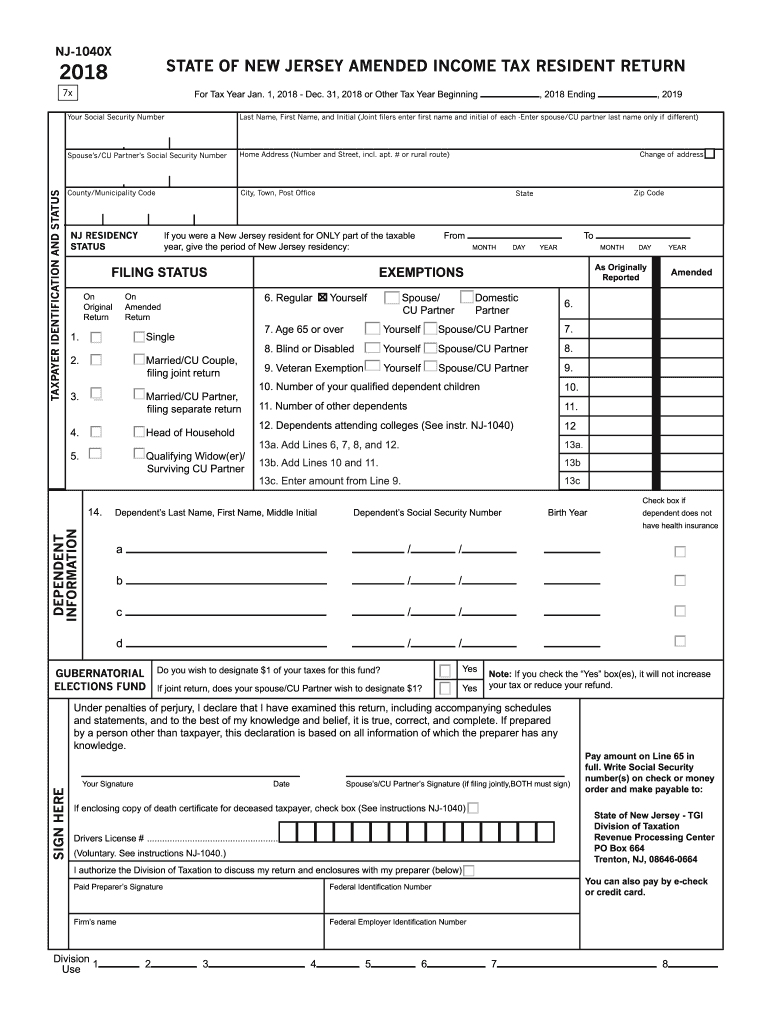

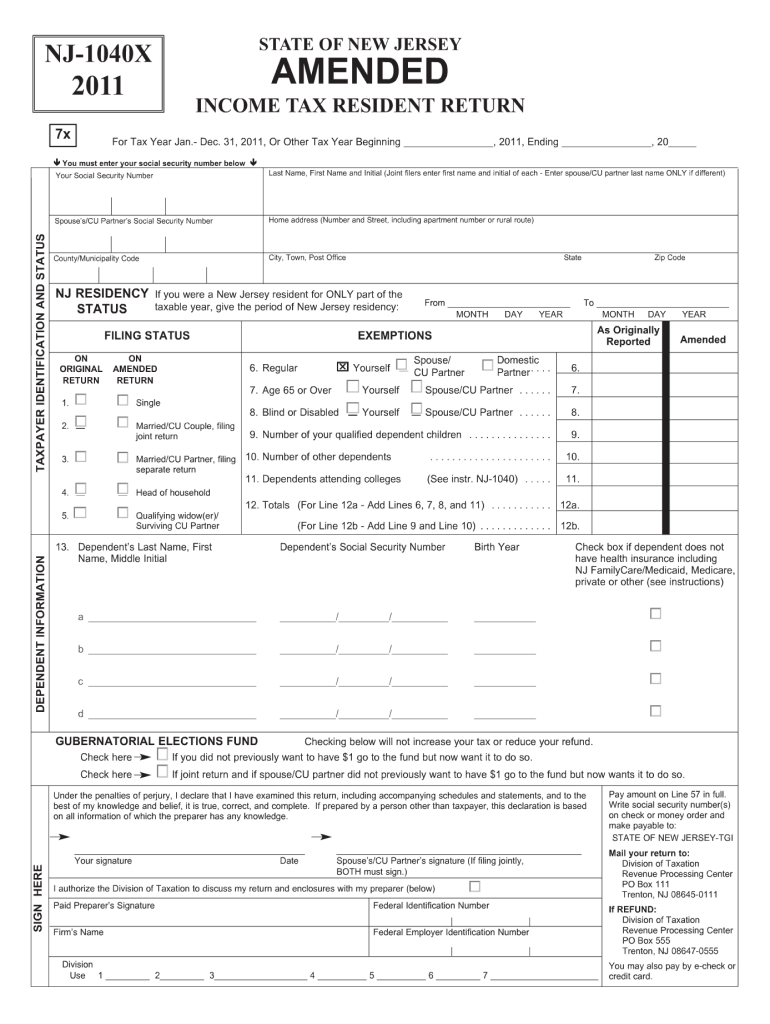

Nj-1040X Form

Nj-1040X Form - We do not have a separate amended form for nonresidents. State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. How can i check the status of my refund? Processing of electronic (online) returns typically takes a minimum of 4 weeks. State of new jersey division of taxation revenue processing center po box 664 trenton nj. Amended resident income tax return. (you may file both federal and state income tax returns.) state of new jersey Resident income tax return instructions. Include an explanation of the changes in the space provided on page three of the return. You cannot use form nj‐1040x to file an original resident return.

We do not have a separate amended form for nonresidents. You cannot use form nj‐1040x to file an original resident return. State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. New jersey resident returns state of new jersey division of taxation revenue processing center'. Include an explanation of the changes in the space provided on page three of the return. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. Amended resident income tax return. Processing of electronic (online) returns typically takes a minimum of 4 weeks. Resident income tax return instructions. (you may file both federal and state income tax returns.) state of new jersey

Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. Include an explanation of the changes in the space provided on page three of the return. Processing of electronic (online) returns typically takes a minimum of 4 weeks. How can i check the status of my refund? State of new jersey division of taxation revenue processing center po box 664 trenton nj. (you may file both federal and state income tax returns.) state of new jersey We do not have a separate amended form for nonresidents. You cannot use form nj‐1040x to file an original resident return. Resident income tax return instructions. Amended resident income tax return.

