North Carolina Tax Extension Form D 410

North Carolina Tax Extension Form D 410 - If you were granted an automatic extension to file. Web pursuant to the secretary of revenue’s statutory authority, the department announced an automatic extension of time to file the north carolina individual income. Third party file and pay option: Web complete d410 nc tax extension online with us legal forms. Get ready for tax season deadlines by completing any required tax forms today. Sign online button or tick the preview image of the form. This form is for income earned in tax year 2022, with tax. Get ready for tax season deadlines by completing any required tax forms today. Easily fill out pdf blank, edit, and sign them. The state grants an extension if you.

Web to file for an extension on your state taxes in north carolina, you can: Save or instantly send your ready documents. Web pursuant to the secretary of revenue’s statutory authority, the department announced an automatic extension of time to file the north carolina individual income. Use blue or black ink to complete this form. If you were granted an automatic extension to file. Web the way to fill out the nc dept of revenue forms d410 online: Easily fill out pdf blank, edit, and sign them. Web complete d410 nc tax extension online with us legal forms. This form is for income earned in tax year 2022, with tax. If you previously made an electronic payment but did not receive a confirmation page do not submit another.

This form is for income earned in tax year 2022, with tax. Web the way to fill out the nc dept of revenue forms d410 online: Use blue or black ink to complete this form. If you owe north carolina tax, remember to make an. If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to. The state grants an extension if you. To start the document, utilize the fill camp; Sign online button or tick the preview image of the form. Get ready for tax season deadlines by completing any required tax forms today. Web complete d410 nc tax extension online with us legal forms.

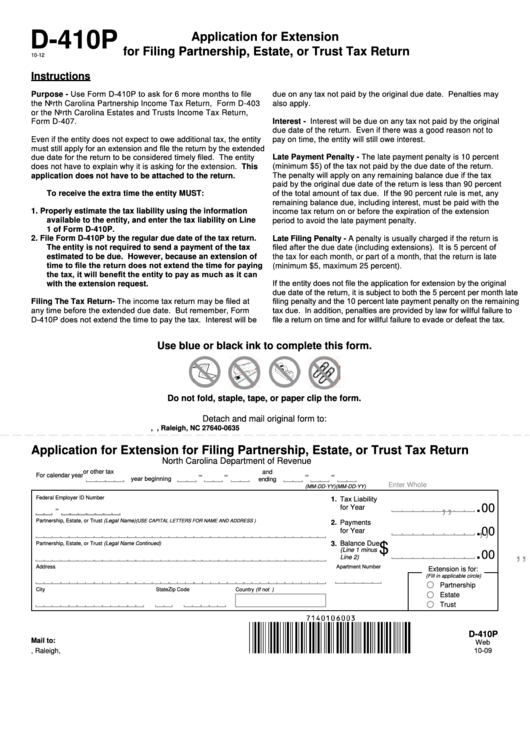

Form D410p Application For Extension For Filing Partnership, Estate

If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to. Web if a taxpayer is not granted an automatic federal extension, the taxpayer may still request a state extension to file their north carolina individual income tax return. If you previously made an electronic payment but did not.

How to File a 2019 Tax Return Extension by July 15

Easily fill out pdf blank, edit, and sign them. If you previously made an electronic payment but did not receive a confirmation page do not submit another. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. If you were granted an automatic extension.

Printable North Carolina Realtor Form 401 T Fill Online, Printable

Ad download or email nc d410p & more fillable forms, register and subscribe now! Easily fill out pdf blank, edit, and sign them. The state grants an extension if you. Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax.

SC DoR WH1612 20202022 Fill out Tax Template Online US Legal Forms

If you were granted an automatic extension to file. Get ready for tax season deadlines by completing any required tax forms today. The state grants an extension if you. Web pursuant to the secretary of revenue’s statutory authority, the department announced an automatic extension of time to file the north carolina individual income. If you were granted an automatic extension.

