New York Non Resident Tax Form

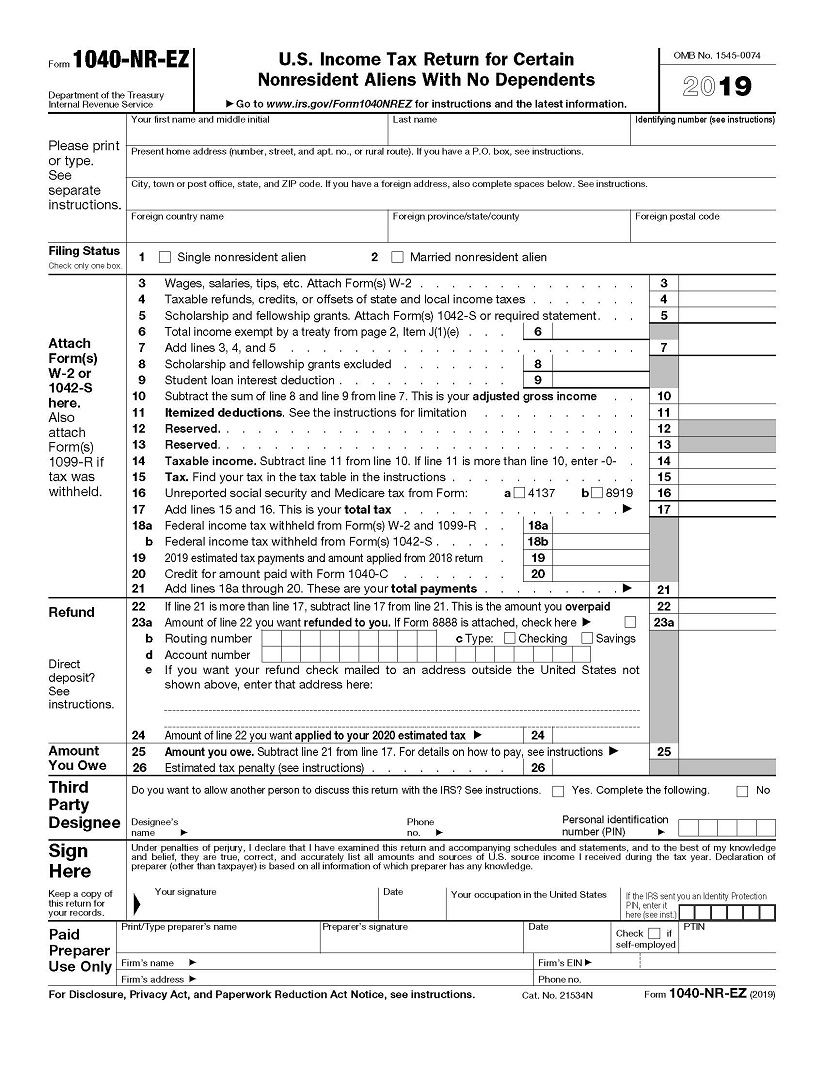

New York Non Resident Tax Form - You are not required to file a ny return since the company is not. Were not a resident of new york state and received income during. Commonly used income tax forms and. Voluntary disclosure program delaware recently sent another round of unclaimed property notices inviting. If you work for the city of new york but live outside new york city and were hired on or after january 4, 1973, you must file form. New york income tax forms. Web apply to new york state or new york city personal income tax. This instruction booklet will help you to fill out and file form 203. Web if you are a nonresident, you are not liable for new york city personal income tax, but may be subject to yonkers nonresident earning tax if your income is. Nonresident alien income tax return.

You are not required to file a ny return since the company is not. Commonly used income tax forms and. If you work for the city of new york but live outside new york city and were hired on or after january 4, 1973, you must file form. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Payment voucher for income tax returns. Who must file if you became an employee of the city of new york on or after january 4, 1973, and if, while. Were not a resident of new york state and received income during. Nonresident alien income tax return. Web if you are a nonresident, you are not liable for new york city personal income tax, but may be subject to yonkers nonresident earning tax if your income is. Here are new york income tax forms, specific to individual filers:

Full list of tax types; Commonly used income tax forms and. If you work for the city of new york but live outside new york city and were hired on or after january 4, 1973, you must file form. Payment voucher for income tax returns. Web if you are a nonresident, you are not liable for new york city personal income tax, but may be subject to yonkers nonresident earning tax if your income is. Were not a resident of new york state and received income during. New york income tax forms. You are not required to file a ny return since the company is not. Here are new york income tax forms, specific to individual filers: Nonresident alien income tax return.

