Payroll Deduction Form Pdf

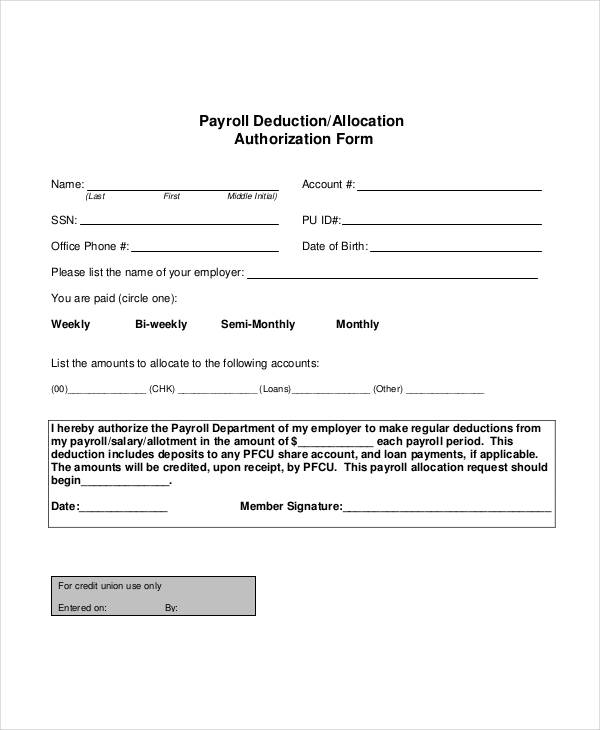

Payroll Deduction Form Pdf - Web i understand and agree that any amount that is due and owing at the time of my termination, regardless of whether my termination was voluntary or not, will be deducted from my last paycheck or any other amounts that may be owed to me. This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Web payroll deduction authorization employee name employee id number ( last name ) ( first name ) ( middle initial ) ssn date of birth account number work phone personal phone employer name pay frequency ( x ) list amounts to allocate to the following accounts: Web schedule b (form 941), employer's record of federal tax liability schedule d (form 941), report of discrepancies caused by acquisitions, statutory mergers, or consolidations schedule r (form 941), allocation schedule for aggregate form 941 filers form 8974, qualified small business payroll tax credit for increasing research activities Your employer’s name and address your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address. It is useful for employees to keep track of what their paycheque is being reduced by. Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2021 tax return and want to reduce your withholding to account for these deductions. Web fillable and printable payroll deduction form 2023. This includes both itemized deductions and other deductions such as for student loan interest and iras. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here.

