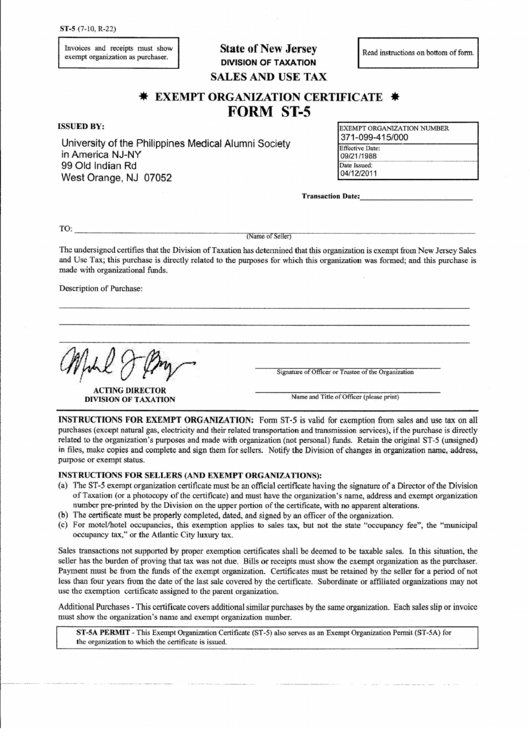

New Jersey St 5 Form

New Jersey St 5 Form - Federal employees claiming sales tax exemption. Web sales and use tax. Check box if using this form as a blanket form date of purchase — leave blank if using blanket form. The form must be signed by an organization officer and include the tax exemption number. Sales tax information for organizations having exemption certificate. For details, see nj sales and use tax exemption below. Exemption on purchases made by contractors If the purchase is directly related to the organization's purposes and. Petroleum products gross receipts tax. Proof of exemption is government purchase order or contract and direct government payment.

For details, see nj sales and use tax exemption below. Federal employees claiming sales tax exemption. Exemption on purchases made by contractors If the purchase is directly related to the organization's purposes and. Sales tax information for organizations having exemption certificate. Check box if using this form as a blanket form date of purchase — leave blank if using blanket form. State of new jersey, division of taxation, p. Web instructions for exempt organization: The form must be signed by an organization officer and include the tax exemption number. Web sales and use tax.

Federal employees claiming sales tax exemption. Exemption on purchases made by contractors If the purchase is directly related to the organization's purposes and. Sales tax information for organizations having exemption certificate. Web sales and use tax. Check box if using this form as a blanket form date of purchase — leave blank if using blanket form. Petroleum products gross receipts tax. State of new jersey, division of taxation, p. The form must be signed by an organization officer and include the tax exemption number. Proof of exemption is government purchase order or contract and direct government payment.

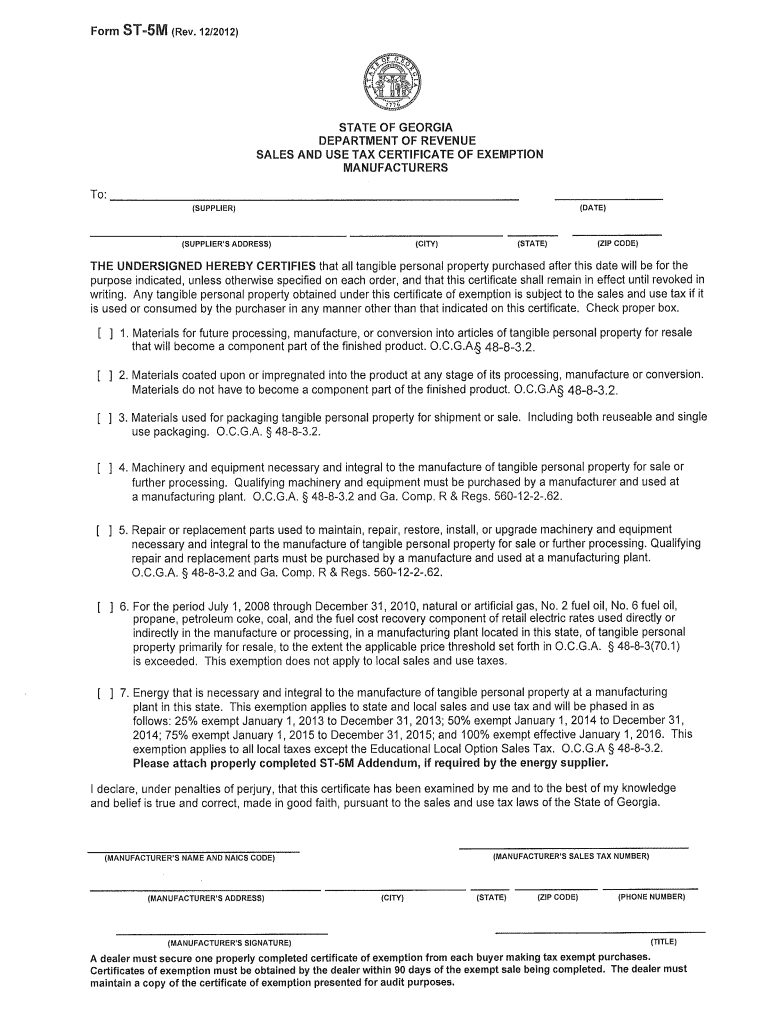

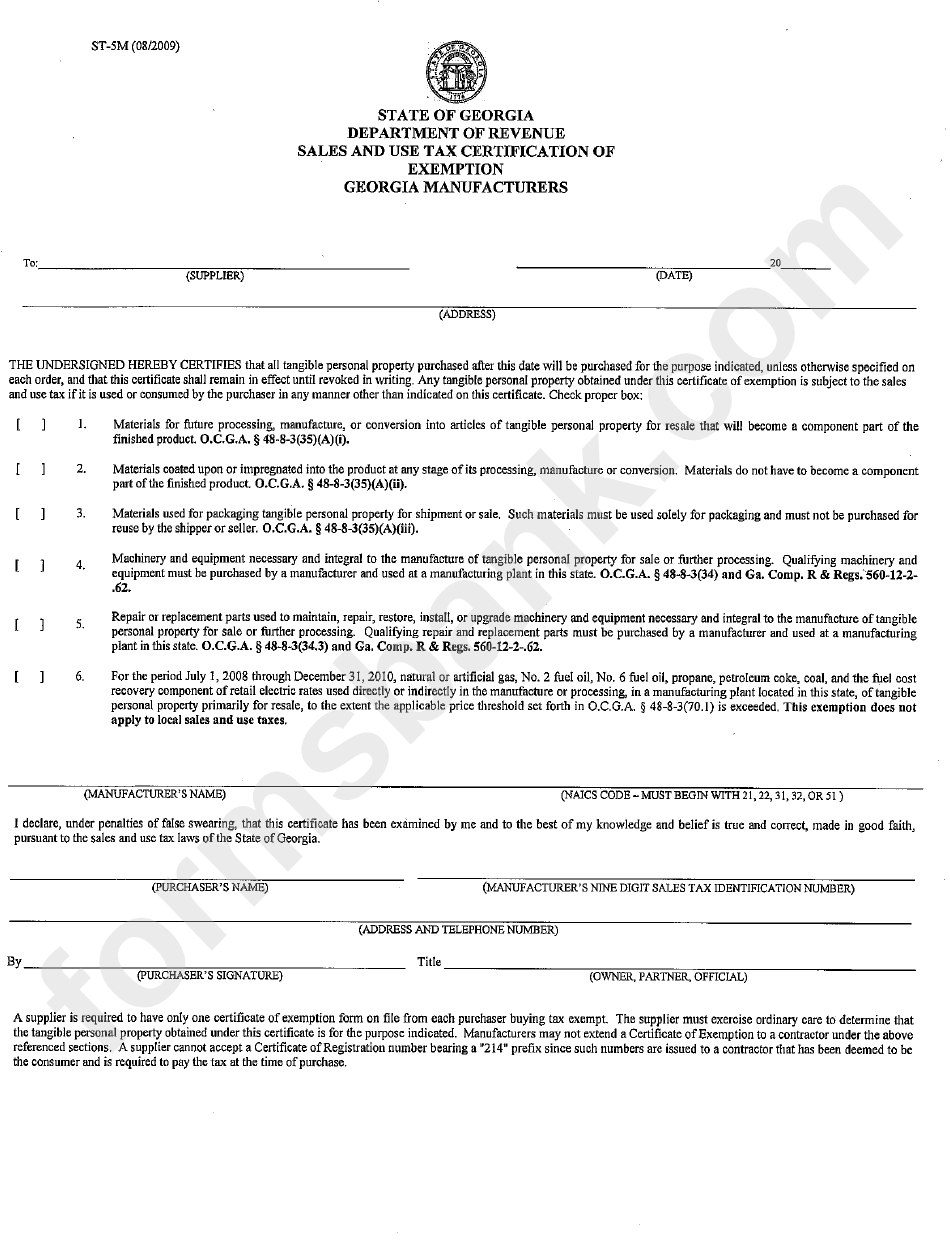

2012 Form GA DoR ST5M Fill Online, Printable, Fillable, Blank pdfFiller

Petroleum products gross receipts tax. Check box if using this form as a blanket form date of purchase — leave blank if using blanket form. For details, see nj sales and use tax exemption below. Web sales and use tax. Sales tax information for organizations having exemption certificate.