The Complete J1 Student Guide to Tax in the US

Here are new york income tax forms, specific to individual filers: You are not required to file a ny return since the company is not. Who must file if you became an employee of the city of new york on or after january 4, 1973, and if, while. Commonly used income tax forms and. New york income tax forms.

New York State urges residents to efile taxes, use direct deposit

Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Web if you are a nonresident, you are not liable for new york city personal income tax, but may be subject to yonkers nonresident earning tax if your income is. Commonly used income tax forms and. You.

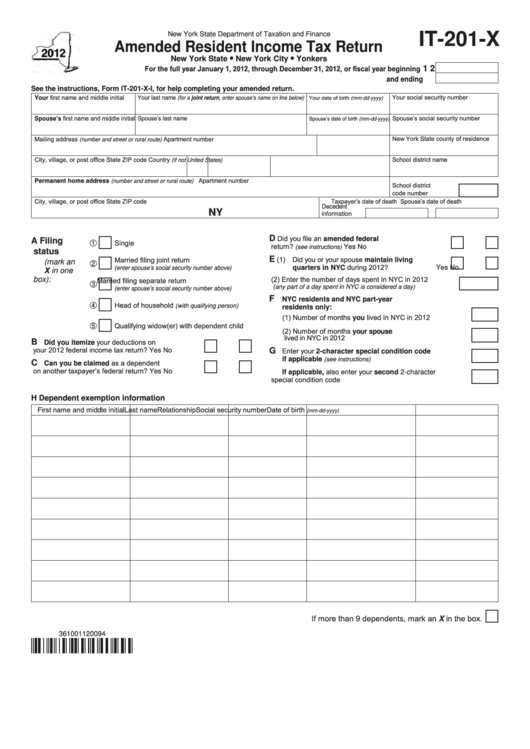

Resident Tax Return New York Free Download

Web july 20, 2023 delaware unclaimed property notices: Were a nonresident alien engaged in a trade or business in the. Voluntary disclosure program delaware recently sent another round of unclaimed property notices inviting. Web if you are a nonresident, you are not liable for new york city personal income tax, but may be subject to yonkers nonresident earning tax if.

NonResidenttaxreturns_1920 Grant Matossian, CGA, CFP

Were a nonresident alien engaged in a trade or business in the. This instruction booklet will help you to fill out and file form 203. Web if you're a nonresident of new york, but want to enter different allocations for income earned inside or outside new york state, follow these instructions: If you work for the city of new york.

