Spousal Lifetime Access Trust Form

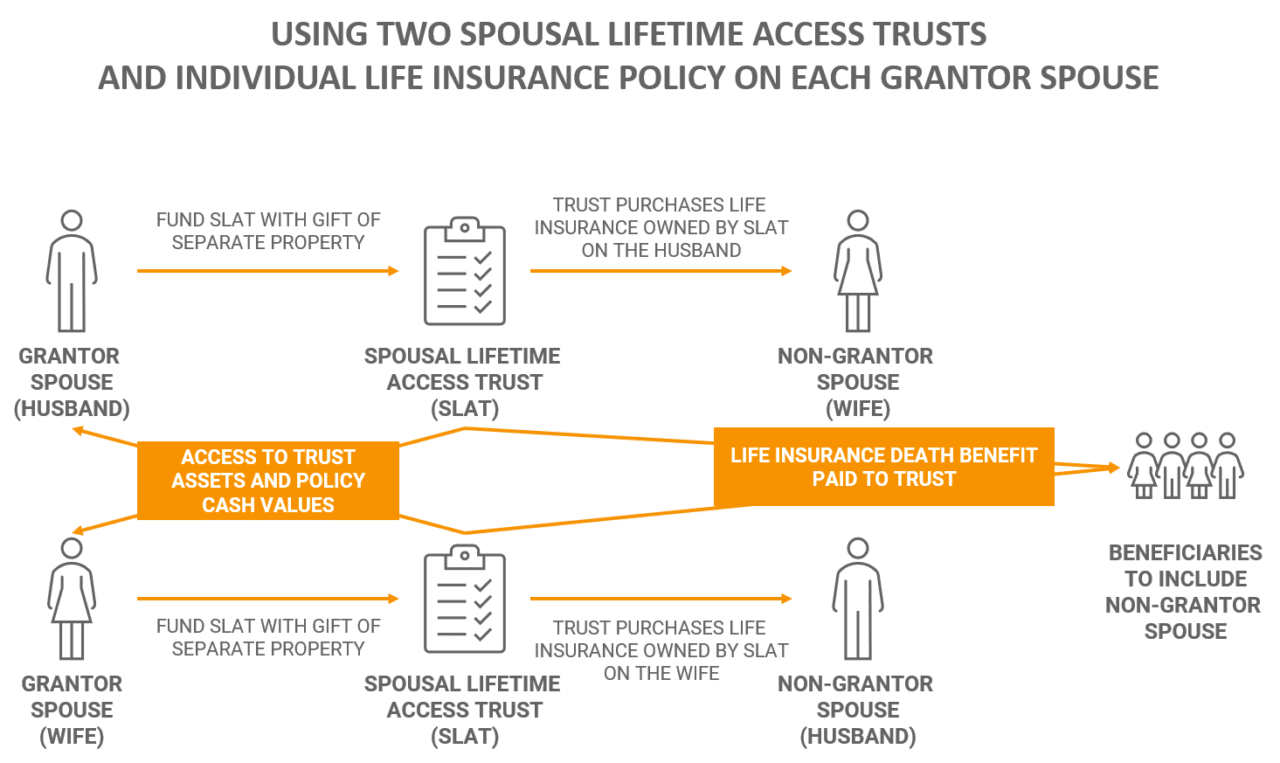

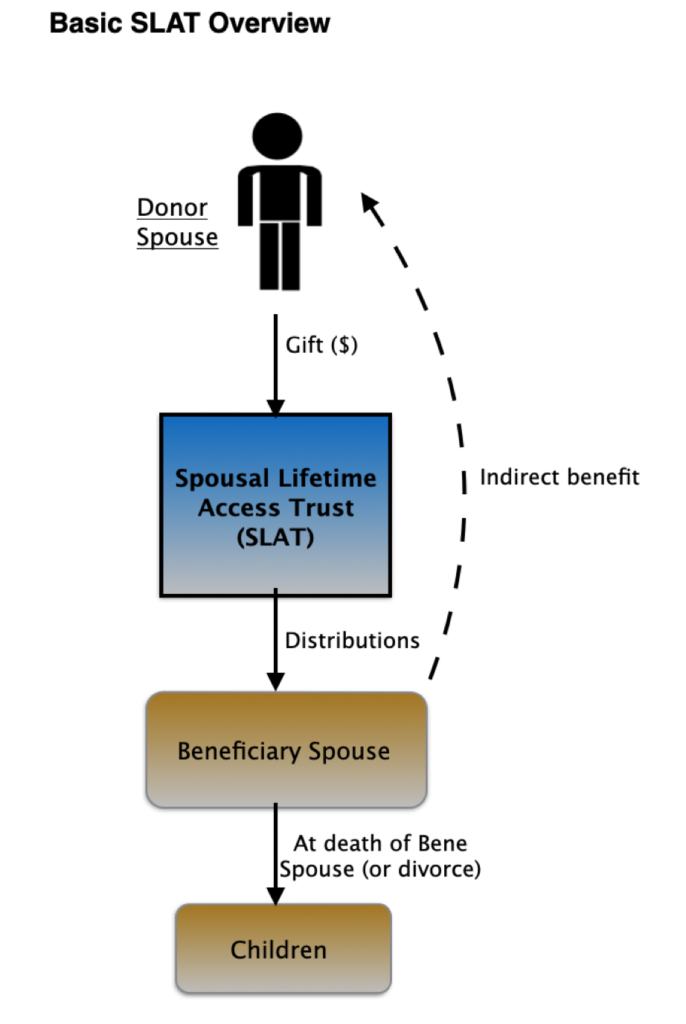

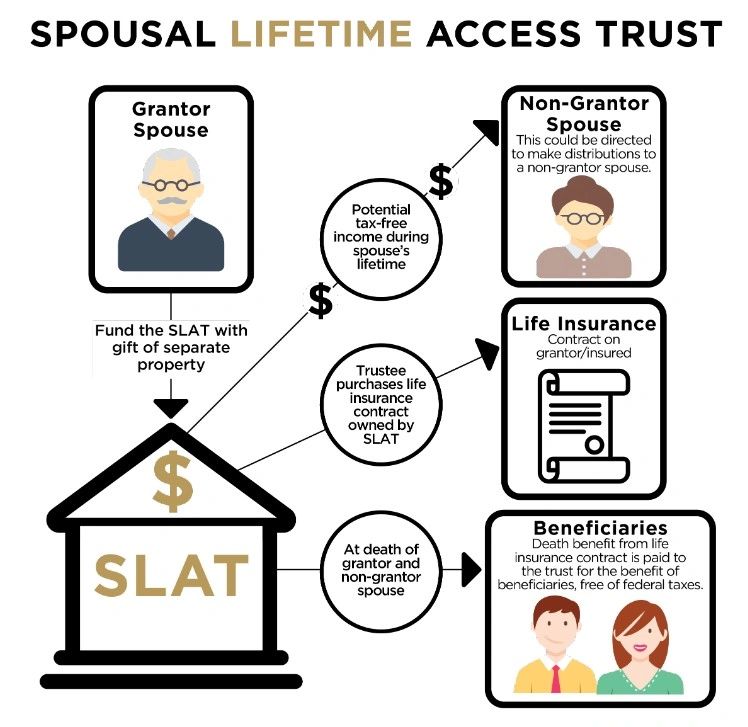

Spousal Lifetime Access Trust Form - Web a south dakota spousal lifetime access trust (“slat”) is an effective way to utilize ones $12.92 million. Web spousal lifetime access trusts (“slats”) may be the most common planning technique for married clients to use in 2020. Web you should be having your cpa file a form 1041 trust income tax return for each slat. Web an instrument creating a spousal lifetime access trust (slat) agreement. If structured properly, the assets and any future appreciation is. Web a slat is an irrevocable trust established by one spouse (the “settlor” or “grantor”) during their lifetime for the benefit of their spouse. A slat allows the settlor to make a gift to the trust that removes the trust assets from the settlor's. The donor's transfer of assets to the slat is considered a taxable gift, but gift tax may not be owed if the donor utilizes their federal gift and estate tax exclusion. Web spousal lifetime access trust (slat) (30 pages) $129.00. Web a spousal lifetime access trust, or “slat,” is an irrevocable trust that names the donor’s spouse as a discretionary beneficiary along with others (e.g., children).

