New Mexico Withholding Form

New Mexico Withholding Form - Employers who are not required to. Employers engaged in a trade or business who pay. New mexico also requires you to deduct and. Web new mexico has released two new withholding forms and related instructions. Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web new mexico withholding tax effective january 1, 2022 please note: Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does. Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). There are no longer adjustments made to new mexico withholding due to the number of allowances. Web state tax withholding state code:

There are no longer adjustments made to new mexico withholding due to the number of allowances. New mexico also requires you to deduct and. Employers engaged in a trade or business who pay. Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). Employers who are not required to. Web new mexico has released two new withholding forms and related instructions. Web state tax withholding state code: Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does. Employee's withholding certificate form 941; Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file:

Web new mexico has released two new withholding forms and related instructions. Employee's withholding certificate form 941; New mexico also requires you to deduct and. Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web new mexico withholding tax effective january 1, 2022 please note: Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does. There are no longer adjustments made to new mexico withholding due to the number of allowances. Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). Employers who are not required to. Web state tax withholding state code:

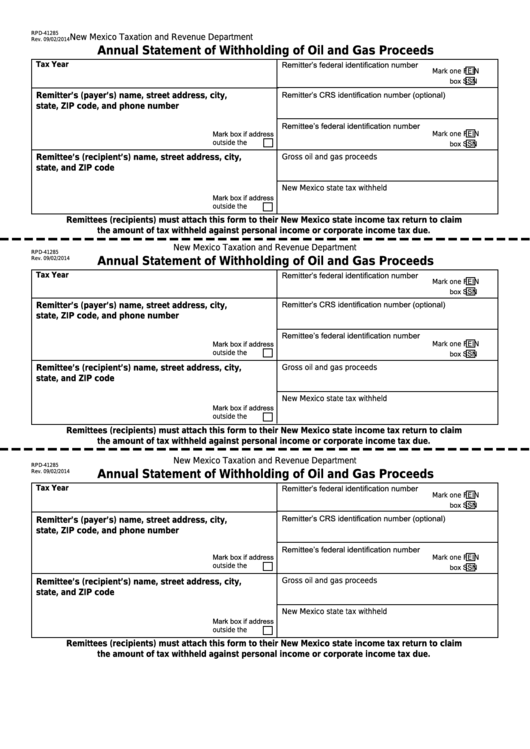

Fillable Form Rpd41285 New Mexico Annual Statement Of Withholding Of

Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does. Employee's withholding certificate form 941; There are no longer adjustments made to new mexico withholding due to the number of allowances. New mexico also requires you to deduct and. Employers engaged in a trade or business.

Nm Withholding Form Fill Out and Sign Printable PDF Template signNow

Web state tax withholding state code: Employers engaged in a trade or business who pay. Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does. New mexico also requires you to deduct.

New Mexico Employee Withholding Form 2022 2022

Web new mexico withholding tax effective january 1, 2022 please note: New mexico also requires you to deduct and. Employers who are not required to. Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: There are no longer adjustments made to new mexico withholding due to the number of allowances.

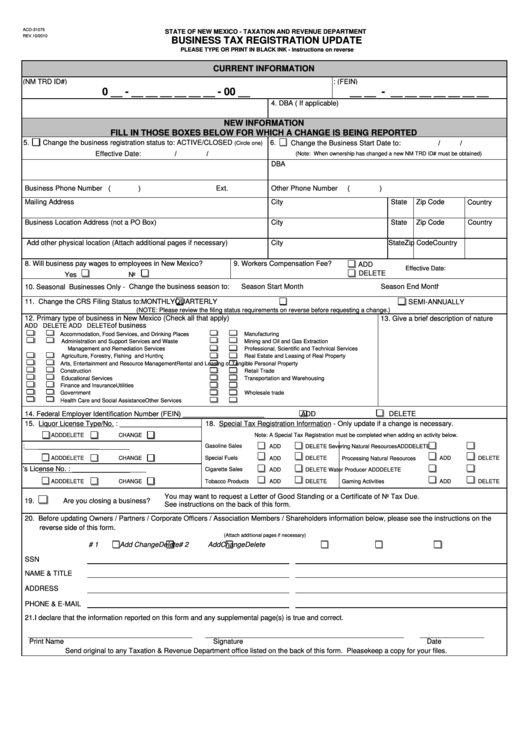

Business Tax Registration Update Form New Mexico Taxation And Revenue

New mexico also requires you to deduct and. There are no longer adjustments made to new mexico withholding due to the number of allowances. Web state tax withholding state code: Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Employee's withholding certificate form 941;

