Promissory Notes Printable

Promissory Notes Printable - Web select a free printable promissory note in pdf format from the template list. This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate. _______________, with a mailing address of. Web download free printable promissory note templates that may be written in fillable adobe pdf (.pdf), ms word (.doc), and rich text format (.rtf). This standard promissory note (“note”) made on _______________, 20____ is by and between: _______________, with a mailing address of ______________________________, (“borrower”), and lender: Enter all the required information in the appropriate fields on the blank form. It is a legal document for a loan and becomes legally binding when signed by the borrower. Different types deal with different repayment structures and schedules. Promissory note templates & examples #1 #2 #3 #4 #5 #6 #7 #8 #9 #10 #11 #12 #13 #14 #15 #16 #17 #18 #19 #20

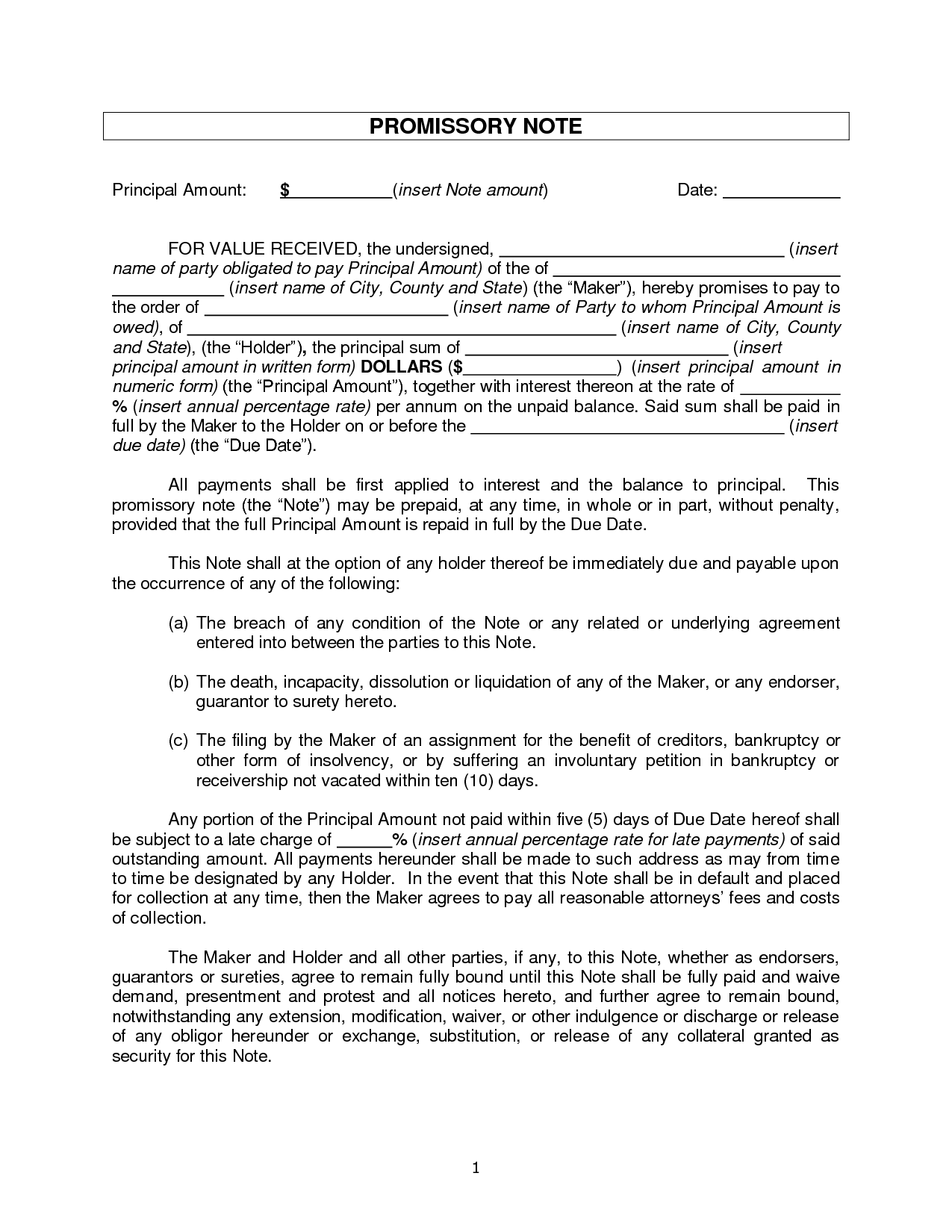

This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate. Different types deal with different repayment structures and schedules. Web select a free printable promissory note in pdf format from the template list. A promissory note is a legal document that sets out the details of a loan made between two people, a borrower and a lender. A promissory note is a written promise made by a borrower to a lender to repay a specified sum of money. The basic promissory note must include your and the borrower’s detailed personal information, the specified amount of the loan, and the signatures of the parties involved. Enter all the required information in the appropriate fields on the blank form. With a template, all you need to do is key in the party’s names, amount, date, and signature to make the form legitimate. The note clearly outlines the borrower’s promise to repay the lender within a. Web standard promissory note the parties.

Web standard promissory note the parties. With a template, all you need to do is key in the party’s names, amount, date, and signature to make the form legitimate. Web a secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. Enter all the required information in the appropriate fields on the blank form. The basic promissory note must include your and the borrower’s detailed personal information, the specified amount of the loan, and the signatures of the parties involved. It is a legal document for a loan and becomes legally binding when signed by the borrower. This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate. Web download free printable promissory note templates that may be written in fillable adobe pdf (.pdf), ms word (.doc), and rich text format (.rtf). The note clearly outlines the borrower’s promise to repay the lender within a. If the borrower is in default under this note or is in default under another provision of this note, and such default is not cured within the minimum allotted time by law after written notice of such default, then lender may, at its option, declare all outstanding sums owed on this note to be immediately due and payable.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Web standard promissory note the parties. This standard promissory note (“note”) made on _______________, 20____ is by and between: _______________, with a mailing address of ______________________________, (“borrower”), and lender: A promissory note is a legal document that sets out the details of a loan made between two people, a borrower and a lender. A promissory note is a written promise.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Enter all the required information in the appropriate fields on the blank form. It is a legal document for a loan and becomes legally binding when signed by the borrower. Web download free printable promissory note templates that may be written in fillable adobe pdf (.pdf), ms word (.doc), and rich text format (.rtf). This standard promissory note (“note”) made.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

If the borrower is in default under this note or is in default under another provision of this note, and such default is not cured within the minimum allotted time by law after written notice of such default, then lender may, at its option, declare all outstanding sums owed on this note to be immediately due and payable. This standard.

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

_______________, with a mailing address of. A promissory note is a written promise made by a borrower to a lender to repay a specified sum of money. With a template, all you need to do is key in the party’s names, amount, date, and signature to make the form legitimate. A promissory note is a legal document that sets out.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Promissory note templates & examples #1 #2 #3 #4 #5 #6 #7 #8 #9 #10 #11 #12 #13 #14 #15 #16 #17 #18 #19 #20 _______________, with a mailing address of ______________________________, (“borrower”), and lender: Web a promissory note is an agreement to pay back a loan. Web a secured promissory note is a document that allows a lender to.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Web a secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. Web select a free printable promissory note in pdf format from the template list. A promissory note is a written promise made by a borrower to.

Promissory Note Form Free Printable Documents

A promissory note is a legal document that sets out the details of a loan made between two people, a borrower and a lender. The note clearly outlines the borrower’s promise to repay the lender within a. Enter all the required information in the appropriate fields on the blank form. This standard promissory note (“note”) made on _______________, 20____ is.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Web a promissory note is an agreement to pay back a loan. With a template, all you need to do is key in the party’s names, amount, date, and signature to make the form legitimate. Enter all the required information in the appropriate fields on the blank form. Web select a free printable promissory note in pdf format from the.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

This standard promissory note (“note”) made on _______________, 20____ is by and between: Different types deal with different repayment structures and schedules. If the borrower is in default under this note or is in default under another provision of this note, and such default is not cured within the minimum allotted time by law after written notice of such default,.

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

A promissory note is a written promise made by a borrower to a lender to repay a specified sum of money. This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate. The basic promissory note must include your and the borrower’s detailed personal information, the specified amount of the.

Web Download Free Printable Promissory Note Templates That May Be Written In Fillable Adobe Pdf (.Pdf), Ms Word (.Doc), And Rich Text Format (.Rtf).

Web select a free printable promissory note in pdf format from the template list. If the borrower is in default under this note or is in default under another provision of this note, and such default is not cured within the minimum allotted time by law after written notice of such default, then lender may, at its option, declare all outstanding sums owed on this note to be immediately due and payable. A promissory note is a written promise made by a borrower to a lender to repay a specified sum of money. The note clearly outlines the borrower’s promise to repay the lender within a.

Web A Secured Promissory Note Is A Document That Allows A Lender To Lend Money With The Added Insurance Of Having Assets Or Property Handed Over To Them In The Chance The Borrower Defaults.

It is a legal document for a loan and becomes legally binding when signed by the borrower. Web updated june 16, 2023. _______________, with a mailing address of. With a template, all you need to do is key in the party’s names, amount, date, and signature to make the form legitimate.

This Standard Promissory Note (“Note”) Made On _______________, 20____ Is By And Between:

The basic promissory note must include your and the borrower’s detailed personal information, the specified amount of the loan, and the signatures of the parties involved. Different types deal with different repayment structures and schedules. _______________, with a mailing address of ______________________________, (“borrower”), and lender: Promissory note templates & examples #1 #2 #3 #4 #5 #6 #7 #8 #9 #10 #11 #12 #13 #14 #15 #16 #17 #18 #19 #20

Web A Promissory Note Is An Agreement To Pay Back A Loan.

This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate. Web standard promissory note the parties. Web updated february 11, 2022. A promissory note is a legal document that sets out the details of a loan made between two people, a borrower and a lender.

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-41.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-33.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-07.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-02.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-06.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-04.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-05.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-18.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-34.jpg)