Nc Form D 410

Nc Form D 410 - Sales and use electronic data interchange (edi) step by step instructions for efile; The north carolina department of revenue also provides a means for taxpayers to make payments online or via telephone. Beginning with tax year 2019, a taxpayer that receives an automatic extension to file a federal individual income tax return will be granted an automatic state extension to file the n.c. You are not required to send a payment of the tax you estimate as due. This form is for income earned in tax year 2022, with tax returns due in april 2023. Electronic filing options and requirements; Worksheet for determining the credit for the disabled taxpayer,. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. The advanced tools of the editor will lead you through the editable pdf template. Web what is nc form d 410?

The advanced tools of the editor will lead you through the editable pdf template. Apply a check mark to indicate the choice. Form details calendar year 2022 fiscal year what's this? We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. The north carolina department of revenue also provides a means for taxpayers to make payments online or via telephone. To receive the extra time you must: Press the arrow with the inscription next to move from field to field. Web the way to fill out the nc dept of revenue forms d410 online: Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Edit your north carolina form d 410 online type text, add images, blackout confidential details, add comments, highlights and more.

Web what is nc form d 410? Apply a check mark to indicate the choice. Electronic filing options and requirements; With the move to may 17, the department will not impose penalties on individuals who file and pay their income taxes after april 15, 2021, as long as they file and pay their tax on or before may 17, 2021. Beginning with tax year 2019, a taxpayer that receives an automatic extension to file a federal individual income tax return will be granted an automatic state extension to file the n.c. Share your form with others send form d 410 pdf via email, link, or fax. Must file the extension by. Worksheet for determining the credit for the disabled taxpayer,. Web form to your return. Complete this web form for assistance.

Standard Form 410 T Revised 2020 Fill and Sign Printable Template

Apply a check mark to indicate the choice. This form is for income earned in tax year 2022, with tax returns due in april 2023. Sales and use electronic data interchange (edi) step by step instructions for efile; Share your form with others send form d 410 pdf via email, link, or fax. Form details calendar year 2022 fiscal year.

Printable North Carolina Realtor Form 401 T Fill Online, Printable

You are not required to send a payment of the tax you estimate as due. Worksheet for determining the credit for the disabled taxpayer,. Electronic filing options and requirements; Enter your official contact and identification details. Web the way to fill out the nc dept of revenue forms d410 online:

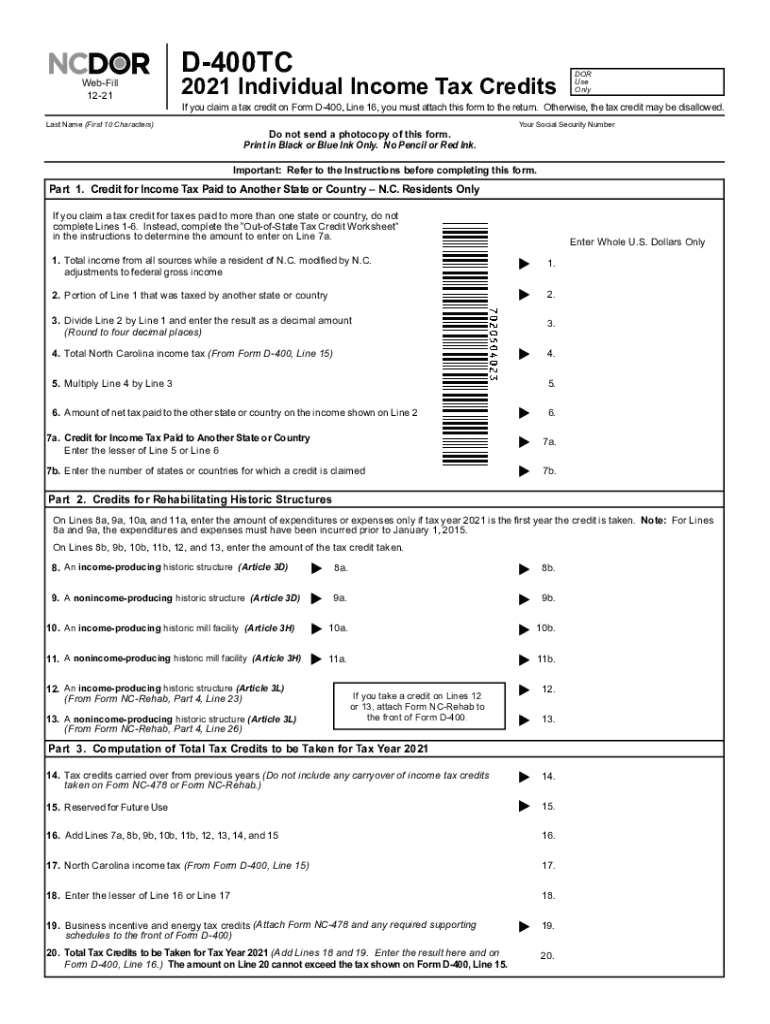

Form D 400Tc Fill Out and Sign Printable PDF Template signNow

Beginning with tax year 2019, a taxpayer that receives an automatic extension to file a federal individual income tax return will be granted an automatic state extension to file the n.c. To start the document, utilize the fill camp; Sign online button or tick the preview image of the form. We will update this page with a new version of.

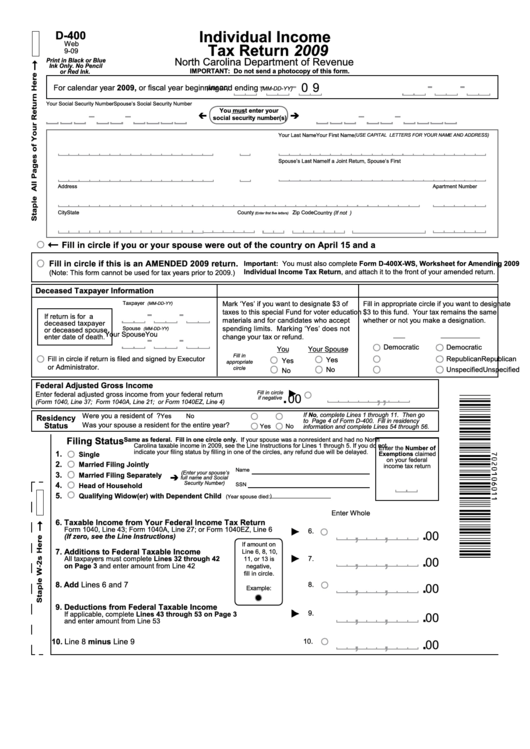

Form D400 Individual Tax Return 2009 printable pdf download

The advanced tools of the editor will lead you through the editable pdf template. To receive the extra time you must: Using efile allows you to file federal and state forms at the same time or separately. Sign online button or tick the preview image of the form. Enter your official contact and identification details.

