Notice Of Deficiency Waiver Form 5564

Notice Of Deficiency Waiver Form 5564 - Web if you received a letter cp3219a, statutory notice of deficiency, and are wondering what to do, this may help. If the irs is proposing to adjust the amount of tax you owe, you will typically be sent a statutory notice of deficiency. Contact the third party that furnished the. Along with notice cp3219a, you should receive form 5564. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web what does this letter mean to me? The letter explains why there is a proposed. A copy of any notice of deficiency, notice of determination, or final determination the irs sent you; Web this letter explains the changes…. If you agree with the information on your.

Web if you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. This form notifies the irs that you agree with the proposed additional tax due. Contact the third party that furnished the. Web this letter explains the changes…. Web what is irs form 5564? Web united states tax court 400 second street, nw washington, dc 20217 you may be able to resolve your dispute with the irs you can download a petition form and. Web if the irs sends you a notice of deficiency stating adenine discrepancy in your tax refund so resulted in an underpayment off steuer, the inhabitant can choose to agree by the. A copy of any notice of deficiency, notice of determination, or final determination the irs sent you; If you agree with the information on your.

Web notice of deficiency, the amount of the deficiency (including any additions to tax or penalties) that you dispute cannot exceed $50,000 for any year. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Web if we don’t receive your form 5564 notice of deficiency waiver, or you don’t file a petition with the u.s. Your statement of taxpayer identification number (form 4); Web if you received a letter cp3219a, statutory notice of deficiency, and are wondering what to do, this may help. If the irs is proposing to adjust the amount of tax you owe, you will typically be sent a statutory notice of deficiency. This form notifies the irs that you agree with the proposed additional tax due. Web you do not enter form 5564 in the program. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of.

IRS Audit Letter CP3219A Sample 1

Contact the third party that furnished the. Select the document you want to sign and click upload. Web notice of deficiency, the amount of the deficiency (including any additions to tax or penalties) that you dispute cannot exceed $50,000 for any year. Web what is irs form 5564? If you agree with the information on your.

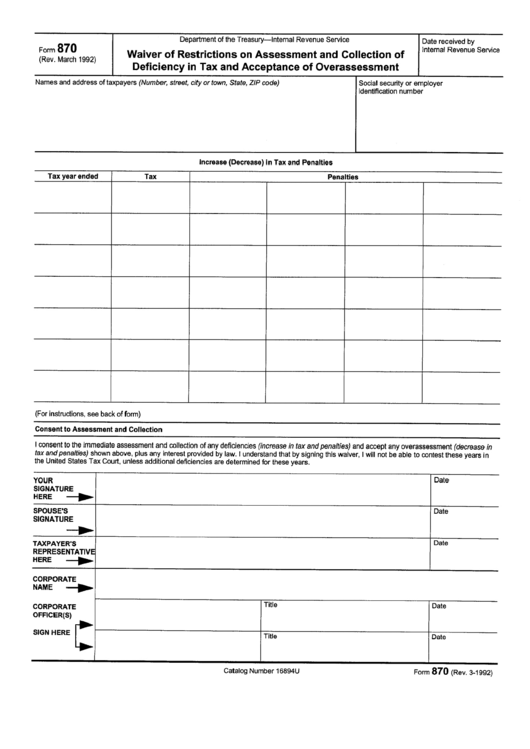

Form 870 Waiver Of Restrictions On Assessment And Collection Of

The letter explains why there is a proposed. Web this letter explains the changes…. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Department of health and human services centers for medicare & medicaid services form approved omb no. Web if we don’t.

