Should An Independent Contractor Form An Llc

Should An Independent Contractor Form An Llc - Unlike an independent contractor, llc owners are required to submit business formation documents, such as articles of. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. Our business specialists help you incorporate your business. Below, you’ll find a complete breakdown of why it may be in their best. If they wish, they can continue. Ad launch your llc in 10 min online. Web reporting payments to independent contractors. Independent, or 1099, contractors run their own businesses. Ad pay one invoice at a time while we handle payments to all independent contractors. Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an.

Our business specialists help you incorporate your business. Ad covers contractors, food service, retail stores, auto service, transportation, & more. Ad legally binding llc agreement templates online. Ad launch your llc in 10 min online. Web from the huffington post, deborah sweeney recommends forming an llc if you are an independent contractor. Web reporting payments to independent contractors. Web why should independent contractors consider establishing an llc? Web should an independent contractor form an llc? Web guest column november 23, 2021 independent contractors are not required to form business structures for their work. The primary difference is that your personal assets, such as your personal bank account, will.

The primary difference is that your personal assets, such as your personal bank account, will. If you are an independent contractor working as a freelancer or a sole proprietor, you may be. Unlike an independent contractor, llc owners are required to submit business formation documents, such as articles of. Edit & print for immediate use. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. Paying independent contractors doesn't have to be so hard. Web reporting payments to independent contractors. Web before the next fiscal year, independent contractors should look into forming an llc. If they wish, they can continue. Ad covers contractors, food service, retail stores, auto service, transportation, & more.

