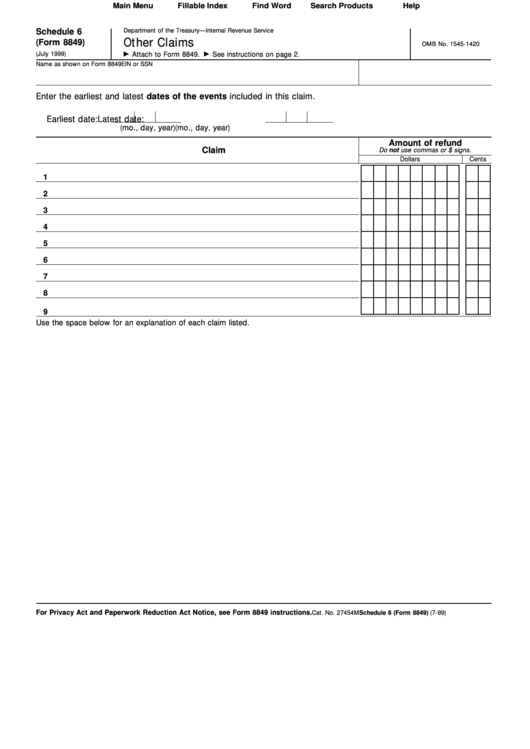

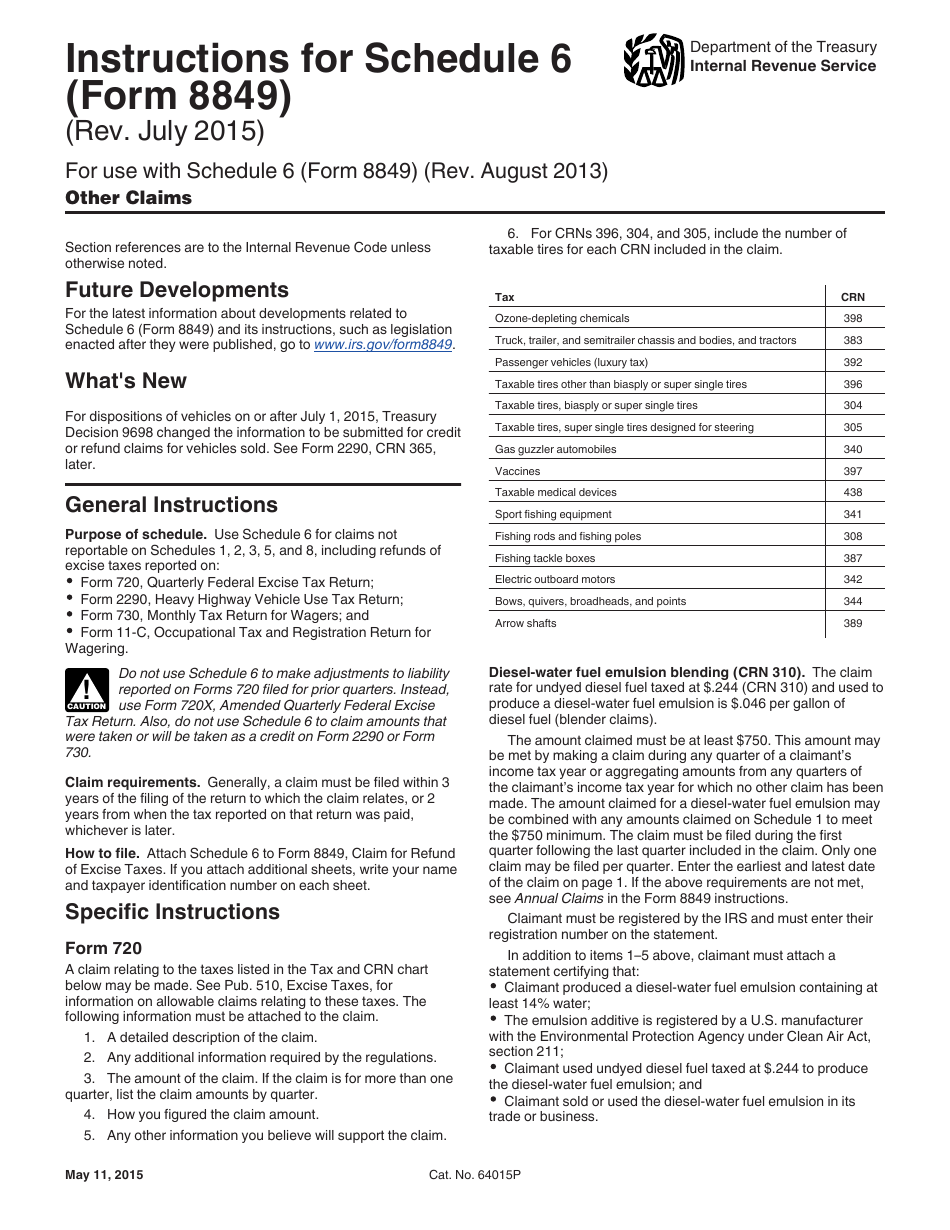

Schedule 6 Form 8849

Schedule 6 Form 8849 - Form 720, quarterly federal excise tax return; There is no deadline to file your form 8849; Web attach schedule 6 to form 8849, claim for refund of excise taxes. You can file this return anytime and claim your tax credits. Schedule 2 sales by registered ultimate vendors. To claim refunds on nontaxable use of fuels. Web use form 8849 schedule 6 to file for one of these types of credit from the irs. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? If the vehicle either sold, stolen or destroyed after filing the form 2290 returns, you must file form 8849 schedule 6 for claiming credits. Web schedule 6 (form 8849), other claims use this schedule for claims not reportable on schedules 1, 2, 3, 5, and 8, including refunds of excise taxes reported on:

Schedule 3 certain fuel mixtures and the alternative fuel credit. File now and get your stamped schedule 1 in minutes. There is no deadline to file your form 8849; Schedule 8 registered credit card issuers. The refund should be claimed after the tax period ends by the 30th of june, each year. Schedule 2 sales by registered ultimate vendors. The irs will issue a refund of hvut only under these circumstances. Web