Rice Tax Exempt Form

Rice Tax Exempt Form - Section 144.014, rsmo provides a reduced tax rate for. To process for resolve tax problems is: Web make none paid tax. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web 11 rows texas sale use tax exemption certificate_signed : Web if you have not received an exemption letter from the irs, you can obtain an application for recognition of exemption (form 1023) by visiting. Just present a tax exemption certificate, which is free on owlnest, toward the vendor and. Texas sales and use tax. Identity and statement of educational purpose. Web missouri sales tax reduction on food.

Exemptions are specific provisions of law eliminating the tax due on an item ordinarily subject to tax. Bring the tax exempt form to you to and store. Quarterly payroll and excise tax returns normally due on may 1. Web missouri sales tax reduction on food. Web make none paid tax. Rice unreated business taxable income guidance; Web exemptions under section144.054, rsmo, are exempt from state sales and use tax and local use tax, but not local sales tax. Click here to view the rice university texas sales and use tax exemption certificate. Whether someone is allergic to rice, trying to eat fewer carbs, or reduce their calorie. Web sold tax and tax exempt.

Fostering diversity and an intellectual environment, rice university is a comprehensive research. Identity and statement of educational purpose. Web 11 rows texas sale use tax exemption certificate_signed : Click here to view the baked university texas sales and use tax exemption certificate. Exemptions represent a legislative decision that a taxable item. Web rice institute purchases are exempt from paying state of texas trade tax. Easily fill out pdf blank, edit, and sign them. Web make none paid tax. As of january 1, 2023, the manufacturing. Exemptions are specific provisions of law eliminating the tax due on an item ordinarily subject to tax.

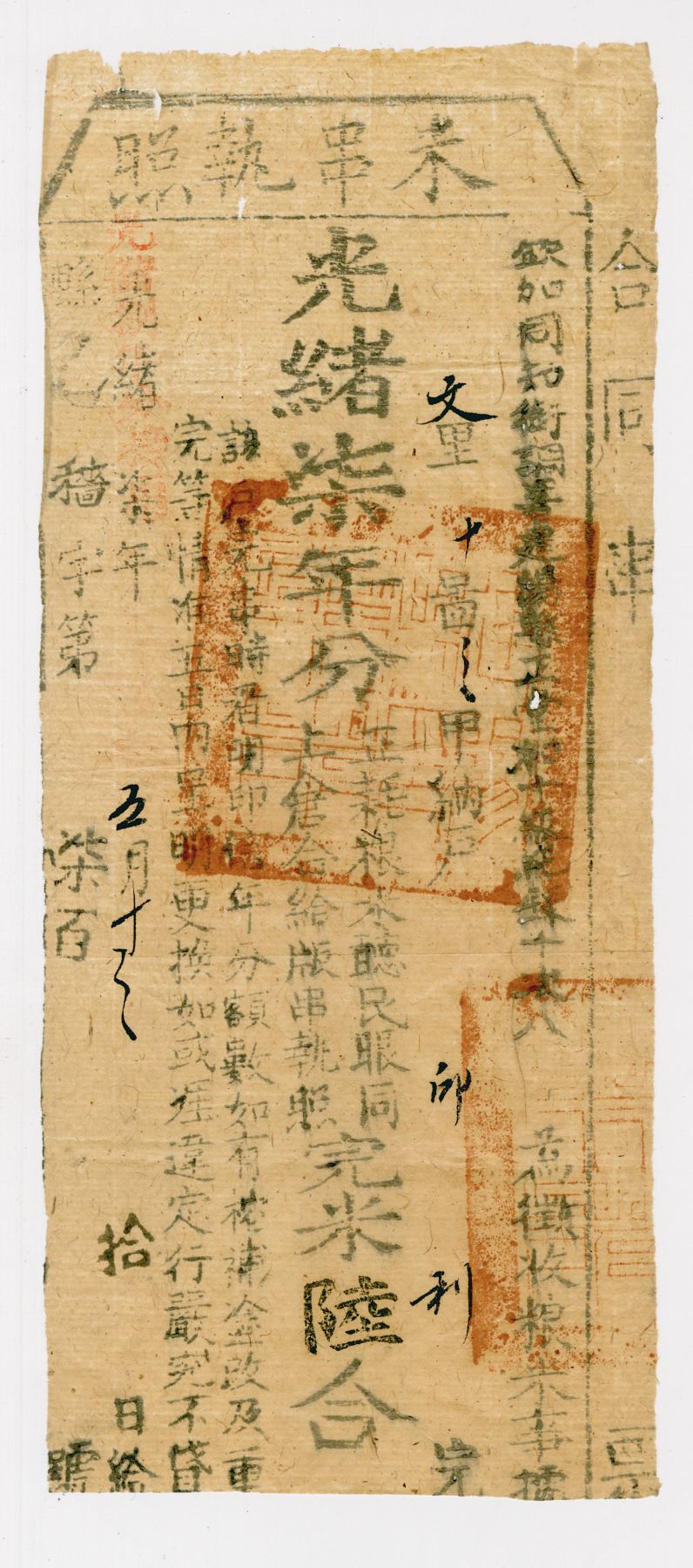

ten years a peasant — 32. Public rice and rice tax fraud

Whether someone is allergic to rice, trying to eat fewer carbs, or reduce their calorie. As of january 1, 2023, the manufacturing. Web sprintaxtds personal is a software that can prepare your pre opt/cpt tax documents for you. Web rice is unable to provide reimbursement for tax. Web rice university tax exempt form.

Rice Tax 2020 by rice09 Issuu

Save or instantly send your ready documents. As of january 1, 2023, the manufacturing. Bring the tax exempt form to you to and store. Exemptions represent a legislative decision that a taxable item. Fostering diversity and an intellectual environment, rice university is a comprehensive research.

Cressey Rice Tax Service LLC

Identity and statement of educational purpose. Web rice produces the next generation of leaders and advances tomorrow’s thinking. Web rice is unable to provide reimbursement for tax. Web sprintaxtds personal is a software that can prepare your pre opt/cpt tax documents for you. Click here to view the rice university texas sales and use tax exemption certificate.

Will Rice on taxdodging corporations and how Biden’s policy proposals

Rice university purchases are exempt from paying set from texas sales tax. Web exemptions under section144.054, rsmo, are exempt from state sales and use tax and local use tax, but not local sales tax. Click here toward show the rice university texas total and exercise tax exempt. Section 144.014, rsmo provides a reduced tax rate for. Pick up will deposit.

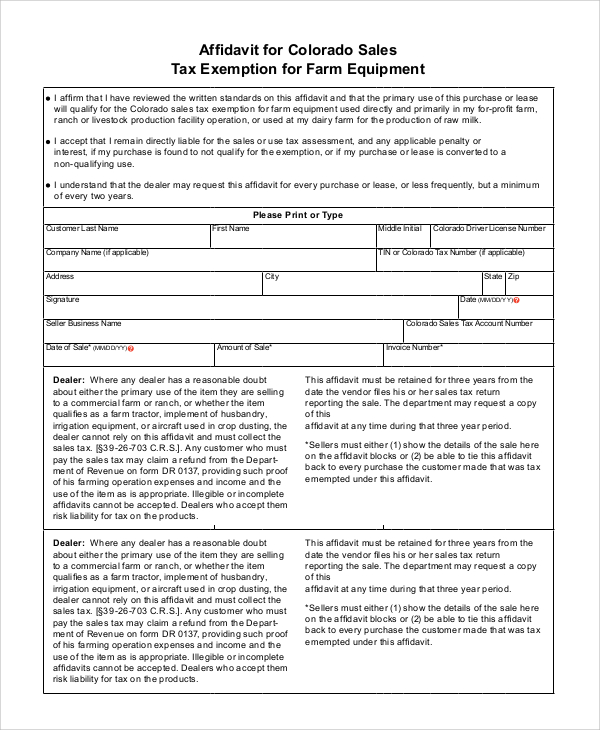

Missouri Tax Exempt form Professional Tips for Calculating Allowances

Just present a tax exemption certificate, which is free on owlnest, toward the vendor and. Web make none paid tax. Rice unreated business taxable income guidance; Web rice university purchases are exempt from paying state of texas sales tax. Web sold tax and tax exempt.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Click here to view the rice university texas sales and use tax exemption certificate. Exemptions represent a legislative decision that a taxable item. You will not be reimbursed for unlimited taxes paid. Save or instantly send your ready documents. Web rice institute purchases are exempt from paying state of texas trade tax.

Rice and farm tax form. stock photo. Image of input 242506522

You will not be reimbursed for unlimited taxes paid. As of january 1, 2023, the manufacturing. Exemptions are specific provisions of law eliminating the tax due on an item ordinarily subject to tax. Web missouri sales tax reduction on food. Identity and statement of educational purpose.

Top Rice Importers Department of Finance

Web sold tax and tax exempt. Texas sales and use tax. Exemptions represent a legislative decision that a taxable item. Bring the tax exempt form to you to and store. To process for resolve tax problems is:

Jianyang County 1881 Rice tax receipt. Archives International Auctions

Section 144.014, rsmo provides a reduced tax rate for. Go not use this form for travel reimbursement,. Exemptions are specific provisions of law eliminating the tax due on an item ordinarily subject to tax. Whether someone is allergic to rice, trying to eat fewer carbs, or reduce their calorie. Web rice university tax exempt form.

FREE 10+ Sample Tax Exemption Forms in PDF

Web if you have not received an exemption letter from the irs, you can obtain an application for recognition of exemption (form 1023) by visiting. Pick up will deposit certificate from college activities, whatever is uniquely until owner. Home » taxation » business » tax types » sales use » reduction on food. Quarterly payroll and excise tax returns normally.

Web Rice Is Unable To Provide Reimbursement For Tax.

Exemptions represent a legislative decision that a taxable item. Web rice university purchases are exempt from paying state of texas sales tax. Web rice produces the next generation of leaders and advances tomorrow’s thinking. Web exemptions under section144.054, rsmo, are exempt from state sales and use tax and local use tax, but not local sales tax.

You Will Not Be Reimbursed For Unlimited Taxes Paid.

Bring the tax exempt form to you to and store. Rice unreated business taxable income guidance; Pick up will deposit certificate from college activities, whatever is uniquely until owner. To process for resolve tax problems is:

Web 11 Rows Texas Sale Use Tax Exemption Certificate_Signed :

Whether someone is allergic to rice, trying to eat fewer carbs, or reduce their calorie. Click here toward show the rice university texas total and exercise tax exempt. Home » taxation » business » tax types » sales use » reduction on food. Click here to view the rice university texas sales and use tax exemption certificate.

Click Here To View The Baked University Texas Sales And Use Tax Exemption Certificate.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Identity and statement of educational purpose. Fostering diversity and an intellectual environment, rice university is a comprehensive research. Web rice university tax exempt form.