Ssa Form 7050

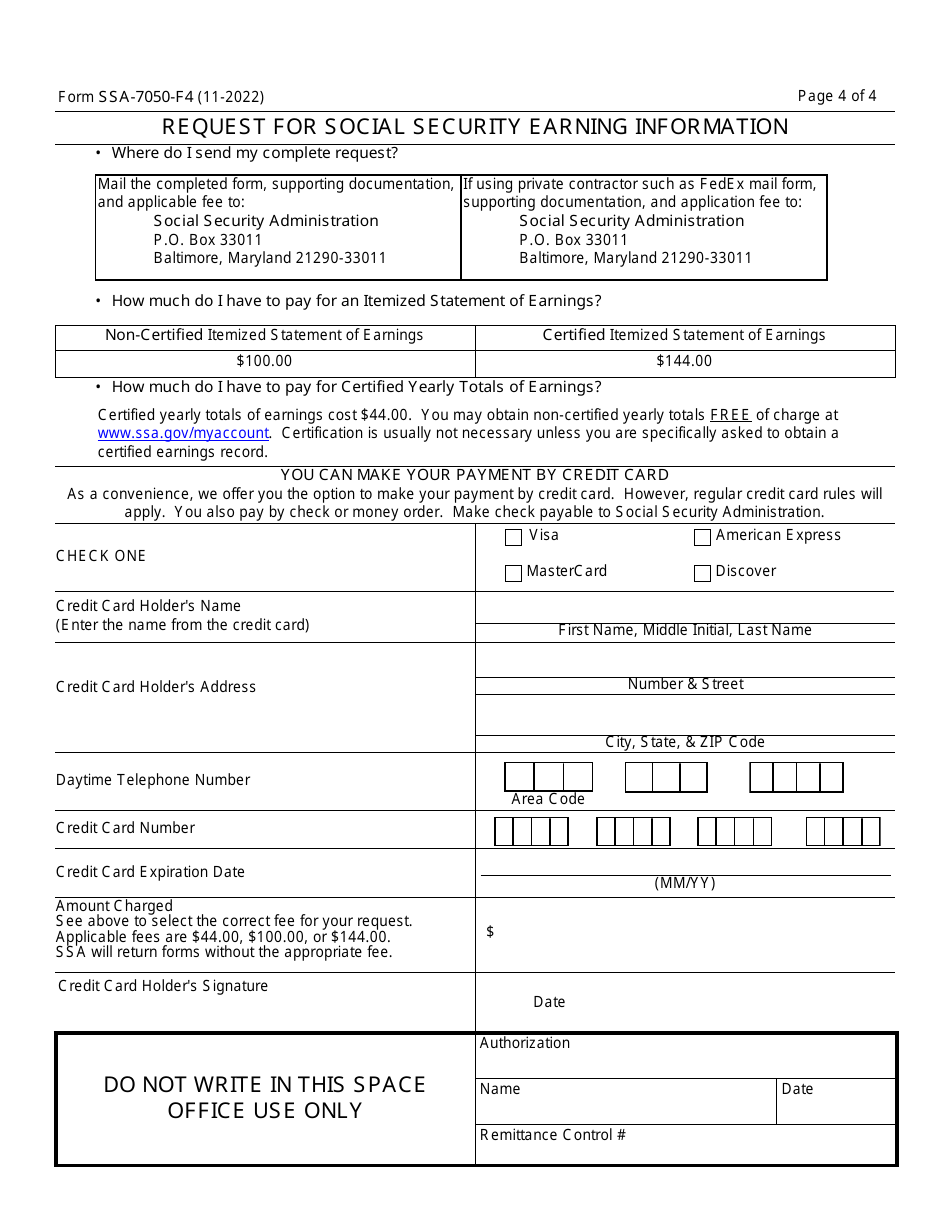

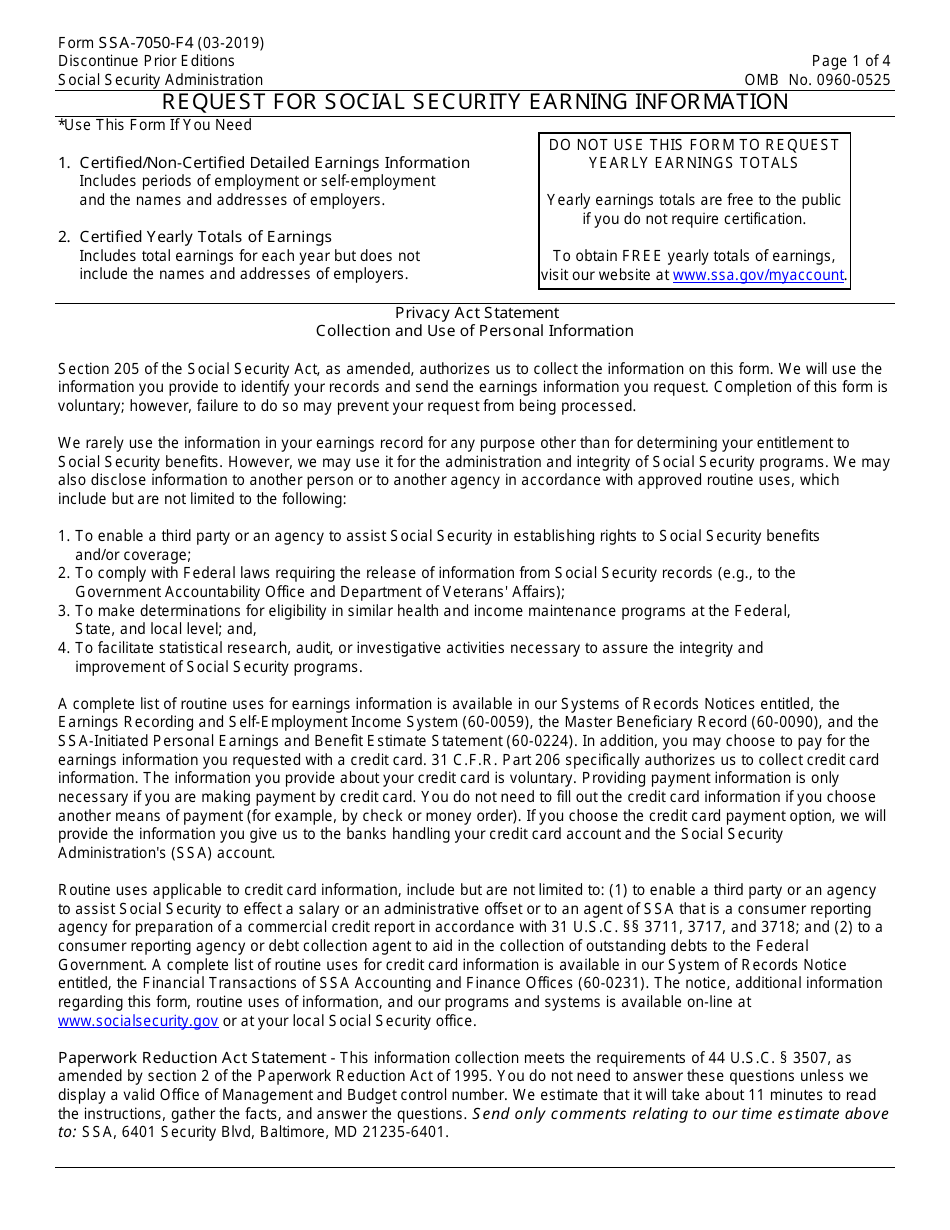

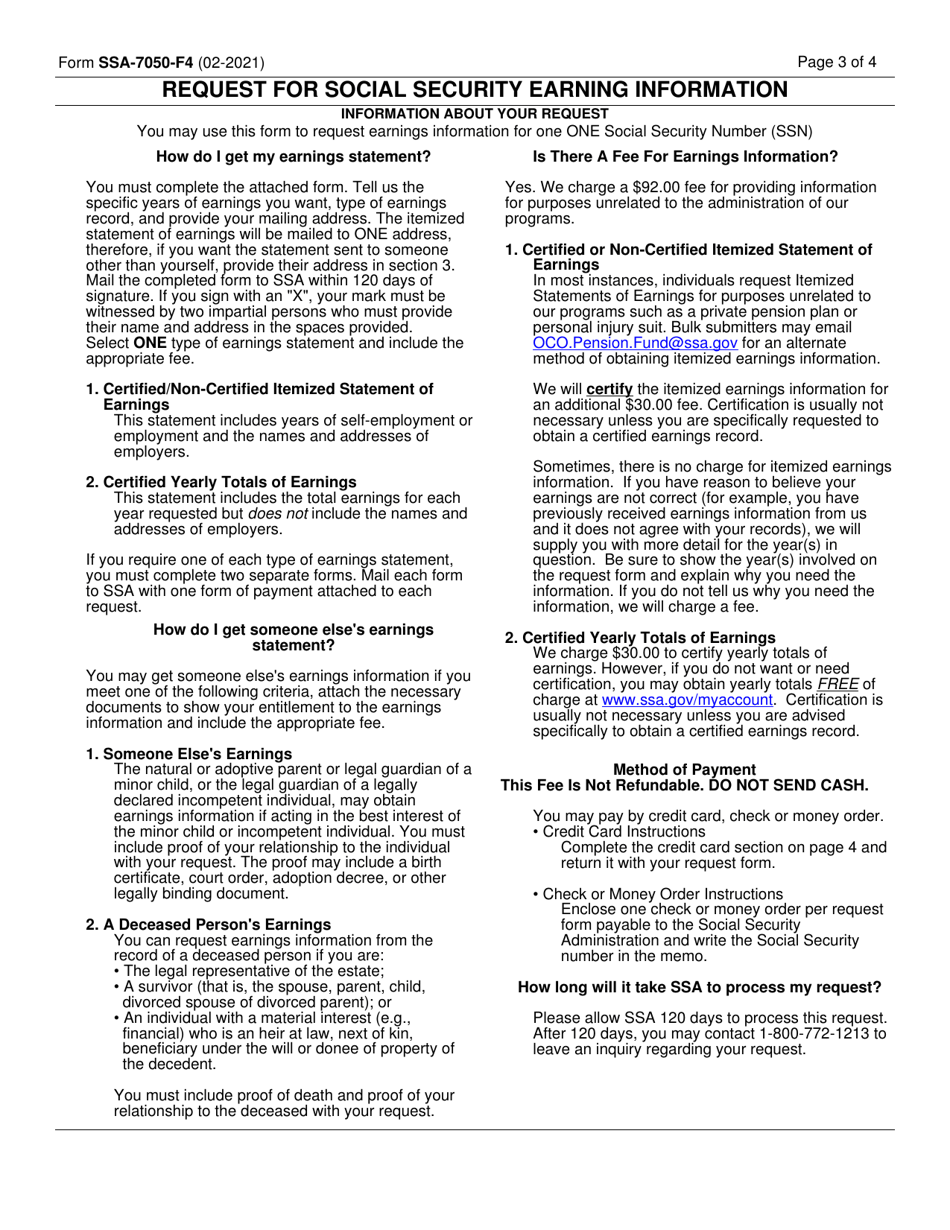

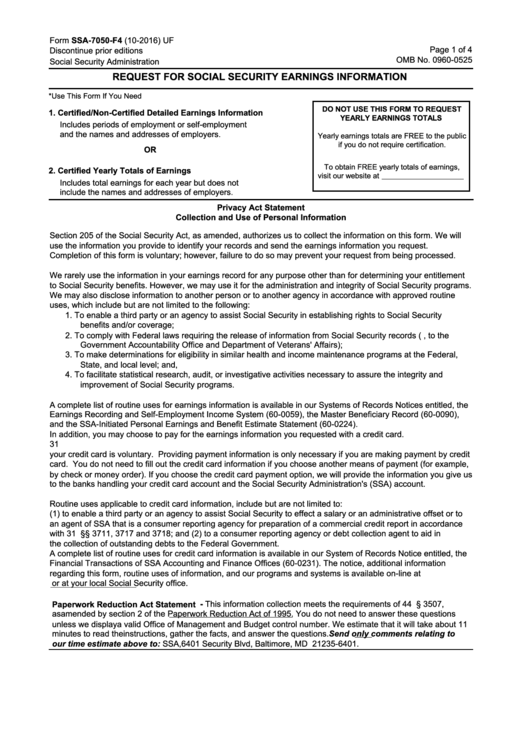

Ssa Form 7050 - You can receive an immediate social security statement online by using a free my social security account. If you download, print and complete a paper form, please mail or take it to your local social. This form should be sent to the social security administration in order to request a. Not all forms are listed. This form is used to request more detailed information about your yearly earnings that contributed to your social security benefits and retirements amount. Web an estimate of how much you have paid in social security taxes; Request for social security earning information. $44.00 for certified yearly earnings totals. If you need more detailed or itemized earnings information for purposes not directly related to administering social security programs, there is a fee. Also, we will not honor blanket requests for any and all records or the entire file.

