Power Of Attorney Form Illinois For Finances

Power Of Attorney Form Illinois For Finances - Updated on june 12th, 2023. Existing poa taxpayer’s name (person or business) fein, ssn, or illinois account id spouse’s name (if joint income tax return) spouse’s ssn (if joint income tax return) Web get an illinois power of attorney in minutes. This document could have serious financial implications if, in fact, the agent doesn’t have the principal’s best interest in mind. Web the illinois durable financial power of attorney form is a document that is designed to allow a principal to grant powers to an agent/attorney in fact, to handle their financial affairs. Web updated january 09, 2023. An illinois general power of attorney permits an individual to grant personal financial authority to another person so that person can act in their place. Depending on the type of form, it will be required to complete and sign in accordance with state law. Web illinois durable (financial) power of attorney form. General (financial) power of attorney.

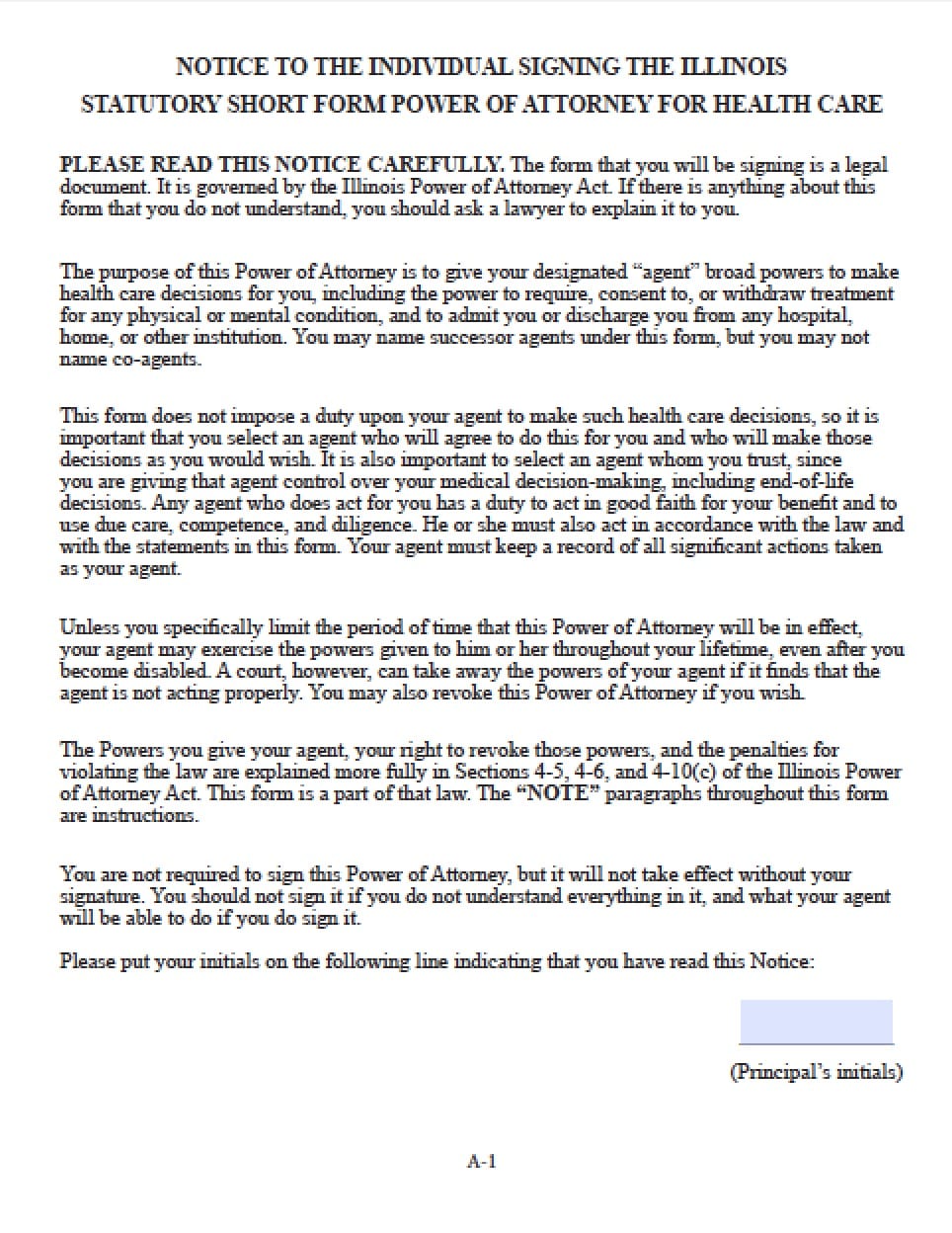

Updated on june 12th, 2023. Updated on may 5th, 2023. Web the purpose of this power of attorney is to give your designated “agent” broad powers to handle your financial affairs, which may include the power to pledge, sell, or dispose of any of your real or personal property, even without your consent or any advance notice to you. Web illinois durable (financial) power of attorney form. Gives broad financial powers to an agent but ends once the principal becomes incapacitated. General (financial) power of attorney. Updated on june 12th, 2023. This document could have serious financial implications if, in