Penalty For Late Filing Of Form 5500

Penalty For Late Filing Of Form 5500 - Generally the dfvcp penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501 (c) (3) plans. Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per plan. The dol penalty for late filing can run up. But following the correct procedures and requirements can result in significantly reduced. A penalty for the late or incomplete filing of this return/report will be assessed unless reasonable cause is established. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Web the secure act, passed in 2019, multiplied the irs late filing penalty by 10, amounting to $250 per day with a maximum penalty of $150,000 per plan year. The dol penalty for late filing. That means that, for a calendar plan year, the due date would. Under penalties of perjury and.

What is the irs penalty relief. But following the correct procedures and requirements can result in significantly reduced. That means that, for a calendar plan year, the due date would. Web 4 rows the irs penalties for late filing are $250 per day (up to a maximum of $150,000 per plan year). Web whatever special extension of filing form 5500 granted by the irs will also be automatically permitted by the dol and pbgc. Web the secure act, passed in 2019, multiplied the irs late filing penalty by 10, amounting to $250 per day with a maximum penalty of $150,000 per plan year. Web keep in mind that the department of labor has the authority to impose a $2,233 penalty per day for failure or refusal to file a form 5500. Effective for returns due after december 31st, 2019, the secure act increased the. Under penalties of perjury and. If you are late in filing, you may apply.

Generally the dfvcp penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501 (c) (3) plans. What is the irs penalty relief. That means that, for a calendar plan year, the due date would. Effective for returns due after december 31st, 2019, the secure act increased the. Under penalties of perjury and. Web 4 rows the irs penalties for late filing are $250 per day (up to a maximum of $150,000 per plan year). Web keep in mind that the department of labor has the authority to impose a $2,233 penalty per day for failure or refusal to file a form 5500. Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per plan. Web a form 5500 is typically due seven months following the end of the plan year, without extension. The dol penalty for late filing can run up.

4,280 IRS Penalty Abated for LateFiled Form 990 David B. McRee, CPA

Web 4 rows the irs penalties for late filing are $250 per day (up to a maximum of $150,000 per plan year). The maximum penalty for failing to file form 5500 as adjusted in 2020 increased from $2,194 to $2,233 per day that the filing is late, starting on the. Web if your return was over 60 days late, the.

Penalty on Late Filing of Tax Return Section 234F GST Guntur

That means that, for a calendar plan year, the due date would. The dol penalty for late filing can run up. A penalty for the late or incomplete filing of this return/report will be assessed unless reasonable cause is established. Effective for returns due after december 31st, 2019, the secure act increased the. Web further, penalties for small plans (generally.

Prepare Form 990EZ

Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. The dol penalty for late filing. The maximum penalty for failing to file form 5500 as adjusted in 2020 increased from $2,194 to $2,233 per day.