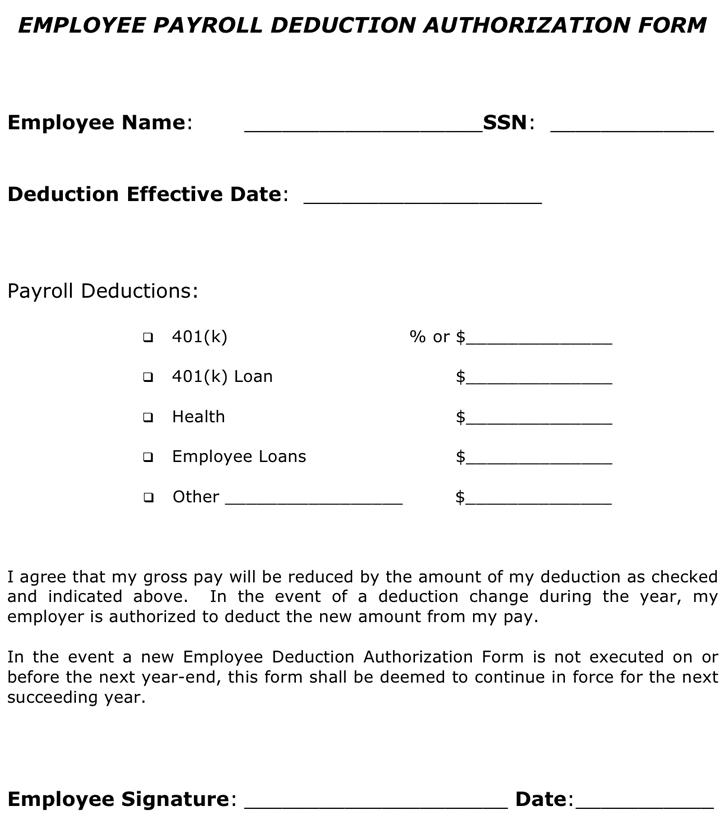

(if you are in the hr department, you might want to look at some templates for effective that do their job.) payroll deduction authorization form. Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2021 tax return and want to reduce your withholding to account for these deductions. You can edit the fine print to match your policies and legal requirements; This includes both itemized deductions and other deductions such as for student loan interest and iras. Your employer’s name and address your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address. Fill, sign and download payroll deduction form online on handypdf.com Web schedule b (form 941), employer's record of federal tax liability schedule d (form 941), report of discrepancies caused by acquisitions, statutory mergers, or consolidations schedule r (form 941), allocation schedule for aggregate form 941 filers form 8974, qualified small business payroll tax credit for increasing research activities Web i understand and agree that any amount that is due and owing at the time of my termination, regardless of whether my termination was voluntary or not, will be deducted from my last paycheck or any other amounts that may be owed to me. This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. 4(a) $ 4(b) $ 4(c) $