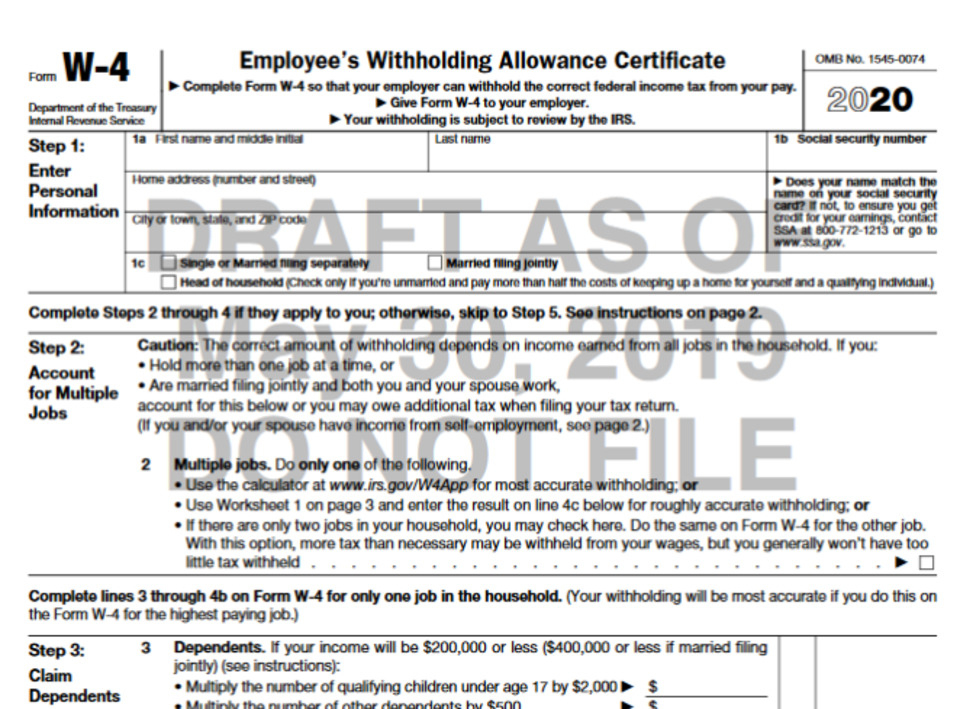

IRS Urges Taxpayers to Review Their Withholding Status [CALCULATOR] WDET

Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does. Web state tax withholding state code: Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). Web employer's quarterly wage, withholding and.