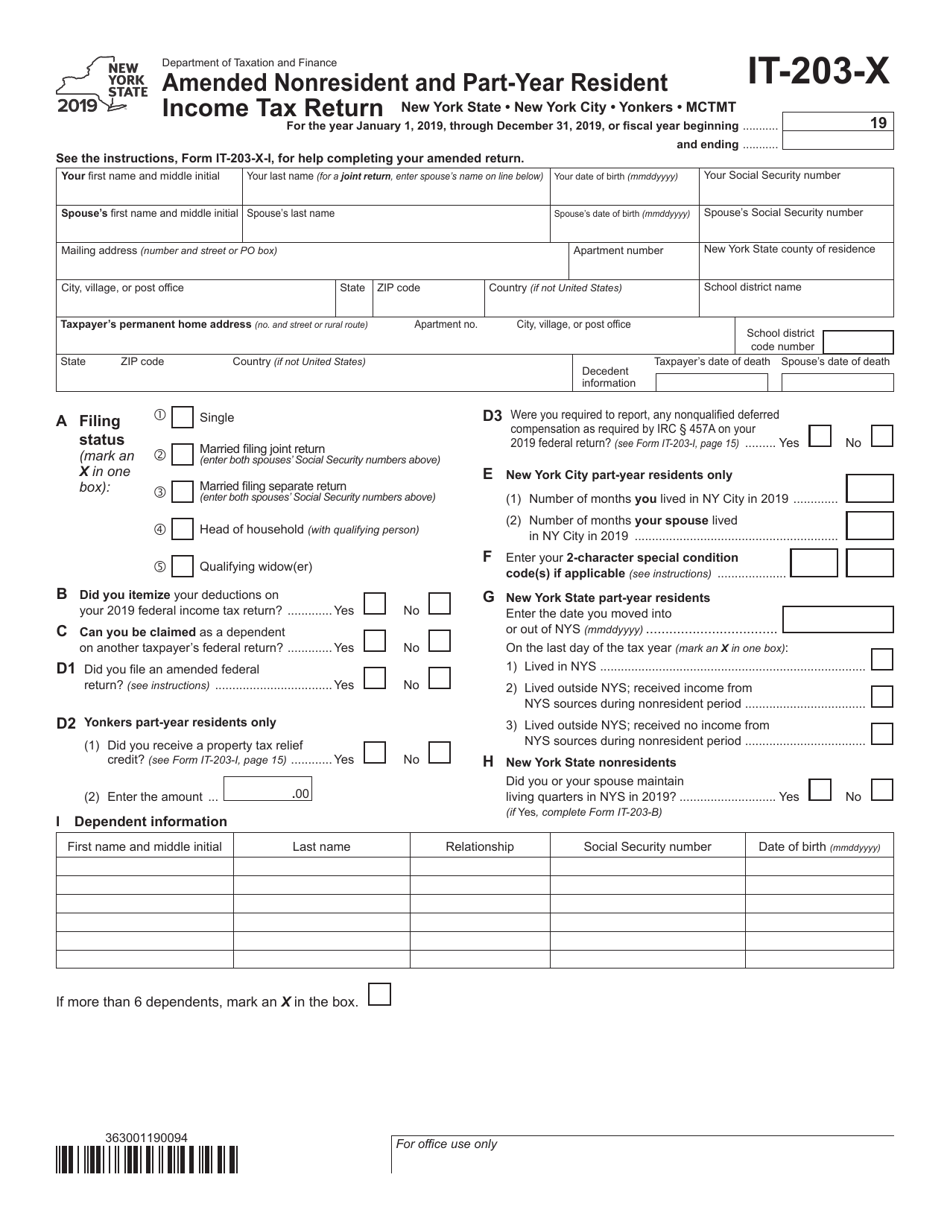

Form IT203X Download Fillable PDF or Fill Online Amended Nonresident

Voluntary disclosure program delaware recently sent another round of unclaimed property notices inviting. Full list of tax types; Here are new york income tax forms, specific to individual filers: Payment voucher for income tax returns. Who must file if you became an employee of the city of new york on or after january 4, 1973, and if, while.

Tax from nonresidents in Spain, what is it and how to do it properly

Payment voucher for income tax returns. Were not a resident of new york state and received income during. Nonresident alien income tax return. Here are new york income tax forms, specific to individual filers: Web july 20, 2023 delaware unclaimed property notices:

Resident Tax Return New York Free Download

Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Were a nonresident alien engaged in a trade or business in the. Here are new york income tax forms, specific to individual filers: Web apply to new york state or new york city personal income tax. Were.

Update On New York State NonResident Permit It's Official. Officially

New york income tax forms. Voluntary disclosure program delaware recently sent another round of unclaimed property notices inviting. Web if you're a nonresident of new york, but want to enter different allocations for income earned inside or outside new york state, follow these instructions: Web july 20, 2023 delaware unclaimed property notices: Web if you are a nonresident, you are.