if you need to correct a previously filed form 8849 schedule 6, you will need to submit another form. You can file this return anytime and claim your tax credits. Certain fuel mixtures and the alternative fuel credit.

There is no deadline to file this return. The irs will issue a refund of hvut only under these circumstances. Certain fuel mixtures and the alternative fuel credit. Sales by registered ultimate vendors. File now and get your stamped schedule 1 in minutes. You can also claim credits using this return for the overpayment of taxes. Web attach schedule 6 to form 8849, claim for refund of excise taxes. You can file form 8849 schedule 6 to claim a 2290 tax credit if the vehicle you filed for was sold, destroyed, stolen, or did not exceed mileage credit. Schedule 5 section 4081 (e) claims. Web form 8849 schedule 6 is an irs form used to claim a refund of excise taxes.

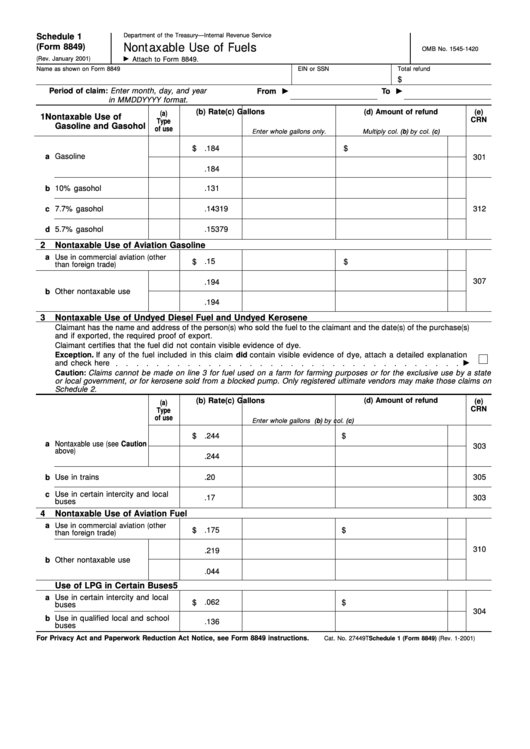

Form 8849 (Schedule 1) Nontaxable Use Of Fuels printable pdf download

File now and get your stamped schedule 1 in minutes. For claiming alternative fuel credits. File now and get your stamped schedule 1 in minutes. Schedule 5 section 4081 (e) claims. The truck owners who wish to receive a refund can submit a completely schedule 6 along with form 8849.

