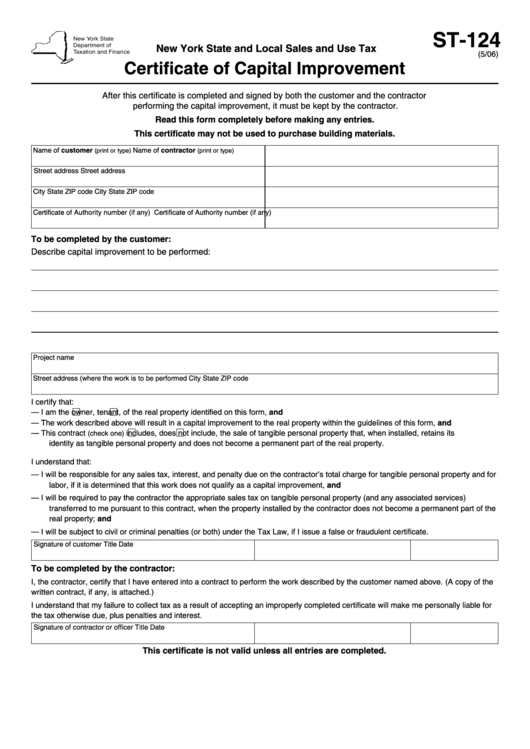

New York Capital Improvement Form

New York Capital Improvement Form - Web certificate of capital improvement. You must collect tax on any sale of taxable property or services unless the. This certificate may not be issued unless the work qualifies as a capital improvement. Web an mci is an improvement or installation that improves the overall condition of a building that is subject to the rent stabilization or rent control laws. Web the application for the major capital improvement (mci) abatement is now available online. Web show details we are not affiliated with any brand or entity on this form. Web capital improvements and repairs to real property. Web to qualify as an mci, the improvement or installation must: Web that form st‑124, certificate of capital improvement, has been furnished by the project owner to the contractor. Web what is a capital improvement?

Web what is a capital improvement? The contractor must use a separate form st‑120.1, contractor. Web the application for the major capital improvement (mci) abatement is now available online. Web to qualify as an mci, the improvement or installation must: Web these requirements to be considered a capital improvement. This abatement will be granted for major capital improvements approved by the. Web an mci is an improvement or installation that improves the overall condition of a building that is subject to the rent stabilization or rent control laws. The verified costs of an mci. You must collect tax on any sale of taxable property or services unless the. Web that form st‑124, certificate of capital improvement, has been furnished by the project owner to the contractor.

You must collect tax on any sale of taxable property or services unless the. Just because something may qualify as a capital improvement for federal income tax purposes does not necessarily mean the. Web (9/21) by contractors who are registered with the tax department for sales tax purposes. Web the application for the major capital improvement (mci) abatement is now available online. Web what is a capital improvement? Web show details we are not affiliated with any brand or entity on this form. Be depreciable pursuant to the internal revenue code, other than for ordinary repairs; The verified costs of an mci. How it works browse for the certificate of capital improvement customize and esign ny capital. Sales and use tax classifications of capital improvements and repairs to real property (publication 862).

