New Mexico Solar Tax Credit 2022 Form

New Mexico Solar Tax Credit 2022 Form - Web r01 rural job tax credit. R02 rural health care practitioners tax credit. Web new mexico provides a 10% personal income tax credit (up to $9,000) for individuals, sole proprietorship businesses, and agricultural enterprises who purchase and install certified. This tax credit is based upon ten. If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Do not complete part ii. Web new mexico energy, minerals, and natural resources department 1220 south st. Santa fe, nm 87505 www.emnrd.state.nm.us/ecmd/ telephone: Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. Web the new mexico state legislature passed senate bill 29 in early 2020.

R02 rural health care practitioners tax credit. This incentive can reduce your state. Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy. If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web r01 rural job tax credit. Web new mexico energy, minerals, and natural resources department 1220 south st. 30%, up to a lifetime. This tax credit is based upon ten. Web home energy audits.

This incentive can reduce your state. Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. Web the applicant understands that there are annual aggregate statetax credit limits in place for solar thermal systems and photovoltaic systems and that the department must certify the. 30%, up to a lifetime. Web home energy audits. The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: Web as the u.s.’s leading residential solar and energy storage company, 6 sunrun works to ensure you can create and store your own solar energy at home to get outage protection. Web r01 rural job tax credit. This tax credit is based upon ten. R02 rural health care practitioners tax credit.

New Mexico solar tax credit clears Senate and proceeds through House

Web home energy audits. Web the new mexico state legislature passed senate bill 29 in early 2020. Web new mexico energy, minerals, and natural resources department 1220 south st. Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications for those credits can be submitted now via this online. Do not.

new mexico solar tax credit 2022 Deafening Bloggers Pictures

Santa fe, nm 87505 www.emnrd.state.nm.us/ecmd/ telephone: Web r01 rural job tax credit. Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy. Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the.

Solar at Home Solar Holler

Web home energy audits. Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy. If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web r01 rural job tax credit. Web the applicant understands that there are annual.

new mexico solar tax credit form In Morrow

Web as the u.s.’s leading residential solar and energy storage company, 6 sunrun works to ensure you can create and store your own solar energy at home to get outage protection. R02 rural health care practitioners tax credit. Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications for those credits.

Solar Tax Credit in 2021 SouthFace Solar & Electric AZ

Web home energy audits. This incentive can reduce your state. Web the applicant understands that there are annual aggregate statetax credit limits in place for solar thermal systems and photovoltaic systems and that the department must certify the. The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: Web.

new mexico solar tax credit 2020 We Have The Greatest Biog Photography

This incentive can reduce your state. Web new mexico energy, minerals, and natural resources department 1220 south st. Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. 30%, up to a lifetime. Web new mexico provides a 10% personal income tax credit (up to.

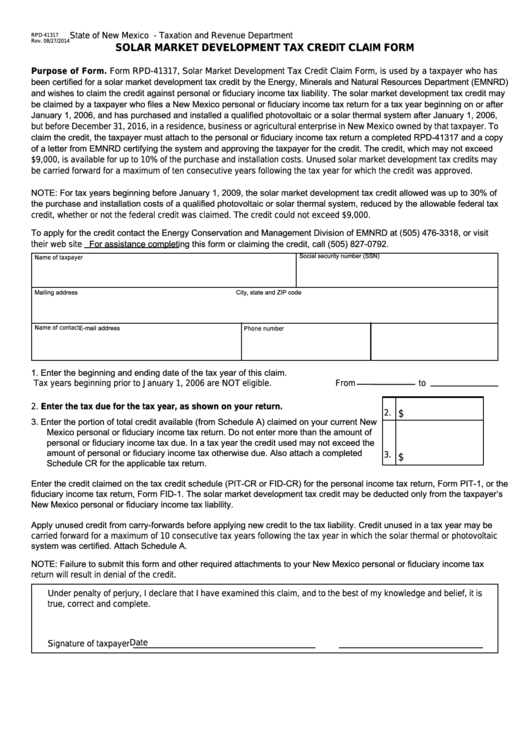

Fillable Form Rpd41317 New Mexico Solar Market Development Tax

30%, up to a lifetime. Santa fe, nm 87505 www.emnrd.state.nm.us/ecmd/ telephone: Web home energy audits. Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

New Mexico’s solar tax credit is back and it can save you thousands

Do not complete part ii. Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications for those credits can be submitted now via this online. Web r01 rural job tax credit. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web if the department finds.

federalsolartaxcreditnewmexico Sol Luna Solar

Web the new mexico state legislature passed senate bill 29 in early 2020. This tax credit is based upon ten. Do not complete part ii. Web r01 rural job tax credit. Web new mexico provides a 10% personal income tax credit (up to $9,000) for individuals, sole proprietorship businesses, and agricultural enterprises who purchase and install certified.

New Mexico Solar Tax Credits Bill Not Yet Dead in Water

Web r01 rural job tax credit. The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web the new mexico state legislature passed senate bill 29 in early 2020. Web catch the top stories.

Web Home Energy Audits.

Web r01 rural job tax credit. Santa fe, nm 87505 www.emnrd.state.nm.us/ecmd/ telephone: The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications for those credits can be submitted now via this online.

R02 Rural Health Care Practitioners Tax Credit.

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) 30%, up to a lifetime. Web as the u.s.’s leading residential solar and energy storage company, 6 sunrun works to ensure you can create and store your own solar energy at home to get outage protection. Web the new mexico state legislature passed senate bill 29 in early 2020.

Do Not Complete Part Ii.

This incentive can reduce your state. Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. Web new mexico energy, minerals, and natural resources department 1220 south st. Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy.

Web The Applicant Understands That There Are Annual Aggregate Statetax Credit Limits In Place For Solar Thermal Systems And Photovoltaic Systems And That The Department Must Certify The.

This tax credit is based upon ten. Web new mexico provides a 10% personal income tax credit (up to $9,000) for individuals, sole proprietorship businesses, and agricultural enterprises who purchase and install certified. If you checked the “no” box, you cannot claim the energy efficient home improvement credit.