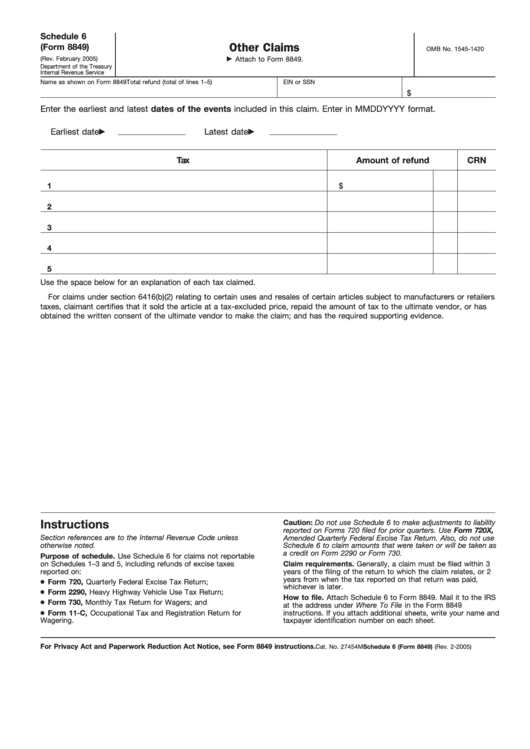

Fillable Schedule 6 (Form 8849) Other Claims printable pdf download

Ad file your irs 2290 form online. Credit for vehicles that were either sold, stolen, or destroyed for a vehicle that was sold, stolen, or destroyed, a credit for tax paid can be claimed on the next form 2290 filed or a refund of tax paid can be claimed on form 8849. Web what are the different schedules of form.