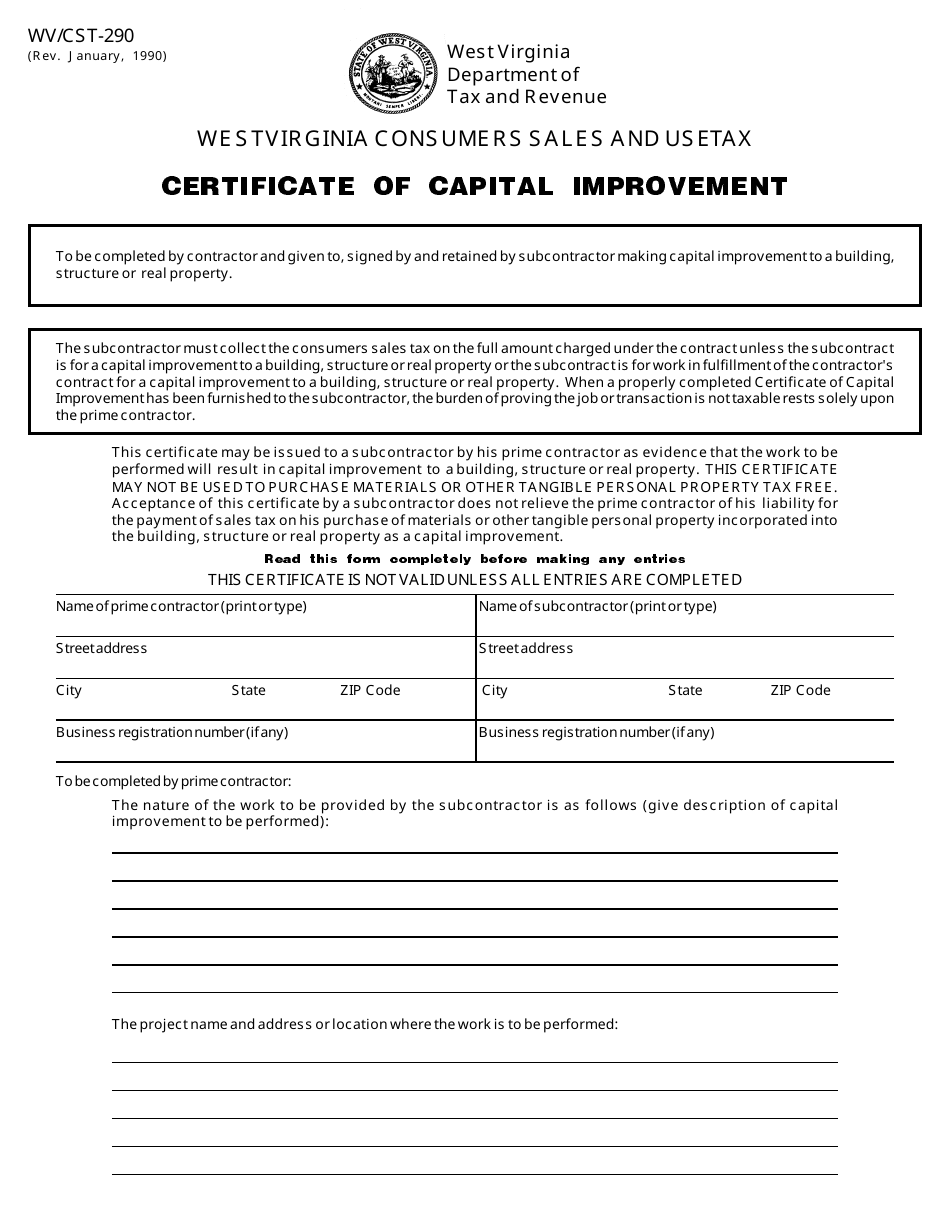

Form WV/CST290 Download Printable PDF or Fill Online Certificate of

Web what is a capital improvement? How it works browse for the certificate of capital improvement customize and esign ny capital. Web capital improvements and repairs to real property. You must collect tax on any sale of taxable property or services unless the. Web the application for the major capital improvement (mci) abatement is now available online.

Gallery of Nys Capital Improvement form Inspirational 24 Fresh Gallery

This certificate may not be issued unless the work qualifies as a capital improvement. Just because something may qualify as a capital improvement for federal income tax purposes does not necessarily mean the. Web (9/21) by contractors who are registered with the tax department for sales tax purposes. Web certificate of capital improvement. This abatement will be granted for major.

Gallery of Nys Capital Improvement form Inspirational 24 Fresh Gallery

Ad get ready for tax season deadline by completing any required tax forms today. The contractor must use a separate form st‑120.1, contractor. Just because something may qualify as a capital improvement for federal income tax purposes does not necessarily mean the. Be depreciable pursuant to the internal revenue code, other than for ordinary repairs; This certificate may not be.