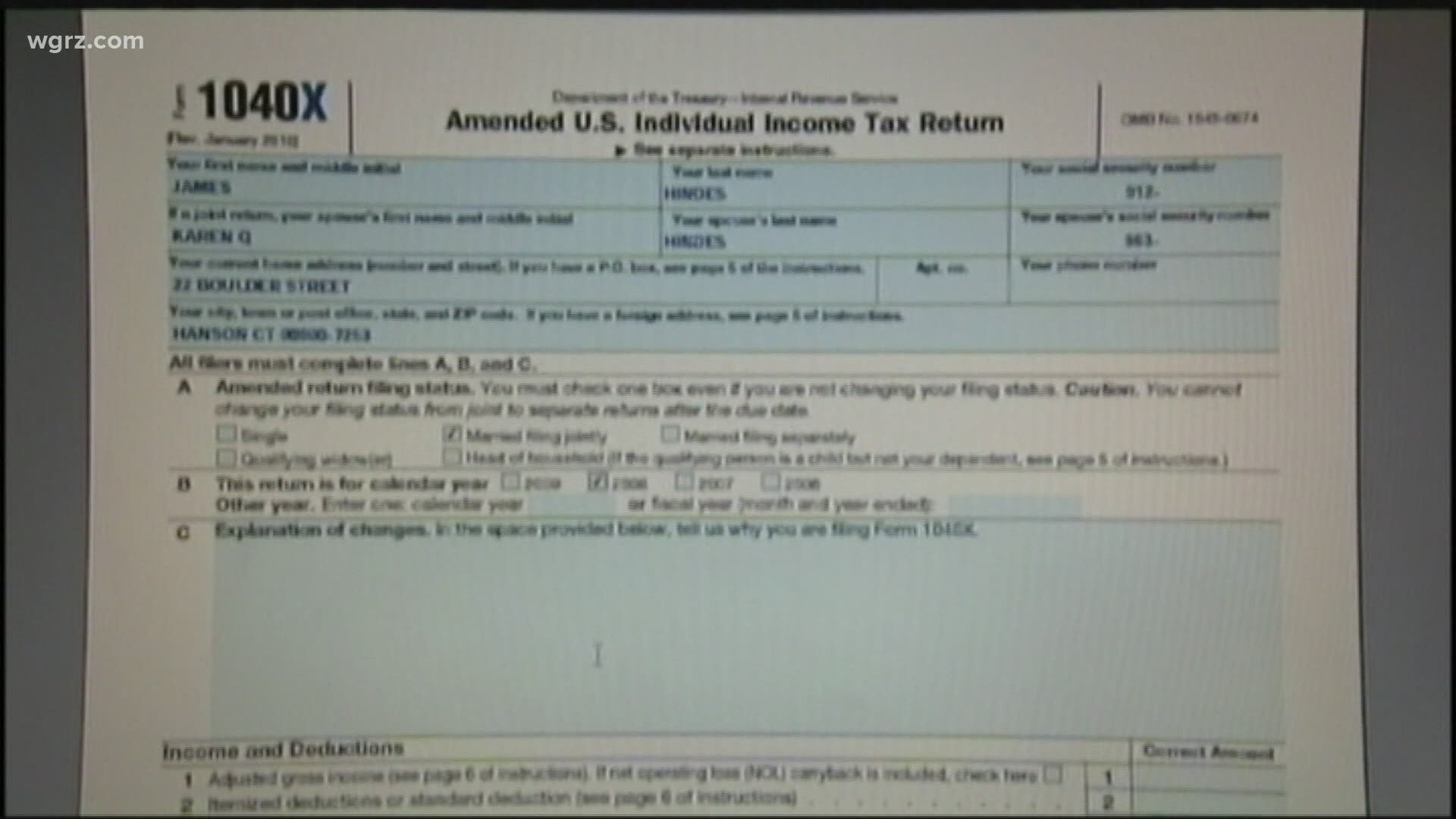

Fillable Form It201X Amended Resident Tax Return 2012

Commonly used income tax forms and. Full list of tax types; This instruction booklet will help you to fill out and file form 203. Web if you're a nonresident of new york, but want to enter different allocations for income earned inside or outside new york state, follow these instructions: Web if you are a nonresident of new york who.

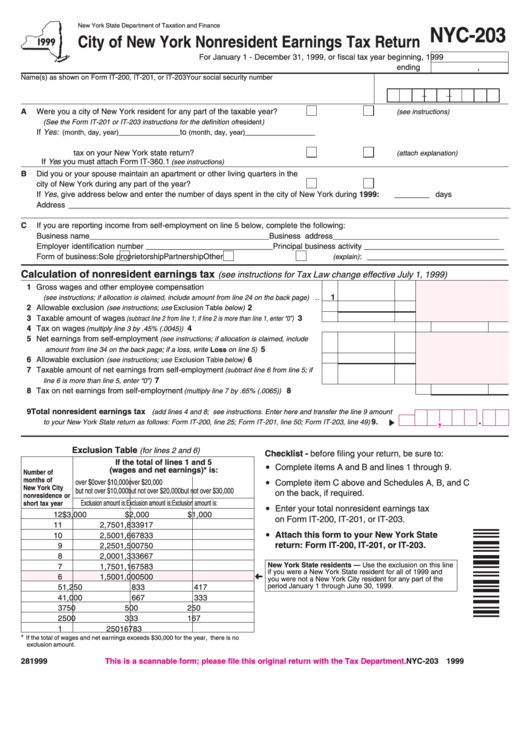

Form Nyc203 City Of New York Nonresident Earnings Tax Return 1999

Full list of tax types; Web if you are a nonresident, you are not liable for new york city personal income tax, but may be subject to yonkers nonresident earning tax if your income is. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Payment voucher.

Web If You're A Nonresident Of New York, But Want To Enter Different Allocations For Income Earned Inside Or Outside New York State, Follow These Instructions:

New york income tax forms. If you work for the city of new york but live outside new york city and were hired on or after january 4, 1973, you must file form. Web apply to new york state or new york city personal income tax. Voluntary disclosure program delaware recently sent another round of unclaimed property notices inviting.

Commonly Used Income Tax Forms And.

You are not required to file a ny return since the company is not. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Were not a resident of new york state and received income during. Who must file if you became an employee of the city of new york on or after january 4, 1973, and if, while.

Were A Nonresident Alien Engaged In A Trade Or Business In The.

Here are new york income tax forms, specific to individual filers: Full list of tax types; This instruction booklet will help you to fill out and file form 203. Nonresident alien income tax return.

Web July 20, 2023 Delaware Unclaimed Property Notices:

Payment voucher for income tax returns. Web if you are a nonresident, you are not liable for new york city personal income tax, but may be subject to yonkers nonresident earning tax if your income is.