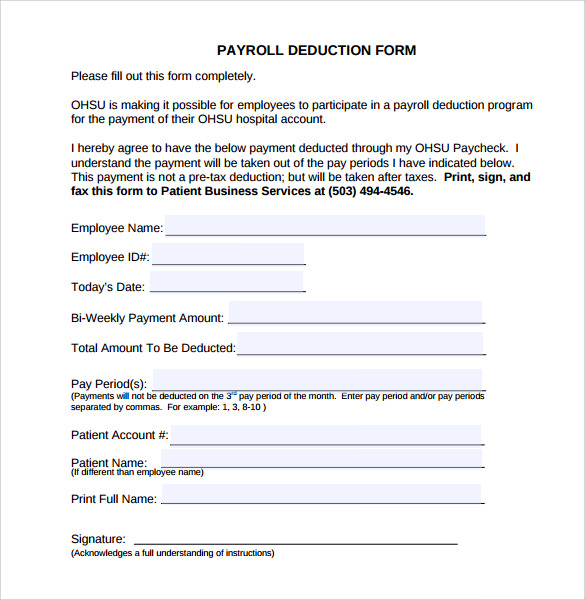

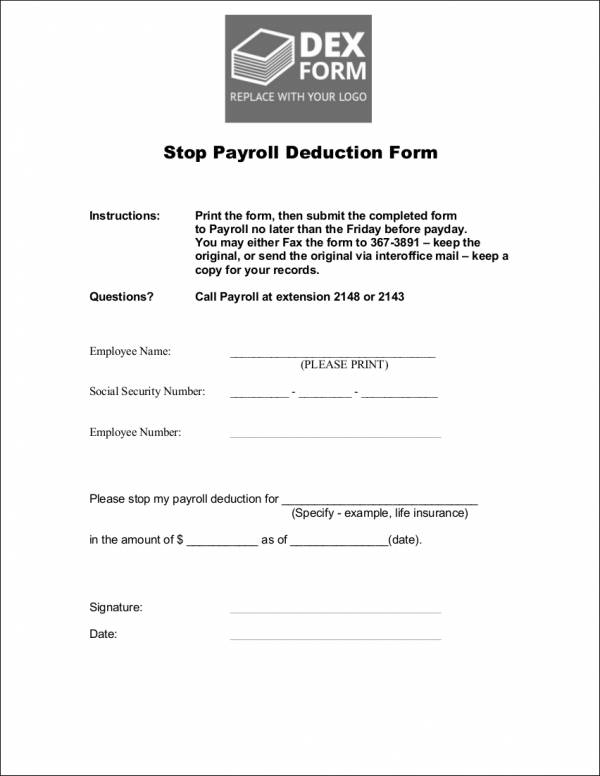

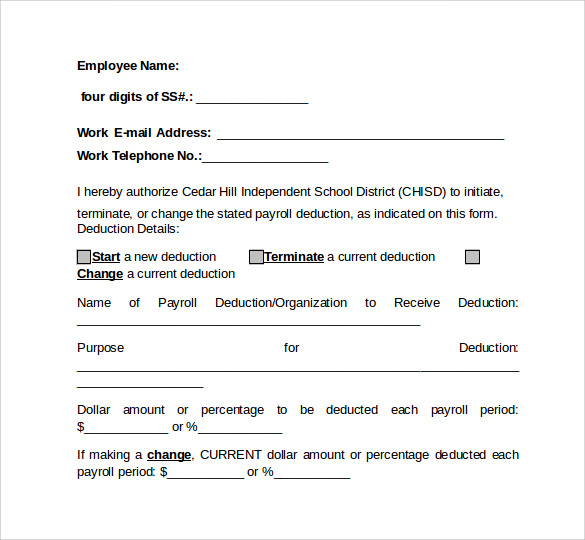

(if you are in the hr department, you might want to look at some templates for effective that do their job.) payroll deduction authorization form. Fill, sign and download payroll deduction form online on handypdf.com Your employer’s name and address your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address. Enter any additional tax you want withheld each pay period. Web a payroll deduction form is a document that contains a list of items that are to be deducted from a paycheque. 4(a) $ 4(b) $ 4(c) $ Thanks to this form, you can easily control. You can edit the fine print to match your policies and legal requirements; This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Web schedule b (form 941), employer's record of federal tax liability schedule d (form 941), report of discrepancies caused by acquisitions, statutory mergers, or consolidations schedule r (form 941), allocation schedule for aggregate form 941 filers form 8974, qualified small business payroll tax credit for increasing research activities

Payroll Deduction Agreement Template PDF Template

This includes both itemized deductions and other deductions such as for student loan interest and iras. Fill, sign and download payroll deduction form online on handypdf.com 4(a) $ 4(b) $ 4(c) $ Web fillable and printable payroll deduction form 2023. This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law.

FREE 9+ Sample Payroll Deduction Forms in PDF MS Word

Web a payroll deduction form is a document that contains a list of items that are to be deducted from a paycheque. Thanks to this form, you can easily control. Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2021 tax return.