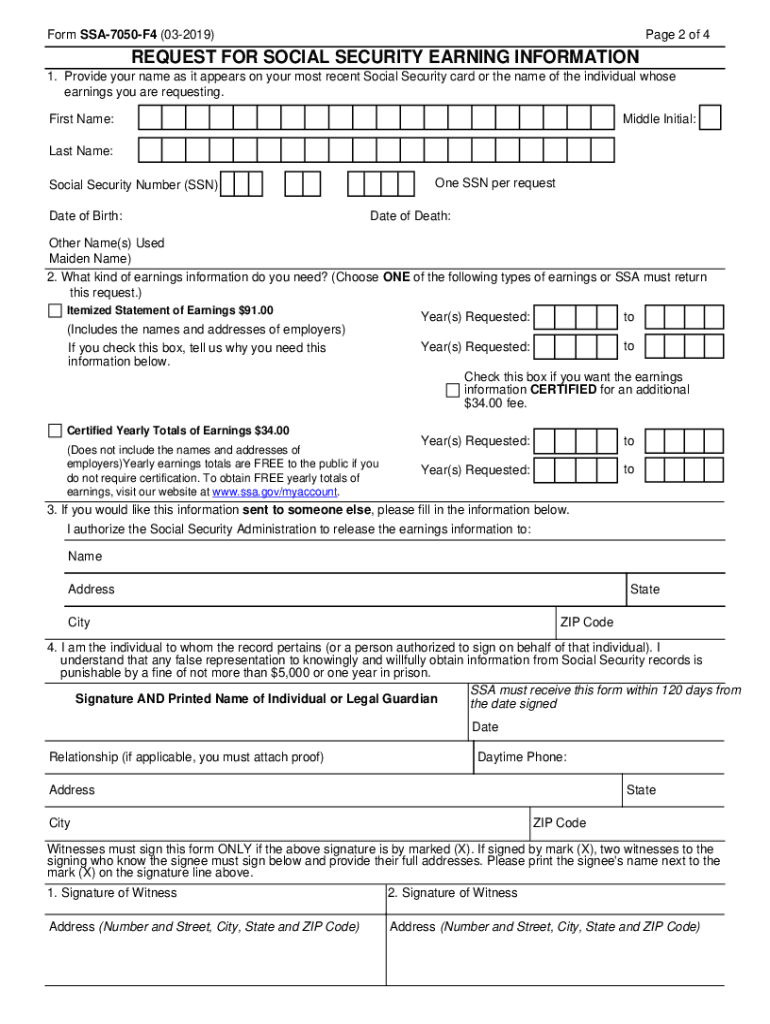

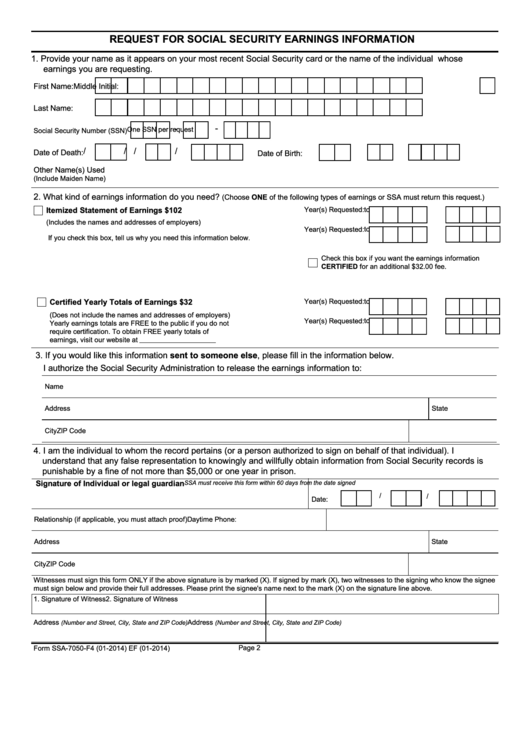

If you need more detailed or itemized earnings information for purposes not directly related to administering social security programs, there is a fee. We charge a $136 fee for providing information purposes unrelated to the administration of our programs. How to complete this form we will not honor this form unless all required fields are completed. An asterisk (*) indicates a required field. Social security number (ssn) one ssn per request date of birth:. You can receive an immediate social security statement online by using a free my social security account. Not all forms are listed. Also, we will not honor blanket requests for any and all records or the entire file. And estimates of benefits you (and your family) may be eligible for now and in the future. $44.00 for certified yearly earnings totals.