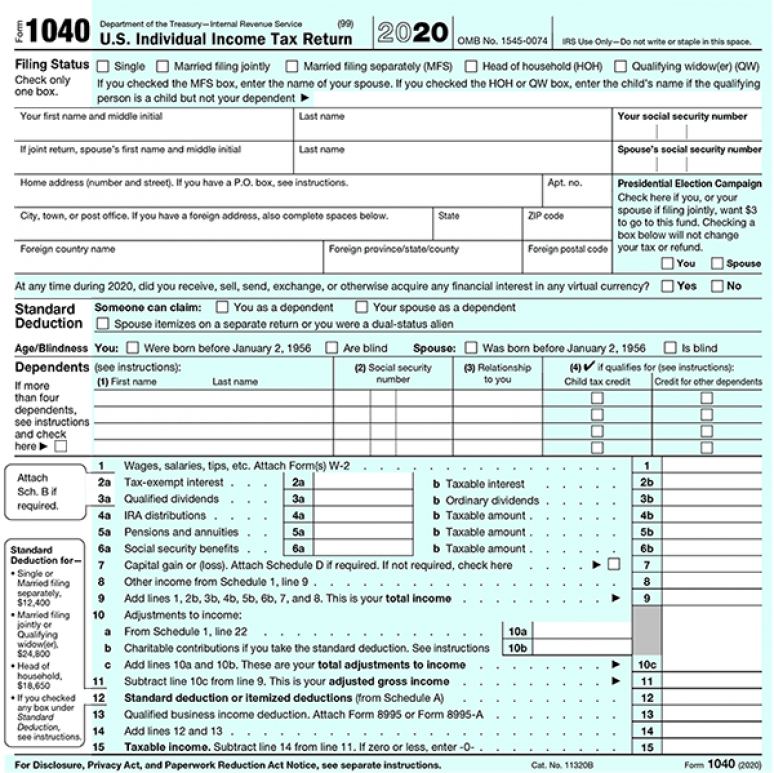

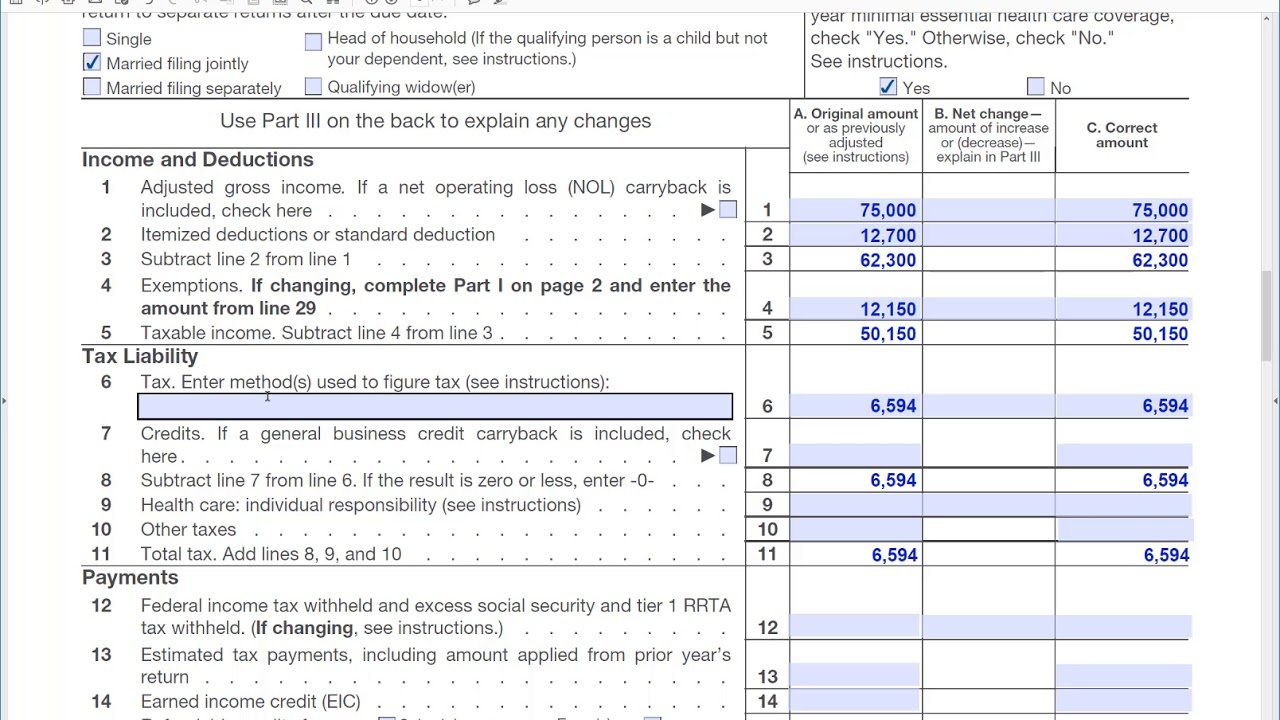

2020 Tax Form 1040 U.S. Government Bookstore

New jersey resident returns state of new jersey division of taxation revenue processing center'. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. Include an explanation of the changes in the space provided on page three of the return. State of new jersey division of taxation revenue processing center.