fact, the agent doesn’t have the principal’s best interest in mind. Web a power of attorney (poa) for property is a form that lets you give someone else the ability to: An illinois power of attorney form allows a person to choose someone else to make decisions on their behalf for medical, financial, parental, or other related purposes.

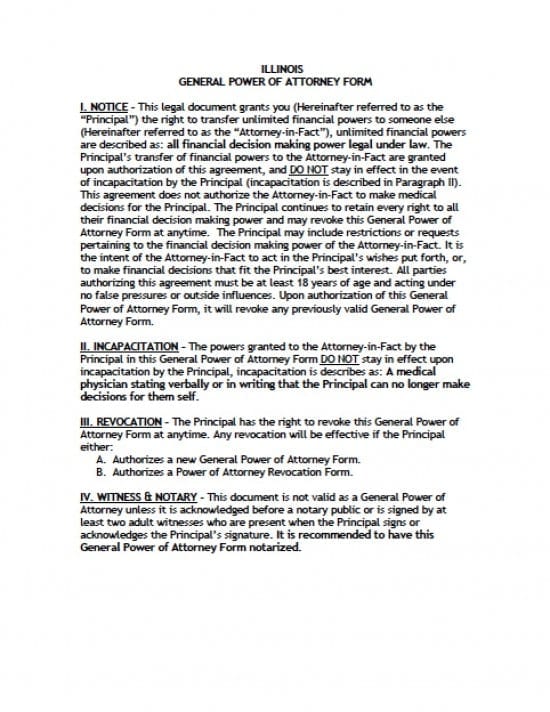

Web power of attorney information. The illinois durable (financial) power of attorney is initiated by individuals who want to deliver powers to another person for the sake of accomplishing tasks in their name. An illinois durable power of attorney form enables the principal, or the individual creating the form, to assign an agent to oversee their finances and make decisions on their behalf. Existing poa taxpayer’s name (person or business) fein, ssn, or illinois account id spouse’s name (if joint income tax return) spouse’s ssn (if joint income tax return) Web the illinois durable financial power of attorney form is a document that is designed to allow a principal to grant powers to an agent/attorney in fact, to handle their financial affairs. Web updated july 27, 2023. General (financial) power of attorney. Choose someone to act in financial matters on your behalf by executing a power of attorney (poa). An illinois power of attorney is a legal document that allows an illinois resident to grant another person (also known as “the agent”) power to act on his or her behalf in financial or healthcare matters. Authorize a general power of attorney form and act for another person’s financial interest by completing this form and signing in front of at least one witness but a notary public is highly recommended.

