Negotiating With Creditors After Chapter 13 Dismissal

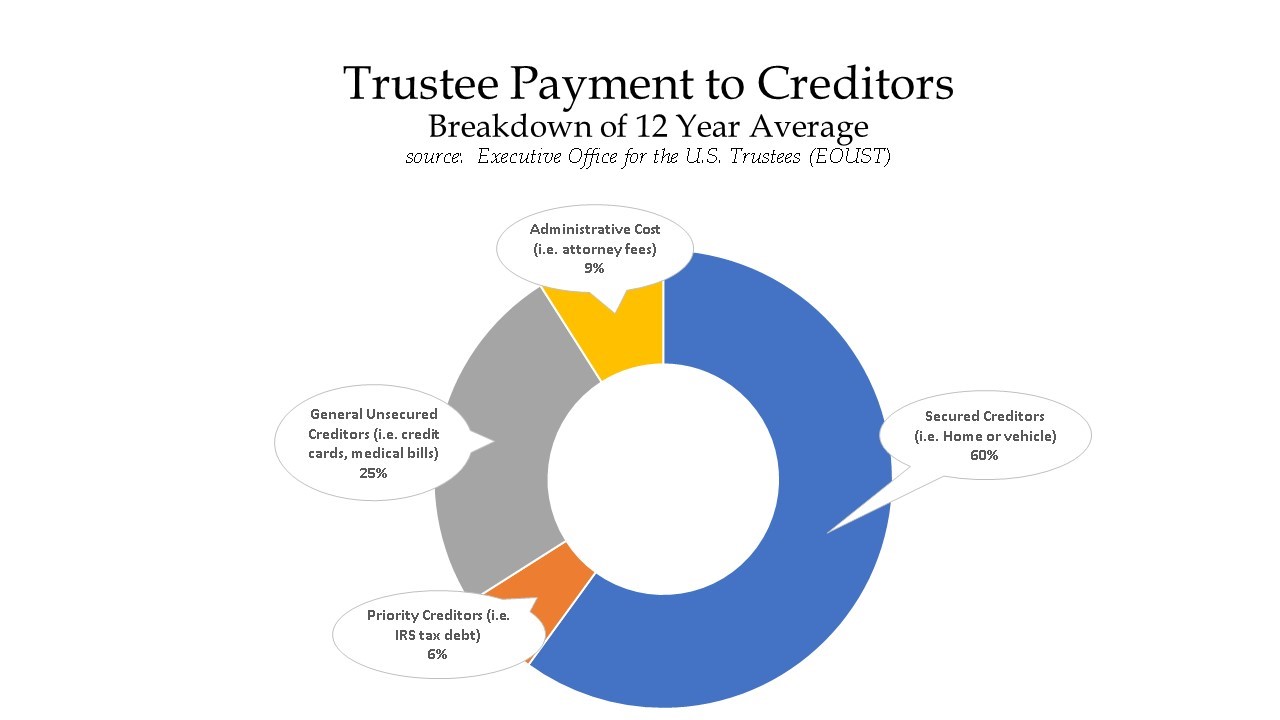

Negotiating With Creditors After Chapter 13 Dismissal - Web responding to the motion to dismiss. Filing for a chapter 13 bankruptcy allows those with a regular income to come up with a plan approved by their creditors and the legal system to pay off debt with their earnings over a. The motion will tell you why the trustee is asking the court to dismiss your case—it's likely. The first thing you'll want to do after receiving a motion to dismiss is to read it carefully. If this happens, you must move quickly to correct the situation. The amount of your chapter 13 plan payment depends on several. File debtor's request for voluntary dismissal. People may never hear from their creditors or debt collectors again. Web you make a payment each month to a chapter 13 trustee who pays your creditors according to the terms in the chapter 13 plan. This is a motion for voluntary dismissal. a.

The first thing you'll want to do after receiving a motion to dismiss is to read it carefully. If this happens, you must move quickly to correct the situation. Web some of the most common reasons a court can find good cause to dismiss or convert a chapter 13 bankruptcy is if you as the debtor, causes an unreasonable delay that is prejudicial to creditors, or if there is a failure to make timely chapter 13. Filing for a chapter 13 bankruptcy allows those with a regular income to come up with a plan approved by their creditors and the legal system to pay off debt with their earnings over a. People may never hear from their creditors or debt collectors again. The motion will tell you why the trustee is asking the court to dismiss your case—it's likely. Web i have seen chapter 13 dismissals that seemed to have created a void for credit card debts to fall into. Ad compare online the best debt loans. How much you pay on a given debt. Web if you are in a chapter 13 plan and are unable to keep the payments current, the trustee, or one of your creditors, may file a motion to dismiss the case.

Web negotiating with creditors after chapter 13 | this blog will thoroughly explain the process of mn bankruptcy, debt consolidation options and other solutions for. Web here's how chapter 13 bankruptcy generally works: Web if you are in a chapter 13 plan and are unable to keep the payments current, the trustee, or one of your creditors, may file a motion to dismiss the case. The first thing you'll want to do after receiving a motion to dismiss is to read it carefully. Web some of the most common reasons a court can find good cause to dismiss or convert a chapter 13 bankruptcy is if you as the debtor, causes an unreasonable delay that is prejudicial to creditors, or if there is a failure to make timely chapter 13. In many cases, creditors are willing to negotiate repayment terms and you can obtain a plan that suits your. File debtor's request for voluntary dismissal. Web in a chapter 13 case, to participate in distributions from the bankruptcy estate, unsecured creditors must file their claims with the court within 90 days after the first date set for the meeting of creditors. Ad compare online the best debt loans. Apply today for financial freedom!

7 Easy Steps to Maintain Your Business Debt Under Control DemotiX

Apply today for financial freedom! As a borrower, you have the right to contact your creditors to request payment options. Web you make a payment each month to a chapter 13 trustee who pays your creditors according to the terms in the chapter 13 plan. The amount of your chapter 13 plan payment depends on several. Web negotiating with creditors.

Can Creditors Sue You After You Have Filed for Bankruptcy? Loan Lawyers

Web on the surface, chapter 13 appears to provide creditors the same general remedies as other chapters of the bankruptcy code — the right to seek dismissal of the case (11 u.s.c. Web i have seen chapter 13 dismissals that seemed to have created a void for credit card debts to fall into. As a borrower, you have the right.

Financial Capability Class 10 Things to Know Before Negotiating with

Web if you are in a chapter 13 plan and are unable to keep the payments current, the trustee, or one of your creditors, may file a motion to dismiss the case. Ad compare online the best debt loans. As a borrower, you have the right to contact your creditors to request payment options. Get instantly matched with the ideal.

3 Exceptionally Useful Tips For Negotiating With Creditors Bit Rebels

Web you make a payment each month to a chapter 13 trustee who pays your creditors according to the terms in the chapter 13 plan. The amount of your chapter 13 plan payment depends on several. Ad compare online the best debt loans. This is a motion for voluntary dismissal. a. Apply today for financial freedom!

Bankruptcy Chapter 13 dismissal Please Help?

Filing for a chapter 13 bankruptcy allows those with a regular income to come up with a plan approved by their creditors and the legal system to pay off debt with their earnings over a. The amount of your chapter 13 plan payment depends on several. In many cases, creditors are willing to negotiate repayment terms and you can obtain.

Why Creditors Call After Bankruptcy Loan Lawyers

Ad compare online the best debt loans. As a borrower, you have the right to contact your creditors to request payment options. Web some of the most common reasons a court can find good cause to dismiss or convert a chapter 13 bankruptcy is if you as the debtor, causes an unreasonable delay that is prejudicial to creditors, or if.

Negotiating With Creditors? ThriftyFun

Apply today for financial freedom! Web some of the most common reasons a court can find good cause to dismiss or convert a chapter 13 bankruptcy is if you as the debtor, causes an unreasonable delay that is prejudicial to creditors, or if there is a failure to make timely chapter 13. The motion will tell you why the trustee.

Credit Card After Chapter 13 Dismissal Blog 13 Myths About Chapter 13

The motion will tell you why the trustee is asking the court to dismiss your case—it's likely. You keep your property and repay some or all of your debts through a repayment plan which lasts for three or five years. People may never hear from their creditors or debt collectors again. Web some of the most common reasons a court.

Credit Card After Chapter 13 Dismissal Blog 13 Myths About Chapter 13

Web responding to the motion to dismiss. The last file i worked like this was about a. Web in a chapter 13 case, to participate in distributions from the bankruptcy estate, unsecured creditors must file their claims with the court within 90 days after the first date set for the meeting of creditors. This is a motion for voluntary dismissal..

48+ Voluntary Dismissal Of Chapter 13 On Credit Report JameeEllaria

Web negotiating with creditors after chapter 13 | this blog will thoroughly explain the process of mn bankruptcy, debt consolidation options and other solutions for. Web on the surface, chapter 13 appears to provide creditors the same general remedies as other chapters of the bankruptcy code — the right to seek dismissal of the case (11 u.s.c. In many cases,.

As A Borrower, You Have The Right To Contact Your Creditors To Request Payment Options.

Web i'd like to khow if anyone has experienced the dismissal of a ch 13 bk and successfully negotiated a settlement with unsecured debt holders? Apply today for financial freedom! The amount of your chapter 13 plan payment depends on several. The last file i worked like this was about a.

If This Happens, You Must Move Quickly To Correct The Situation.

Web once the case is dismissed, your creditors will receive notice and collection efforts may begin right away. Web on the surface, chapter 13 appears to provide creditors the same general remedies as other chapters of the bankruptcy code — the right to seek dismissal of the case (11 u.s.c. Ad compare online the best debt loans. Web you make a payment each month to a chapter 13 trustee who pays your creditors according to the terms in the chapter 13 plan.

Web Some Of The Most Common Reasons A Court Can Find Good Cause To Dismiss Or Convert A Chapter 13 Bankruptcy Is If You As The Debtor, Causes An Unreasonable Delay That Is Prejudicial To Creditors, Or If There Is A Failure To Make Timely Chapter 13.

Web in a chapter 13 case, to participate in distributions from the bankruptcy estate, unsecured creditors must file their claims with the court within 90 days after the first date set for the meeting of creditors. Web if you are in a chapter 13 plan and are unable to keep the payments current, the trustee, or one of your creditors, may file a motion to dismiss the case. Web negotiating with creditors after chapter 13 | this blog will thoroughly explain the process of mn bankruptcy, debt consolidation options and other solutions for. The first thing you'll want to do after receiving a motion to dismiss is to read it carefully.

Get Instantly Matched With The Ideal Debt Repayment Plan For You.

In many cases, creditors are willing to negotiate repayment terms and you can obtain a plan that suits your. Web responding to the motion to dismiss. How much you pay on a given debt. Web i have seen chapter 13 dismissals that seemed to have created a void for credit card debts to fall into.