Ppp Form 3508S

Ppp Form 3508S - Web you can apply for forgiveness of your first or second draw paycheck protection program (ppp) loan using this sba form 3508s only if the loan amount you received from your lender was $150,000 or less for an individual first or second draw ppp loan. Web sba form 3508ez if your ppp loan amount is more than $150,000 and you can check at least one of the two boxes below. Web ppp loan forgiveness calculation form. If you are not eligible to use this form, you must apply for forgiveness of your ppp loan using sba form 3508 01/31/2022 ppp loan forgiveness calculation form first draw ppp loan ☐ second draw ppp loan (check one) sba ppp loan number: If your loan amount is $150,000 or less, please use sba form 3508s. 12/31/2023 a borrower may use this form only if the borrower received a ppp loan of $50,000 or less. Prepare first understand covered period and eligible costs. Here’s what ppp borrowers need to know about this simplified forgiveness application. Employees at time of loan application:.

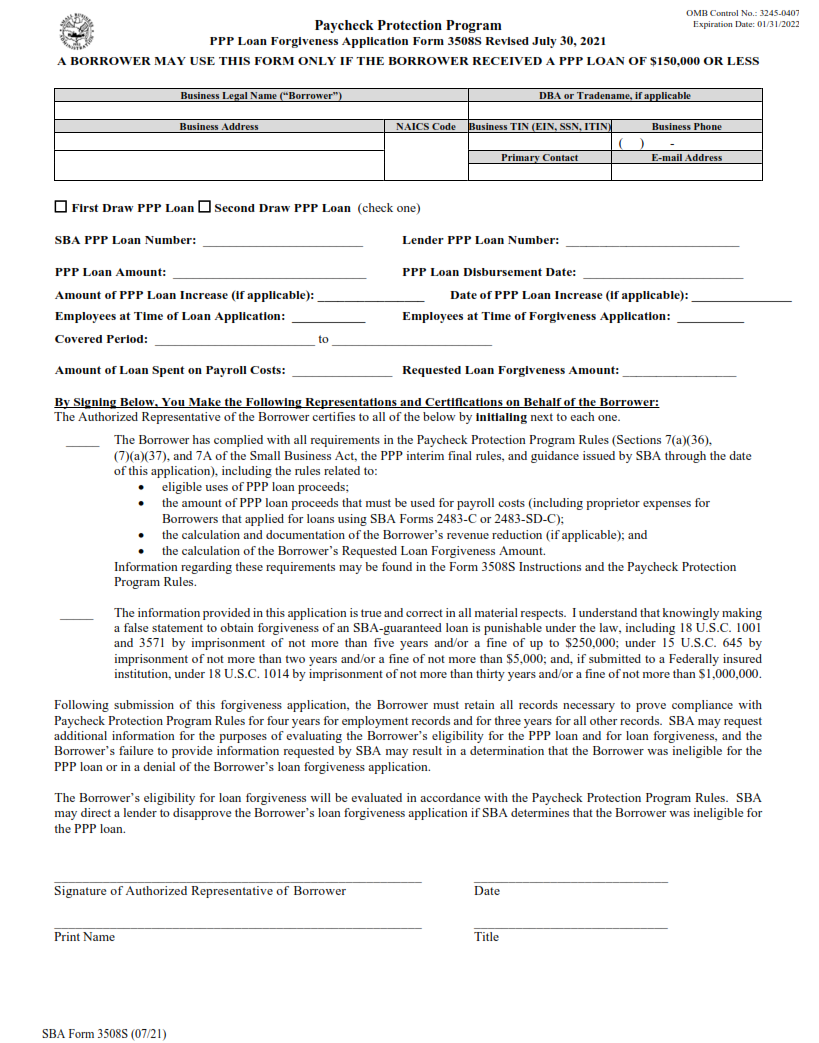

01/31/2022 ppp loan forgiveness calculation form first draw ppp loan ☐ second draw ppp loan (check one) sba ppp loan number: Web ppp loan forgiveness calculation form. Web you can apply for forgiveness of your first or second draw paycheck protection program (ppp) loan using this sba form 3508s only if the loan amount you received from your lender was $150,000 or less for an individual first or second draw ppp loan. If you are not eligible to use this form, you must apply for forgiveness of your ppp loan using sba form 3508 Consider using this form if your loan is $150,000 or less. Ppp loan di sbursement date: Web sba form 3508s. If your loan amount is $150,000 or less, please use sba form 3508s. Employees at time of loan application:. Do not submit this checklist with your sba form 3508ez.

Web protection program protection program loan forgiveness application form 3508 revised july 30, 2021 omb control no.: Review the ppp loan forgiveness application options. Each ppp loan must use a separate loan forgiveness application form. A borrower may use this form only if the borrower received a ppp loan of $150,000 or less. Consider using this form if your loan is $150,000 or less. You will find additional information in our faqs. Web ppp loan forgiveness calculation form. Web sba form 3508ez if your ppp loan amount is more than $150,000 and you can check at least one of the two boxes below. Do not submit this checklist with your sba form 3508ez. Web ppp loan forgiveness application form 3508s omb control no.

Ppp Loan Application Form 3508S Fillable A New PPP

The paycheck protection program (ppp) ended on may 31, 2021. Web you can apply for forgiveness of your first or second draw paycheck protection program (ppp) loan using this sba form 3508s only if the loan amount you received from your lender was $150,000 or less for an individual first or second draw ppp loan. Web ppp loan forgiveness calculation.

Is PPP Loan SBA Form 3508S For You? HM&M

Each ppp loan must use a separate loan forgiveness application form. Prepare first understand covered period and eligible costs. Lender ppp lo an number: 01/31/2022 ppp loan forgiveness calculation form first draw ppp loan ☐ second draw ppp loan (check one) sba ppp loan number: A borrower that, together with its affiliates, received ppp loans totaling $2 million or greater.

Kabbage (K Servicing) PPP Loan Application via Biz2X Form

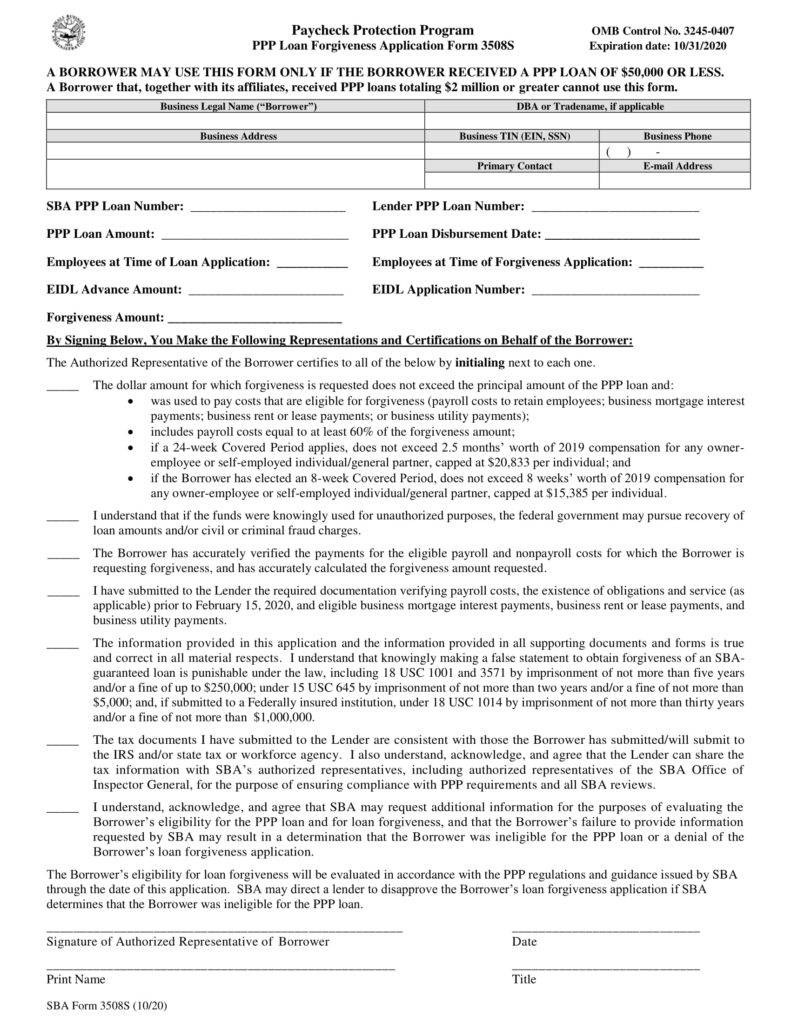

12/31/2023 a borrower may use this form only if the borrower received a ppp loan of $50,000 or less. Lender ppp lo an number: A borrower may use this form only if the borrower received a ppp loan of $150,000 or less. Web sba form 3508s only if the loan amount you received from your lender was $150,000 or less.

PPP Loan Form 3508s PPP Loan Form

Web protection program protection program loan forgiveness application form 3508 revised july 30, 2021 omb control no.: Web sba form 3508s. Each ppp loan must use a separate loan forgiveness application form. Consider using this form if your loan is $150,000 or less. Web you can apply for forgiveness of your first or second draw paycheck protection program (ppp) loan.

PPP Loan Application Form 3508 S.pdf PPP Loan

Web sba form 3508ez if your ppp loan amount is more than $150,000 and you can check at least one of the two boxes below. Here’s what ppp borrowers need to know about this simplified forgiveness application. Web sba form 3508s only if the loan amount you received from your lender was $150,000 or less for an individual first or.

SBA Form 3508s PPP 3508S Loan Application + Instructions

Web on january 19, 2021, the small business administration (sba) released an updated ppp loan forgiveness application form 3508s which requires fewer calculations and less documentation from borrowers. Ppp loan di sbursement date: Web ppp loan forgiveness calculation form. Do not submit this checklist with your sba form 3508ez. Web you (the borrower) can apply for forgiveness of your paycheck.

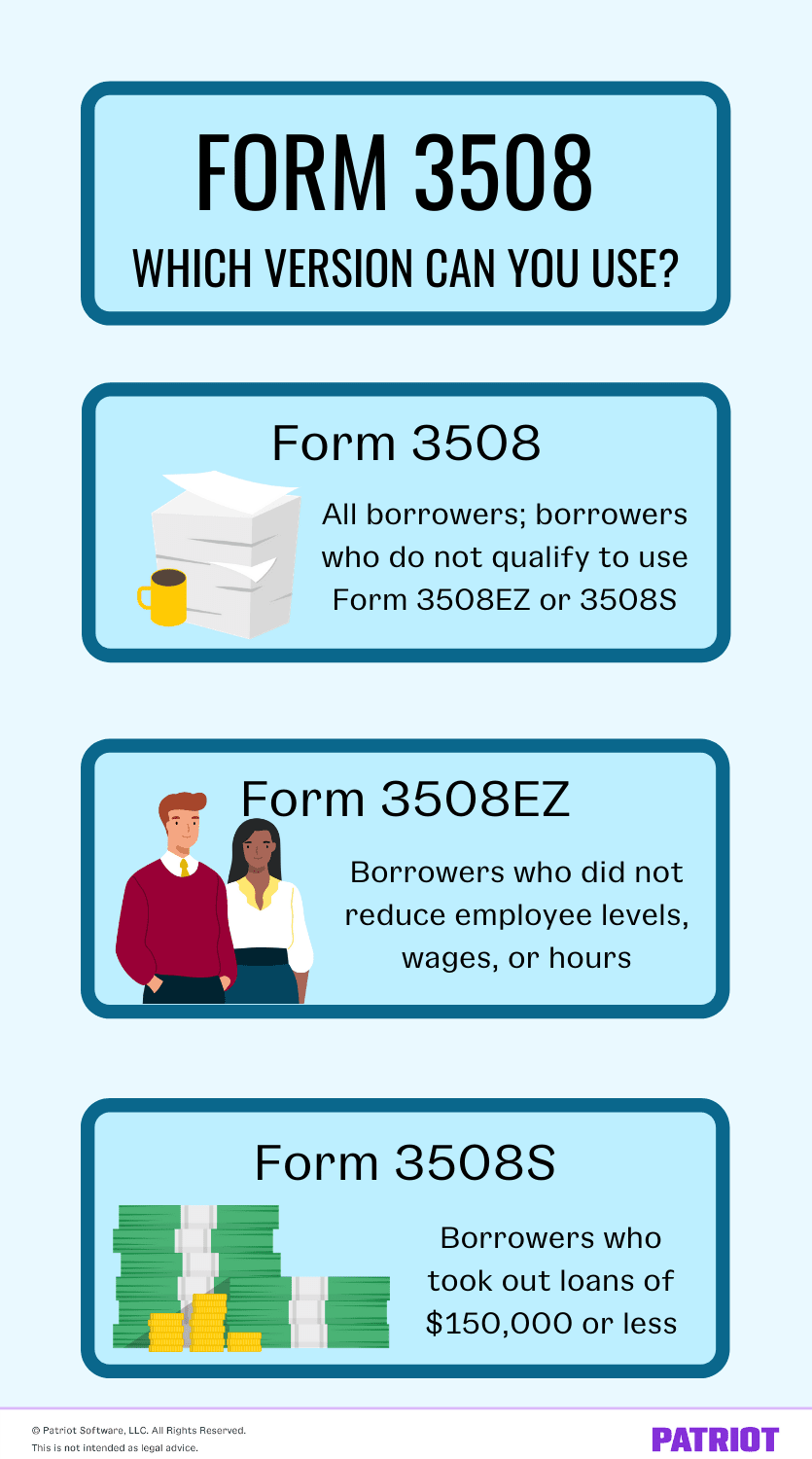

Form 3508 Should You Use 3508, 3508EZ, or 3508S?

Each ppp loan must use a separate loan forgiveness application form. Consider using this form if your loan is $150,000 or less. Web sba form 3508ez if your ppp loan amount is more than $150,000 and you can check at least one of the two boxes below. Prepare first understand covered period and eligible costs. Existing borrowers may be eligible.

SBA Simplifies PPP for Loans of 50,000 or Less Workest

Ppp loan di sbursement date: A borrower that, together with its affiliates, received ppp loans totaling $2 million or greater cannot use this form. If your loan amount is $150,000 or less, please use sba form 3508s. Web you can apply for forgiveness of your first or second draw paycheck protection program (ppp) loan using this sba form 3508s only.

SBA Form 3508S Download Printable PDF Or Fill Online Ppp Printable

Web ppp loan forgiveness calculation form. Here’s what ppp borrowers need to know about this simplified forgiveness application. 12/31/2023 a borrower may use this form only if the borrower received a ppp loan of $50,000 or less. Web sba form 3508s. If your loan amount is $150,000 or less, please use sba form 3508s.

SBA Releases New PPP Application Form 3508S

Web you can apply for forgiveness of your first or second draw paycheck protection program (ppp) loan using this sba form 3508s only if the loan amount you received from your lender was $150,000 or less for an individual first or second draw ppp loan. If you are not eligible to use this form, you must apply for forgiveness of.

01/31/2022 Ppp Loan Forgiveness Calculation Form First Draw Ppp Loan ☐ Second Draw Ppp Loan (Check One) Sba Ppp Loan Number:

A borrower that, together with its affiliates, received ppp loans totaling $2 million or greater cannot use this form. Existing borrowers may be eligible for ppp loan forgiveness. Each ppp loan must use a separate loan forgiveness application form. Review the ppp loan forgiveness application options.

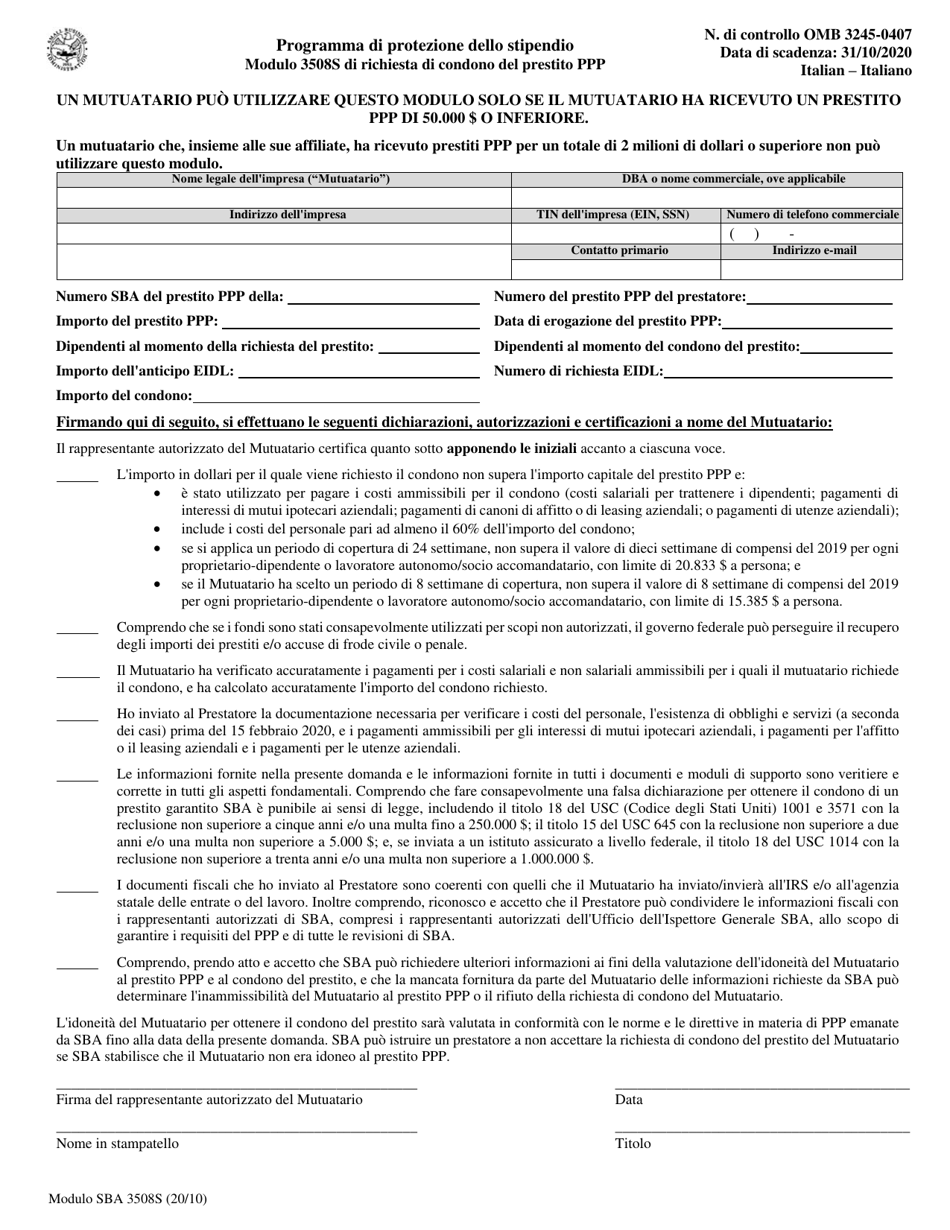

12/31/2023 A Borrower May Use This Form Only If The Borrower Received A Ppp Loan Of $50,000 Or Less.

Web you can apply for forgiveness of your first or second draw paycheck protection program (ppp) loan using this sba form 3508s only if the loan amount you received from your lender was $150,000 or less for an individual first or second draw ppp loan. Prepare first understand covered period and eligible costs. Web you (the borrower) can apply for forgiveness of your paycheck protection program (ppp) loan using this sba form 3508s only if the total ppp loan amount you received from your lender was $50,000 or less. If your loan amount is $150,000 or less, please use sba form 3508s.

A Borrower May Use This Form Only If The Borrower Received A Ppp Loan Of $150,000 Or Less.

Web ppp loan forgiveness calculation form. You will find additional information in our faqs. Web sba form 3508s only if the loan amount you received from your lender was $150,000 or less for an individual first or second draw ppp loan. Employees at time of loan application:.

Ppp Loan Di Sbursement Date:

Web ppp loan forgiveness application form 3508s omb control no. Web sba form 3508s. Web on january 19, 2021, the small business administration (sba) released an updated ppp loan forgiveness application form 3508s which requires fewer calculations and less documentation from borrowers. Consider using this form if your loan is $150,000 or less.