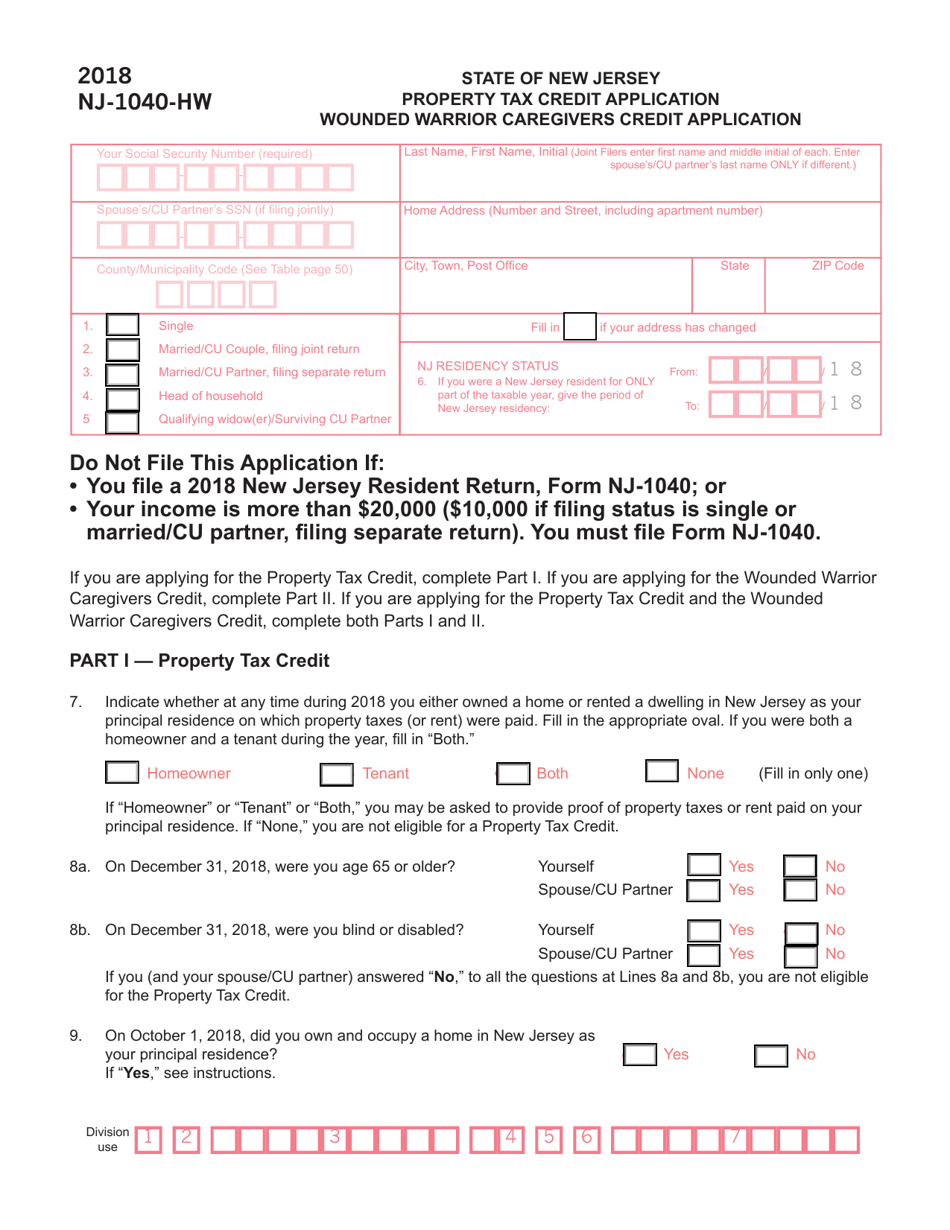

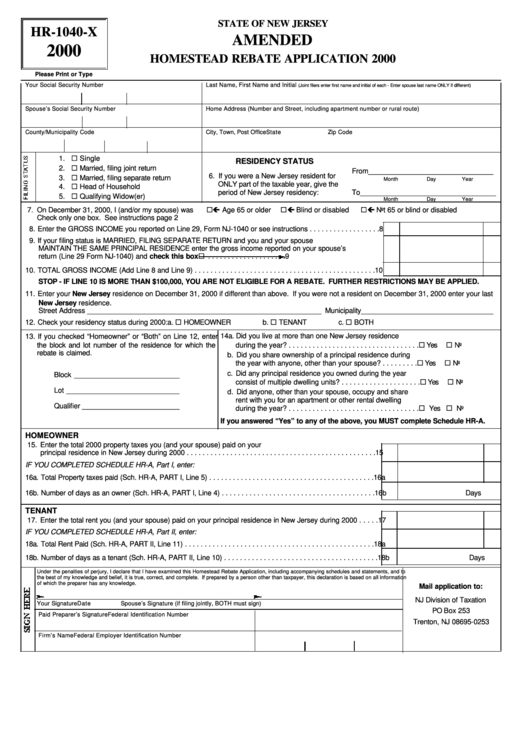

Form NJ1040HW Download Fillable PDF or Fill Online Property Tax

You cannot use form nj‐1040x to file an original resident return. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. (you may file both federal and state income tax returns.) state of new jersey Processing of electronic (online) returns typically takes a minimum of 4 weeks. Amended resident income.

NJ DoT NJ1040x 2018 Fill out Tax Template Online US Legal Forms

How can i check the status of my refund? State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. Amended resident income tax return. Processing of electronic (online) returns typically takes a minimum of 4 weeks. You cannot use form nj‐1040x to file an original resident return.

