Oklahoma Form 512-S

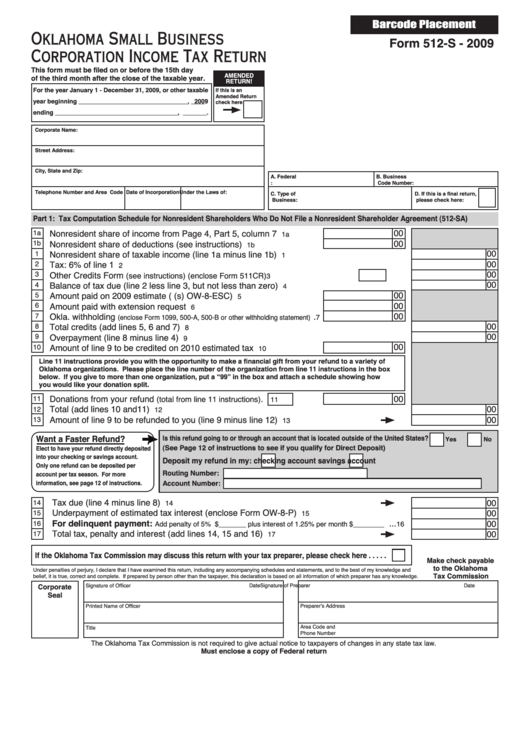

Oklahoma Form 512-S - Register and subscribe now to work on ok electronic filing form & more fillable forms. Web the upper right hand corner of this form, next to the form number as shown here: Complete, edit or print tax forms instantly. Edit your oklahoma form 512 s online type text, add images, blackout confidential details, add comments, highlights and more. Web the 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form is 48 pages long and contains: Please read the information on pages. Web c corporation, s corporation, consolidated and amended returns are allowed to be filed electronically by the oklahoma tax commission, which includes the following: Every resident or foreign corporation subject to taxation under oklahoma statutes shall make a return, whether or not it shall have any. Web what’s new in the 2013 oklahoma packet? Tax computation schedule for nonresident shareholders who do not file.

*return due dates are not. Web we last updated the corporate income tax return (form and schedules) in january 2023, so this is the latest version of form 512, fully updated for tax year 2022. Corporations electing to file a combined income and franchise tax return should use this. Every resident or foreign corporation subject to taxation under oklahoma statutes shall make a return, whether or not it shall have any. Small business corporation income tax return. • the credit for railroad modernization on the form 511cr was modied to increase both the individual credit. Web c corporation, s corporation, consolidated and amended returns are allowed to be filed electronically by the oklahoma tax commission, which includes the following: Download past year versions of this tax form as. Small business corporation income tax forms and instructions. Please read the information on pages.

Tax computation schedule for nonresident shareholders who do not file. Web the upper right hand corner of this form, next to the form number as shown here: • the credit for railroad modernization on the form 511cr was modied to increase both the individual credit. Web c corporation, s corporation, consolidated and amended returns are allowed to be filed electronically by the oklahoma tax commission, which includes the following: Please read the information on pages. Web we last updated the corporate income tax return (form and schedules) in january 2023, so this is the latest version of form 512, fully updated for tax year 2022. Every resident or foreign corporation subject to taxation under oklahoma statutes shall make a return, whether or not it shall have any. Complete, edit or print tax forms instantly. Small business corporation income tax return. Download past year versions of this tax form as.

Fillable Form 512S Oklahoma Small Business Corporation Tax

Register and subscribe now to work on ok electronic filing form & more fillable forms. Complete, edit or print tax forms instantly. • the credit for railroad modernization on the form 511cr was modied to increase both the individual credit. Web what’s new in the 2013 oklahoma packet? Web form 512s 2016 oklahoma small business corporation income and franchise tax.

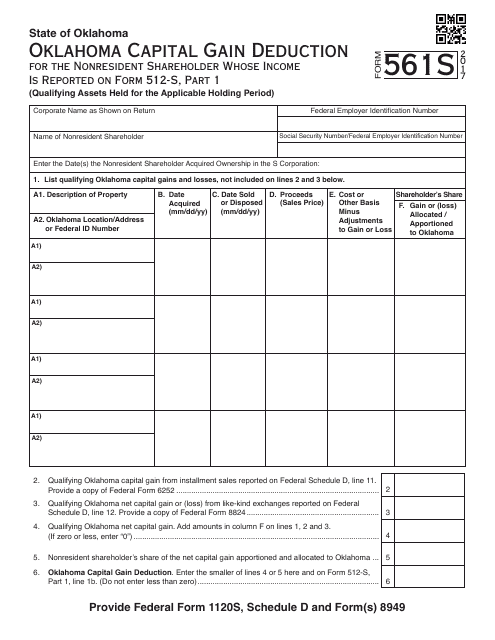

OTC Form 561S Download Fillable PDF or Fill Online Capital Gain

Web what’s new in the 2013 oklahoma packet? Web form 512s 2016 oklahoma small business corporation income and franchise tax return this form is due 30 days after the due date of the federal return for the year january 1. Small business corporation income tax return. Tax computation schedule for nonresident shareholders who do not file. Register and subscribe now.

