Ohio Chapter 7 Exemptions

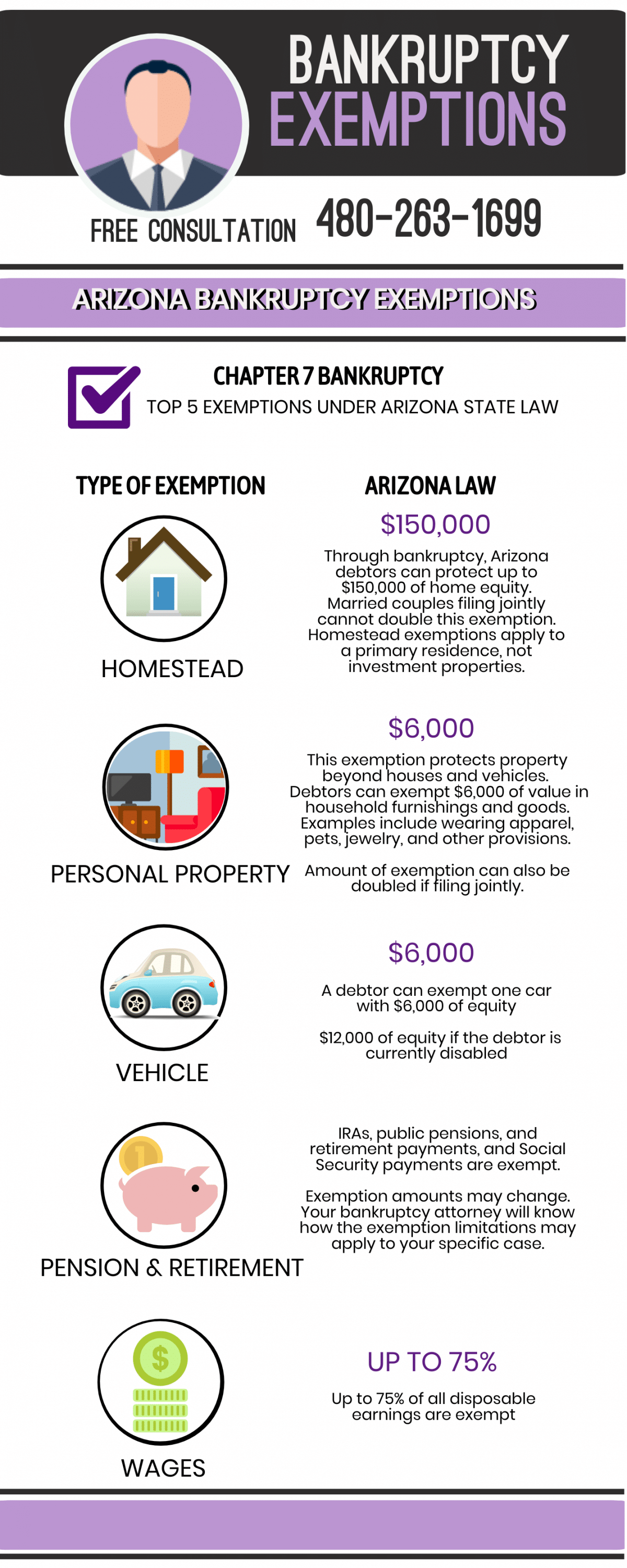

Ohio Chapter 7 Exemptions - Web bankruptcy if you have overwhelming debt, you may be able to get a fresh start and get rid of some or all of your debt. Web what is exempt in ohio chapter 7 bankruptcy? Web spousal or child support most insurance benefits most public benefits retirement accounts most personal injury awards the situation also can be complicated if a creditor has a secured debt connected to. Ohio chapter 7 bankruptcy allows you to exempt up to $145,425 in equity in your home or another property. In the middle ages and before, creditors could. Web ohio’s homestead exemption protects your house in bankruptcy historically, a creditor could take everything you owned in payment of your debt. Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. When property is exempt in chapter 7, it means. Web so technically, you could keep $1,825 of your cash when filing for chapter 7 bankruptcy in ohio. Web in ohio, the homestead exemption applies to real and personal property that you or your dependents use as a residence, including your home, condominium, or mobile home.

Other exemptions in ohio there are other property exemptions you can take in ohio. How do i qualify for chapter 7 or 13 bankruptcy in ohio? You may exempt any property that falls into one of the. Web exempt property can include: Ohio courts impose a “stay” during the. When the value of a. Discover why chapter 13 solves more problems than chapter 7. In many cases, most if not all your assets will be exempt from liquidation, which means you can. This is also referred to as a “liquidation bankruptcyand your assets will be sold to pay your creditors in return for eliminating some types of debt. Web each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions.

How do i choose the right bankruptcy chapter in ohio? Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. When the value of a. This is also referred to as a “liquidation bankruptcyand your assets will be sold to pay your creditors in return for eliminating some types of debt. Web in a chapter 7 bankruptcy you wipe out your debts and get a “fresh start”. How do i keep property in ohio using bankruptcy exemptions? Web exempt property can include: Web by cara o'neill, attorney table of contents how does bankruptcy work in ohio? Web each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. Web in ohio, the homestead exemption applies to real and personal property that you or your dependents use as a residence, including your home, condominium, or mobile home.