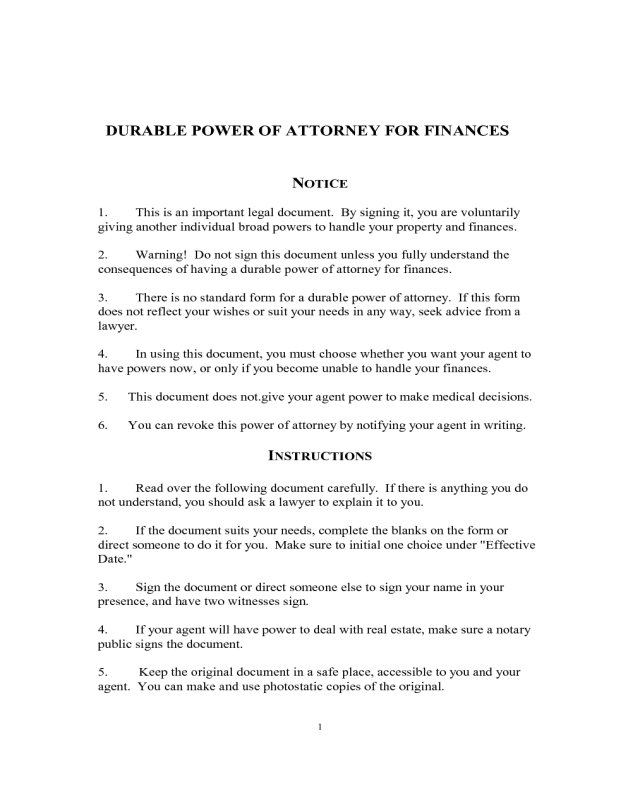

2021 Durable Power of Attorney Form Fillable, Printable PDF & Forms

The illinois durable (financial) power of attorney is initiated by individuals who want to deliver powers to another person for the sake of accomplishing tasks in their name. An illinois durable power of attorney form enables the principal, or the individual creating the form, to assign an agent to oversee their finances and make decisions on their behalf. Web illinois.

44+ Financial Power Of Attorney Illinois Images picture

Web the purpose of this power of attorney is to give your designated “agent” broad powers to handle your financial affairs, which may include the power to pledge, sell, or dispose of any of your real or personal property, even without your consent or any advance notice to you. The illinois durable (financial) power of attorney is initiated by individuals.

Download Florida Durable Power of Attorney Form For Finances, Property

You will have the unrestricted power to handle any type of financial decision on. Web illinois durable (financial) power of attorney form. An illinois power of attorney is a legal document that allows an illinois resident to grant another person (also known as “the agent”) power to act on his or her behalf in financial or healthcare matters. Web a.

Free Power of Attorney Forms PDF WORD

Create the poa using a statutory form, software, or attorney illinois offers a statutory form (a form drafted by the state legislature) with blanks that you can fill out to create your poa. An illinois general power of attorney permits an individual to grant personal financial authority to another person so that person can act in their place. Existing poa.

Kansas Financial Power of Attorney Form Free Printable Legal Forms

General (financial) power of attorney. Findlaw’s guided process means you can complete your own poa quickly and easily. Web power of attorney for property. A power of attorney for property makes sure that your financial decisions are handled properly if you can't handle them on your own. Updated on june 12th, 2023.

Illinois Revocation Power of Attorney Form Power of Attorney Power

An illinois power of attorney form allows a person to choose someone else to make decisions on their behalf for medical, financial, parental, or other related purposes. Web free illinois power of attorney forms and templates home> illinois power of attorney forms and templates if you need someone else to manage your financial or health care decisions, you can execute.

Free Maine Durable (Financial) Power of Attorney Form PDF WORD

Handle your money, and make financial decisions for you. Web illinois general (financial) power of attorney. Authorize a general power of attorney form and act for another person’s financial interest by completing this form and signing in front of at least one witness but a notary public is highly recommended. Web free illinois power of attorney forms and templates home>.