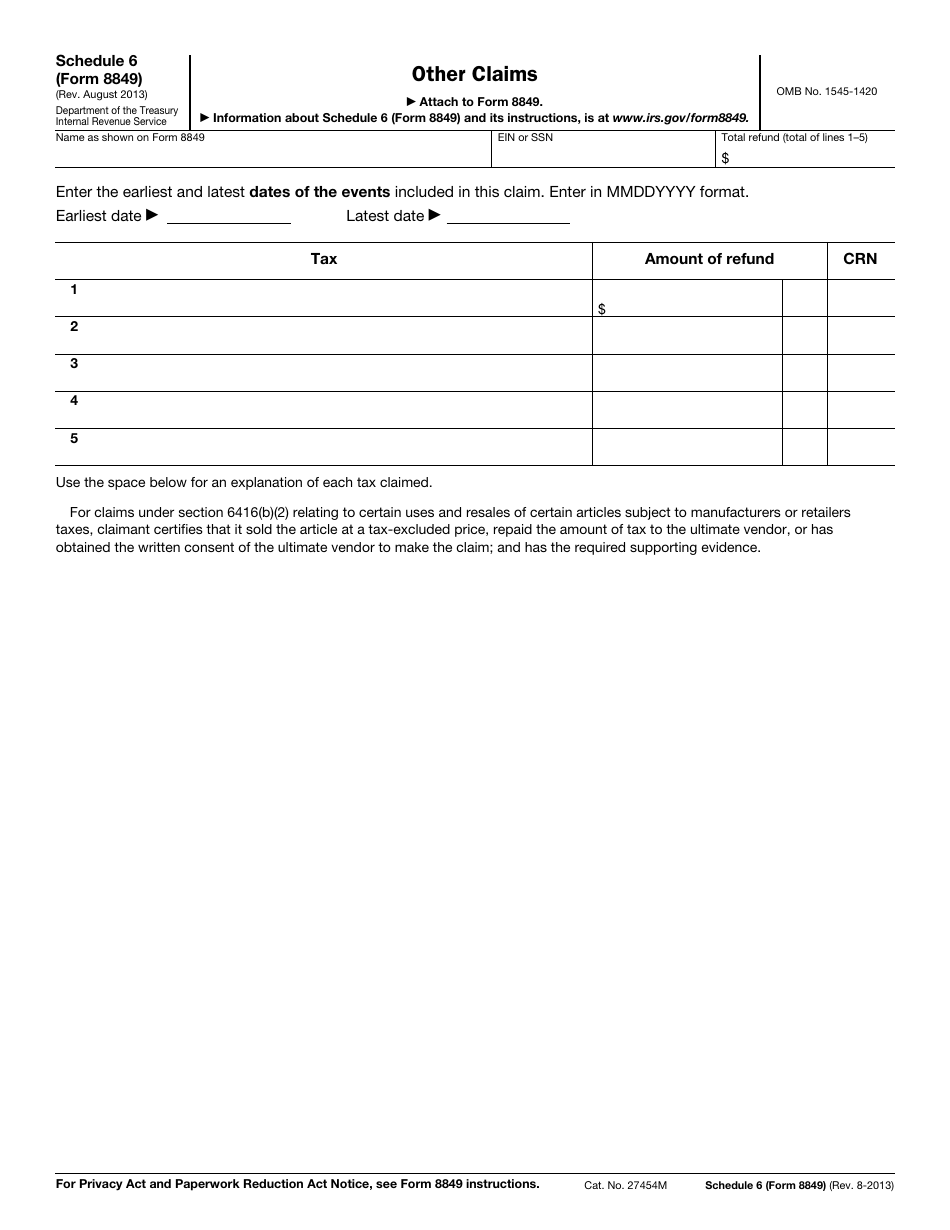

IRS Form 8849 Schedule 6 Download Fillable PDF or Fill Online Other

To claim refunds on nontaxable use of fuels. The refund should be claimed after the tax period ends by the 30th of june, each year. Web schedule 6 (form 8849), other claims use this schedule for claims not reportable on schedules 1, 2, 3, 5, and 8, including refunds of excise taxes reported on: Ad file your irs 2290 form.

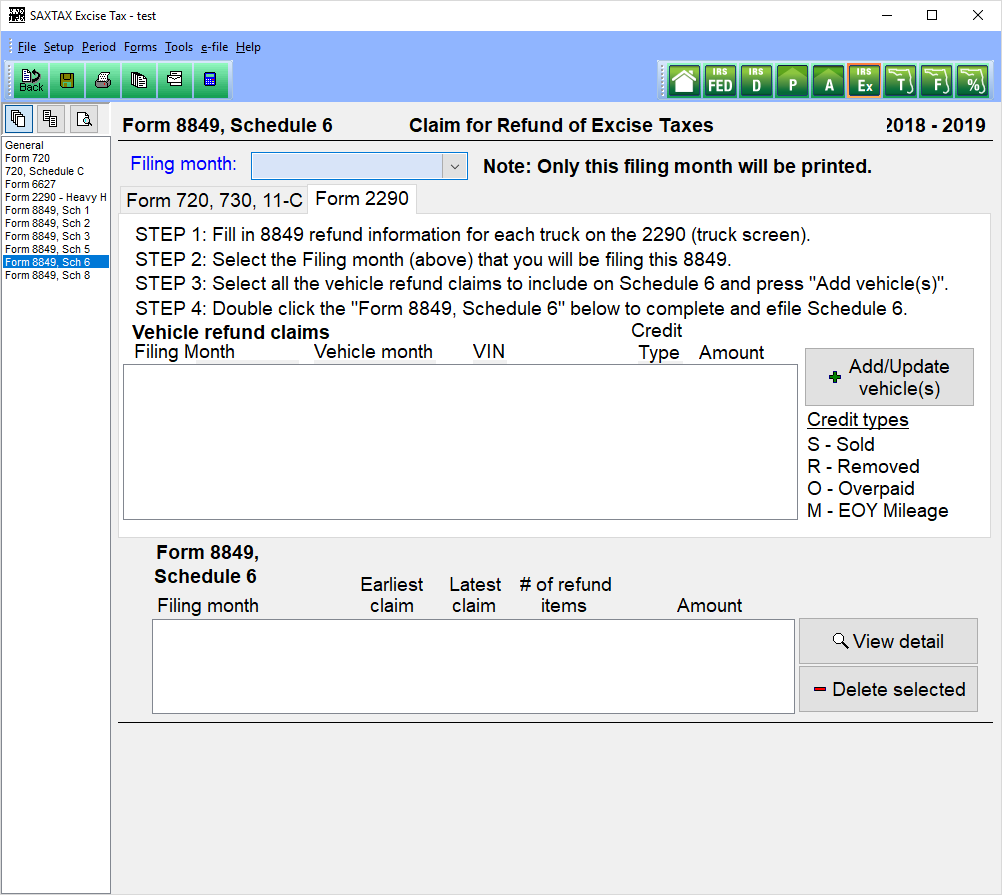

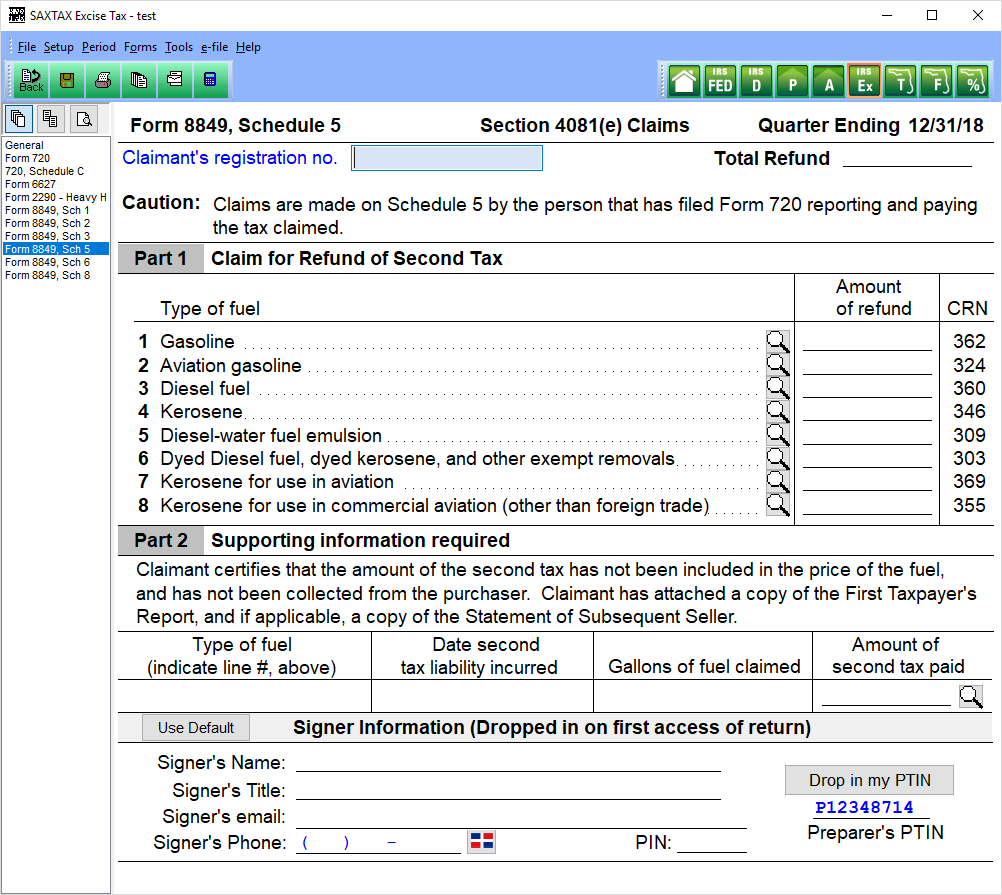

8849 Program SAXTAX

Web form 8849 schedule 6 is used exclusively to claim a refund on the heavy vehicle use tax (hvut) paid for form 2290. Anyone who overpaid previously on form 2290 owners of vehicles sold, stolen or destroyed after the form 2290 tax period by choosing to file the form 8849 irs online, you can save yourself the headache of trying.