Chapter 7 Bankruptcy Exemptions in Arizona Judge Law Firm

Web ohio’s homestead exemption protects your house in bankruptcy historically, a creditor could take everything you owned in payment of your debt. Other exemptions in ohio there are other property exemptions you can take in ohio. Web so technically, you could keep $1,825 of your cash when filing for chapter 7 bankruptcy in ohio. Chapter 7 bankruptcy is a liquidation.

To The Columbus Bankruptcy Lawyer Debt And Bankruptcy Blog

When property is exempt in chapter 7, it means. Part of the process of filing bankruptcy is accounting for all your property, and listing any property to claim any exemptions. Ohio courts impose a “stay” during the. Web the ohio bankruptcy exemptions chart, see below, details the property you can exempt or protect from creditors when you file bankruptcy in.

Chapter 7 Exemptions and Defenses

How do i qualify for chapter 7 or 13 bankruptcy in ohio? Web what is exempt in ohio chapter 7 bankruptcy? Web ohio law allows for exemptions when you file for a chapter 7. Web the ohio bankruptcy exemptions chart, see below, details the property you can exempt or protect from creditors when you file bankruptcy in ohio. How do.

What Is Ohio's Homestead Exemption? Richard P. Arthur Attorney at Law

You may exempt any property that falls into one of the. Web bankruptcy if you have overwhelming debt, you may be able to get a fresh start and get rid of some or all of your debt. Using exemptions when filing for bankruptcy in ohio bankruptcy is a federal. Web 16 rows how do exemptions work in chapter 7 bankruptcy?.

How to use Exemptions when Filing for Chapter 13 Bankruptcy Rosenblum Law

How do i choose the right bankruptcy chapter in ohio? Other exemptions in ohio there are other property exemptions you can take in ohio. Bankruptcy is a legal process to eliminate some debts and to stop debt collection. When property is exempt in chapter 7, it means. Chapter 7 bankruptcy is a liquidation where the trustee collects all of your.

Bankruptcy means test (Chapter 7 and 13 filing)

Web so technically, you could keep $1,825 of your cash when filing for chapter 7 bankruptcy in ohio. Web in ohio, the homestead exemption applies to real and personal property that you or your dependents use as a residence, including your home, condominium, or mobile home. How do i choose the right bankruptcy chapter in ohio? Motor vehicles, up to.

What Can Be Exempted in Bankruptcy Phoenix Bankruptcy Attorney

Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. In the middle ages and before, creditors could. Web bankruptcy if you have overwhelming debt, you may be able to get a fresh start and get rid of some or all of your debt. Discover why chapter 13.

What are the Federal Bankruptcy Exemptions? Bankruptcy Track Law Firm

Web in ohio, the homestead exemption applies to real and personal property that you or your dependents use as a residence, including your home, condominium, or mobile home. In the middle ages and before, creditors could. When the value of a. Web find out if you qualify to wipe out debts in chapter 7 bankruptcy. The current it 4 revised.

Bankruptcy Chapter 7 Exempt Property YouTube

How do i choose the right bankruptcy chapter in ohio? Part of the process of filing bankruptcy is accounting for all your property, and listing any property to claim any exemptions. When property is exempt in chapter 7, it means. Ohio courts impose a “stay” during the. Web the ohio bankruptcy exemptions chart, see below, details the property you can.

Chapter 7 Bankruptcy Exemptions The Needleman Law Office

Web the ohio bankruptcy exemptions chart, see below, details the property you can exempt or protect from creditors when you file bankruptcy in ohio. Web each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. In many cases, most if not all your assets will.

Ohio Chapter 7 Bankruptcy Allows You To Exempt Up To $145,425 In Equity In Your Home Or Another Property.

Web 16 rows how do exemptions work in chapter 7 bankruptcy? Web exempt property can include: Bankruptcy is a legal process to eliminate some debts and to stop debt collection. How do i choose the right bankruptcy chapter in ohio?

Web In A Chapter 7 Bankruptcy You Wipe Out Your Debts And Get A “Fresh Start”.

Discover why chapter 13 solves more problems than chapter 7. Web what is exempt in ohio chapter 7 bankruptcy? This is also referred to as a “liquidation bankruptcyand your assets will be sold to pay your creditors in return for eliminating some types of debt. How do i keep property in ohio using bankruptcy exemptions?

The Sale Of Assets Generates Funds To Pay Off The Debtor’s Debts As Much As Possible.

Web ohio’s homestead exemption protects your house in bankruptcy historically, a creditor could take everything you owned in payment of your debt. How do i qualify for chapter 7 or 13 bankruptcy in ohio? Web so technically, you could keep $1,825 of your cash when filing for chapter 7 bankruptcy in ohio. Web by cara o'neill, attorney table of contents how does bankruptcy work in ohio?

When The Value Of A.

Web the ohio bankruptcy exemptions chart, see below, details the property you can exempt or protect from creditors when you file bankruptcy in ohio. Web there are bankruptcy exemptions in chapter 7 filings in ohio. Web spousal or child support most insurance benefits most public benefits retirement accounts most personal injury awards the situation also can be complicated if a creditor has a secured debt connected to. Using exemptions when filing for bankruptcy in ohio bankruptcy is a federal.