North Carolina Tax Extension

Web the way to fill out the nc dept of revenue forms d410 online: To start the document, utilize the fill camp; Web to file for an extension on your state taxes in north carolina, you can: Easily fill out pdf blank, edit, and sign them. Get ready for tax season deadlines by completing any required tax forms today.

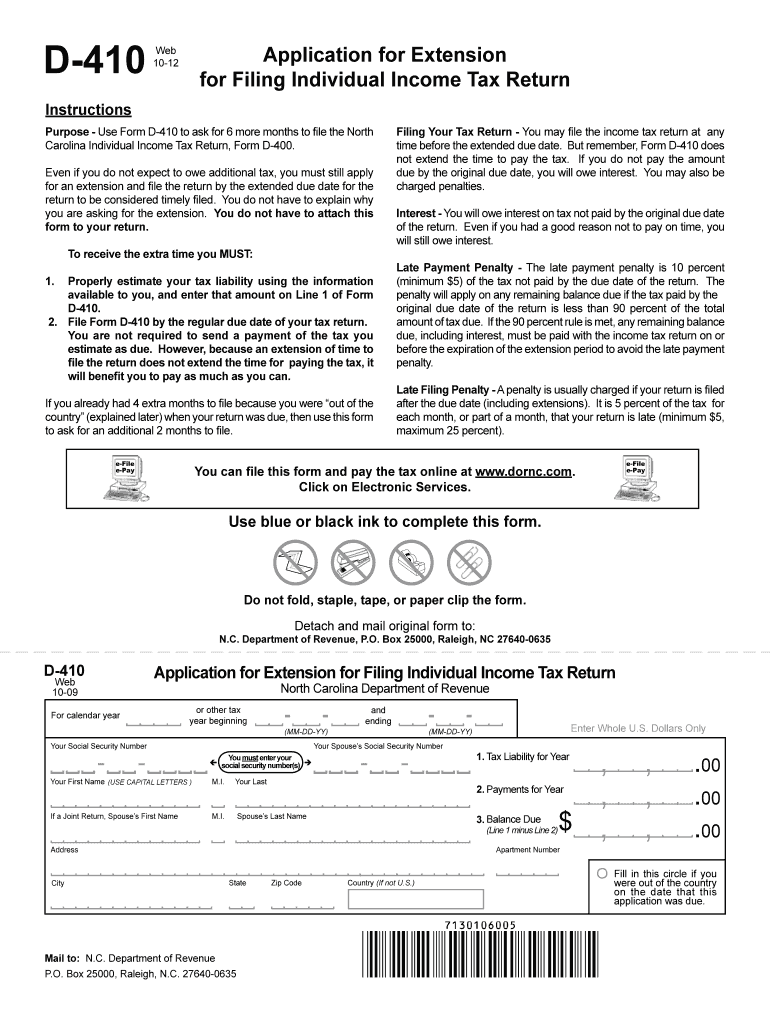

D 410 Fill Online, Printable, Fillable, Blank pdfFiller

Web complete d410 nc tax extension online with us legal forms. This form is for income earned in tax year 2022, with tax. Do not fold, staple, tape, or paper clip the form. Web the way to fill out the nc dept of revenue forms d410 online: Web if a taxpayer is not granted an automatic federal extension, the taxpayer.

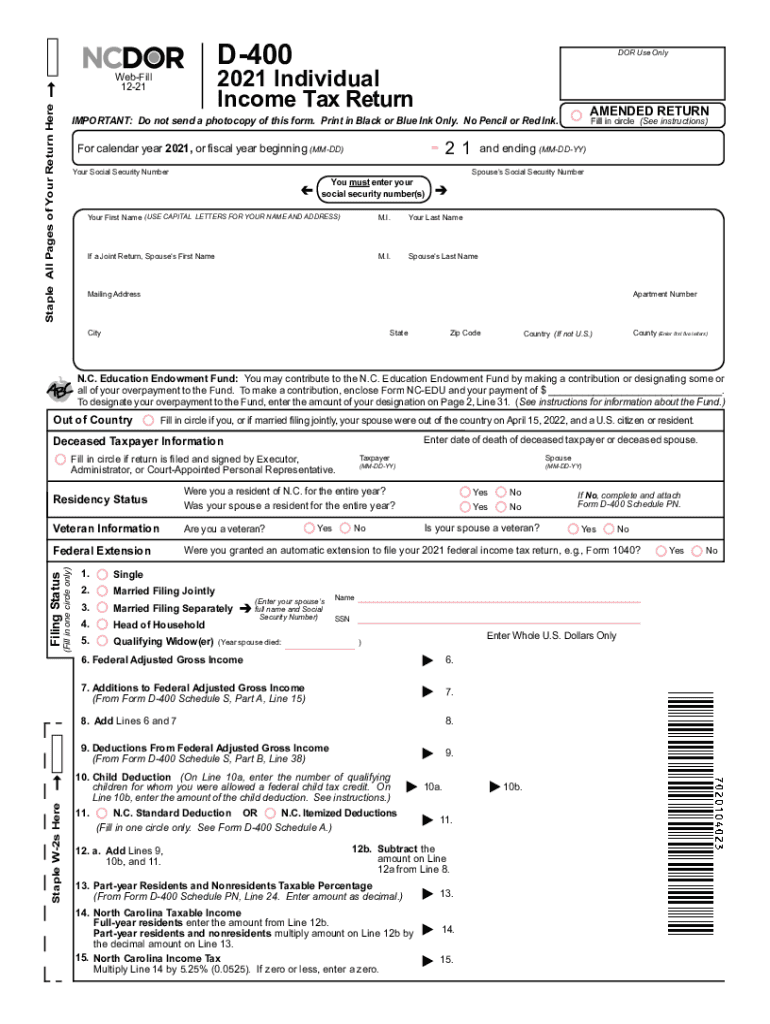

2021 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. Third party file and pay option: Sign online button or tick the preview image of the form. If you previously made an electronic payment but did not receive a confirmation page do not submit another.

Application for Extension for Filing Individual Tax Return Free

Do not fold, staple, tape, or paper clip the form. If you were granted an automatic extension to file. Get ready for tax season deadlines by completing any required tax forms today. Web the way to fill out the nc dept of revenue forms d410 online: Sign online button or tick the preview image of the form.

North carolina 2016 tax extension form stpassl

Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Web if a taxpayer is not granted an automatic federal extension, the taxpayer may still request a state extension to file their north carolina individual income tax return. Sign online button or tick the preview image of the form. Third.

How To Request An Extension On Your Taxes

Ad download or email nc d410p & more fillable forms, register and subscribe now! Web pursuant to the secretary of revenue’s statutory authority, the department announced an automatic extension of time to file the north carolina individual income. The state grants an extension if you. Do not fold, staple, tape, or paper clip the form. Use blue or black ink.

If You Previously Made An Electronic Payment But Did Not Receive A Confirmation Page Do Not Submit Another.

Sign online button or tick the preview image of the form. Save or instantly send your ready documents. Web complete d410 nc tax extension online with us legal forms. If you owe north carolina tax, remember to make an.

To Start The Document, Utilize The Fill Camp;

Get ready for tax season deadlines by completing any required tax forms today. Nonresident aliens are required to file returns at the same time they are required to file. If you were granted an automatic extension to file. Get ready for tax season deadlines by completing any required tax forms today.

Web If A Taxpayer Is Not Granted An Automatic Federal Extension, The Taxpayer May Still Request A State Extension To File Their North Carolina Individual Income Tax Return.

Use blue or black ink to complete this form. Third party file and pay option: The state grants an extension if you. Easily fill out pdf blank, edit, and sign them.

Ad Download Or Email Nc D410P & More Fillable Forms, Register And Subscribe Now!

Do not fold, staple, tape, or paper clip the form. Web pursuant to the secretary of revenue’s statutory authority, the department announced an automatic extension of time to file the north carolina individual income. This form is for income earned in tax year 2022, with tax. Third party file and pay option: