Tax Form 4506 C

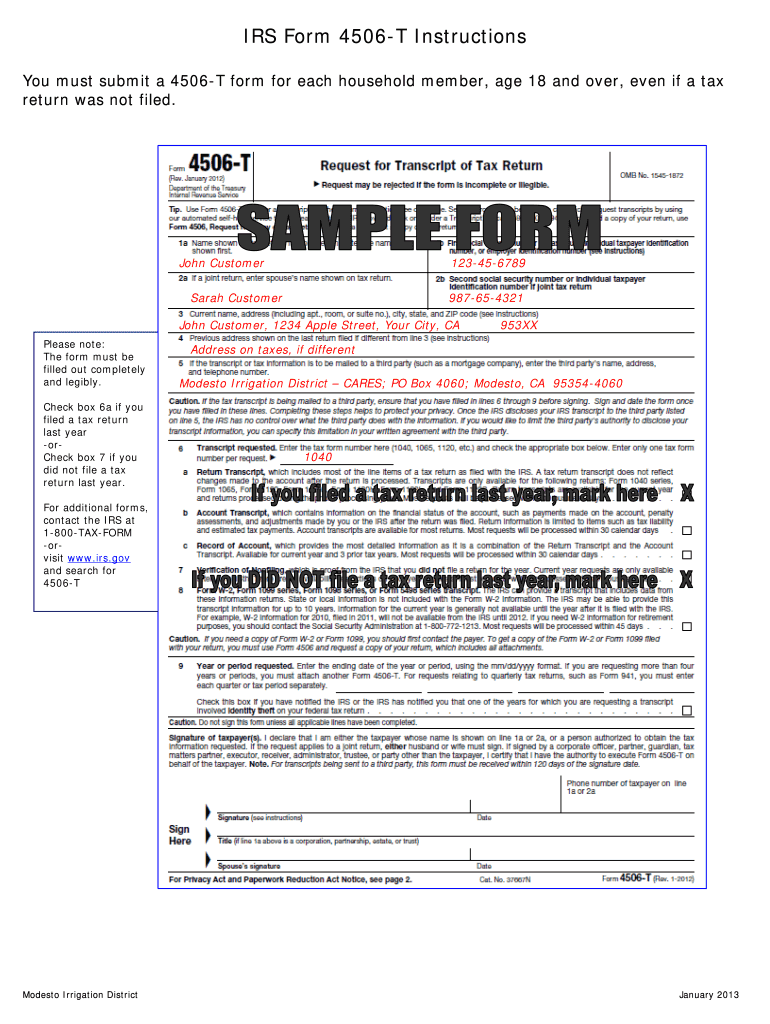

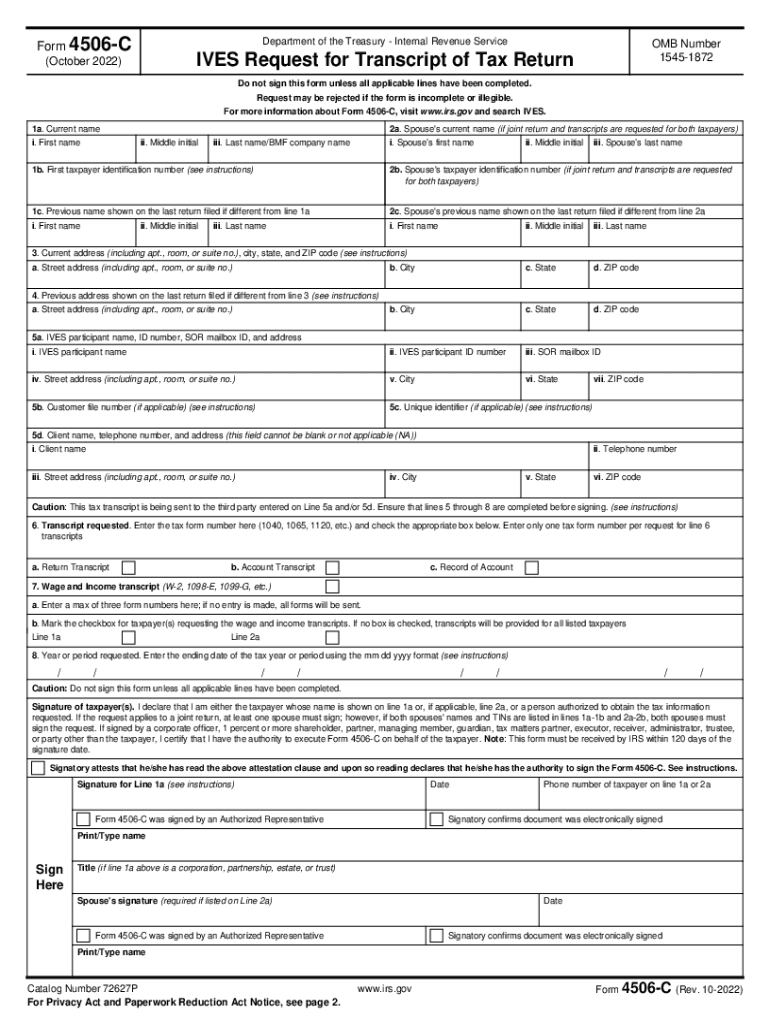

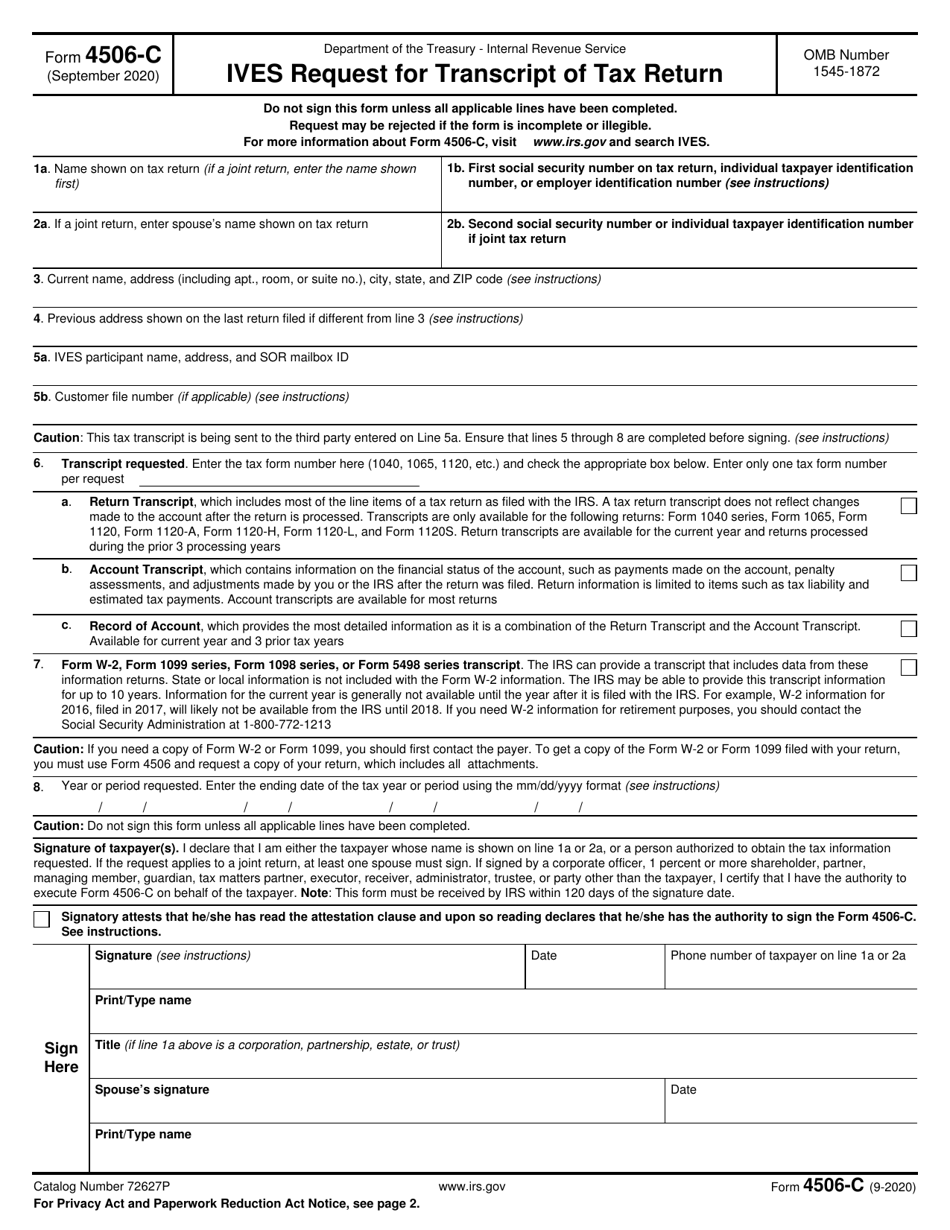

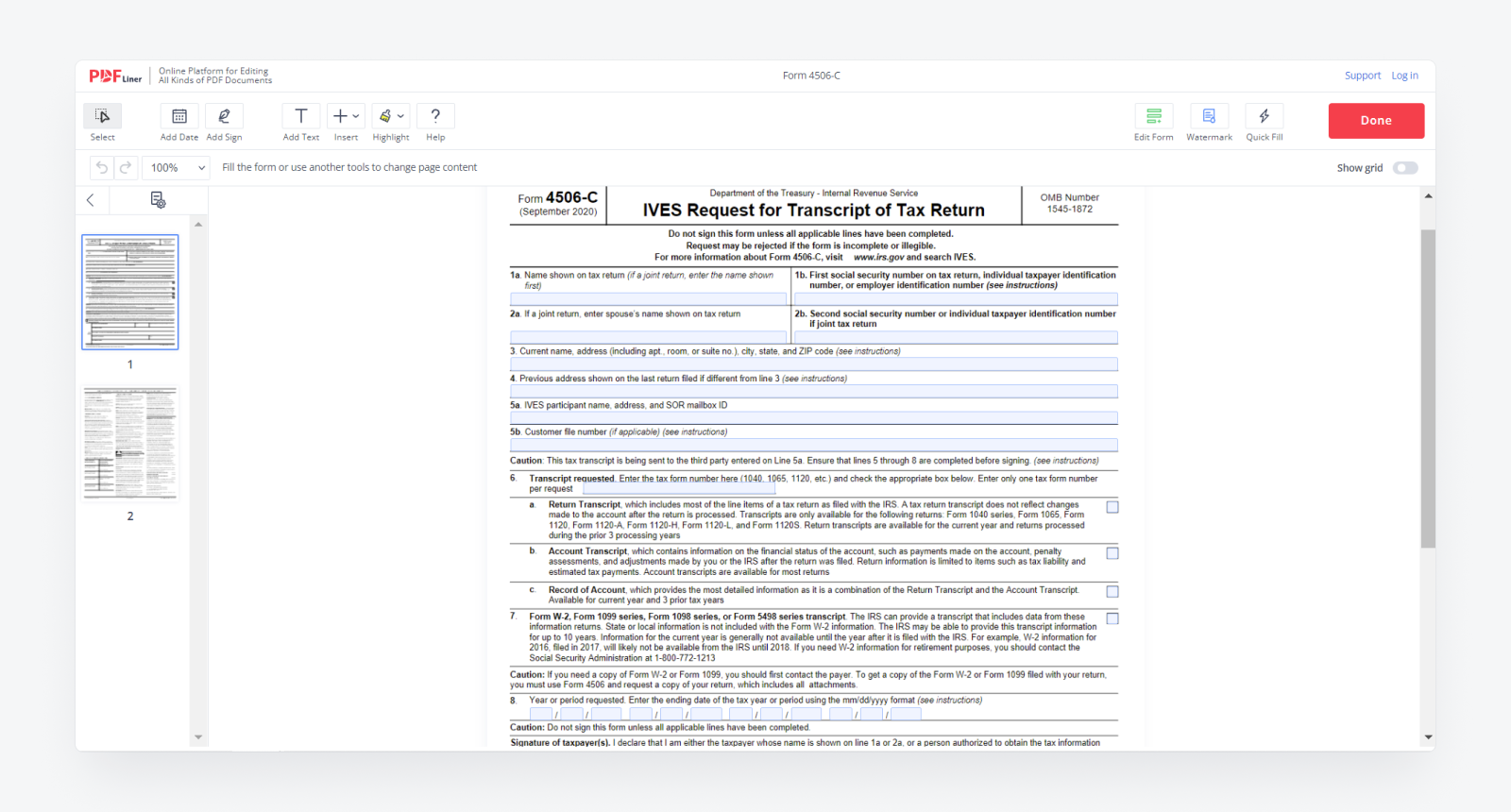

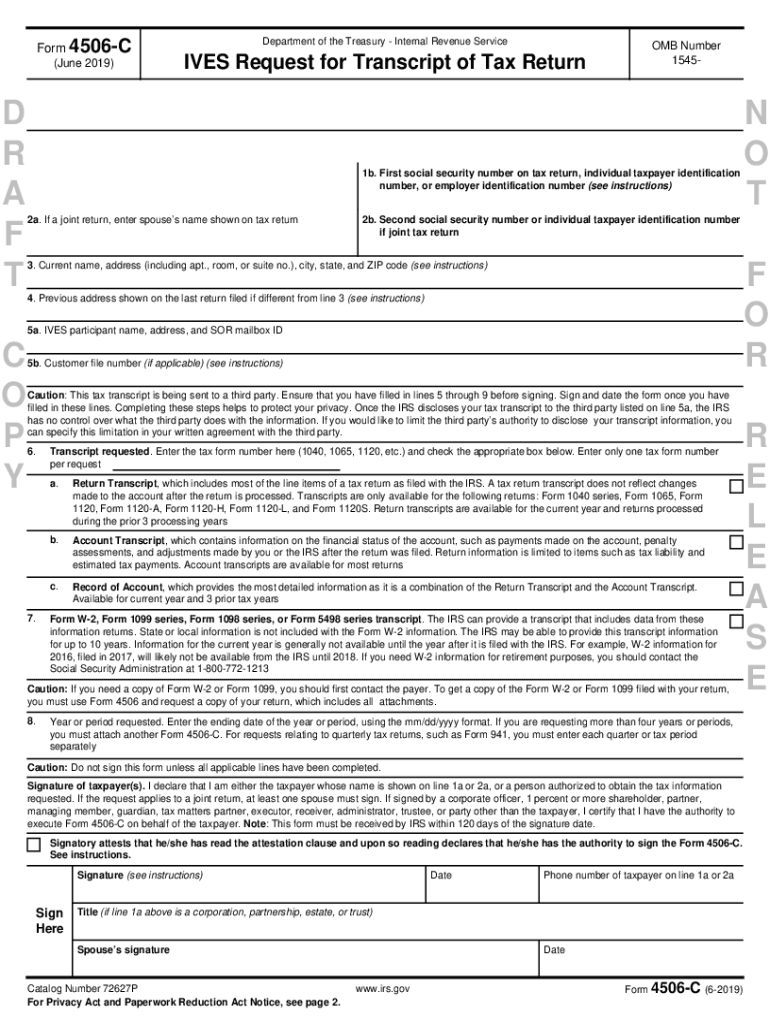

Tax Form 4506 C - You must enter your information exactly as it appears on your 2021 form 1040, otherwise the evaluation of your financial aid eligibility will be delayed. If you are unsure of which type of transcript you need, check. Web generally, tax returns and return information are confidential, as required by section 6103. What is form 4506 c used for? Complete, edit or print tax forms instantly. Tax forms and publications division 1111 constitution ave. With this file, you can choose which transcripts to get for free. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. If you are unsure of which type of transcript you need, request the record of account, as it provides the most To fill out the form, you will need to provide basic information about yourself and the tax return you are requesting.

The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be rejected. It must be filled by the taxpayer and sent to the irs. If you are unsure of which type of transcript you need, request the record of account, as it provides the most Tax forms and publications division 1111 constitution ave. If you are unsure of which type of transcript you need, check. Insert the name of the spouse as it appears on the most recent tax return. Form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. The form may also be used to provide detailed information on your tax return to the third party if you need it. To fill out the form, you will need to provide basic information about yourself and the tax return you are requesting. Enter the name of the primary taxpayer shown on the tax return (if a joint return, enter the name shown first on the tax return.) line 2a:

You must enter your information exactly as it appears on your 2021 form 1040, otherwise the evaluation of your financial aid eligibility will be delayed. If you are unsure of which type of transcript you need, request the record of account, as it provides the most If you’re an ives participant, you can order transcript records online; Form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. You will designate an ives participant to receive the information on line 5a. What is form 4506 c used for? If you are unsure of which type of transcript you need, check. With this file, you can choose which transcripts to get for free. Do not sign this form unless all applicable lines have been completed.

4506 C Fill Out and Sign Printable PDF Template signNow

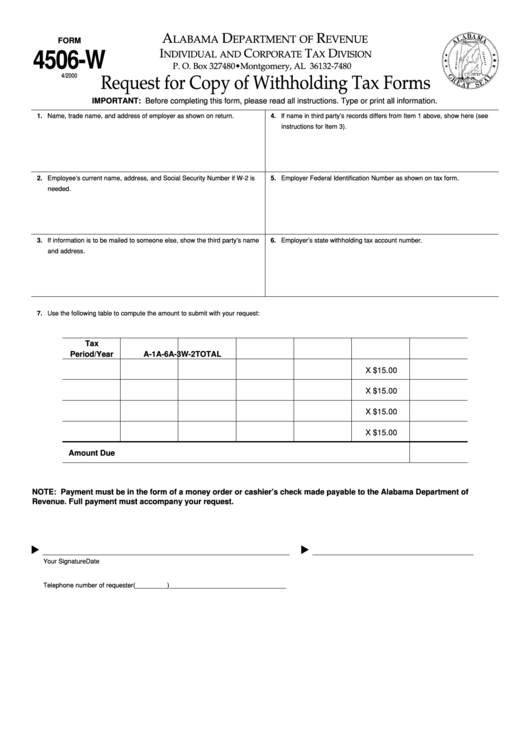

Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Tax forms and publications division 1111 constitution ave. Insert the name of the spouse as it appears on the most recent tax return. Request may be rejected if the form is incomplete or illegible. Form 4506 is used.

