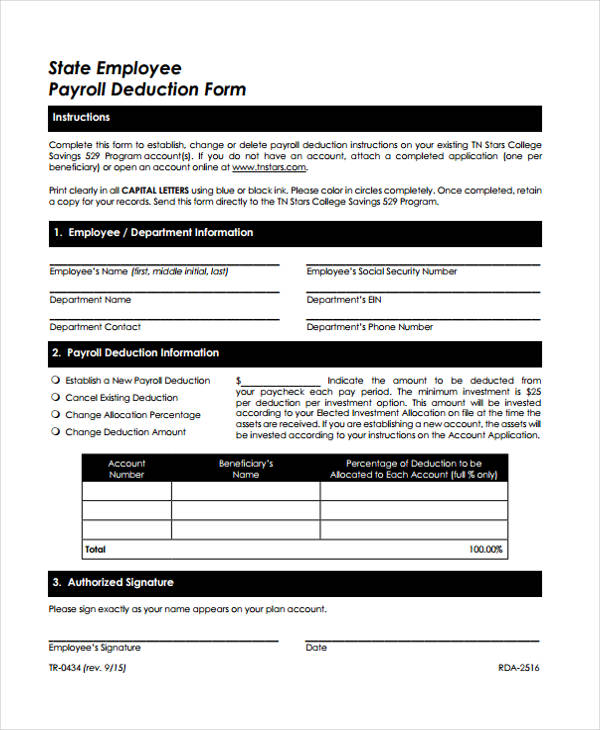

Payroll Adjustment Form

Payroll Adjustment Form - You must complete all five pages. Salary increases and sick leave are just some of the possible reasons. It’s the hr department’s job to compile this information and ensure it gets to the person responsible for payroll. Type or print within the boxes. Payments can be made using eftps, by sending a check, or by credit card (for most x forms). Changes may happen for a number of reasons, from starting new employment to getting a promotion or leaving a job. April, may, june read the separate instructions before completing this form. Amounts owed must be paid by the receipt of the x form. Hit the get form option to start editing. Iforms access is based upon employees' positions and it accessed by visiting duke@work.

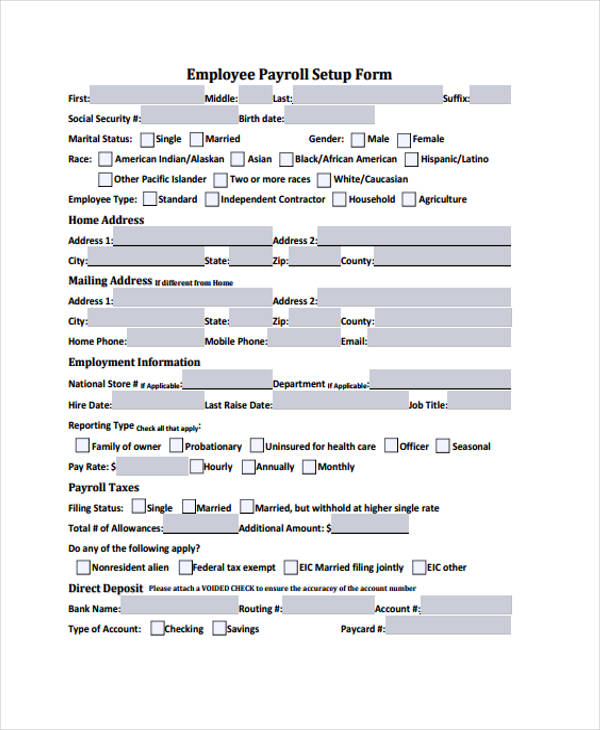

Web payroll adjustment forms are used to make adjustments in salaries by increasing or decreasing an employee's gross pay. Amounts owed must be paid by the receipt of the x form. You must complete all five pages. Web 5 min read having to make changes to employees’ payslips from month to month isn’t unusual in business today. Payments can be made using eftps, by sending a check, or by credit card (for most x forms). It’s the hr department’s job to compile this information and ensure it gets to the person responsible for payroll. Direct deposit waiver request form. Type or print within the boxes. Hit the get form option to start editing. Fill in all of the requested fields (they are marked in.