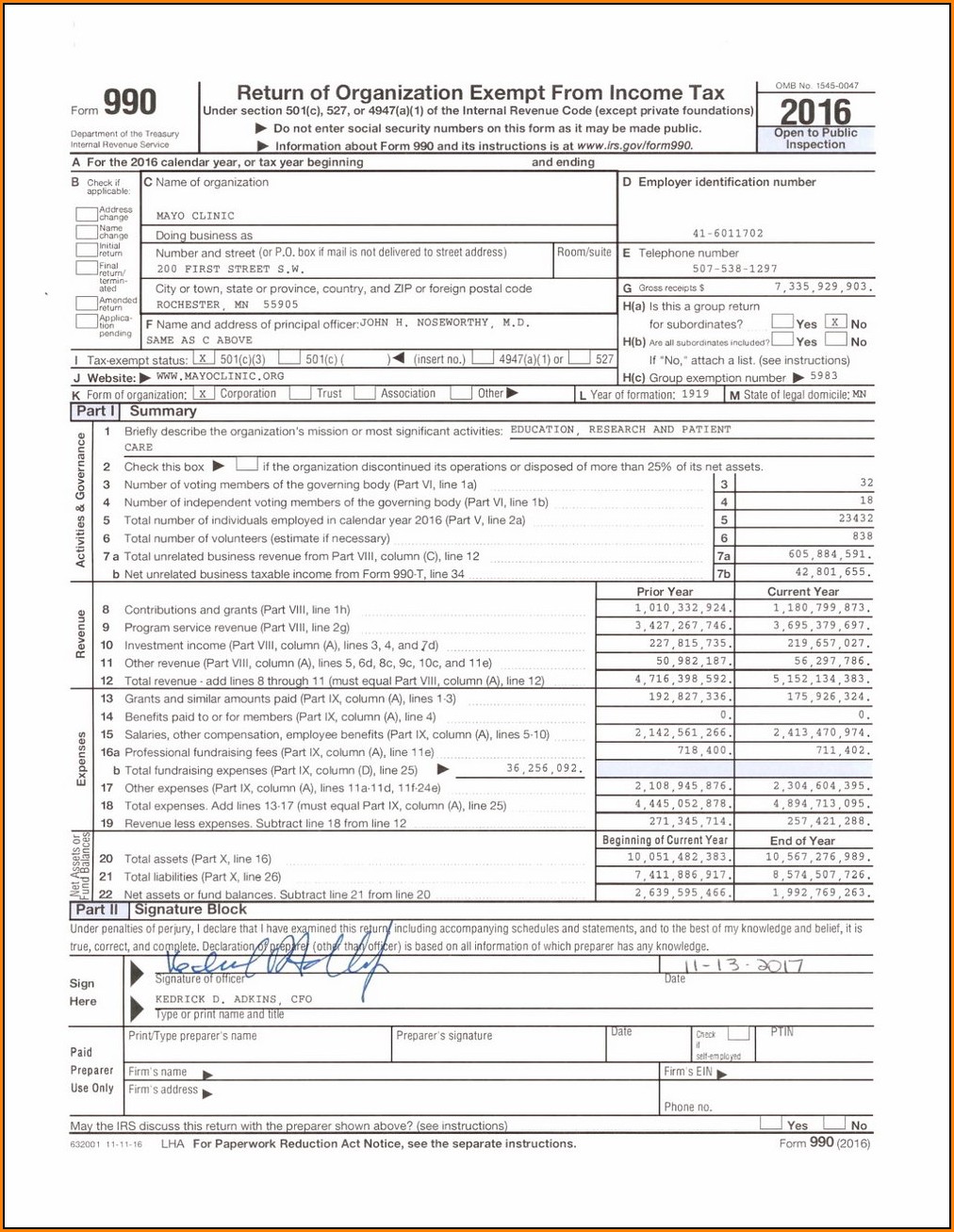

1040x Free Fillable Forms 2018 Form Resume Examples nO9br7B94D

How can i check the status of my refund? State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. State of new jersey division of taxation revenue processing center po box 664 trenton nj. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return..

1040 X Form 1040 Form Printable

State of new jersey division of taxation revenue processing center po box 664 trenton nj. (you may file both federal and state income tax returns.) state of new jersey Amended resident income tax return. Include an explanation of the changes in the space provided on page three of the return. Resident income tax return instructions.

5 amended tax return filing tips Don't Mess With Taxes

Processing of electronic (online) returns typically takes a minimum of 4 weeks. State of new jersey division of taxation revenue processing center po box 664 trenton nj. New jersey resident returns state of new jersey division of taxation revenue processing center'. State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. Amended resident income.

Fillable Form Hr1040X Amended Homestead Rebate Application 2000

State of new jersey division of taxation revenue processing center po box 664 trenton nj. New jersey resident returns state of new jersey division of taxation revenue processing center'. Include an explanation of the changes in the space provided on page three of the return. (you may file both federal and state income tax returns.) state of new jersey You.

2011 nj 1040x form Fill out & sign online DocHub

Processing of electronic (online) returns typically takes a minimum of 4 weeks. How can i check the status of my refund? State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. State of new.

2019 Form NJ DoT NJ1040x Fill Online, Printable, Fillable, Blank

State of new jersey division of taxation revenue processing center po box 664 trenton nj. (you may file both federal and state income tax returns.) state of new jersey You cannot use form nj‐1040x to file an original resident return. We do not have a separate amended form for nonresidents. Include an explanation of the changes in the space provided.

Instructions for Form NJ1040X Amended Resident Return Download

Amended resident income tax return. You cannot use form nj‐1040x to file an original resident return. Resident income tax return instructions. Include an explanation of the changes in the space provided on page three of the return. We do not have a separate amended form for nonresidents.

Include An Explanation Of The Changes In The Space Provided On Page Three Of The Return.

New jersey resident returns state of new jersey division of taxation revenue processing center'. Resident income tax return instructions. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. (you may file both federal and state income tax returns.) state of new jersey

Processing Of Electronic (Online) Returns Typically Takes A Minimum Of 4 Weeks.

We do not have a separate amended form for nonresidents. State of new jersey division of taxation revenue processing center po box 664 trenton nj. Amended resident income tax return. You cannot use form nj‐1040x to file an original resident return.

How Can I Check The Status Of My Refund?

State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646.