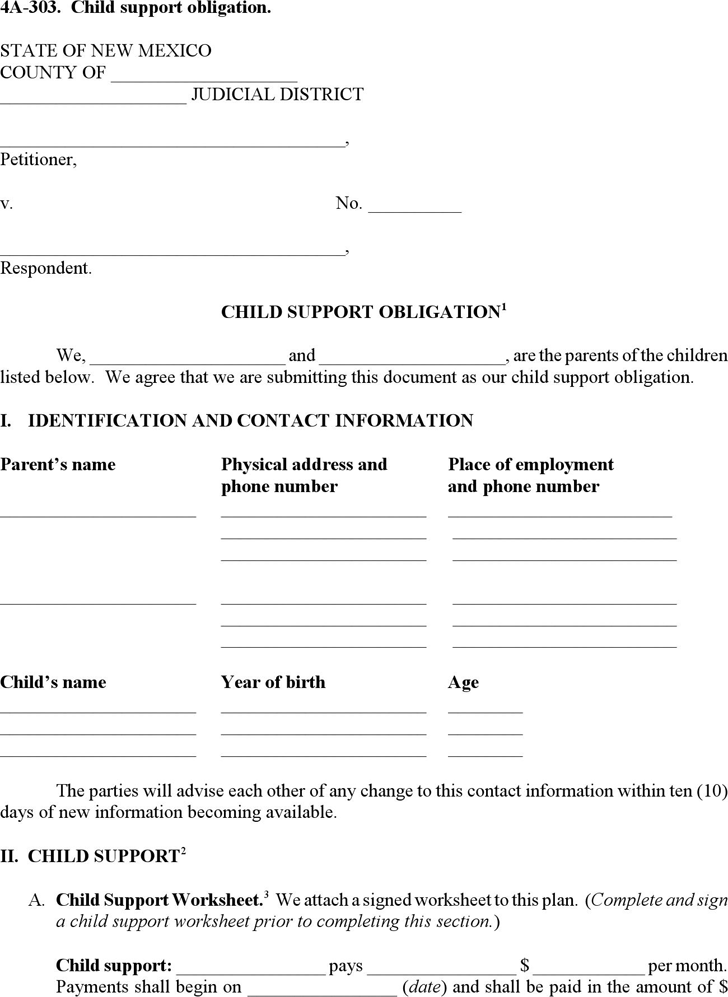

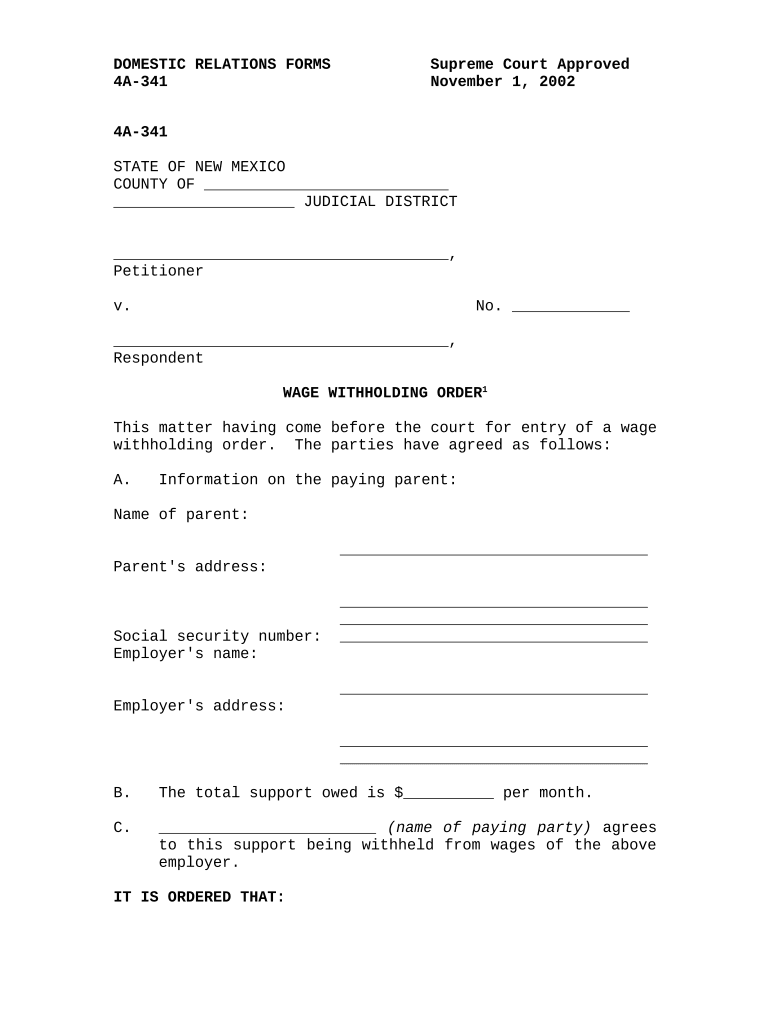

Free New Mexico Child Support Obligation Form PDF 16KB 5 Page(s)

Web new mexico has released two new withholding forms and related instructions. Employers who are not required to. Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). Employers engaged in a trade or business who pay. Web employer's quarterly wage, withholding and *82260200* workers' compensation.

New Mexico Employee Withholding Form

Employers engaged in a trade or business who pay. Web state tax withholding state code: Web new mexico has released two new withholding forms and related instructions. Web new mexico withholding tax effective january 1, 2022 please note: Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file:

Michigan 2022 Annual Tax Withholding Form

New mexico also requires you to deduct and. Web state tax withholding state code: Web new mexico has released two new withholding forms and related instructions. Employers who are not required to. Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1).

FREE 9+ Sample Employee Tax Forms in MS Word PDF

Employers engaged in a trade or business who pay. There are no longer adjustments made to new mexico withholding due to the number of allowances. Employee's withholding certificate form 941; New mexico also requires you to deduct and. Web new mexico withholding tax effective january 1, 2022 please note:

New Mexico Tax Form Fill Out and Sign Printable PDF Template

Employee's withholding certificate form 941; Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Employers engaged in a trade or business who pay. Employers who are not required to. Web new mexico withholding tax effective january 1, 2022 please note:

Web New Mexico Withholding Tax Effective January 1, 2022 Please Note:

Web state tax withholding state code: Web new mexico has released two new withholding forms and related instructions. Employers engaged in a trade or business who pay. Employee's withholding certificate form 941;

Web New Mexico Taxation And Revenue Department Withholding From Wages An Employee’s Wages Are Subject To New Mexico Withholding Tax If The Employer Does.

New mexico also requires you to deduct and. There are no longer adjustments made to new mexico withholding due to the number of allowances. Employers who are not required to. Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1).

![IRS Urges Taxpayers to Review Their Withholding Status [CALCULATOR] WDET](https://wdet.org/media/daguerre/2018/03/08/ba020281c80c289f0c3a.jpeg)