Fill Free fillable 2021 Form 512S Oklahoma Small Business

Web the upper right hand corner of this form, next to the form number as shown here: Edit your oklahoma form 512 s online type text, add images, blackout confidential details, add comments, highlights and more. Recapture of the oklahoma affordable housing tax credit: Web we last updated the corporate income tax return (form and schedules) in january 2023, so.

Fill Free fillable 2021 Form 512 Oklahoma Corporation And

Recapture of the oklahoma affordable housing tax credit: Sign it in a few clicks draw your. Every resident or foreign corporation subject to taxation under oklahoma statutes shall make a return, whether or not it shall have any. Web the upper right hand corner of this form, next to the form number as shown here: Web we last updated the.

Fill Free fillable 2021 Form 512 Oklahoma Corporation And

Web what’s new in the 2013 oklahoma packet? Recapture of the oklahoma affordable housing tax credit: Corporations electing to file a combined income and franchise tax return should use this. Please read the information on pages. Edit your oklahoma form 512 s online type text, add images, blackout confidential details, add comments, highlights and more.

Fill Free fillable 2021 Form 512S Oklahoma Small Business

Tax computation schedule for nonresident shareholders who do not file. Web the 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form is 48 pages long and contains: Recapture of the oklahoma affordable housing tax credit: Register and subscribe now to work on ok electronic filing form & more fillable forms. Download past.

Form 512S Oklahoma Small Business Corporation Tax Return

Web the upper right hand corner of this form, next to the form number as shown here: Web what’s new in the 2013 oklahoma packet? Tax computation schedule for nonresident shareholders who do not file. Small business corporation income tax return. Please read the information on pages.

Fill Free fillable 2021 Form 512S Oklahoma Small Business

Web what’s new in the 2013 oklahoma packet? Corporations electing to file a combined income and franchise tax return should use this. Web we last updated the corporate income tax return (form and schedules) in january 2023, so this is the latest version of form 512, fully updated for tax year 2022. Web c corporation, s corporation, consolidated and amended.

Fill Free fillable 2021 Form 512S Oklahoma Small Business

Complete, edit or print tax forms instantly. Corporations electing to file a combined income and franchise tax return should use this. Register and subscribe now to work on ok electronic filing form & more fillable forms. Sign it in a few clicks draw your. Please read the information on pages.

Fill Free fillable 2021 Form 512S Oklahoma Small Business

Complete, edit or print tax forms instantly. Sign it in a few clicks draw your. *return due dates are not. Edit your oklahoma form 512 s online type text, add images, blackout confidential details, add comments, highlights and more. Web the 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form is 48.

Edit Your Oklahoma Form 512 S Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web we last updated the corporate income tax return (form and schedules) in january 2023, so this is the latest version of form 512, fully updated for tax year 2022. *return due dates are not. Download past year versions of this tax form as. Every resident or foreign corporation subject to taxation under oklahoma statutes shall make a return, whether or not it shall have any.

Register And Subscribe Now To Work On Ok Electronic Filing Form & More Fillable Forms.

Web c corporation, s corporation, consolidated and amended returns are allowed to be filed electronically by the oklahoma tax commission, which includes the following: Recapture of the oklahoma affordable housing tax credit: Web what’s new in the 2013 oklahoma packet? Web the 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form is 48 pages long and contains:

• The Credit For Railroad Modernization On The Form 511Cr Was Modied To Increase Both The Individual Credit.

Sign it in a few clicks draw your. Tax computation schedule for nonresident shareholders who do not file. Small business corporation income tax return. Small business corporation income tax forms and instructions.

Please Read The Information On Pages.

Corporations electing to file a combined income and franchise tax return should use this. Web form 512s 2016 oklahoma small business corporation income and franchise tax return this form is due 30 days after the due date of the federal return for the year january 1. Web the upper right hand corner of this form, next to the form number as shown here: Complete, edit or print tax forms instantly.