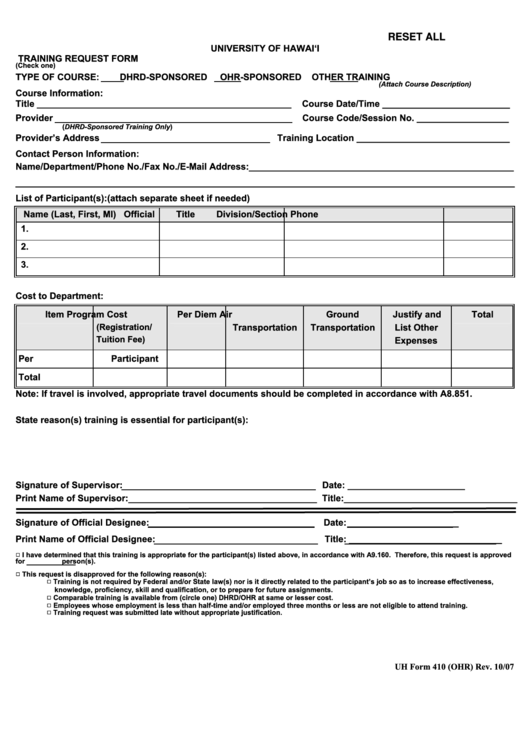

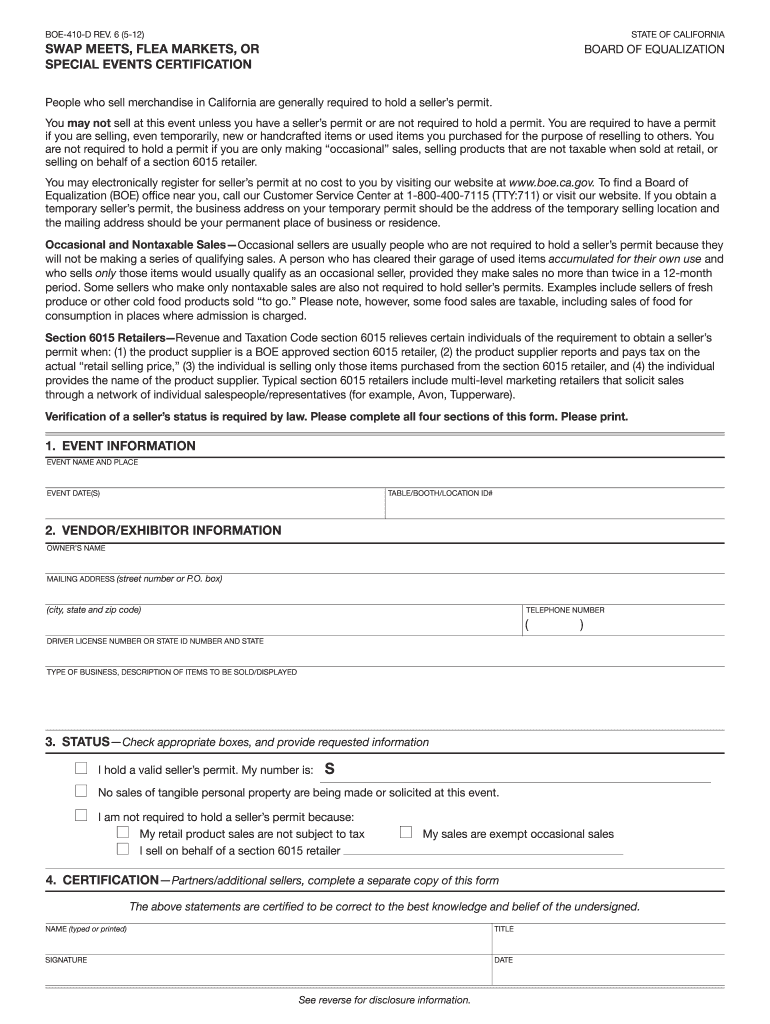

Top 5 Form 410 Templates free to download in PDF format

We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web the way to fill out the nc dept of revenue forms d410 online: The advanced tools.

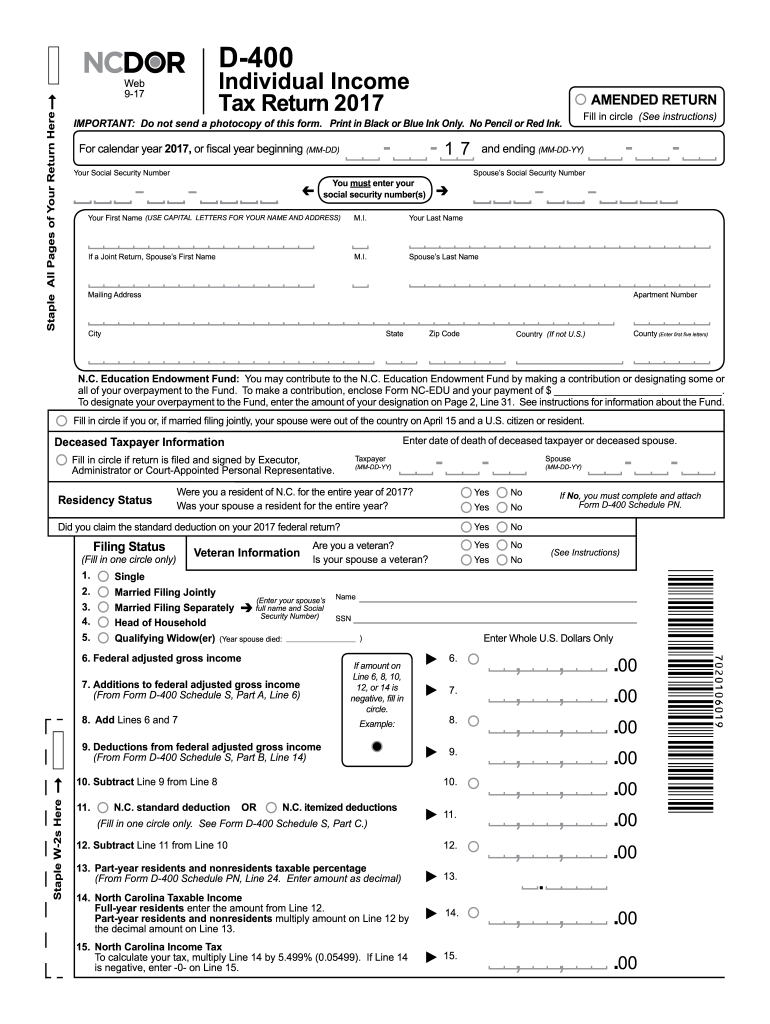

NC DoR D400 2017 Fill out Tax Template Online US Legal Forms

Electronic filing options and requirements; Out of country what's this? Beginning with tax year 2019, a taxpayer that receives an automatic extension to file a federal individual income tax return will be granted an automatic state extension to file the n.c. Sales and use electronic data interchange (edi) step by step instructions for efile; Worksheet for determining the credit for.

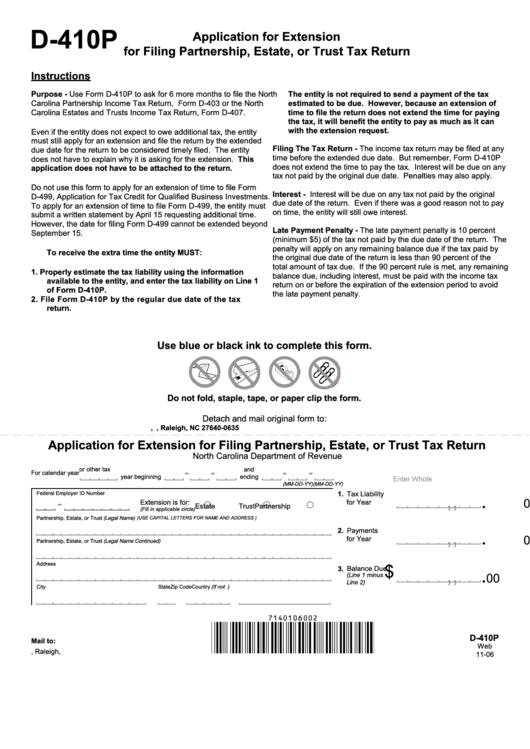

Form D410p Application For Extension For Filing Partnership, Estate

You are not required to send a payment of the tax you estimate as due. Complete this web form for assistance. Web the way to fill out the nc dept of revenue forms d410 online: Press the arrow with the inscription next to move from field to field. Form details calendar year 2022 fiscal year what's this?