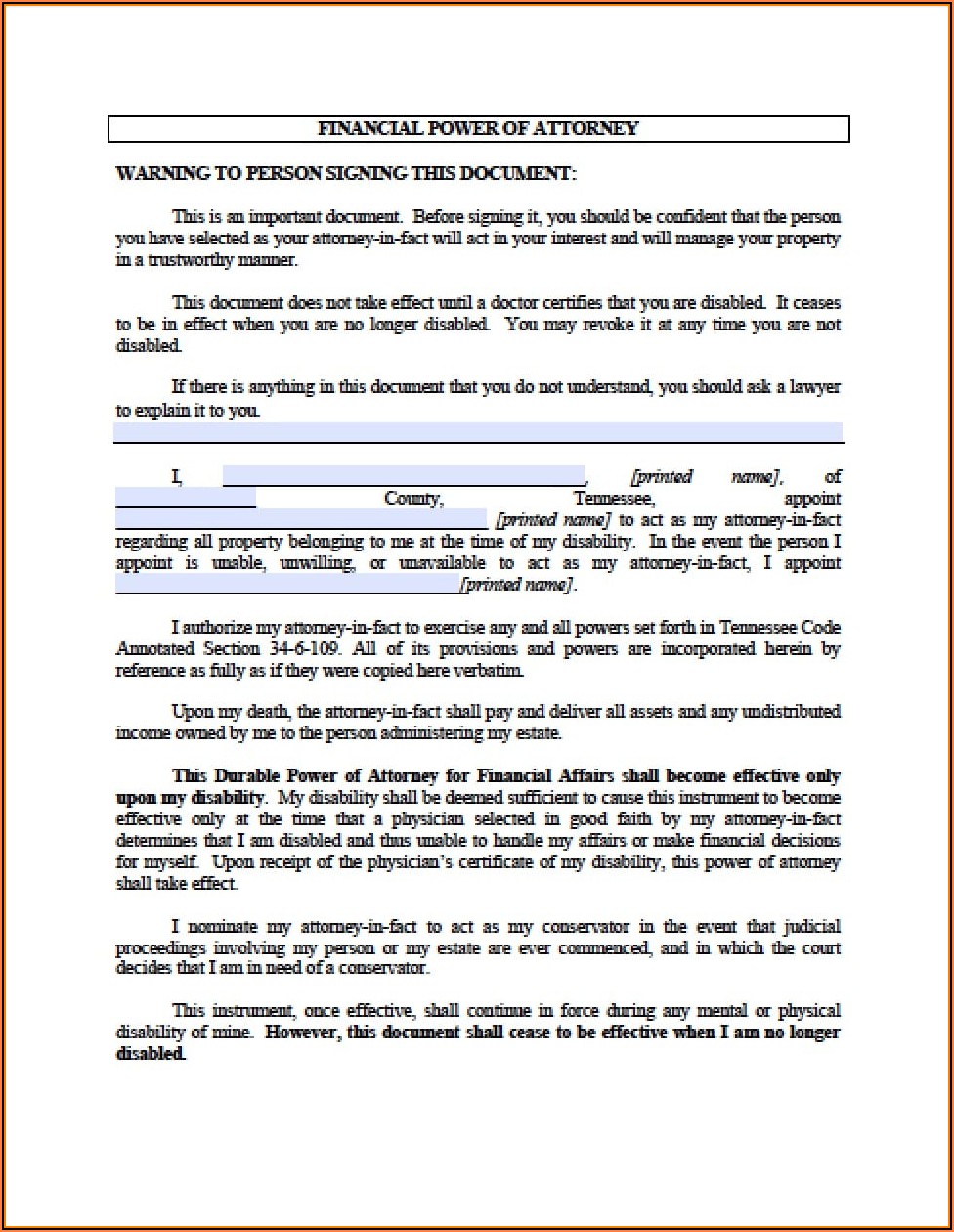

Tennessee Durable Power Of Attorney For Finances Form Form Resume

Provides broad legal powers to an agent and continues if the principal becomes incapacitated. The term “durable” refers to the form remaining valid even if the person who handed over power becomes incapacitated or mentally not able to speak for. It’s also the name of the document that grants this authority. Web illinois general (financial) power of attorney. Web durable.