Web you should be having your cpa file a form 1041 trust income tax return for each slat. The form 2848 or form 8821 will be used solely to release the ein to the representative authorized on the form. Possible law changes in 2021 may have an adverse. Web an instrument creating a spousal lifetime access trust (slat) agreement. Web these trusts are sometimes called spousal lifetime access trusts or “slats.” · if you’re single you might consider some variation of what is called a self. Web what is a spousal lifetime access trust (slat)? For beneficiary spouse’s lifetime, he or she may receive trust income and principal restricted to ascertainable standard of health,. Pressing planning suggestions from steve siegel: Pressing planning suggestions from steve siegel: Possible law changes in 2021 may have an adverse.

Web the benefits of a slat are: Web transfers of appreciating assets to spousal lifetime access trusts (slats) have become an increasingly popular and flexible estate planning technique. Possible law changes in 2021 may have an adverse. All correspondence for your account will then be sent to the new address. For beneficiary spouse’s lifetime, he or she may receive trust income and principal restricted to ascertainable standard of health,. Web spousal lifetime access trust (slat) (30 pages) $129.00. That should be properly done reflecting whether your slat is a grantor or. Web both spouses manage a joint trust while they are still alive and competent. Web the spousal lifetime access trust (slat) is one estate planning tool that may address the issue. Web the library of forms you can access to assist in managing your account can be found here.

The Benefits of A Spousal Lifetime Access Trust (SLAT)

A slat allows the settlor to make a gift to the trust that removes the trust assets from the settlor's. Web what is a spousal lifetime access trust (slat)? Web a spousal lifetime access trust, or “slat,” is an irrevocable trust that names the donor’s spouse as a discretionary beneficiary along with others (e.g., children). For beneficiary spouse’s lifetime, he.

Spousal Lifetime Access Trusts A Key Planning Tool

A slat allows the settlor to make a gift to the trust that removes the trust assets from the settlor's. Web a spousal lifetime access trust, or “slat,” is an irrevocable trust that names the donor’s spouse as a discretionary beneficiary along with others (e.g., children). All correspondence for your account will then be sent to the new address. Web.

Spousal Lifetime Access Trusts (SLATs) Wealthspire

For beneficiary spouse’s lifetime, he or she may receive trust income and principal restricted to ascertainable standard of health,. A slat is an irrevocable trust. Web these trusts are sometimes called spousal lifetime access trusts or “slats.” · if you’re single you might consider some variation of what is called a self. The form 2848 or form 8821 will be.

Do I Need A Spousal Lifetime Access Trust? Monument Wealth Management

It is a popular planning tool used among married couples who wish. Web these trusts are sometimes called spousal lifetime access trusts or “slats.” · if you’re single you might consider some variation of what is called a self. Web you should be having your cpa file a form 1041 trust income tax return for each slat. If this form.

Leveraging a Spousal Lifetime Access Trust Olsen Thielen & Co., Ltd

Web a slat is an irrevocable trust established by one spouse (the “settlor” or “grantor”) during their lifetime for the benefit of their spouse. For beneficiary spouse’s lifetime, he or she may receive trust income and principal restricted to ascertainable standard of health,. All correspondence for your account will then be sent to the new address. A slat is an.

Building a spousal lifetime access trust Diamond & Associates CPAs

Web the intent of the slat is to have a spouse create a significant trust (funding it with as much (or all) of the donor’s lifetime transfer tax exemption as the donor is willing to use). If this form requires a signature guarantee, the original form must be mailed to us for. Possible law changes in 2021 may have an.

Estate Planning 101 Series Lesson 2 Spousal Lifetime Access Trust

Web these trusts are sometimes called spousal lifetime access trusts or “slats.” · if you’re single you might consider some variation of what is called a self. It is a trust that you (the grantor) set up for the benefit of your spouse and your descendants. All correspondence for your account will then be sent to the new address. Web.

Risk Management for Clients; Spousal Lifetime Access Trust and the True

If structured properly, the assets and any future appreciation is. Web a spousal lifetime access trust, or “slat,” is an irrevocable trust that names the donor’s spouse as a discretionary beneficiary along with others (e.g., children). Pressing planning suggestions from steve siegel: A slat is an irrevocable trust. Possible law changes in 2021 may have an adverse.

Estate Planning Spousal Lifetime Access Trusts (SLATs) Jennings Strouss

Web the spousal lifetime access trust (slat) is one estate planning tool that may address the issue. Web both spouses manage a joint trust while they are still alive and competent. If this form requires a signature guarantee, the original form must be mailed to us for. For beneficiary spouse’s lifetime, he or she may receive trust income and principal.

Spousal Lifetime Access Trusts (SLATs)

Pressing planning suggestions from steve siegel: Web spousal lifetime access trust (slat) (30 pages) $129.00. A slat is an irrevocable trust. Web these trusts are sometimes called spousal lifetime access trusts or “slats.” · if you’re single you might consider some variation of what is called a self. Web the benefits of a slat are:

A Slat Is An Irrevocable Trust.

Web spousal lifetime access trusts (“slats”) may be the most common planning technique for married clients to use in 2020. The form 2848 or form 8821 will be used solely to release the ein to the representative authorized on the form. Web the spousal lifetime access trust (slat) is one estate planning tool that may address the issue. Pressing planning suggestions from steve siegel:

Web An Instrument Creating A Spousal Lifetime Access Trust (Slat) Agreement.

Web you should be having your cpa file a form 1041 trust income tax return for each slat. A slat allows the settlor to make a gift to the trust that removes the trust assets from the settlor's. Pressing planning suggestions from steve siegel: Removal of assets and future appreciation from the grantor’s estate.

Possible Law Changes In 2021 May Have An Adverse.

Web the benefits of a slat are: Web access to funds through his/her spouse. Both spouses will have full access and control over the trust and can change the. Web a spousal lifetime access trust, or “slat,” is an irrevocable trust that names the donor’s spouse as a discretionary beneficiary along with others (e.g., children).

Possible Law Changes In 2021 May Have An Adverse.

For beneficiary spouse’s lifetime, he or she may receive trust income and principal restricted to ascertainable standard of health,. Web these trusts are sometimes called spousal lifetime access trusts or “slats.” · if you’re single you might consider some variation of what is called a self. Web the intent of the slat is to have a spouse create a significant trust (funding it with as much (or all) of the donor’s lifetime transfer tax exemption as the donor is willing to use). All correspondence for your account will then be sent to the new address.