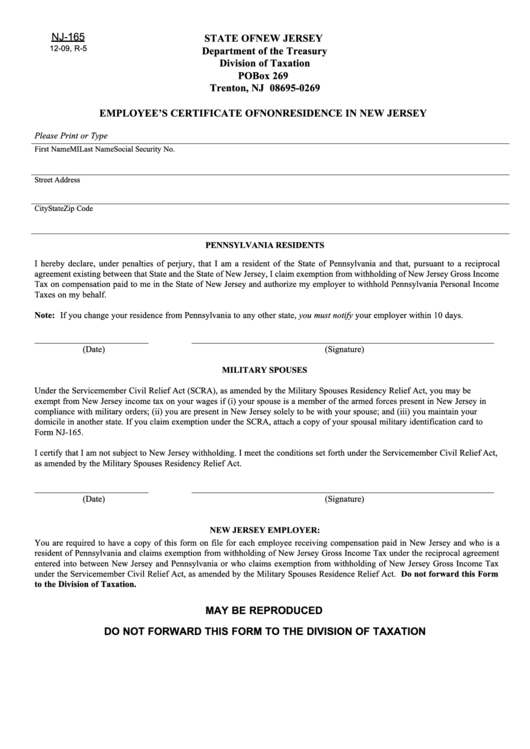

Nj 165 Form

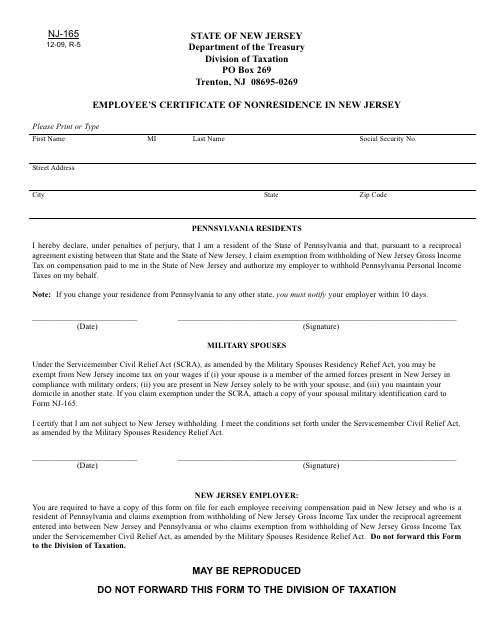

Nj 165 Form - Estimated income tax payment voucher for 4th quarter 2022. Web find and fill out the correct new jersey nj 165. Click done and save the filled out template to your gadget. I meet the conditions set forth under the servicemember civil relief act, as amended by the military spouses. Web you are required to have a copy of this form on file for each employee receiving compensation paid in newjersey and who is a resident of pennsylvania and claims. Certify that i am not subject to new jersey withholding. Web if you are a pennsylvania resident and new jersey income tax was withheld from your wages, you must file a new jersey nonresident return to get a. What is a nj 165? Web estimated income tax payment voucher for 2023. Start completing the fillable fields and carefully.

Use get form or simply click on the template preview to open it in the editor. Click done and save the filled out template to your gadget. Choose the correct version of the editable pdf form from the list. Web if you are a pennsylvania resident and new jersey income tax was withheld from your wages, you must file a new jersey nonresident return to get a. Estimated income tax payment voucher for 4th quarter 2022. Web quick steps to complete and esign nj 165 online: Certify that i am not subject to new jersey withholding. If you are a pennsylvania resident and new jersey income tax was withheld from. I certify that i am not subject to new jersey withholding. Web you are required to have a copy of this form on file for each employee receiving compensation paid in newjersey and who is a resident of pennsylvania and claims.

Start completing the fillable fields and carefully. Click done and save the filled out template to your gadget. What is a nj 165? Web estimated income tax payment voucher for 2023. Web adjust your nj income to $0 on the nj tax form to get the full amount back. Web you are required to have a copy of this form on file for each employee receiving compensation paid in newjersey and who is a resident of pennsylvania and claims. Choose the correct version of the editable pdf form from the list. This form is for income earned in tax year 2022, with tax returns due in april. Use get form or simply click on the template preview to open it in the editor. Certify that i am not subject to new jersey withholding.