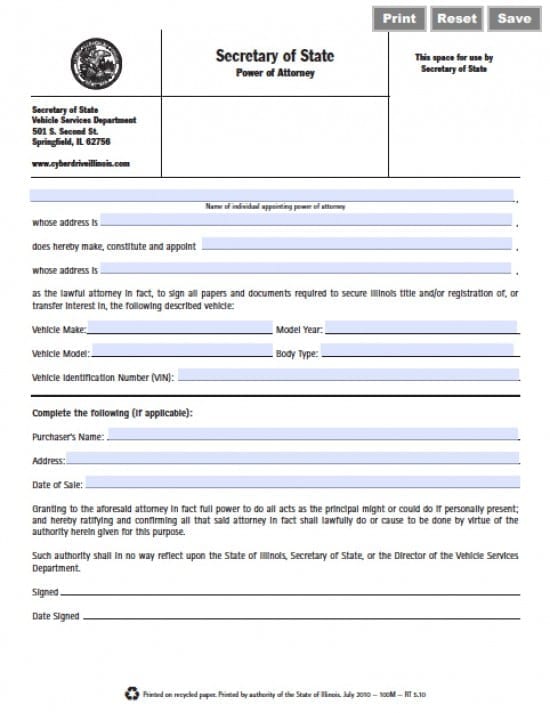

Illinois Vehicle Power of Attorney Form Power of Attorney Power of

Web the eight illinois power of attorney forms include: Durable (statutory) power of attorney. An illinois power of attorney is a legal document that allows an illinois resident to grant another person (also known as “the agent”) power to act on his or her behalf in financial or healthcare matters. The term “durable” refers to the form remaining valid even.