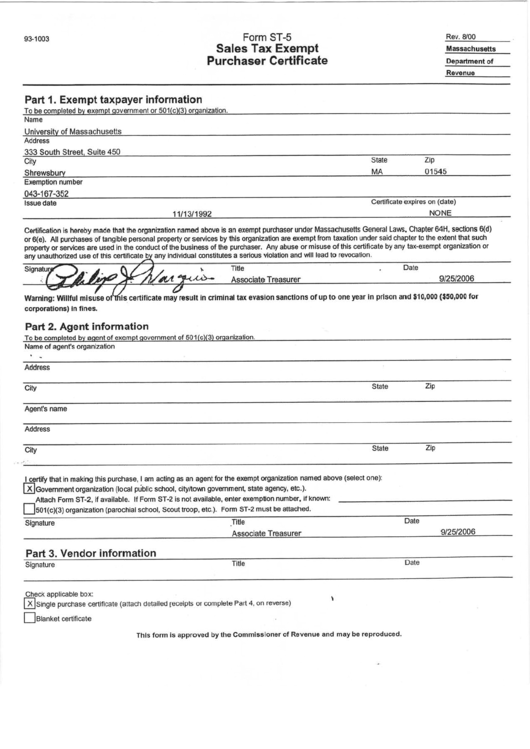

Form St5 Sales Tax Exempt Purchaser Certification Massachusetts

Sales tax information for organizations having exemption certificate. For details, see nj sales and use tax exemption below. Exemption on purchases made by contractors Check box if using this form as a blanket form date of purchase — leave blank if using blanket form. Web sales and use tax.