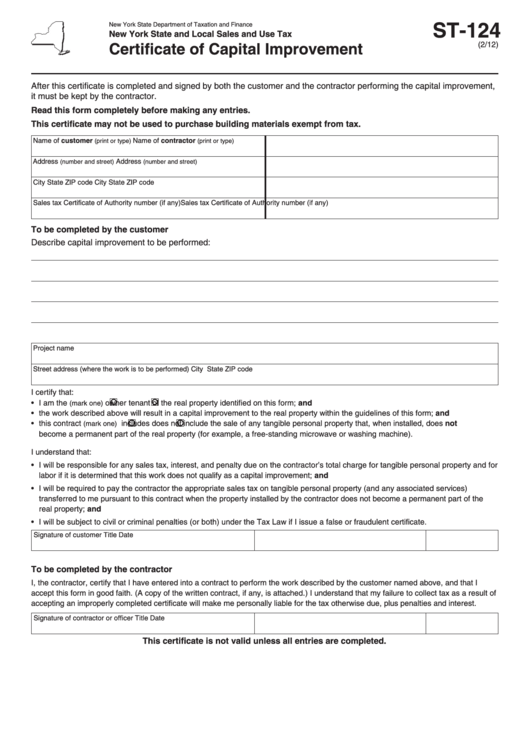

Certificate Of Capital Improvement St124 printable pdf download

The verified costs of an mci. Web these requirements to be considered a capital improvement. Web (9/21) by contractors who are registered with the tax department for sales tax purposes. Web an mci is an improvement or installation that improves the overall condition of a building that is subject to the rent stabilization or rent control laws. How it works.

Fillable Form St124 Certificate Of Capital Improvement printable pdf

This certificate may not be issued unless the work qualifies as a capital improvement. The verified costs of an mci. Web show details we are not affiliated with any brand or entity on this form. Web what is a capital improvement? Be depreciable pursuant to the internal revenue code, other than for ordinary repairs;