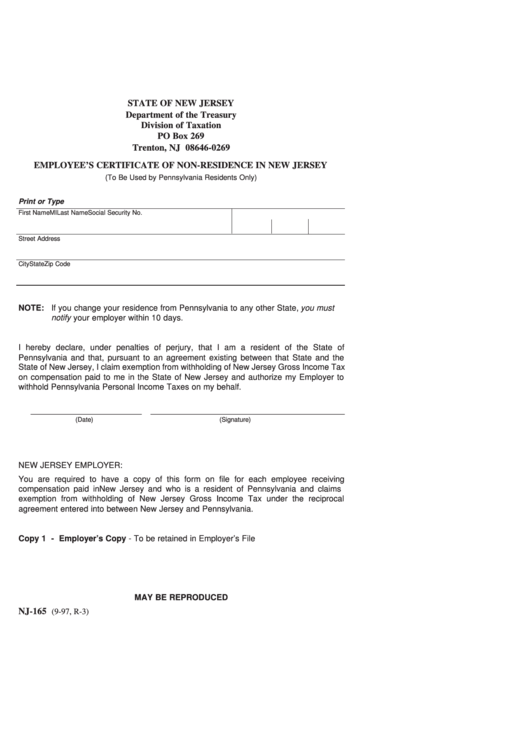

Fillable Form Nj165 Employee'S Certificate Of Nonresidence In New

Check the entire form to be certain you?ve filled out everything and no corrections are needed. Click done and save the filled out template to your gadget. Start completing the fillable fields and carefully. Certify that i am not subject to new jersey withholding. This form is for income earned in tax year 2022, with tax returns due in april.

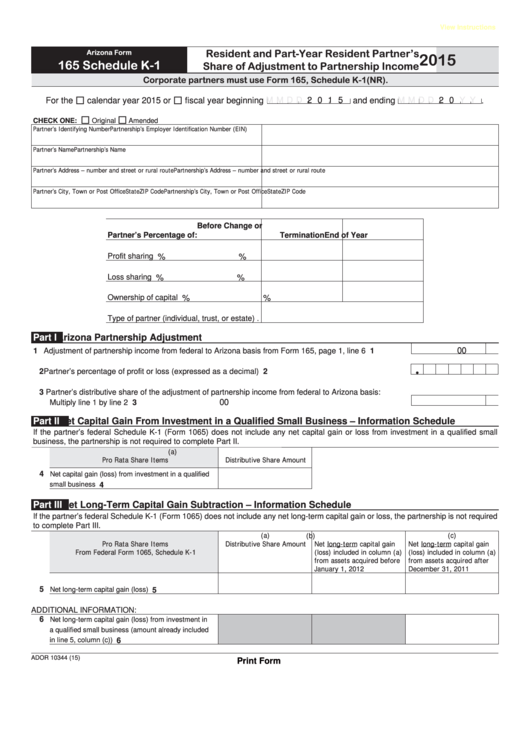

Fillable Arizona Form 165 (Schedule K1) Resident And PartYear

If you are a pennsylvania resident and new jersey income tax was withheld from. Web find and fill out the correct new jersey nj 165. Web adjust your nj income to $0 on the nj tax form to get the full amount back. Certify that i am not subject to new jersey withholding. Web quick steps to complete and esign.

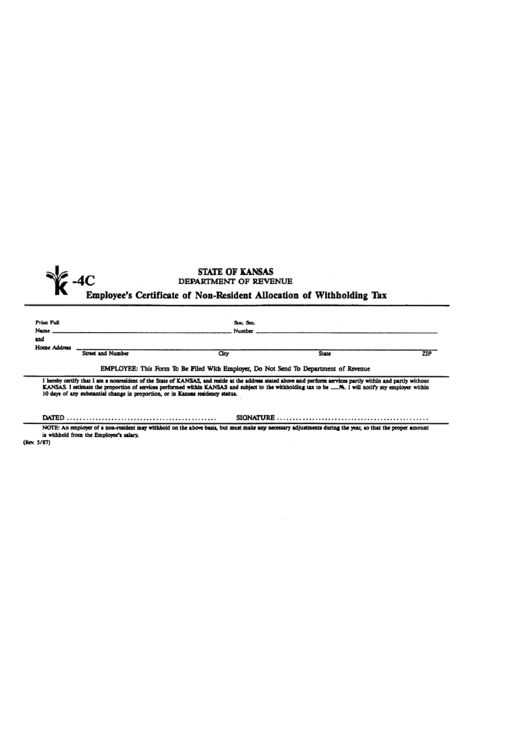

Employee'S Certificate Of NonResident Allocation Of Withholding Tax

Estimated income tax payment voucher for 4th quarter 2022. Use get form or simply click on the template preview to open it in the editor. I certify that i am not subject to new jersey withholding. Check the entire form to be certain you?ve filled out everything and no corrections are needed. Choose the correct version of the editable pdf.