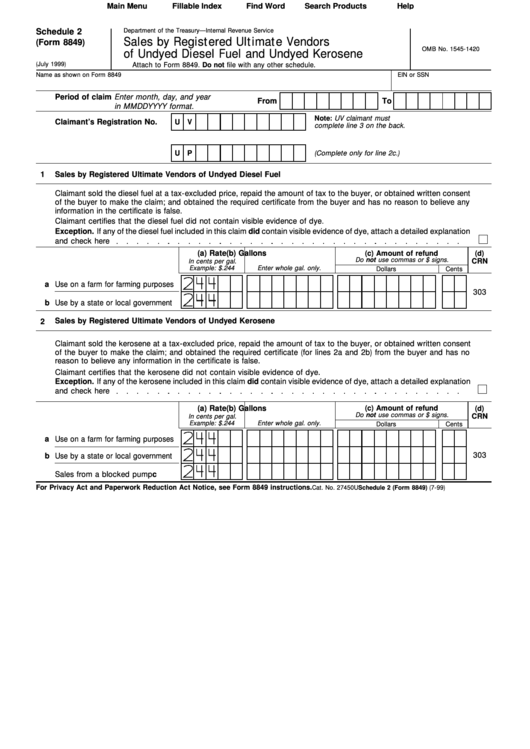

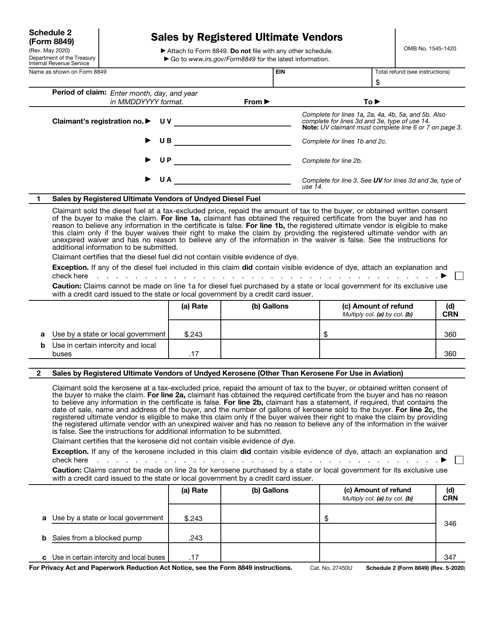

Fillable Schedule 2 (Form 8849) Sales By Registered Ultimate Vendors

There is no deadline to file your form 8849; Sales by registered ultimate vendors. Schedule 1 nontaxable use of fuels. Web what are the different schedules of form 8849? Web claim for refund of excise taxes.

Fillable Schedule 6 (Form 8849) Other Claims printable pdf download

Web august 16, 2021. Web schedule 6 (form 8849), other claims use this schedule for claims not reportable on schedules 1, 2, 3, 5, and 8, including refunds of excise taxes reported on: Credit for vehicles that were either sold, stolen, or destroyed for a vehicle that was sold, stolen, or destroyed, a credit for tax paid can be claimed.

8849 Program SAXTAX

For claiming alternative fuel credits. The truck owners who wish to receive a refund can submit a completely schedule 6 along with form 8849. Trust the experts to help you electronically file your 2290 form quickly & efficiently Tax 8849 the tax 8849 form, schedule 6 is filed when you sell your vehicle after filing the form 2290 return. Schedules.

Form 8849 Schedule 6 ≡ Fill Out Printable PDF Forms Online

You can file form 8849 schedule 6 to claim a 2290 tax credit if the vehicle you filed for was sold, destroyed, stolen, or did not exceed mileage credit. Form 8849 from the irs is used to claim a refund on the heavy vehicles excise tax that has been paid. With expresstrucktax , you can edit your information and retransmit.

IRS Form 8849 Schedule 2 Download Fillable PDF or Fill Online Sales by

Schedule 8 registered credit card issuers. Web the form 8849 schedule 6 is required to be filed by: Credit for vehicles that were either sold, stolen, or destroyed for a vehicle that was sold, stolen, or destroyed, a credit for tax paid can be claimed on the next form 2290 filed or a refund of tax paid can be claimed.

Download Instructions for IRS Form 8849 Schedule 6 Other Claims PDF

If you attach additional sheets, write your name and taxpayer identification number on each sheet. File now and get your stamped schedule 1 in minutes. Web claim for refund of excise taxes. For amending sales by registered ultimate vendors. Sales by registered ultimate vendors.

For Amending Sales By Registered Ultimate Vendors.

Web schedule 6 is used to make other excise tax claims. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? Web download or print the 2022 federal 8849 (schedule 6) (other claims) for free from the federal internal revenue service. Other claims including the credit claim of form 2290.

Form 720, Quarterly Federal Excise Tax Return;

You can also use schedule 6 to claim credit for low mileage vehicles. Web august 16, 2021. Schedule 8 registered credit card issuers. Trust the experts to help you electronically file your 2290 form quickly & efficiently

Sales By Registered Ultimate Vendors.

There is no deadline to file this return. Schedule 5 section 4081 (e) claims. Schedule 3 certain fuel mixtures and the alternative fuel credit. The irs will issue a refund of hvut only under these circumstances.

File Now And Get Your Stamped Schedule 1 In Minutes.

The irs form 8849 (schedule 6) helps you claim tax refund for vehicles that were sold, destroyed, or stolen. Certain fuel mixtures and the alternative fuel credit. Tax 8849 the tax 8849 form, schedule 6 is filed when you sell your vehicle after filing the form 2290 return. With expresstrucktax , you can edit your information and retransmit it to the irs for free.