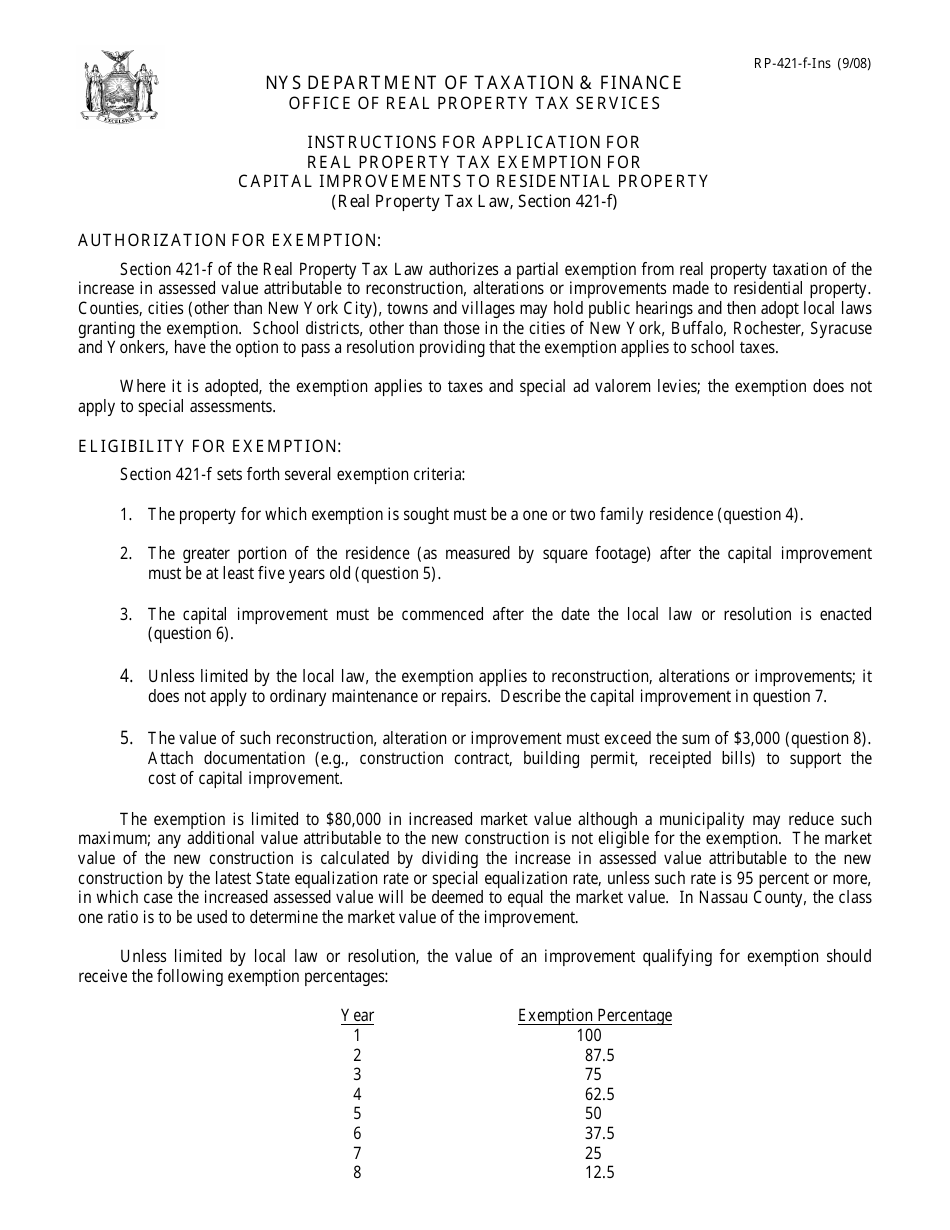

Download Instructions for Form RP421F Application for Real Property

Web these requirements to be considered a capital improvement. Web capital improvements and repairs to real property. Web what is a capital improvement? The contractor must use a separate form st‑120.1, contractor. This certificate may not be issued unless the work qualifies as a capital improvement.

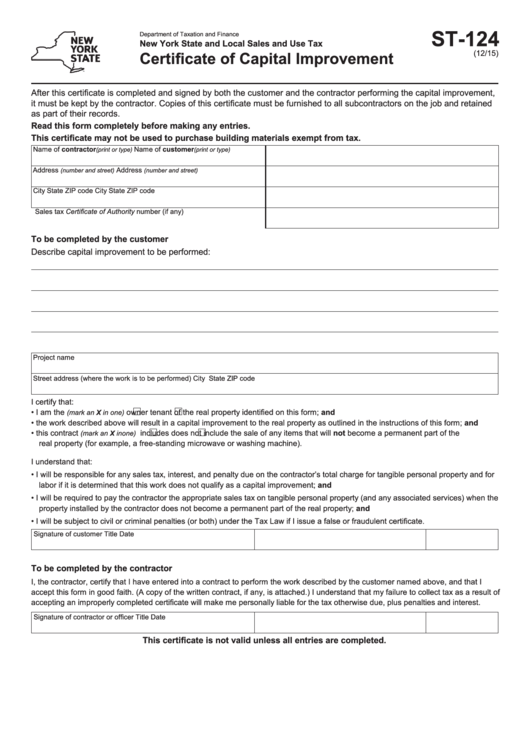

Fillable Form St124 (5/06) Certificate Of Capital Improvement

The verified costs of an mci. Web (9/21) by contractors who are registered with the tax department for sales tax purposes. This certificate may not be issued unless the work qualifies as a capital improvement. Web that form st‑124, certificate of capital improvement, has been furnished by the project owner to the contractor. Web capital improvements and repairs to real.

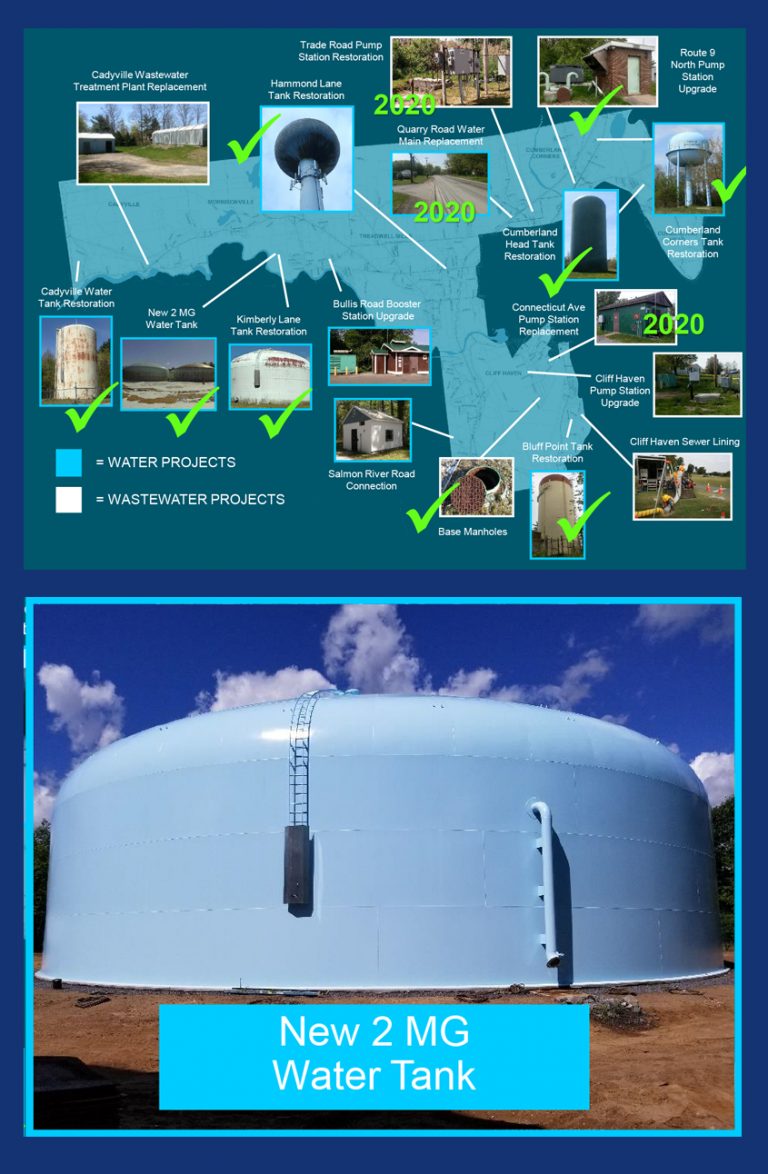

Capital Improvement Plan Addresses Water and Wastewater Infrastructure

The verified costs of an mci. Ad get ready for tax season deadline by completing any required tax forms today. How it works browse for the certificate of capital improvement customize and esign ny capital. Web the application for the major capital improvement (mci) abatement is now available online. You must collect tax on any sale of taxable property or.

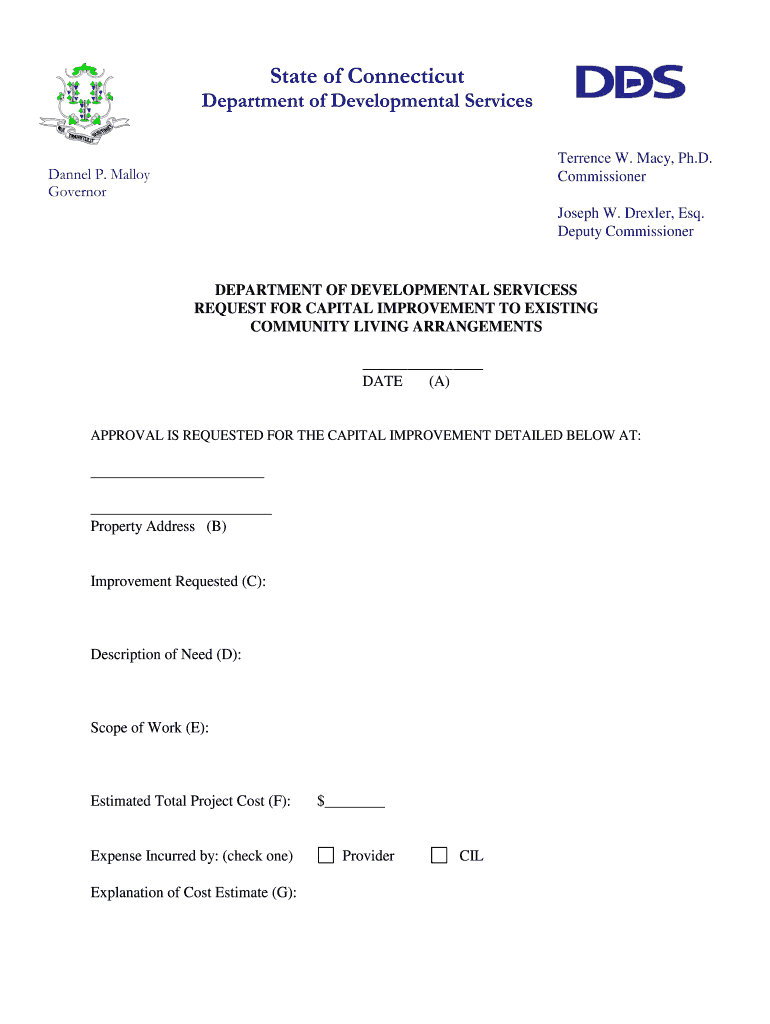

Certificate of Capital Improvement Ct Form Fill Out and Sign

Web certificate of capital improvement. This certificate may not be issued unless the work qualifies as a capital improvement. Web that form st‑124, certificate of capital improvement, has been furnished by the project owner to the contractor. Web to qualify as an mci, the improvement or installation must: Sales and use tax classifications of capital improvements and repairs to real.

2014 Capital Improvement Project SWBR

Web certificate of capital improvement. Web capital improvements and repairs to real property. Web the application for the major capital improvement (mci) abatement is now available online. How it works browse for the certificate of capital improvement customize and esign ny capital. Sales and use tax classifications of capital improvements and repairs to real property (publication 862).

Web These Requirements To Be Considered A Capital Improvement.

Web show details we are not affiliated with any brand or entity on this form. Web the application for the major capital improvement (mci) abatement is now available online. Web capital improvements and repairs to real property. This certificate may not be issued unless the work qualifies as a capital improvement.

This Abatement Will Be Granted For Major Capital Improvements Approved By The.

Web (9/21) by contractors who are registered with the tax department for sales tax purposes. Web what is a capital improvement? Ad get ready for tax season deadline by completing any required tax forms today. Web certificate of capital improvement.

Web That Form St‑124, Certificate Of Capital Improvement, Has Been Furnished By The Project Owner To The Contractor.

Be depreciable pursuant to the internal revenue code, other than for ordinary repairs; Web to qualify as an mci, the improvement or installation must: How it works browse for the certificate of capital improvement customize and esign ny capital. Just because something may qualify as a capital improvement for federal income tax purposes does not necessarily mean the.

You Must Collect Tax On Any Sale Of Taxable Property Or Services Unless The.

The verified costs of an mci. The contractor must use a separate form st‑120.1, contractor. Web an mci is an improvement or installation that improves the overall condition of a building that is subject to the rent stabilization or rent control laws. Sales and use tax classifications of capital improvements and repairs to real property (publication 862).