Payroll Deduction Form Template PDF Template

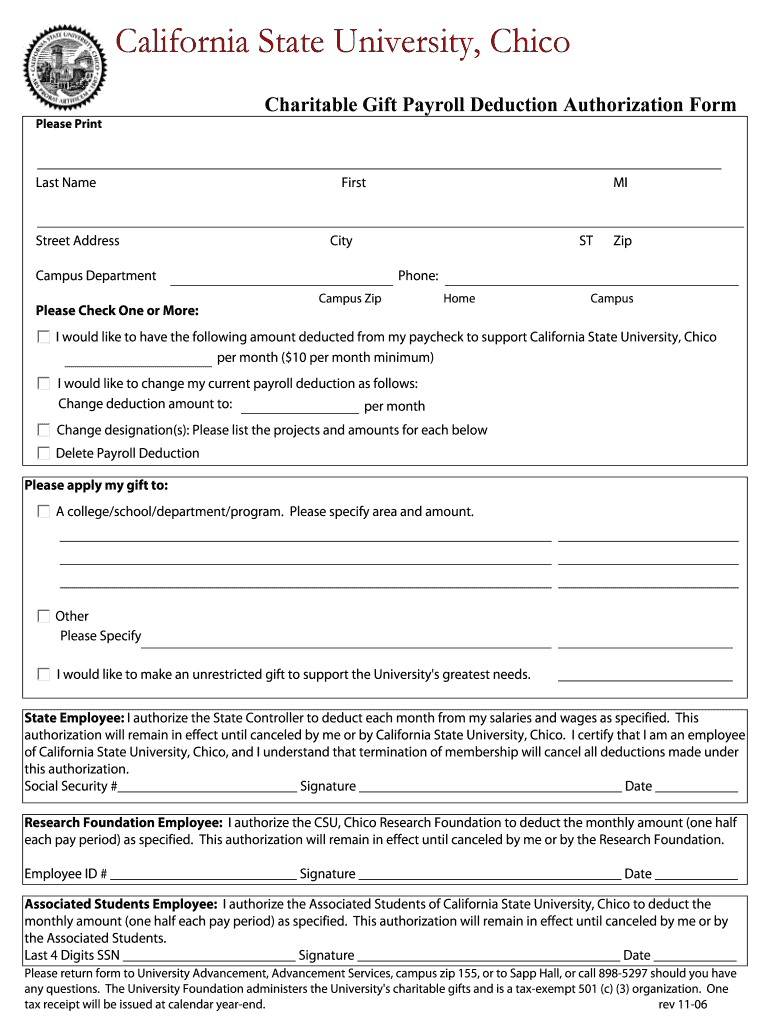

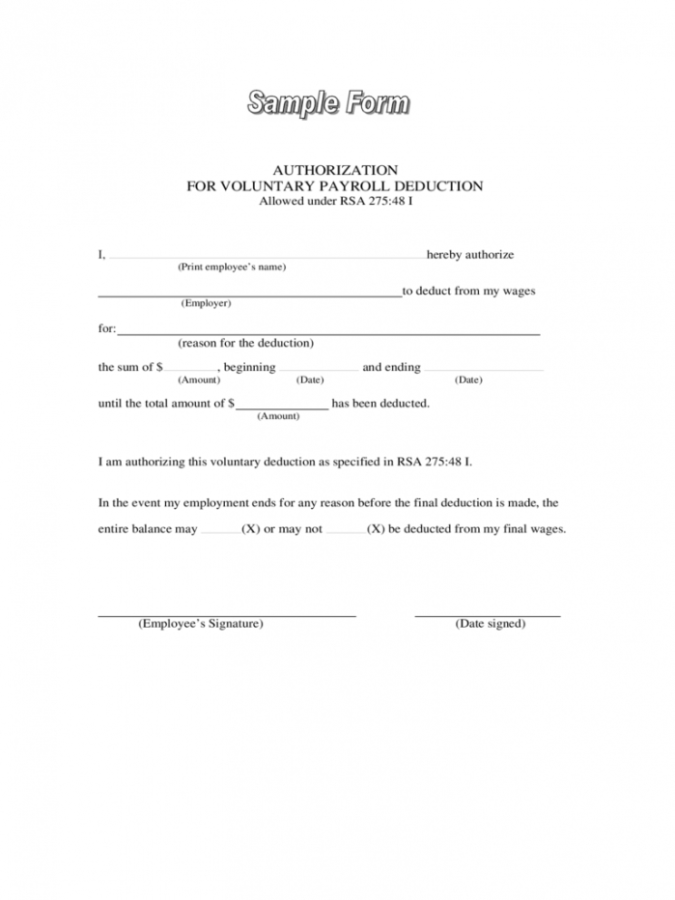

Web this payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Your employer’s name and address your name(s) (plus spouse’s name if the.

Payroll Deduction Authorization Form Template Collection

Your employer’s name and address your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address. This includes both itemized deductions and other deductions such as for student loan interest and iras. Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the.

FREE 31+ Payroll Samples & Templates in MS Word MS Excel Pages

4(a) $ 4(b) $ 4(c) $ Web schedule b (form 941), employer's record of federal tax liability schedule d (form 941), report of discrepancies caused by acquisitions, statutory mergers, or consolidations schedule r (form 941), allocation schedule for aggregate form 941 filers form 8974, qualified small business payroll tax credit for increasing research activities You can edit the fine print.

FREE 14+ Sample Payrolle Deduction Forms in PDF Excel Word

4(a) $ 4(b) $ 4(c) $ Web i understand and agree that any amount that is due and owing at the time of my termination, regardless of whether my termination was voluntary or not, will be deducted from my last paycheck or any other amounts that may be owed to me. Web enter in this step the amount from the.

Payroll Deduction Authorization Form Template charlotte clergy coalition

Thanks to this form, you can easily control. Employees then provide signatures to authorize the deductions. Web i understand and agree that any amount that is due and owing at the time of my termination, regardless of whether my termination was voluntary or not, will be deducted from my last paycheck or any other amounts that may be owed to.