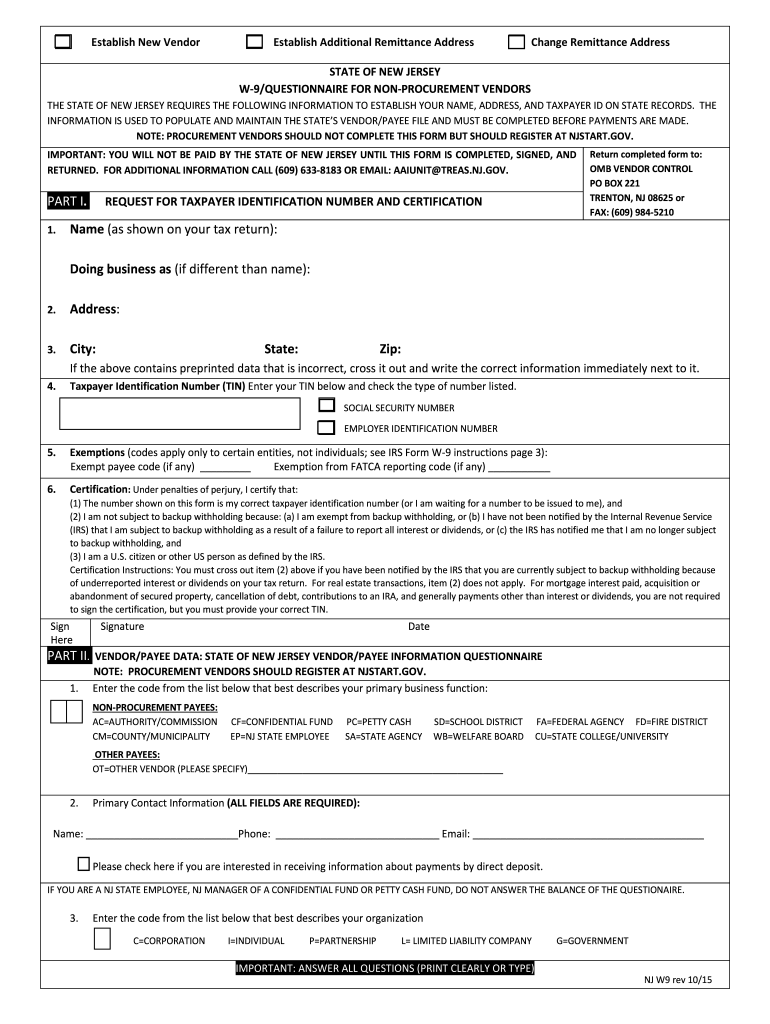

20152021 Form NJ W9 Fill Online, Printable, Fillable, Blank pdfFiller

Web sales and use tax. Federal employees claiming sales tax exemption. Exemption on purchases made by contractors State of new jersey, division of taxation, p. Sales tax information for organizations having exemption certificate.

5841 N New Jersey St

Check box if using this form as a blanket form date of purchase — leave blank if using blanket form. Exemption on purchases made by contractors Proof of exemption is government purchase order or contract and direct government payment. The form must be signed by an organization officer and include the tax exemption number. Web instructions for exempt organization:

Fill Free fillable The State of New Jersey PDF forms

If the purchase is directly related to the organization's purposes and. State of new jersey, division of taxation, p. Check box if using this form as a blanket form date of purchase — leave blank if using blanket form. Exemption on purchases made by contractors Federal employees claiming sales tax exemption.

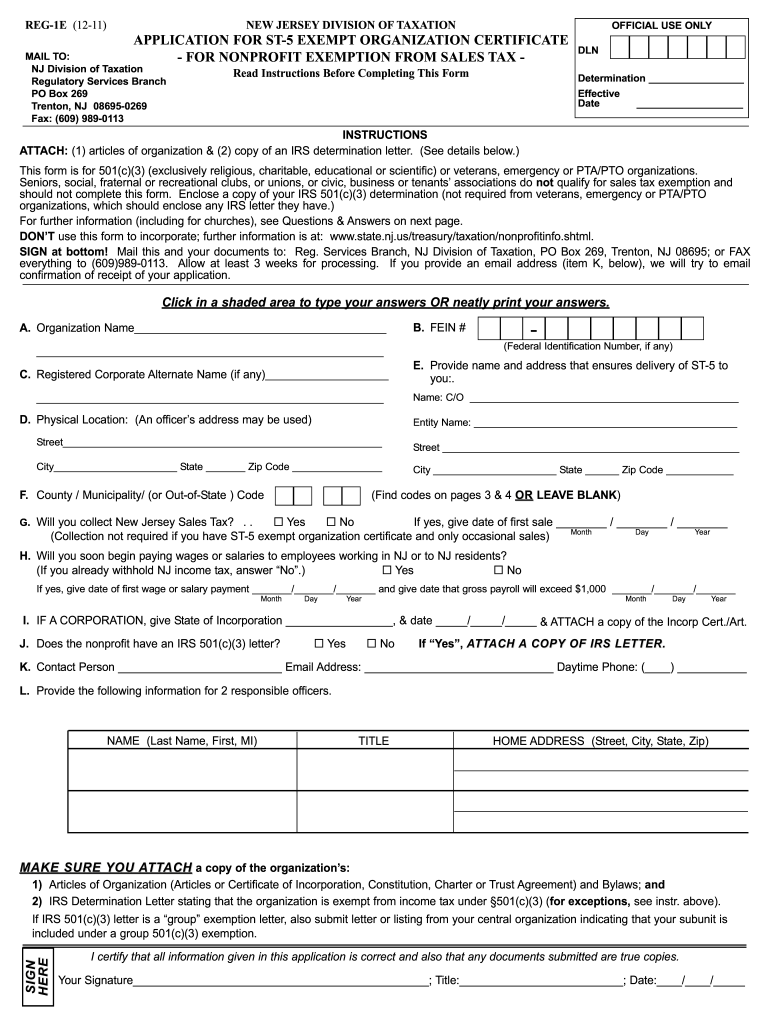

2011 Form NJ REG1E Fill Online, Printable, Fillable, Blank pdfFiller

Petroleum products gross receipts tax. Sales tax information for organizations having exemption certificate. Web instructions for exempt organization: Exemption on purchases made by contractors State of new jersey, division of taxation, p.