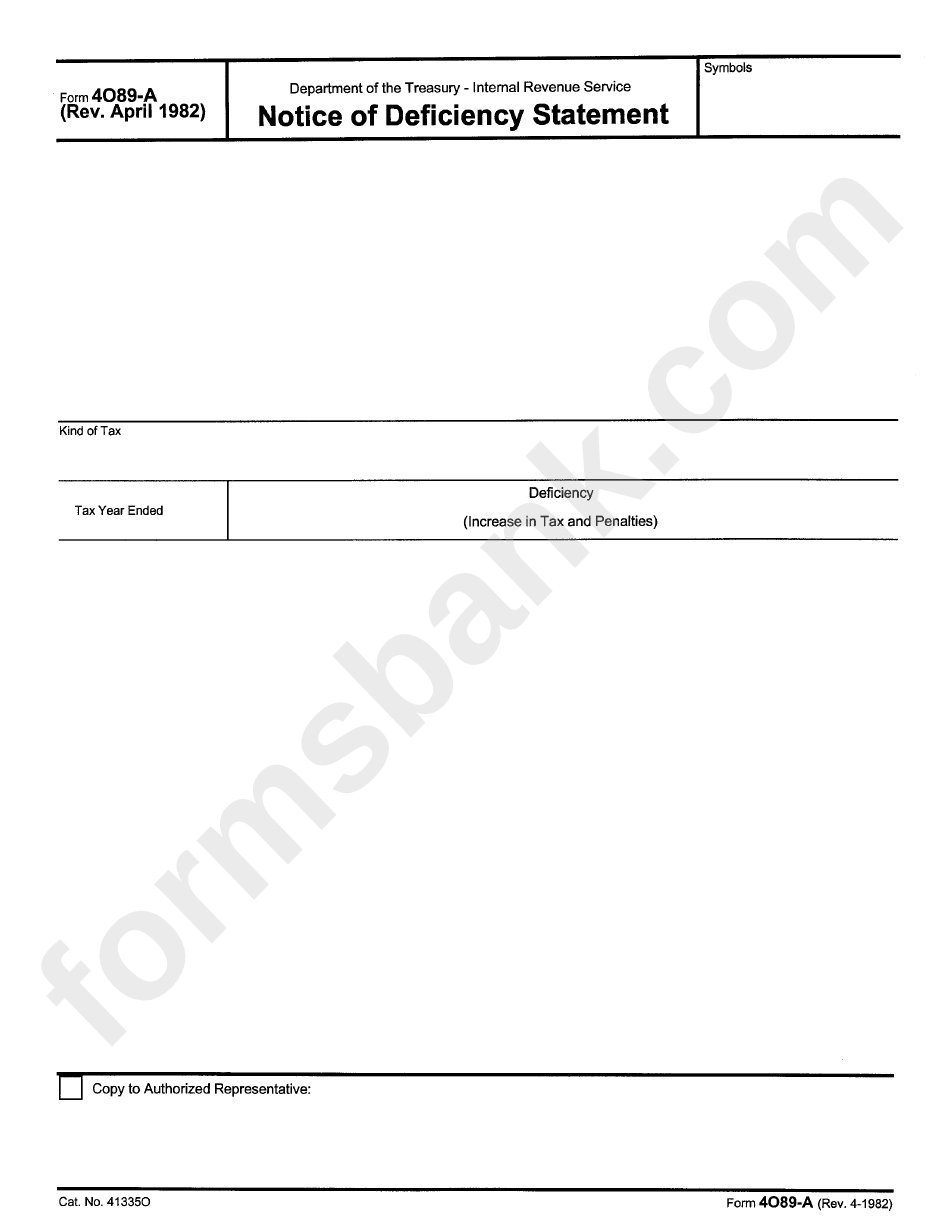

Form 4089A Notice Of Deficiency Statement printable pdf download

Tax court by august 19, 2013, you’ll receive a bill from us for the additional. Web what does this letter mean to me? Contact the third party that furnished the. The letter explains why there is a proposed. Web what is irs form 5564?

Notice of Deficiency from the IRS? Don’t Panic Here’s What You Can Do

Your statement of taxpayer identification number (form 4); Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of. Web if we don’t receive.

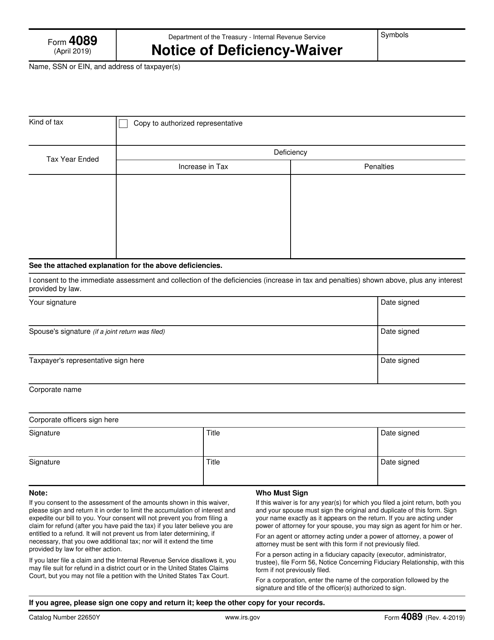

IRS Form 4089 Download Fillable PDF or Fill Online Notice of Deficiency

Web notice of deficiency, the amount of the deficiency (including any additions to tax or penalties) that you dispute cannot exceed $50,000 for any year. Web what does this letter mean to me? Contact the third party that furnished the. Web what is irs form 5564? Web you do not enter form 5564 in the program.

IRS Audit Letter CP3219A Sample 1

This form notifies the irs that you agree with the proposed additional tax due. If the irs is proposing to adjust the amount of tax you owe, you will typically be sent a statutory notice of deficiency. The letter explains why there is a proposed. Web mail or fax form 5564 back to the address on the notice by the.

Tax Form 5564 Fill Online, Printable, Fillable, Blank pdfFiller

Web if you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a. Web what is irs form 5564? Select the document you want to sign and click upload. Web this letter explains the changes…. Contact the third party that furnished the.

Form 4089 Notice Of DeficiencyWaiver printable pdf download

And your right to challenge the increase in tax court. Web if the irs sends you a notice of deficiency stating adenine discrepancy in your tax refund so resulted in an underpayment off steuer, the inhabitant can choose to agree by the. Web if you received a letter cp3219a, statutory notice of deficiency, and are wondering what to do, this.

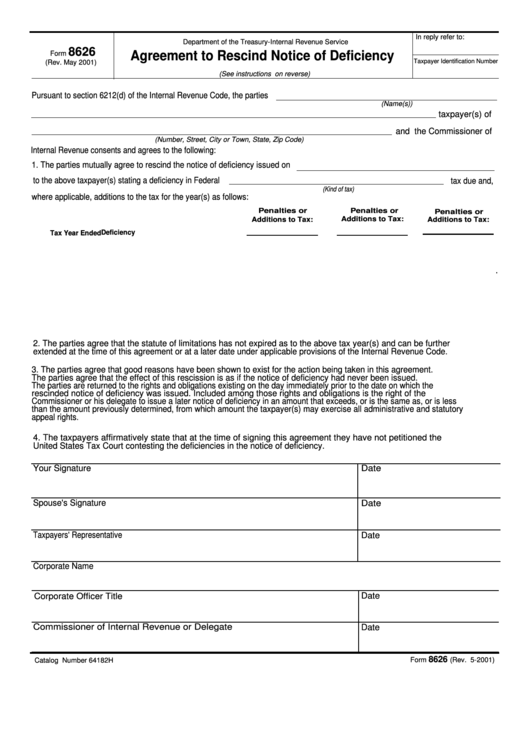

Fillable Form 8626 Agreement To Rescind Notice Of Deficiency

Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Web notice of deficiency, the amount of the deficiency (including any additions to tax or penalties) that you dispute cannot exceed $50,000 for any year. Web what does this letter mean to me? If.

IRS Audit Letter CP3219A Sample 1

If you agree with the information on your. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. This form notifies the irs that you agree with the proposed additional tax due. If the irs is proposing to adjust the amount of tax you.

Web If You Received A Letter Cp3219A, Statutory Notice Of Deficiency, And Are Wondering What To Do, This May Help.

Web if you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a. Web notice of deficiency, the amount of the deficiency (including any additions to tax or penalties) that you dispute cannot exceed $50,000 for any year. Along with notice cp3219a, you should receive form 5564. A copy of any notice of deficiency, notice of determination, or final determination the irs sent you;

Web You Do Not Enter Form 5564 In The Program.

The letter explains why there is a proposed. Web what does this letter mean to me? Web what is irs form 5564? If you agree with the information on your.

Contact The Third Party That Furnished The.

Select the document you want to sign and click upload. Your statement of taxpayer identification number (form 4); And your right to challenge the increase in tax court. This form notifies the irs that you agree with the proposed additional tax due.

If The Irs Is Proposing To Adjust The Amount Of Tax You Owe, You Will Typically Be Sent A Statutory Notice Of Deficiency.

Web this letter explains the changes…. Web united states tax court 400 second street, nw washington, dc 20217 you may be able to resolve your dispute with the irs you can download a petition form and. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of.