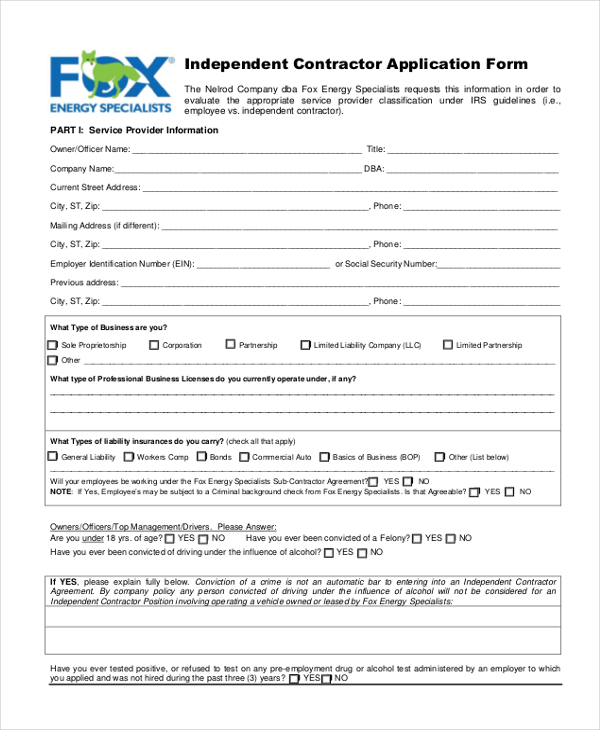

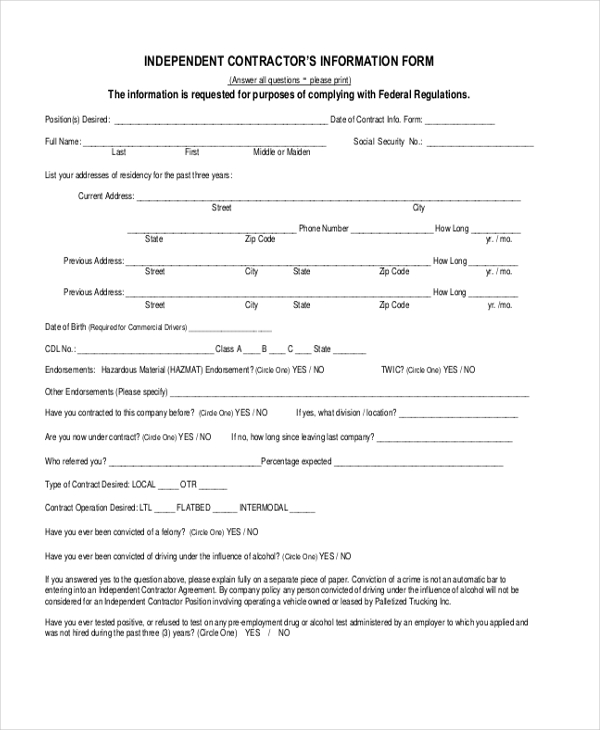

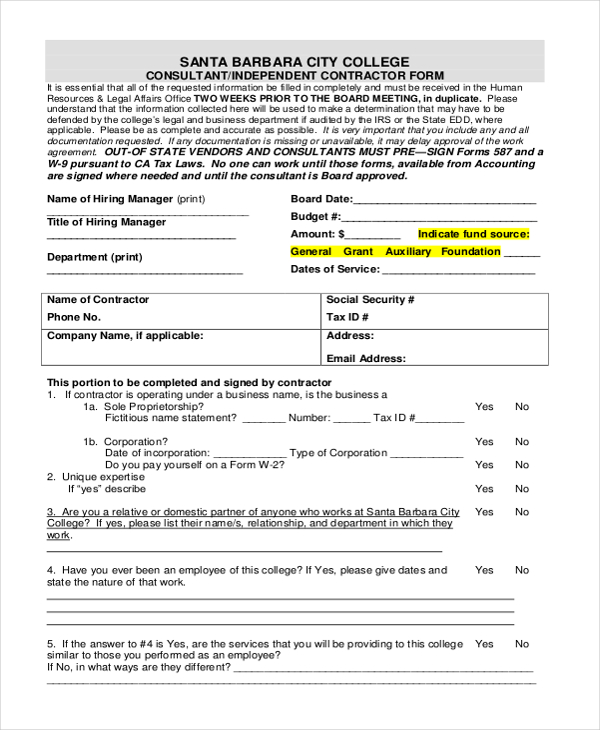

Independent Contractor Application Fill Online, Printable, Fillable

If you are an independent contractor working as a freelancer or a sole proprietor, you may be. Web an independent contractor is a broad term that describes anyone who provides goods or services without being employed by someone else. Web guest column november 23, 2021 independent contractors are not required to form business structures for their work. A properly classified.

Independent Contractor, LLC & Businesses YouTube

Web guest column november 23, 2021 independent contractors are not required to form business structures for their work. Edit & print for immediate use. If they wish, they can continue. Web why should independent contractors consider establishing an llc? A properly classified independent contractor is.

INDEPENDENT CONTRACTOR TAXES & HOW TO INCORPORATE

Below, you’ll find a complete breakdown of why it may be in their best. Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an. Web from the huffington post,.

Should independent contractors form a LLC? YouTube

Web reporting payments to independent contractors. Ad launch your llc in 10 min online. Get a general liability insurance policy customized to your business needs today. If they wish, they can continue. Ad pay one invoice at a time while we handle payments to all independent contractors.

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an. Ad covers contractors, food service, retail stores, auto service, transportation, & more. Independent, or 1099, contractors run their own businesses. Web from the huffington post, deborah sweeney recommends forming an llc if you are.

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

Web should you form an llc as an independent contractor or not? Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability.

California’s Independent Contractor Test & What Your Business Must

Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Edit & print for immediate use. 2023's best llc formation services. Web up to 24% cash back 2 min read. Web should an independent contractor form an llc?

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

A properly classified independent contractor is. We make it simple to register your new llc. If they wish, they can continue. Web up to 24% cash back 2 min read. Web an independent contractor is a broad term that describes anyone who provides goods or services without being employed by someone else.

Free Independent Contractor Agreement Template 1099 Word PDF eForms

Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. In fact, we just covered that in. If you are an independent contractor working as a freelancer or a sole proprietor, you may be. Web why should independent contractors.

Independent Contractor Form Sample Forms

A properly classified independent contractor is. Web from the huffington post, deborah sweeney recommends forming an llc if you are an independent contractor. Web up to 24% cash back 2 min read. Web why should independent contractors consider establishing an llc? Ad launch your llc in 10 min online.

Web An Independent Contractor Is A Broad Term That Describes Anyone Who Provides Goods Or Services Without Being Employed By Someone Else.

Web reporting payments to independent contractors. Create a fully customized form llc in minutes. Web from the huffington post, deborah sweeney recommends forming an llc if you are an independent contractor. In fact, we just covered that in.

Unlike An Independent Contractor, Llc Owners Are Required To Submit Business Formation Documents, Such As Articles Of.

Get a general liability insurance policy customized to your business needs today. Ad legally binding llc agreement templates online. If you are an independent contractor working as a freelancer or a sole proprietor, you may be. File your llc paperwork in just 3 easy steps!

The Primary Difference Is That Your Personal Assets, Such As Your Personal Bank Account, Will.

Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an. Independent, or 1099, contractors run their own businesses. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. 2023's best llc formation services.

Web If You Are A Sole Proprietor Working As An Independent Contractor, There Are Lots Of Advantages To Setting Up Your Business As An Llc.

Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Ad covers contractors, food service, retail stores, auto service, transportation, & more. Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Web before the next fiscal year, independent contractors should look into forming an llc.