St 5 Form Nj Fill Online, Printable, Fillable, Blank pdfFiller

Exemption on purchases made by contractors Web sales and use tax. Proof of exemption is government purchase order or contract and direct government payment. Petroleum products gross receipts tax. For details, see nj sales and use tax exemption below.

Form St5 Exempt Organization Certificate printable pdf download

State of new jersey, division of taxation, p. Petroleum products gross receipts tax. The form must be signed by an organization officer and include the tax exemption number. Check box if using this form as a blanket form date of purchase — leave blank if using blanket form. If the purchase is directly related to the organization's purposes and.

Form St5m Sales And Use Tax Certification Of Exemption printable pdf

Exemption on purchases made by contractors The form must be signed by an organization officer and include the tax exemption number. Check box if using this form as a blanket form date of purchase — leave blank if using blanket form. Petroleum products gross receipts tax. Sales tax information for organizations having exemption certificate.

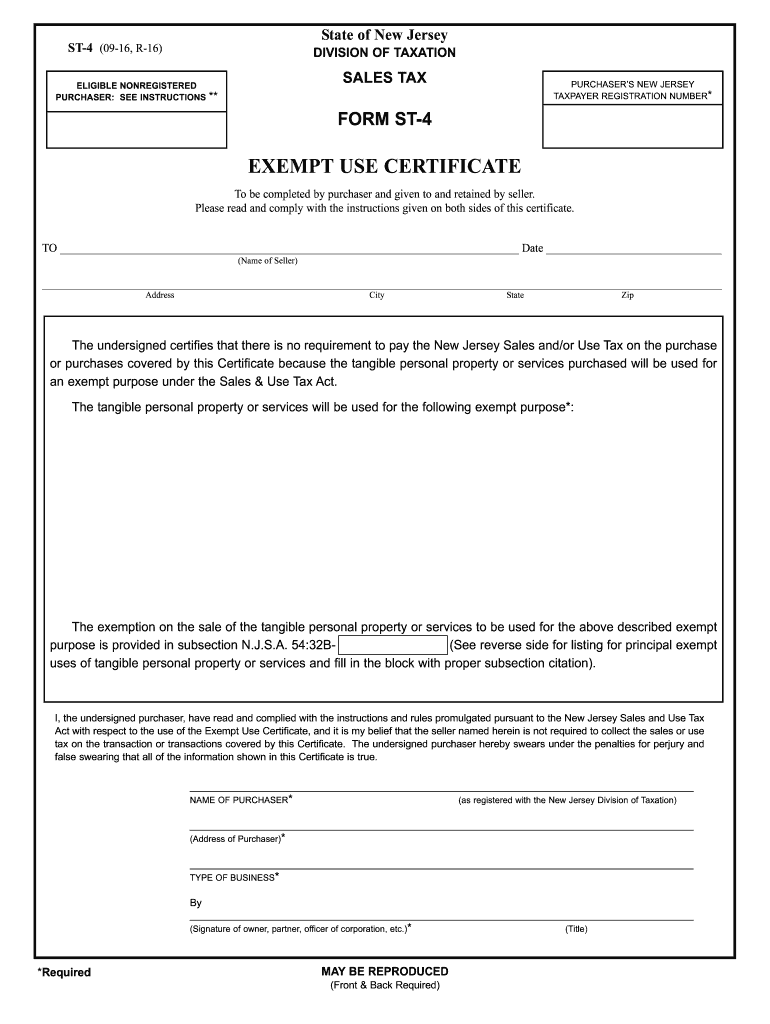

20162022 Form NJ ST4 Fill Online, Printable, Fillable, Blank pdfFiller

Petroleum products gross receipts tax. Proof of exemption is government purchase order or contract and direct government payment. Web sales and use tax. Sales tax information for organizations having exemption certificate. State of new jersey, division of taxation, p.

Check Box If Using This Form As A Blanket Form Date Of Purchase — Leave Blank If Using Blanket Form.

The form must be signed by an organization officer and include the tax exemption number. Web instructions for exempt organization: Petroleum products gross receipts tax. Proof of exemption is government purchase order or contract and direct government payment.

Sales Tax Information For Organizations Having Exemption Certificate.

Web sales and use tax. Federal employees claiming sales tax exemption. Exemption on purchases made by contractors If the purchase is directly related to the organization's purposes and.

State Of New Jersey, Division Of Taxation, P.

For details, see nj sales and use tax exemption below.