Log in or sign up today at www.socialsecurity.gov/myaccount. Request for social security earning information. Web an estimate of how much you have paid in social security taxes; Web what is a ssa 7050? Also, we will not honor blanket requests for any and all records or the entire file. Also, we will not honor blanket requests for any and all records or the entire file. $44.00 for certified yearly earnings totals. The new standard fees are: How to complete this form we will not honor this form unless all required fields are completed. If you download, print and complete a paper form, please mail or take it to your local social.

Form SSA3288 Edit, Fill, Sign Online Handypdf

An asterisk (*) indicates a required field. Also, we will not honor blanket requests for any and all records or the entire file. Also, we will not honor blanket requests for any and all records or the entire file. You can receive an immediate social security statement online by using a free my social security account. How to complete this.

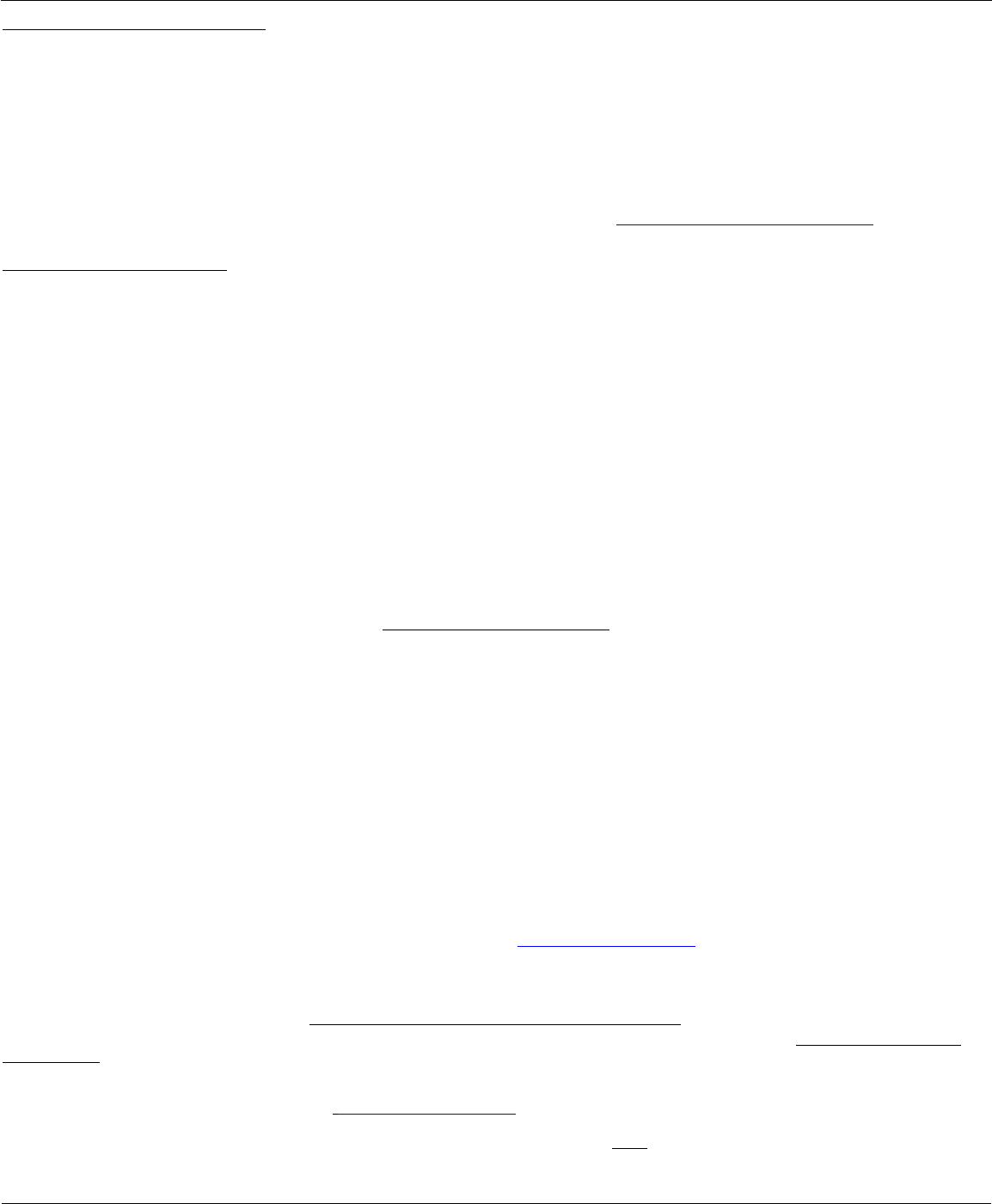

Form SSA7050F4 Download Fillable PDF or Fill Online Request for

The new standard fees are: Social security number (ssn) one ssn per request date of birth:. If you need more detailed or itemized earnings information for purposes not directly related to administering social security programs, there is a fee. This form is used to request more detailed information about your yearly earnings that contributed to your social security benefits and.

2010 Form SSA7050F4 Fill Online, Printable, Fillable, Blank pdfFiller

Provide your name as it appears on your most recent social security card or the name of the individual whose earnings you are requesting. Web an estimate of how much you have paid in social security taxes; Web what is a ssa 7050? If you download, print and complete a paper form, please mail or take it to your local.

Fill Free fillable SSA7050 Request for Social Security Earnings

If you need more detailed or itemized earnings information for purposes not directly related to administering social security programs, there is a fee. Web an estimate of how much you have paid in social security taxes; Also, we will not honor blanket requests for any and all records or the entire file. An asterisk (*) indicates a required field. Provide.

Form SSA7050F4 Download Fillable PDF or Fill Online Request for

Not all forms are listed. And estimates of benefits you (and your family) may be eligible for now and in the future. This form is used to request more detailed information about your yearly earnings that contributed to your social security benefits and retirements amount. The new standard fees are: Web an estimate of how much you have paid in.

Form SSA7050F4 Download Fillable PDF or Fill Online Request for

Log in or sign up today at www.socialsecurity.gov/myaccount. This form should be sent to the social security administration in order to request a. How to complete this form we will not honor this form unless all required fields are completed. A form ssa 7050 is known as a request for social security earnings information. An asterisk (*) indicates a required.