20172023 Form TX VS165 Fill Online, Printable, Fillable, Blank

Estimated income tax payment voucher for 4th quarter 2022. Certify that i am not subject to new jersey withholding. Web quick steps to complete and esign nj 165 online: Start completing the fillable fields and carefully. Web adjust your nj income to $0 on the nj tax form to get the full amount back.

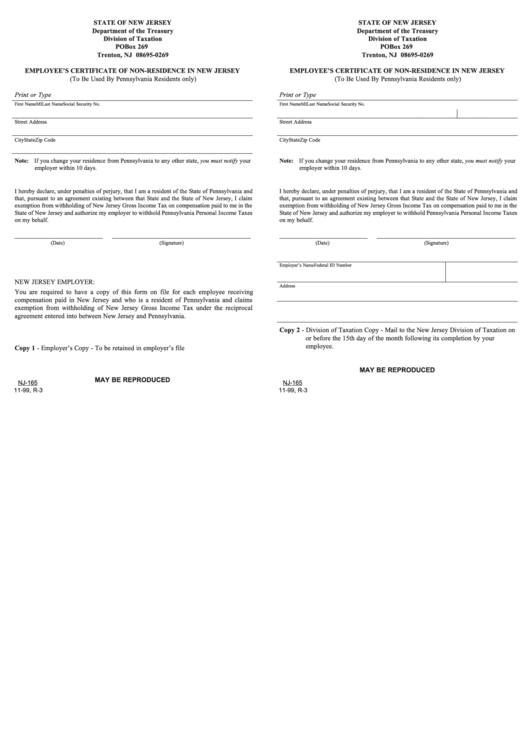

Form Nj165 Employee'S Certificate Of NonResidence In New Jersey

Web adjust your nj income to $0 on the nj tax form to get the full amount back. Start completing the fillable fields and carefully. Web you are required to have a copy of this form on file for each employee receiving compensation paid in newjersey and who is a resident of pennsylvania and claims. Check the entire form to.

Fillable Form Nj165 Employee'S Certificate Of NonResidence In New

I meet the conditions set forth under the servicemember civil relief act, as amended by the military spouses. Web adjust your nj income to $0 on the nj tax form to get the full amount back. Web quick steps to complete and esign nj 165 online: Web if you are a pennsylvania resident and new jersey income tax was withheld.

FIA Historic Database

Check the entire form to be certain you?ve filled out everything and no corrections are needed. This form is for income earned in tax year 2022, with tax returns due in april. Web adjust your nj income to $0 on the nj tax form to get the full amount back. Certify that i am not subject to new jersey withholding..

DD Form 165 Fill Out, Sign Online and Download Fillable PDF

Web you are required to have a copy of this form on file for each employee receiving compensation paid in newjersey and who is a resident of pennsylvania and claims. What is a nj 165? Choose the correct version of the editable pdf form from the list. Click done and save the filled out template to your gadget. Certify that.

Form Nj 165 Download Fillable Pdf Employee S Certificate Of Non

Use get form or simply click on the template preview to open it in the editor. I certify that i am not subject to new jersey withholding. Web find and fill out the correct new jersey nj 165. Web if you are a pennsylvania resident and new jersey income tax was withheld from your wages, you must file a new.

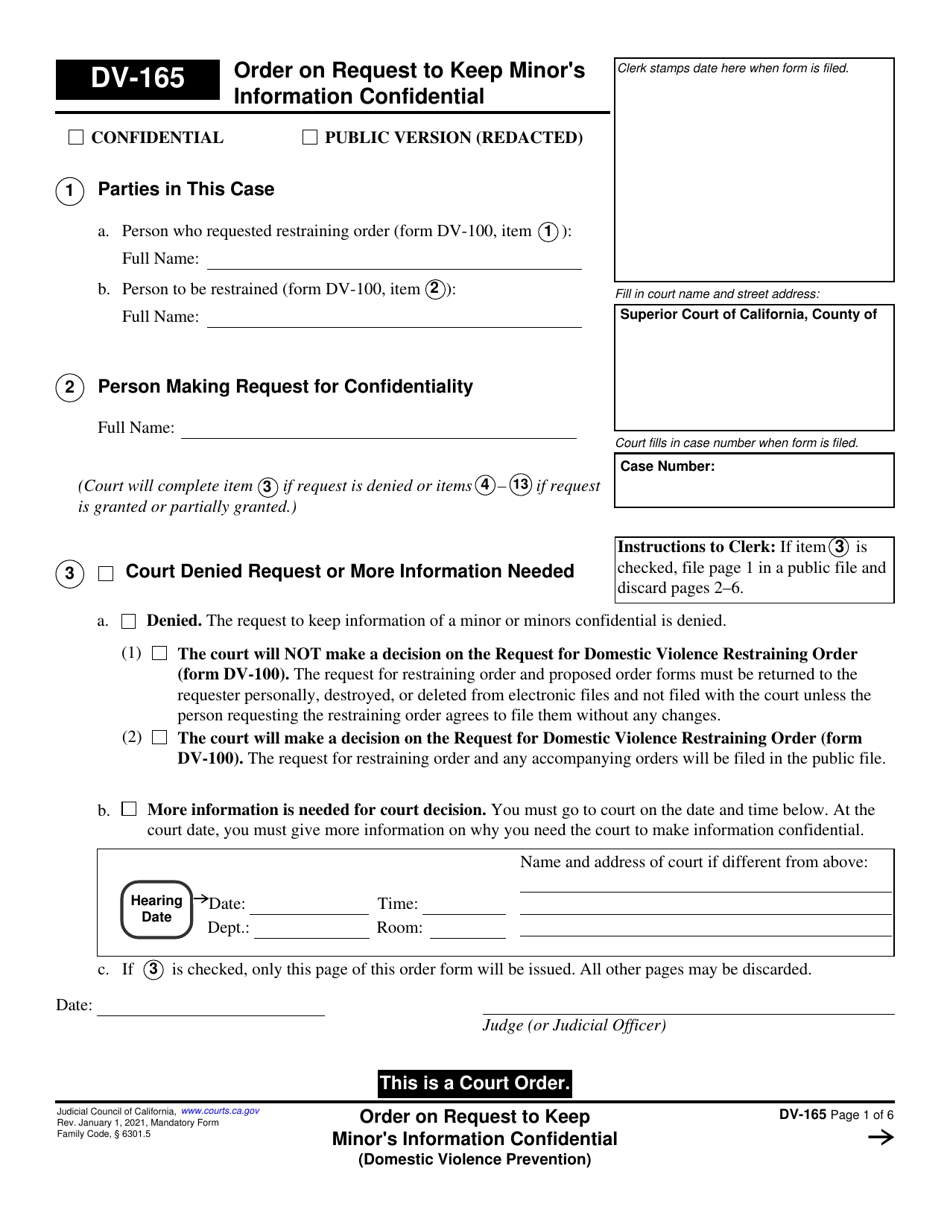

Form DV165 Download Fillable PDF or Fill Online Order on Request to

I meet the conditions set forth under the servicemember civil relief act, as amended by the military spouses. What is a nj 165? Web if you are a pennsylvania resident and new jersey income tax was withheld from your wages, you must file a new jersey nonresident return to get a. Click done and save the filled out template to.

Click Done And Save The Filled Out Template To Your Gadget.

Certify that i am not subject to new jersey withholding. Web you are required to have a copy of this form on file for each employee receiving compensation paid in newjersey and who is a resident of pennsylvania and claims. Certify that i am not subject to new jersey withholding. Web estimated income tax payment voucher for 2023.

Web Adjust Your Nj Income To $0 On The Nj Tax Form To Get The Full Amount Back.

If you are a pennsylvania resident and new jersey income tax was withheld from. Choose the correct version of the editable pdf form from the list. Web quick steps to complete and esign nj 165 online: What is a nj 165?

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Start completing the fillable fields and carefully. Check the entire form to be certain you?ve filled out everything and no corrections are needed. Web find and fill out the correct new jersey nj 165. Use get form or simply click on the template preview to open it in the editor.

I Meet The Conditions Set Forth Under The Servicemember Civil Relief Act, As Amended By The Military Spouses.

Web if you are a pennsylvania resident and new jersey income tax was withheld from your wages, you must file a new jersey nonresident return to get a. I certify that i am not subject to new jersey withholding. Estimated income tax payment voucher for 4th quarter 2022.