Schedule B Form 990

Schedule B Form 990 - This provides the irs with a detailed. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Nonprofits active nationally (other than 501(c)(3) and 527 organizations) may well now have to. Web every private foundation must attach schedule b if a person contributes more than the greater of $5000 or 2% of $700,000 ($14,000) during the tax year. If the return is not. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web these differing state rules, which are likely to increase, are a trap for the unwary. Web wednesday, june 3, 2020. Instructions for these schedules are.

Web wednesday, june 3, 2020. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web the answer should be no, for now. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Web b c schedule c (form 990) 2022 for each yes response on lines 1a through 1i below, provide in part iv a detailed description of the lobbying activity. On this page you may download the 990 series filings on record for 2021. A nonprofit is required to file. Web these differing state rules, which are likely to increase, are a trap for the unwary. Instructions for these schedules are. This past summer, the supreme court invalidated california’s requirement to include unredacted form 990, schedule b donor.

Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. The download files are organized by month. Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor disclosure. If the return is not. This past summer, the supreme court invalidated california’s requirement to include unredacted form 990, schedule b donor. This provides the irs with a detailed. Nonprofits active nationally (other than 501(c)(3) and 527 organizations) may well now have to. Instructions for these schedules are. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web the answer should be no, for now.

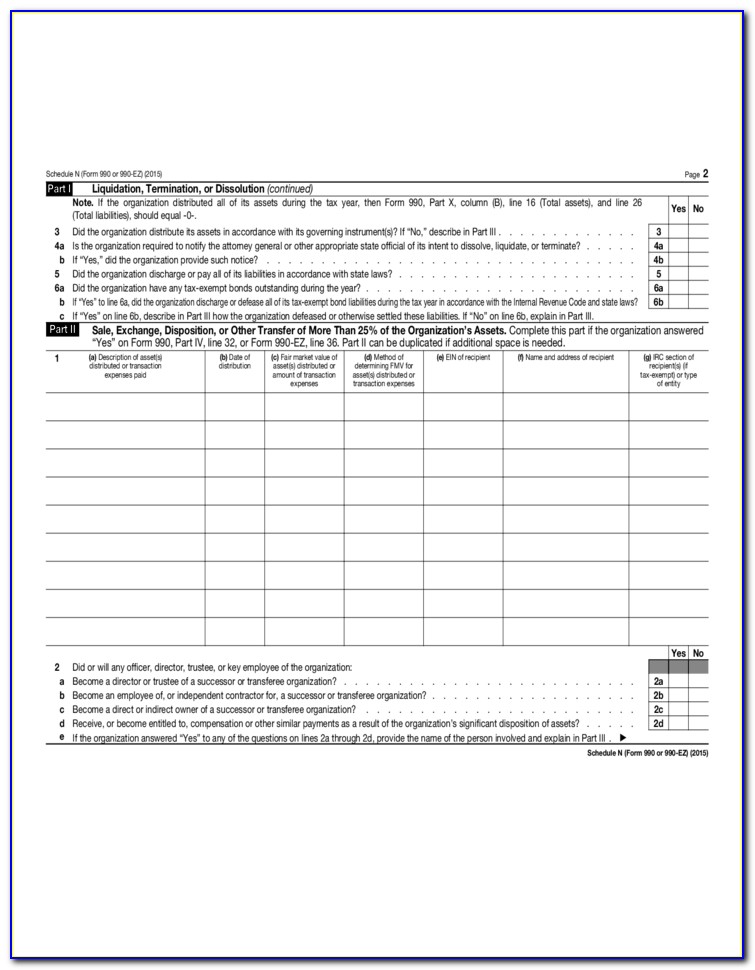

Form 990 (Schedule D) Supplemental Financial Statements (2015) Free

This provides the irs with a detailed. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one. Web wednesday, june 3, 2020. Go to www.irs.gov/form990 for the. Web these differing state rules, which are likely to increase, are a trap.

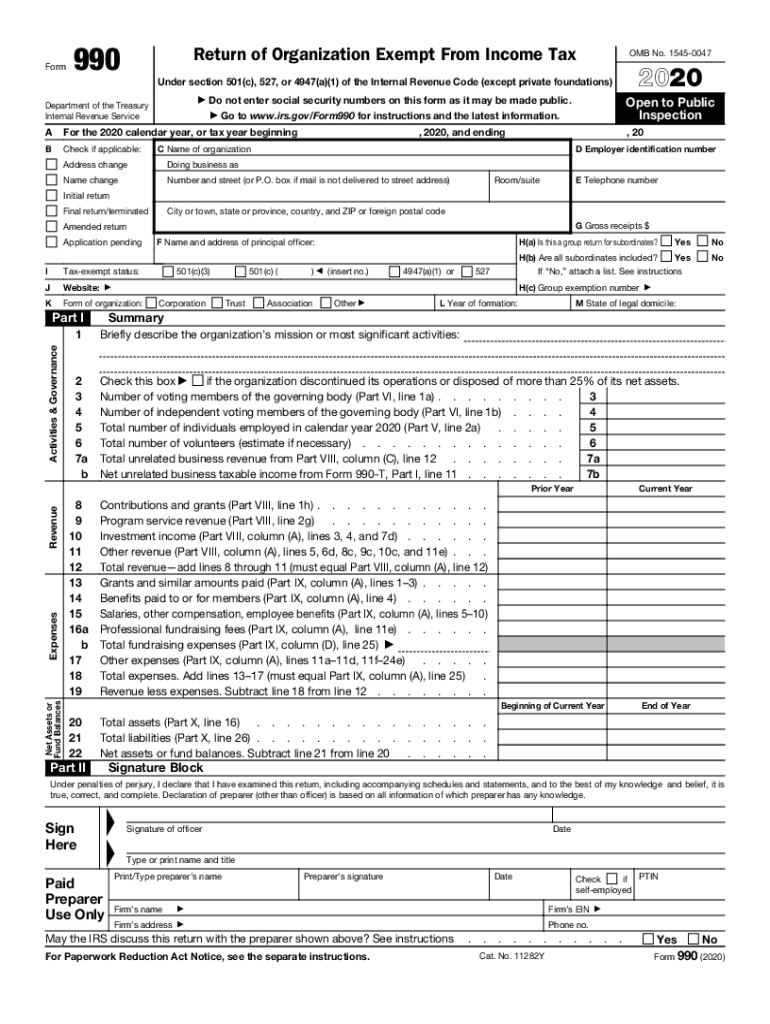

Form 990 Fill Out and Sign Printable PDF Template signNow

Instructions for these schedules are. This provides the irs with a detailed. For other organizations that file. On this page you may download the 990 series filings on record for 2021. This past summer, the supreme court invalidated california’s requirement to include unredacted form 990, schedule b donor.

Form 990 (Schedule D) Supplemental Financial Statements (2015) Free

Web b c schedule c (form 990) 2022 for each yes response on lines 1a through 1i below, provide in part iv a detailed description of the lobbying activity. For other organizations that file. This past summer, the supreme court invalidated california’s requirement to include unredacted form 990, schedule b donor. Web the answer should be no, for now. The.

Irs Form 990 Ez 2015 Schedule O Form Resume Examples qQ5M9wJ5Xg

Instructions for these schedules are. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. See the schedule b instructions to determine the requirements for filing. Effective may 28, 2020, the internal revenue service (irs) issued.

2018 Form IRS 990 Schedule D Fill Online, Printable, Fillable, Blank

Web the answer should be no, for now. See the schedule b instructions to determine the requirements for filing. The download files are organized by month. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Nonprofits active nationally (other than 501(c)(3) and 527 organizations) may well now have.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one. Web every private foundation must attach schedule b if.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

Web wednesday, june 3, 2020. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web these differing state rules, which are likely to increase, are a trap for the unwary. This past summer, the supreme court invalidated california’s requirement to include unredacted form 990, schedule b donor. Web generally, a npo must attach schedule b to.

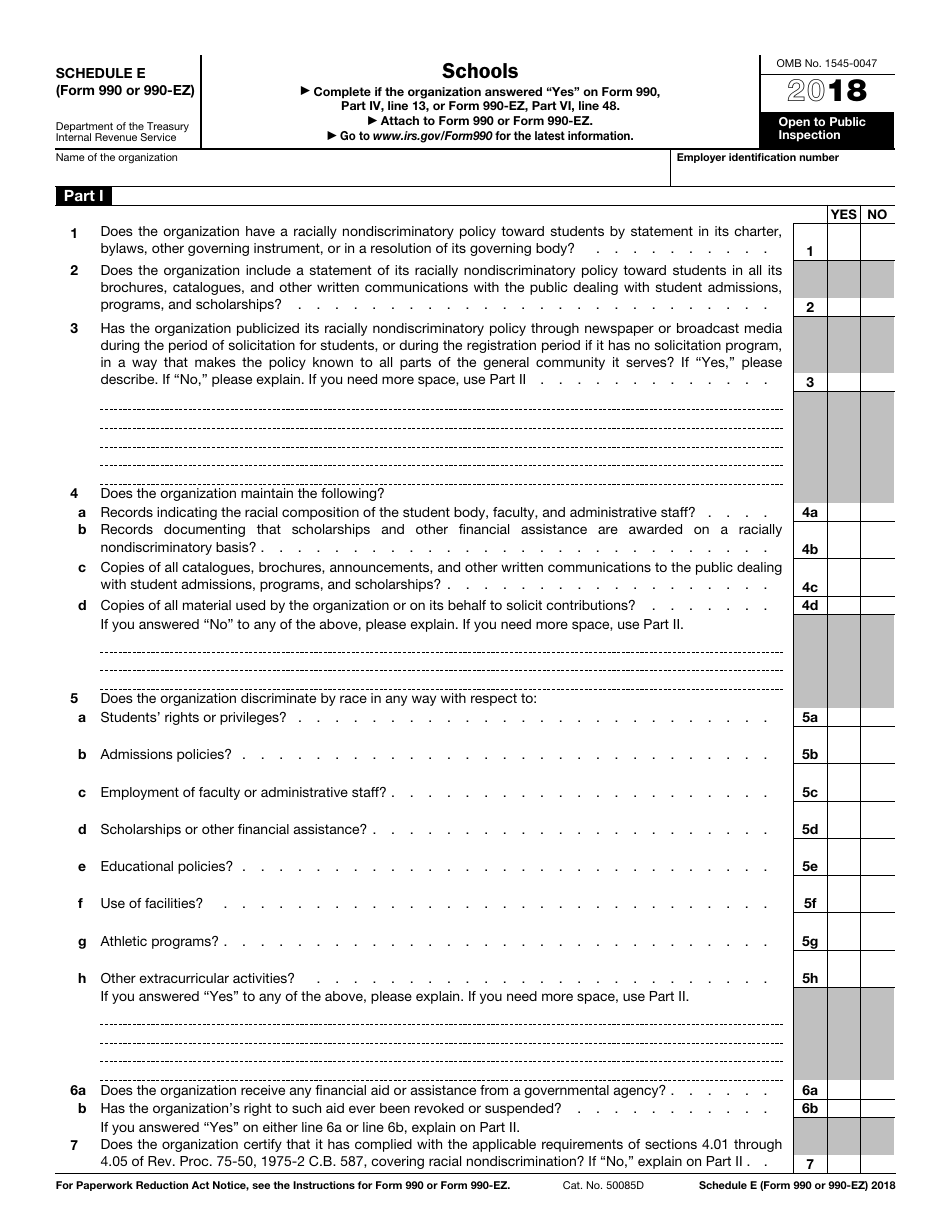

IRS Form 990 (990EZ) Schedule E Download Fillable PDF or Fill Online

Nonprofits active nationally (other than 501(c)(3) and 527 organizations) may well now have to. Effective may 28, 2020, the internal revenue service (irs) issued final treasury regulations addressing donor disclosure. Ad download or email form 990 sb & more fillable forms, register and subscribe now! Web wednesday, june 3, 2020. Web generally, a npo must attach schedule b to its.

IRS Form 990 Schedule B 2018 2019 Printable & Fillable Sample in PDF

Web every private foundation must attach schedule b if a person contributes more than the greater of $5000 or 2% of $700,000 ($14,000) during the tax year. If the return is not. A nonprofit is required to file. Nonprofits active nationally (other than 501(c)(3) and 527 organizations) may well now have to. Ad download or email form 990 sb &.

990 schedule b requirements

Instructions for these schedules are. Web currently, charitable organizations are required to disclose the names of their major donors to the irs on schedule b of their form 990. A nonprofit is required to file. Web wednesday, june 3, 2020. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a.

Web Every Private Foundation Must Attach Schedule B If A Person Contributes More Than The Greater Of $5000 Or 2% Of $700,000 ($14,000) During The Tax Year.

Web b c schedule c (form 990) 2022 for each yes response on lines 1a through 1i below, provide in part iv a detailed description of the lobbying activity. Nonprofits active nationally (other than 501(c)(3) and 527 organizations) may well now have to. If the return is not. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w.

Instructions For These Schedules Are.

This past summer, the supreme court invalidated california’s requirement to include unredacted form 990, schedule b donor. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web currently, charitable organizations are required to disclose the names of their major donors to the irs on schedule b of their form 990. See the schedule b instructions to determine the requirements for filing.

(Column (B) Must Equal Form 990, Part X, Col.

Go to www.irs.gov/form990 for the. This schedule is designed to report information about. Web these differing state rules, which are likely to increase, are a trap for the unwary. For other organizations that file.

Web The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

Web wednesday, june 3, 2020. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Ad download or email form 990 sb & more fillable forms, register and subscribe now! Web generally, a npo must attach schedule b to its form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one.