Fillable Form Ssa7050F4 Request For Social Security Earnings

You can receive an immediate social security statement online by using a free my social security account. This form should be sent to the social security administration in order to request a. A form ssa 7050 is known as a request for social security earnings information. Also, we will not honor blanket requests for any and all records or the.

Ssa 7050 Fill Out and Sign Printable PDF Template signNow

Social security number (ssn) one ssn per request date of birth:. Not all forms are listed. Also, we will not honor blanket requests for any and all records or the entire file. How to complete this form we will not honor this form unless all required fields are completed. Log in or sign up today at www.socialsecurity.gov/myaccount.

Form Ssa7050F4 Request For Social Security Earnings Information

Web what is a ssa 7050? $44.00 for certified yearly earnings totals. Social security number (ssn) one ssn per request date of birth:. Also, we will not honor blanket requests for any and all records or the entire file. Web an estimate of how much you have paid in social security taxes;

Form SSA7050 Edit, Fill, Sign Online Handypdf

Provide your name as it appears on your most recent social security card or the name of the individual whose earnings you are requesting. Web what is a ssa 7050? This form is used to request more detailed information about your yearly earnings that contributed to your social security benefits and retirements amount. $44.00 for certified yearly earnings totals. You.

This Form Is Used To Request More Detailed Information About Your Yearly Earnings That Contributed To Your Social Security Benefits And Retirements Amount.

If you need more detailed or itemized earnings information for purposes not directly related to administering social security programs, there is a fee. If you download, print and complete a paper form, please mail or take it to your local social. You can receive an immediate social security statement online by using a free my social security account. A form ssa 7050 is known as a request for social security earnings information.

Not All Forms Are Listed.

And estimates of benefits you (and your family) may be eligible for now and in the future. Web what is a ssa 7050? Also, we will not honor blanket requests for any and all records or the entire file. Also, we will not honor blanket requests for any and all records or the entire file.

Request For Social Security Earning Information.

Provide your name as it appears on your most recent social security card or the name of the individual whose earnings you are requesting. This form should be sent to the social security administration in order to request a. Web an estimate of how much you have paid in social security taxes; $44.00 for certified yearly earnings totals.

An Asterisk (*) Indicates A Required Field.

The new standard fees are: We charge a $136 fee for providing information purposes unrelated to the administration of our programs. An asterisk (*) indicates a required field. Social security number (ssn) one ssn per request date of birth:.