Payments can be made using eftps, by sending a check, or by credit card (for most x forms). This article will provide you all that you need to know about payroll adjustment forms, plus samples that you can download for free. Web fill out payroll adjustment form within a couple of moments by simply following the instructions listed below: Fill out each fillable area. Click the get form key to open the document and move to editing. It’s the hr department’s job to compile this information and ensure it gets to the person responsible for payroll. Web how to fill out and sign estart adjustment form online? Web 5 min read having to make changes to employees’ payslips from month to month isn’t unusual in business today. Type or print within the boxes. Iforms access is based upon employees' positions and it accessed by visiting duke@work.

WPS Template Free Download Writer, Presentation & Spreadsheet Templates

Document and authorize payroll changes and reasons for the adjustments with this form. Salary increases and sick leave are just some of the possible reasons. This article will provide you all that you need to know about payroll adjustment forms, plus samples that you can download for free. Web fill out payroll adjustment form within a couple of moments by.

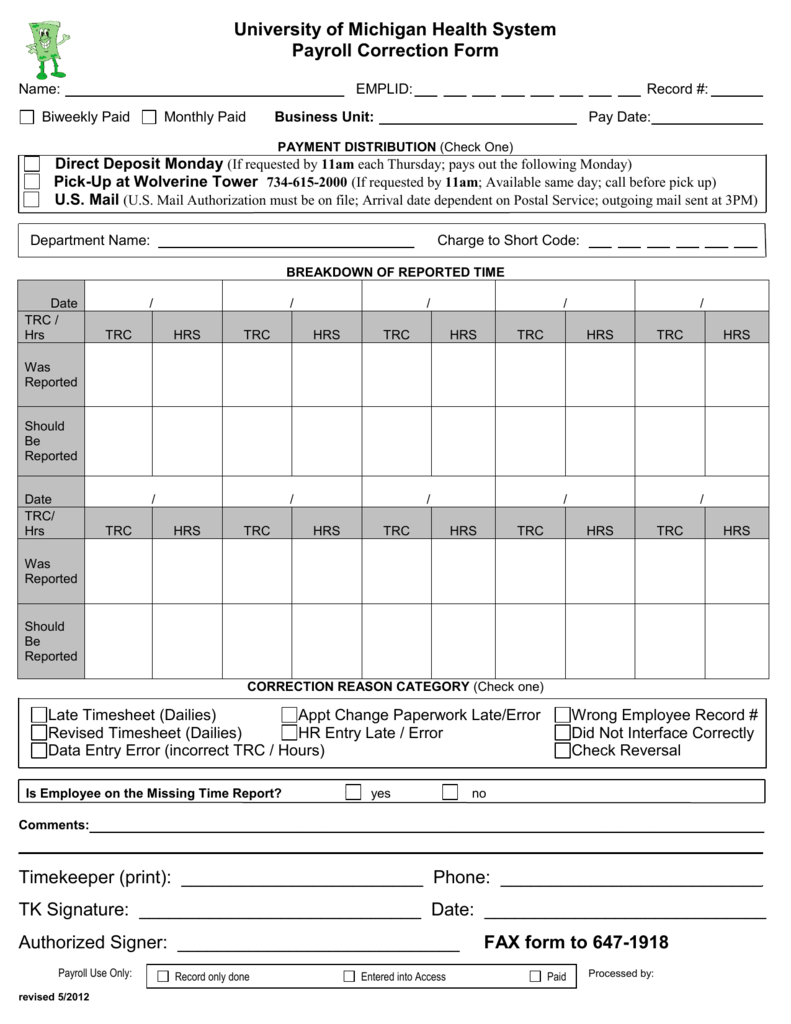

UMHS Payroll Adjustment/Correction Form

Payments can be made using eftps, by sending a check, or by credit card (for most x forms). Direct deposit waiver request form. Fill out each fillable area. It’s the hr department’s job to compile this information and ensure it gets to the person responsible for payroll. Hit the get form option to start editing.

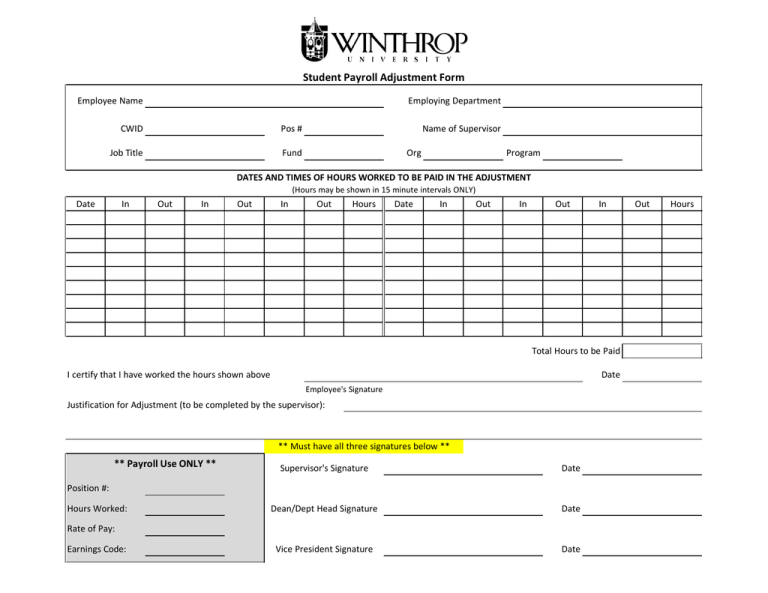

Student Payroll Adjustment Form

Direct deposit waiver request form. Type or print within the boxes. Web fill out payroll adjustment form within a couple of moments by simply following the instructions listed below: Pick the template you require in the collection of legal forms. Salary increases and sick leave are just some of the possible reasons.

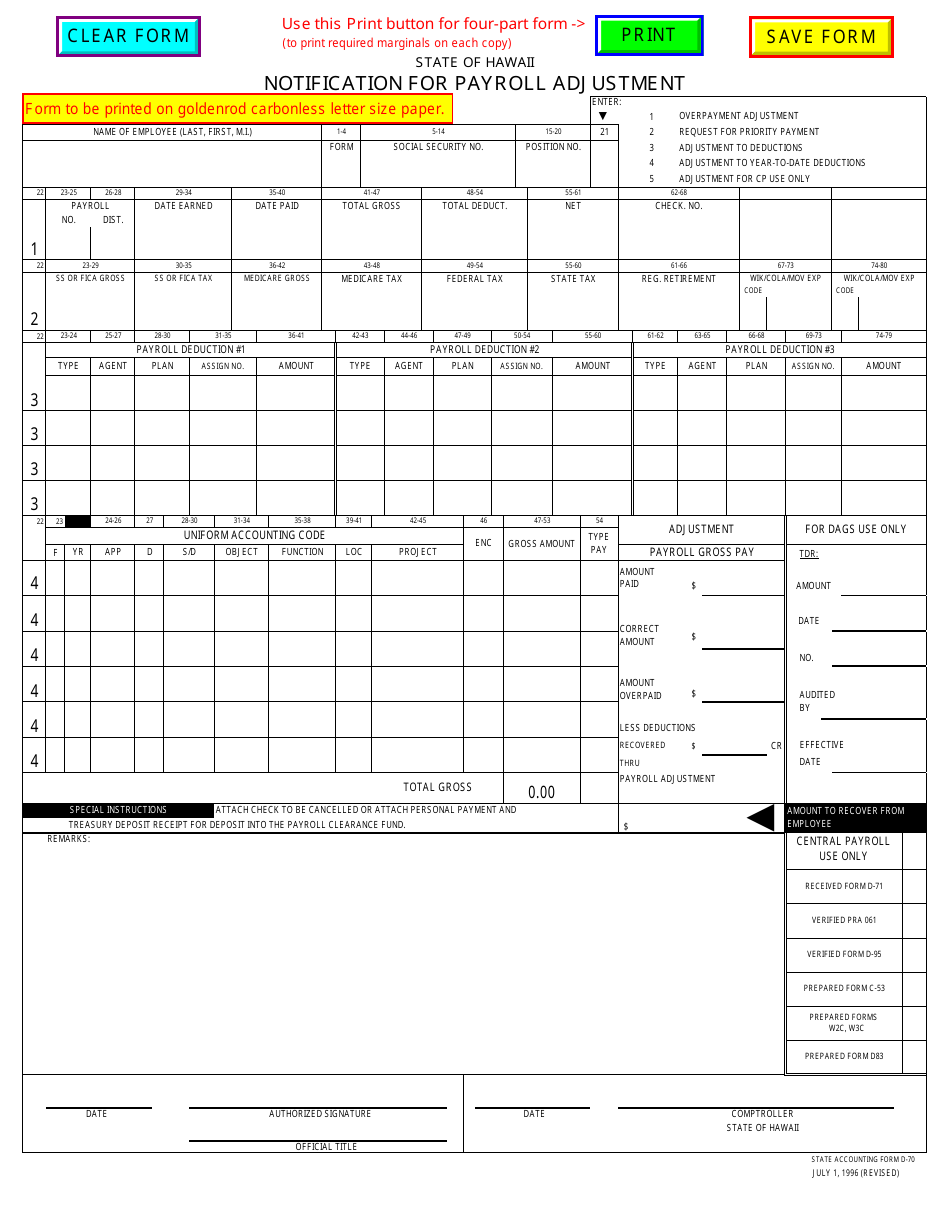

Form D70 Download Fillable PDF or Fill Online Notification for Payroll

Document and authorize payroll changes and reasons for the adjustments with this form. Iforms access is based upon employees' positions and it accessed by visiting duke@work. Salary increases and sick leave are just some of the possible reasons. Switch on the wizard mode on the top toolbar to have additional recommendations. Payments can be made using eftps, by sending a.

Payroll Templates For Mac HQ Printable Documents

Pick the template you require in the collection of legal forms. Document and authorize payroll changes and reasons for the adjustments with this form. Fill in all of the requested fields (they are marked in. Salary increases and sick leave are just some of the possible reasons. Iforms access is based upon employees' positions and it accessed by visiting duke@work.

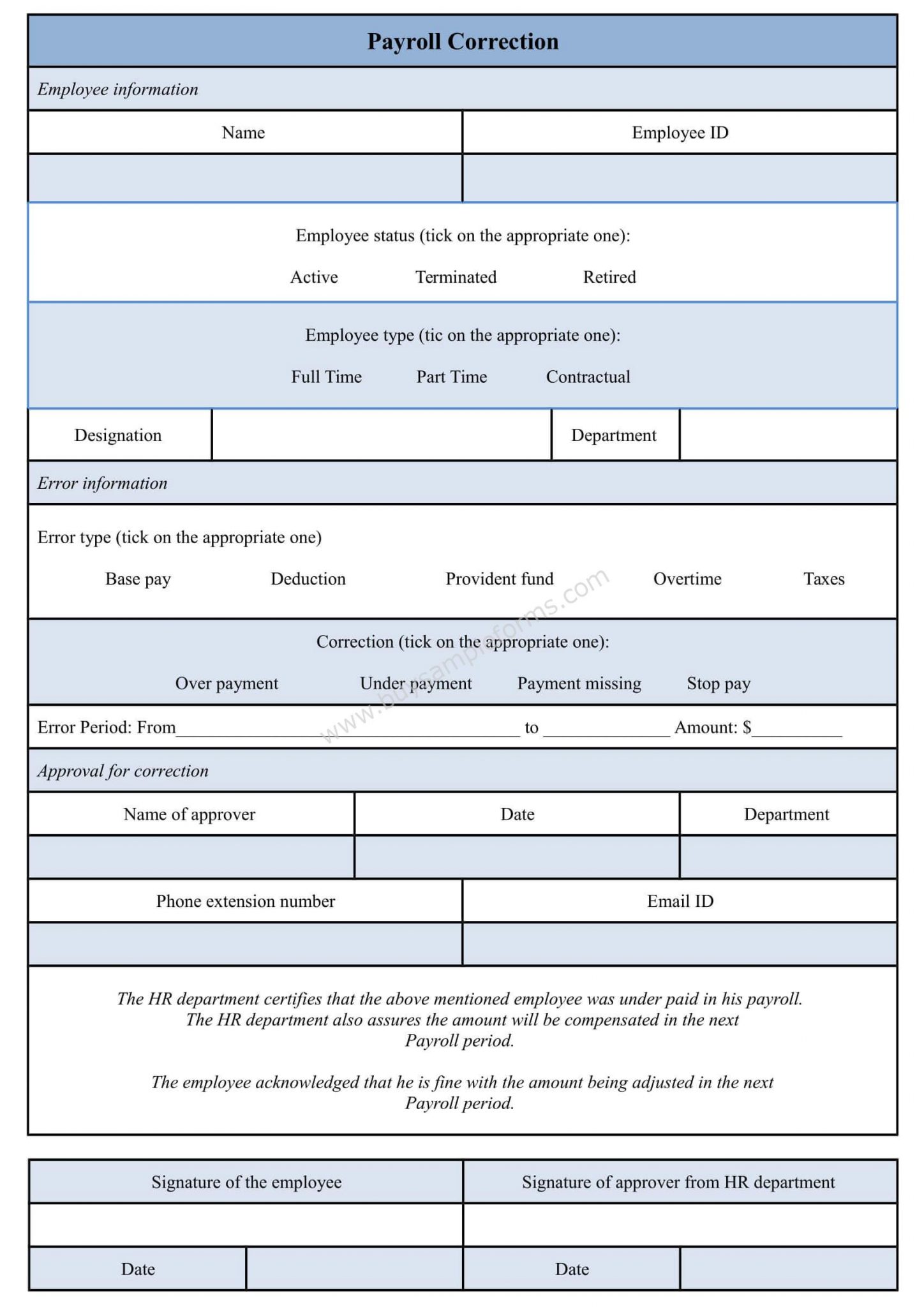

Payroll Correction Form Template Sample Forms

You must complete all five pages. April, may, june read the separate instructions before completing this form. Web fill out payroll adjustment form within a couple of moments by simply following the instructions listed below: Web how to fill out and sign estart adjustment form online? It’s the hr department’s job to compile this information and ensure it gets to.

Free download program Payroll Adjustment Form Template softwaregorilla

It’s the hr department’s job to compile this information and ensure it gets to the person responsible for payroll. This article will provide you all that you need to know about payroll adjustment forms, plus samples that you can download for free. You must complete all five pages. Changes may happen for a number of reasons, from starting new employment.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Web download payroll change form. Fill out each fillable area. Web 5 min read having to make changes to employees’ payslips from month to month isn’t unusual in business today. Click the get form key to open the document and move to editing. Hit the get form option to start editing.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Type or print within the boxes. Web download payroll change form. It’s the hr department’s job to compile this information and ensure it gets to the person responsible for payroll. Switch on the wizard mode on the top toolbar to have additional recommendations. Employers correcting an underpayment must use the corresponding x form using the adjustment process.

9 Payroll form Templates SampleTemplatess SampleTemplatess

It’s the hr department’s job to compile this information and ensure it gets to the person responsible for payroll. Salary increases and sick leave are just some of the possible reasons. You must complete all five pages. Click the get form key to open the document and move to editing. Direct deposit waiver request form.

Salary Increases And Sick Leave Are Just Some Of The Possible Reasons.

Employers correcting an underpayment must use the corresponding x form using the adjustment process. Switch on the wizard mode on the top toolbar to have additional recommendations. April, may, june read the separate instructions before completing this form. This article will provide you all that you need to know about payroll adjustment forms, plus samples that you can download for free.

Fill Out Each Fillable Area.

You must complete all five pages. Web how to fill out and sign estart adjustment form online? Amounts owed must be paid by the receipt of the x form. Direct deposit waiver request form.

Hit The Get Form Option To Start Editing.

Web payroll adjustment forms are used to make adjustments in salaries by increasing or decreasing an employee's gross pay. Web 5 min read having to make changes to employees’ payslips from month to month isn’t unusual in business today. Web download payroll change form. Document and authorize payroll changes and reasons for the adjustments with this form.

Click The Get Form Key To Open The Document And Move To Editing.

Fill in all of the requested fields (they are marked in. Iforms access is based upon employees' positions and it accessed by visiting duke@work. Type or print within the boxes. It’s the hr department’s job to compile this information and ensure it gets to the person responsible for payroll.