Form 4506W Request For Copy Of Withholding Tax Forms printable pdf

Tax forms and publications division 1111 constitution ave. If you’re an ives participant, you can order transcript records online; Web generally, tax returns and return information are confidential, as required by section 6103. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Form 4506 must be signed and dated by the taxpayer listed on line 1a or.

Form 4506 Request for Copy of Tax Return (2015) Free Download

You must enter your information exactly as it appears on your 2021 form 1040, otherwise the evaluation of your financial aid eligibility will be delayed. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. With this file, you can choose which transcripts to get for free. The first section of the form requires your name, address, social.

IRS Form 4506C Download Fillable PDF or Fill Online Ives Request for

See how do i apply for ives? Do not sign this form unless all applicable lines have been completed. Web generally, tax returns and return information are confidential, as required by section 6103. You must enter your information exactly as it appears on your 2021 form 1040, otherwise the evaluation of your financial aid eligibility will be delayed. Tax forms.

Fill Free fillable Form 4506C IVES Request for Transcript of Tax

Form 4506 is used by taxpayers to request copies of their tax returns for a fee. Instead, see where to file on this page. You will designate an ives participant to receive the information on line 5a. Enter the name of the primary taxpayer shown on the tax return (if a joint return, enter the name shown first on the.

Fill Free fillable Request For Verification Of Nonfiling PDF form

Complete, edit or print tax forms instantly. What is form 4506 c used for? It must be filled by the taxpayer and sent to the irs. If you are unsure of which type of transcript you need, check. You will designate an ives participant to receive the information on line 5a.

How to Fill Out Form 4506C & Tips on IRS Tax Form 4506C Completion

With this file, you can choose which transcripts to get for free. Do not send the form to this address. Form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Request may be rejected if the form is incomplete or illegible. To fill out the form, you will need to provide basic information about.

4506 C Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Insert the name of the spouse as it appears on the most recent tax return. If you are unsure of which type of transcript you need, check. Request may be rejected if the form is incomplete or illegible. It must be filled by the taxpayer and sent to the irs. Do not sign this form unless all applicable lines have.

Form 4506 Request for Copy of Tax Return Definition

Do not send the form to this address. You must enter your information exactly as it appears on your 2021 form 1040, otherwise the evaluation of your financial aid eligibility will be delayed. 1 to access the form, click on “click here to review and esign.” With this file, you can choose which transcripts to get for free. Complete, edit.

HardyHardhik

Complete, edit or print tax forms instantly. You must enter your information exactly as it appears on your 2021 form 1040, otherwise the evaluation of your financial aid eligibility will be delayed. You will designate an ives participant to receive the information on line 5a. The first section of the form requires your name, address, social security number, and date.

Form 4506 Is Used By Taxpayers To Request Copies Of Their Tax Returns For A Fee.

Web generally, tax returns and return information are confidential, as required by section 6103. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. 1 to access the form, click on “click here to review and esign.” The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be rejected.

Tax Forms And Publications Division 1111 Constitution Ave.

You will designate an ives participant to receive the information on line 5a. Instead, see where to file on this page. What is form 4506 c used for? The form may also be used to provide detailed information on your tax return to the third party if you need it.

Web Form 4506 (Novmeber 2021) Department Of The Treasury Internal Revenue Service.

Enter the name of the primary taxpayer shown on the tax return (if a joint return, enter the name shown first on the tax return.) line 2a: You must enter your information exactly as it appears on your 2021 form 1040, otherwise the evaluation of your financial aid eligibility will be delayed. Do not send the form to this address. See how do i apply for ives?

Request May Be Rejected If The Form Is Incomplete Or Illegible.

The first section of the form requires your name, address, social security number, and date of birth. To fill out the form, you will need to provide basic information about yourself and the tax return you are requesting. It must be filled by the taxpayer and sent to the irs. If you are unsure of which type of transcript you need, request the record of account, as it provides the most

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)