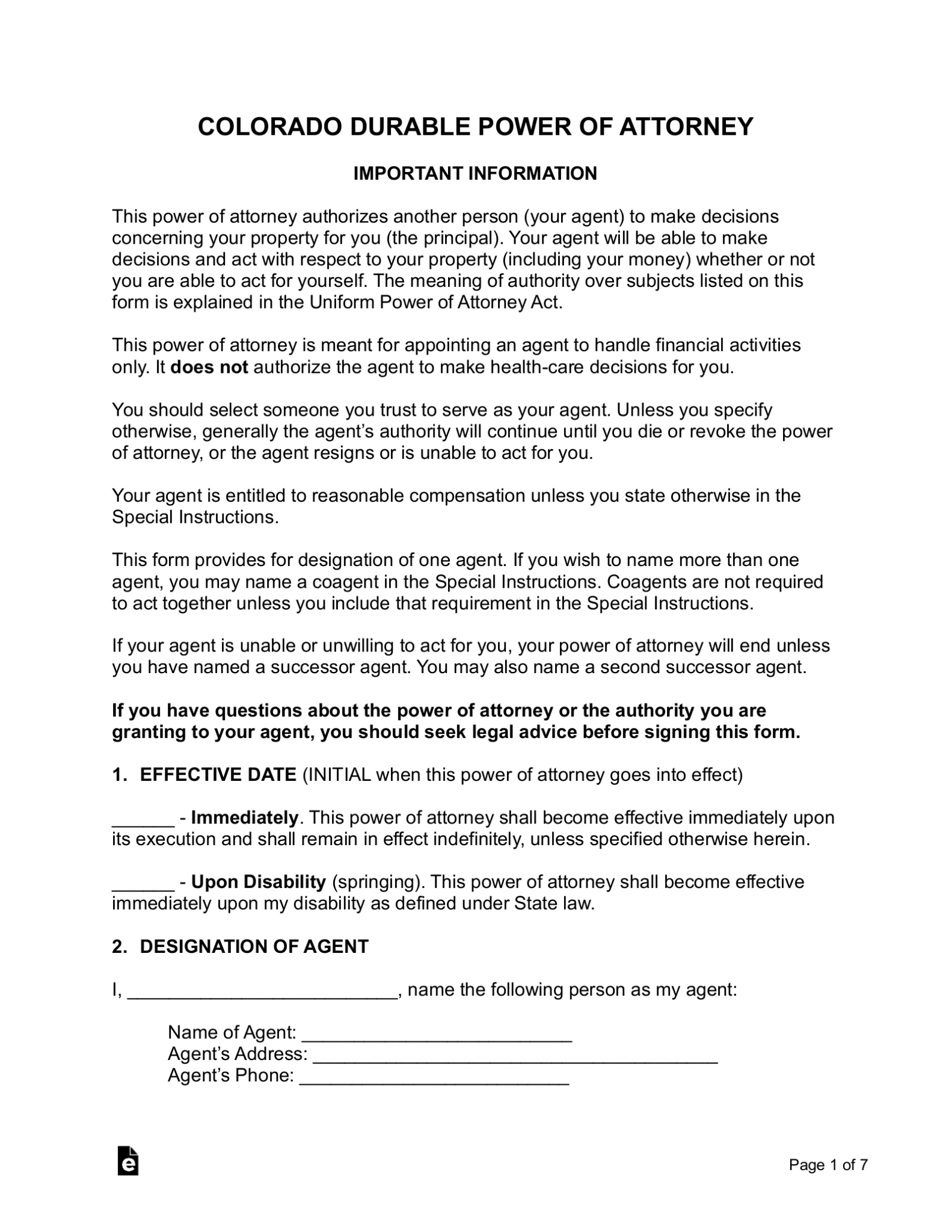

Free Colorado Power of Attorney Forms PDF Word eForms

Web updated january 09, 2023. Web power of attorney for property. Updated on june 12th, 2023. An illinois power of attorney form allows a person to choose someone else to make decisions on their behalf for medical, financial, parental, or other related purposes. Web a power of attorney (poa) for property is a form that lets you give someone else.

Web Illinois General (Financial) Power Of Attorney.

Web updated january 9, 2023 power of attorney is the legal authority to make decisions for another person. Web durable (financial) power of attorney general (financial) power of attorney form limited power of attorney form advance directive (medical poa & living will) minor child power of attorney form real estate power of attorney form revocation of power of attorney form. Web the illinois durable financial power of attorney form is a document that is designed to allow a principal to grant powers to an agent/attorney in fact, to handle their financial affairs. Mytax illinois — upload it as a single pdf file.

This Document Could Have Serious Financial Implications If, In Fact, The Agent Doesn’t Have The Principal’s Best Interest In Mind.

Provides broad legal powers to an agent and continues if the principal becomes incapacitated. An illinois general power of attorney permits an individual to grant personal financial authority to another person so that person can act in their place. Web free illinois power of attorney forms and templates home> illinois power of attorney forms and templates if you need someone else to manage your financial or health care decisions, you can execute a power of attorney document to authorize an agent to make these decisions for you. Web a power of attorney (poa) for property is a form that lets you give someone else the ability to:

Authorize A General Power Of Attorney Form And Act For Another Person’s Financial Interest By Completing This Form And Signing In Front Of At Least One Witness But A Notary Public Is Highly Recommended.

Updated on may 5th, 2023. Create the poa using a statutory form, software, or attorney illinois offers a statutory form (a form drafted by the state legislature) with blanks that you can fill out to create your poa. Web power of attorney for property. Durable (statutory) power of attorney.

Updated On June 12Th, 2023.

Depending on the type of form, it will be required to complete and sign in accordance with state law. Existing poa taxpayer’s name (person or business) fein, ssn, or illinois account id spouse’s name (if joint income tax return) spouse’s ssn (if joint income tax return) The term “durable” refers to the form remaining valid even if the person who handed over power becomes incapacitated or mentally not able to speak for. Gives broad financial powers to an agent but ends once the principal becomes incapacitated.