FREE 9+ Sample Payroll Deduction Forms in PDF MS Word

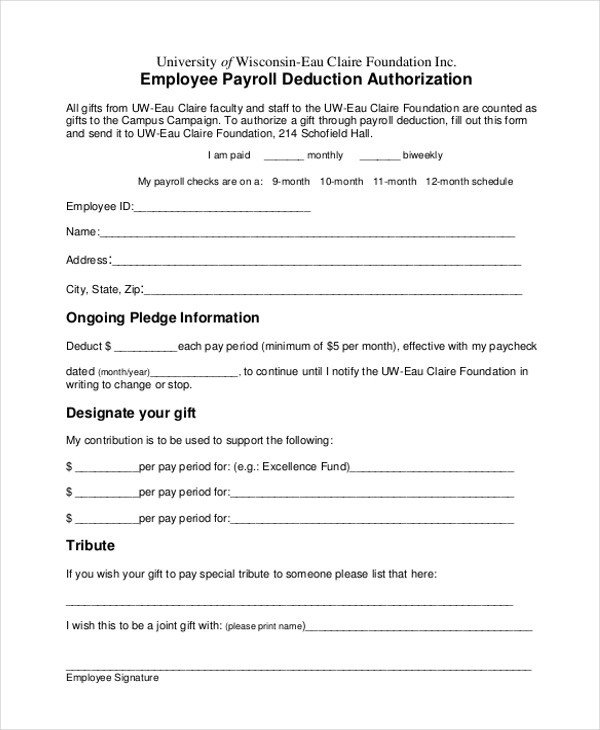

Web payroll deduction authorization employee name employee id number ( last name ) ( first name ) ( middle initial ) ssn date of birth account number work phone personal phone employer name pay frequency ( x ) list amounts to allocate to the following accounts: You can edit the fine print to match your policies and legal requirements; Web.

Payroll Deduction Form PDF Fill Out and Sign Printable PDF Template

Web a payroll deduction form is a document that contains a list of items that are to be deducted from a paycheque. Your employer’s name and address your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address. 4(a) $ 4(b) $ 4(c) $ You can edit the fine print to match your policies.

Payroll Deduction Form 2 Free Templates In Pdf Word Employee Payroll

It is useful for employees to keep track of what their paycheque is being reduced by. Web payroll deduction authorization employee name employee id number ( last name ) ( first name ) ( middle initial ) ssn date of birth account number work phone personal phone employer name pay frequency ( x ) list amounts to allocate to the.

Web Schedule B (Form 941), Employer's Record Of Federal Tax Liability Schedule D (Form 941), Report Of Discrepancies Caused By Acquisitions, Statutory Mergers, Or Consolidations Schedule R (Form 941), Allocation Schedule For Aggregate Form 941 Filers Form 8974, Qualified Small Business Payroll Tax Credit For Increasing Research Activities

Web fillable and printable payroll deduction form 2023. Employees then provide signatures to authorize the deductions. 4(a) $ 4(b) $ 4(c) $ This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law.

This Includes Both Itemized Deductions And Other Deductions Such As For Student Loan Interest And Iras.

Fill, sign and download payroll deduction form online on handypdf.com Web a payroll deduction form is a document that contains a list of items that are to be deducted from a paycheque. (if you are in the hr department, you might want to look at some templates for effective that do their job.) payroll deduction authorization form. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here.

You Can Edit The Fine Print To Match Your Policies And Legal Requirements;

It is useful for employees to keep track of what their paycheque is being reduced by. Web i understand and agree that any amount that is due and owing at the time of my termination, regardless of whether my termination was voluntary or not, will be deducted from my last paycheck or any other amounts that may be owed to me. Enter any additional tax you want withheld each pay period. Web payroll deduction authorization employee name employee id number ( last name ) ( first name ) ( middle initial ) ssn date of birth account number work phone personal phone employer name pay frequency ( x ) list amounts to allocate to the following accounts:

Thanks To This Form, You Can Easily Control.

Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2021 tax return and want to reduce your withholding to account for these deductions. Web this payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. Your employer’s name and address your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address.