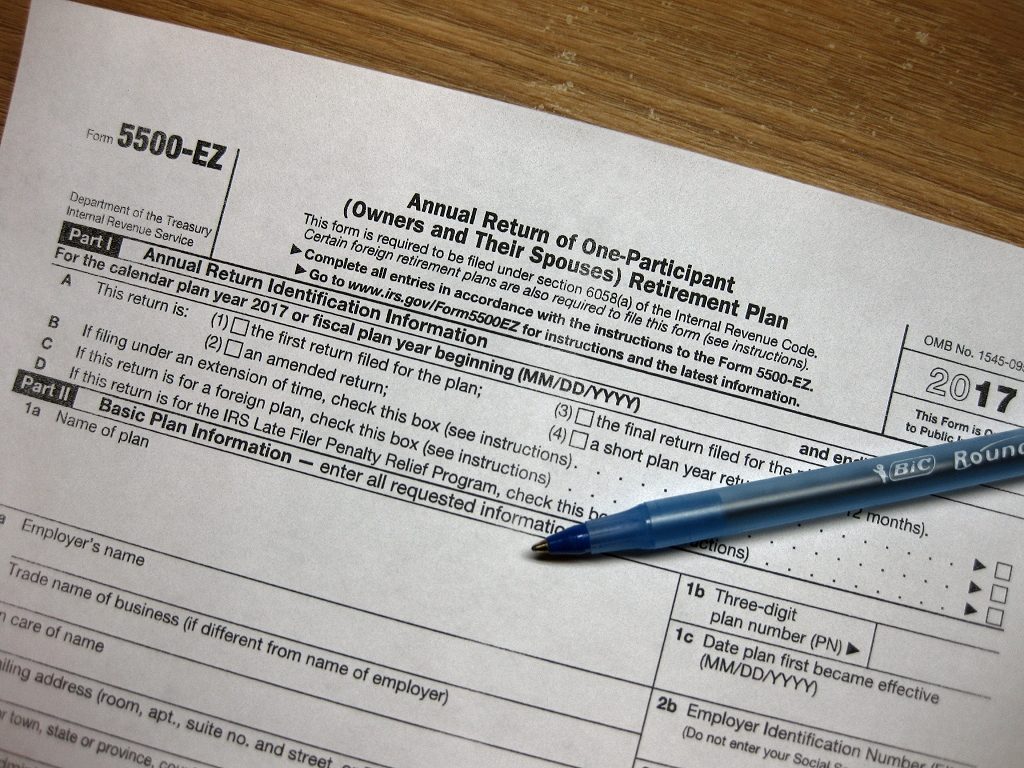

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

Under the secure act, penalties have increased significantly. If you are late in filing, you may apply. Under penalties of perjury and. Web how to find the mistake: But following the correct procedures and requirements can result in significantly reduced.

Late Filing Penalty Malaysia Avoid Penalties

What is the irs penalty relief. The maximum penalty for failing to file form 5500 as adjusted in 2020 increased from $2,194 to $2,233 per day that the filing is late, starting on the. Under the secure act, penalties have increased significantly. The dol penalty for late filing can run up. Under penalties of perjury and.

Penalty Section 234F for Late Tax Return Filers in AY 202021

Web how to find the mistake: Web further, penalties for small plans (generally under 100 participants) are capped at $750 for a single late form 5500 and $1,500 for multiple years per plan. Web 4 rows the irs penalties for late filing are $250 per day (up to a maximum of $150,000 per plan year). A penalty for the late.

DOL 2022 Penalty Fees Wrangle 5500 ERISA Reporting and Disclosure

That means that, for a calendar plan year, the due date would. Under penalties of perjury and. Web whatever special extension of filing form 5500 granted by the irs will also be automatically permitted by the dol and pbgc. Web the secure act, passed in 2019, multiplied the irs late filing penalty by 10, amounting to $250 per day with.

Penalty for Late Filing Form 2290 Computer Tech Reviews

What is the irs penalty relief. Web the secure act, passed in 2019, multiplied the irs late filing penalty by 10, amounting to $250 per day with a maximum penalty of $150,000 per plan year. But following the correct procedures and requirements can result in significantly reduced. Web further, penalties for small plans (generally under 100 participants) are capped at.

DOL Tips on Filing Form 5500 PNC Insights

If you are late in filing, you may apply. The dol penalty for late filing can run up. Web how to find the mistake: Web a form 5500 is typically due seven months following the end of the plan year, without extension. A penalty for the late or incomplete filing of this return/report will be assessed unless reasonable cause is.

Letter To Waive Penalty Charge Request To Waive Penalty Letter

What is the irs penalty relief. The dol penalty for late filing can run up. Generally the dfvcp penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501 (c) (3) plans. Web the secure act, passed in 2019, multiplied the irs late filing penalty by 10, amounting to $250 per day with.

The Maximum Penalty For Failing To File Form 5500 As Adjusted In 2020 Increased From $2,194 To $2,233 Per Day That The Filing Is Late, Starting On The.

If you are late in filing, you may apply. That means that, for a calendar plan year, the due date would. The dol penalty for late filing. What is the irs penalty relief.

Web Keep In Mind That The Department Of Labor Has The Authority To Impose A $2,233 Penalty Per Day For Failure Or Refusal To File A Form 5500.

Generally the dfvcp penalty is capped at $1,500 for most small plans, $4,000 for large plans, and $750 for small 501 (c) (3) plans. Web how to find the mistake: Web a form 5500 is typically due seven months following the end of the plan year, without extension. Effective for returns due after december 31st, 2019, the secure act increased the.

A Penalty For The Late Or Incomplete Filing Of This Return/Report Will Be Assessed Unless Reasonable Cause Is Established.

Under penalties of perjury and. But following the correct procedures and requirements can result in significantly reduced. Web whatever special extension of filing form 5500 granted by the irs will also be automatically permitted by the dol and pbgc. Under the secure act, penalties have increased significantly.

Web Further, Penalties For Small Plans (Generally Under 100 Participants) Are Capped At $750 For A Single Late Form 5500 And $1,500 For Multiple Years Per Plan.

The dol penalty for late filing can run up. Web 4 rows the irs penalties for late filing are $250 per day (up to a maximum of $150,000 per plan year). Web the secure act, passed in 2019, multiplied the irs late filing penalty by 10, amounting to $250 per day with a maximum penalty of $150,000 per plan year. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax.