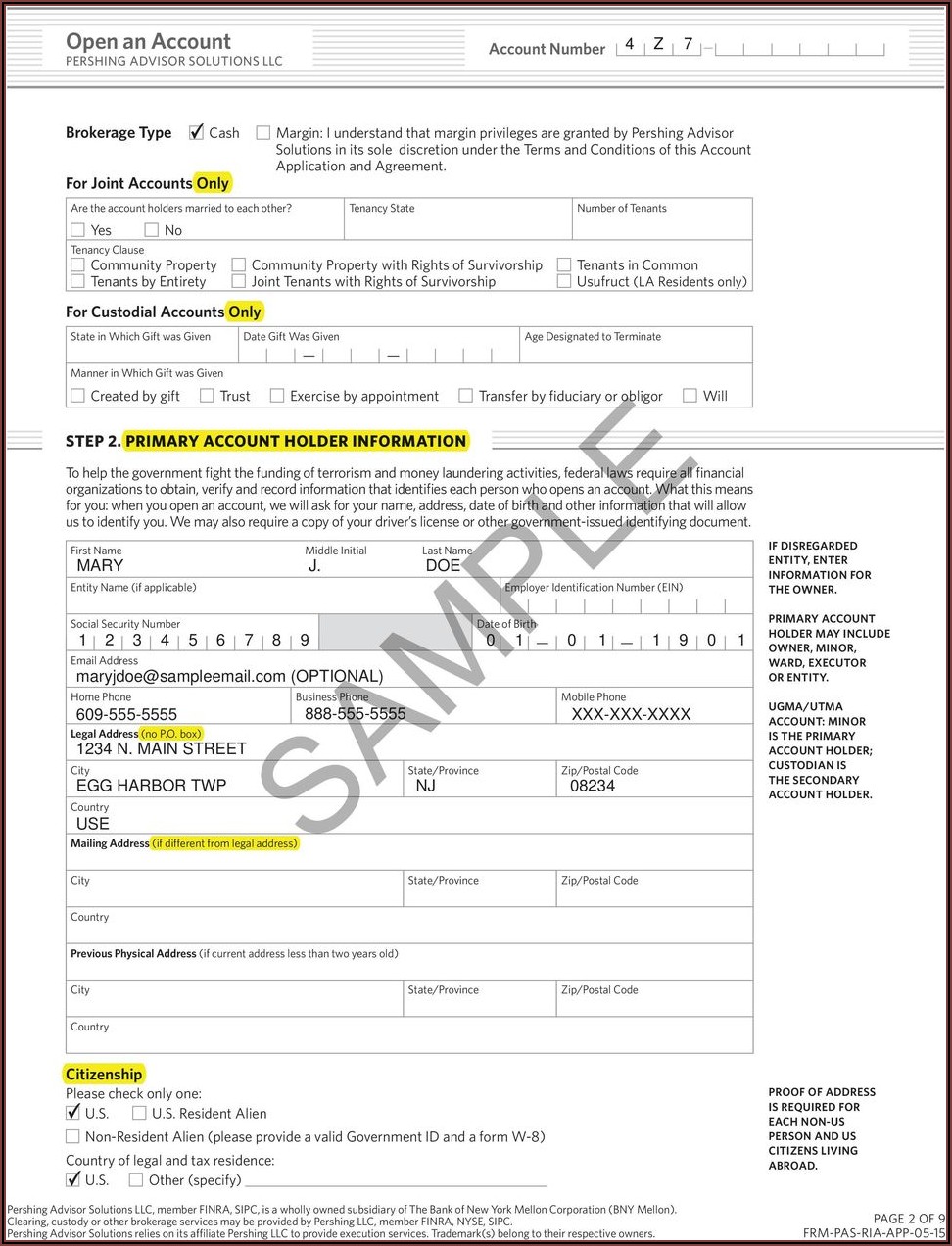

Pershing Ira Withdrawal Form Form Resume Examples goVLdJqpVv

Please complete sections a, c, and e. Log in to your account. Beneficiary payout form for ira assets(pdf) use this form to transfer account ownership to a beneficiary or to make a distribution, or distributions, in the event an ira account owner is deceased. C home c work c cell F home f work f cell

Pin on Retirement

Web log in to your account at nrsforu.com and click “manage account” to locate “withdraw money” or “track withdrawal status”. Beneficiary payout form for ira assets(pdf) use this form to transfer account ownership to a beneficiary or to make a distribution, or distributions, in the event an ira account owner is deceased. Need to file an insurance or death benefit.

Please Complete Sections A, C, And E.

Popular nationwide forms key person benefits forms find forms to help manage your key person employee benefits. Need to file an insurance or death benefit claim? Web log in to your account at nrsforu.com and click “manage account” to locate “withdraw money” or “track withdrawal status”. Account options form for all accounts add or update banking information add or update automatic investment, withdrawal and exchange plans manage how distributions are delivered manage how statements, tax forms and regulatory materials are delivered account.

Beneficiary Payout Form For Ira Assets(Pdf) Use This Form To Transfer Account Ownership To A Beneficiary Or To Make A Distribution, Or Distributions, In The Event An Ira Account Owner Is Deceased.

Roth ira distributions within 5 years may be subject to 10% premature withdrawal penalty. Web find the form you need for your nationwide mutual fund, including iras. Log in to your account. Web sum or systematic withdrawal lasting less than 10 years 20% of the taxable portion of the distribution paid to you will be withheld for federal income taxes.

Use This Form To Draft Money From Your Bank Account Into Your Nationwide Annuity Contract.

Web withdrawal penalty (25% if from a simple ira and within 2 years of the initial simple contribution) in addition to normal income tax for early withdrawal. Do not use this form to take annuity withdrawals from your contract. Key person forms mutual fund account forms Web log in to your account at nrsforu.com and click “manage account” to locate “withdraw money” or “track withdrawal status”.

State Taxes Will Be Withheld Where Applicable.

Web roth − you pay taxes now and will be eligible for tax free withdrawals if the the withdraw is made at five years or more after the january 1 of the first year that a roth contribution was made to the ira and the withdrawal was on account of. C home c work c cell 72(t) substantially equal periodic payments. Save time and file a claim online.