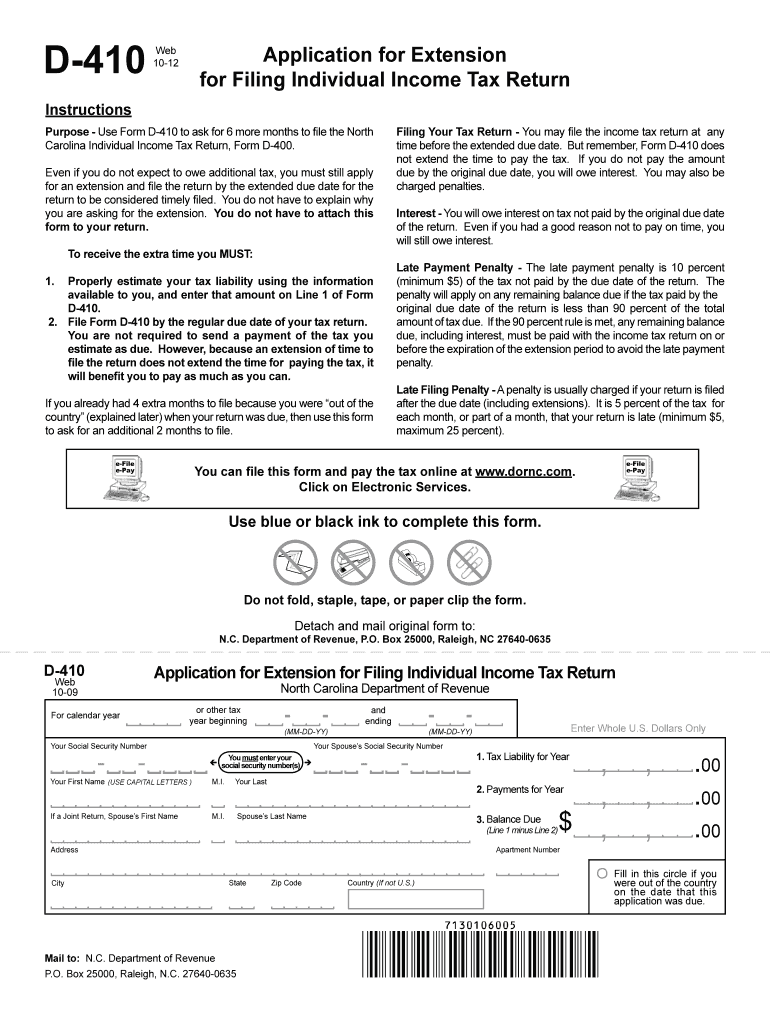

Nc extension form Fill out & sign online DocHub

You are not required to send a payment of the tax you estimate as due. Complete this web form for assistance. Beginning with tax year 2019, a taxpayer that receives an automatic extension to file a federal individual income tax return will be granted an automatic state extension to file the n.c. Edit your north carolina form d 410 online.

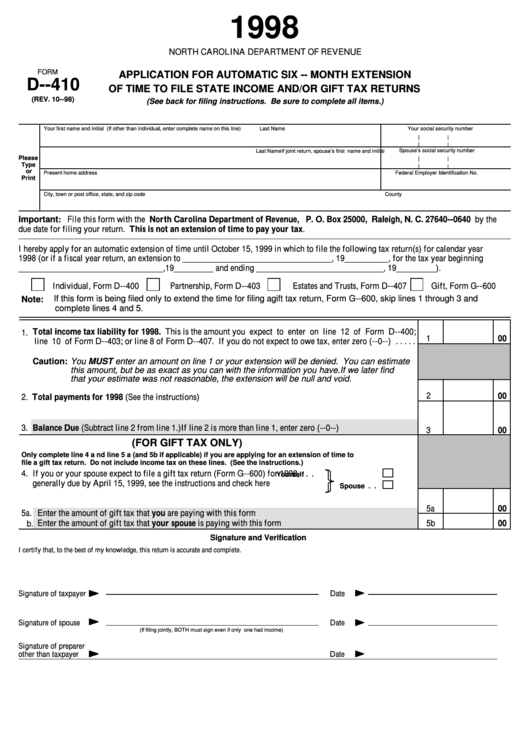

D410 Application For Automatic SixMonth Extension Of Time To File

Edit your north carolina form d 410 online type text, add images, blackout confidential details, add comments, highlights and more. Complete this web form for assistance. With the move to may 17, the department will not impose penalties on individuals who file and pay their income taxes after april 15, 2021, as long as they file and pay their tax.

Printable Nc Form D 410 Printable Word Searches

Web form to your return. The north carolina department of revenue also provides a means for taxpayers to make payments online or via telephone. Press the arrow with the inscription next to move from field to field. We will update this page with a new version of the form for 2024 as soon as it is made available by the.

Form Details Calendar Year 2022 Fiscal Year What's This?

Complete this web form for assistance. Electronic filing options and requirements; Web the way to fill out the nc dept of revenue forms d410 online: Web the tips below can help you complete d410 nc tax extension quickly and easily:

Must File The Extension By.

Sign online button or tick the preview image of the form. You are not required to send a payment of the tax you estimate as due. Beginning with tax year 2019, a taxpayer that receives an automatic extension to file a federal individual income tax return will be granted an automatic state extension to file the n.c. To start the document, utilize the fill camp;

Web What Is Nc Form D 410?

Share your form with others send form d 410 pdf via email, link, or fax. Press the arrow with the inscription next to move from field to field. Sales and use electronic data interchange (edi) step by step instructions for efile; Out of country what's this?

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Apply a check mark to indicate the choice. With the move to may 17, the department will not impose penalties on individuals who file and pay their income taxes after april 15, 2021, as long as they file and pay their tax on or before may 17, 2021. The north carolina department of revenue also provides a means for taxpayers to make payments online or via telephone. Web form to your return.