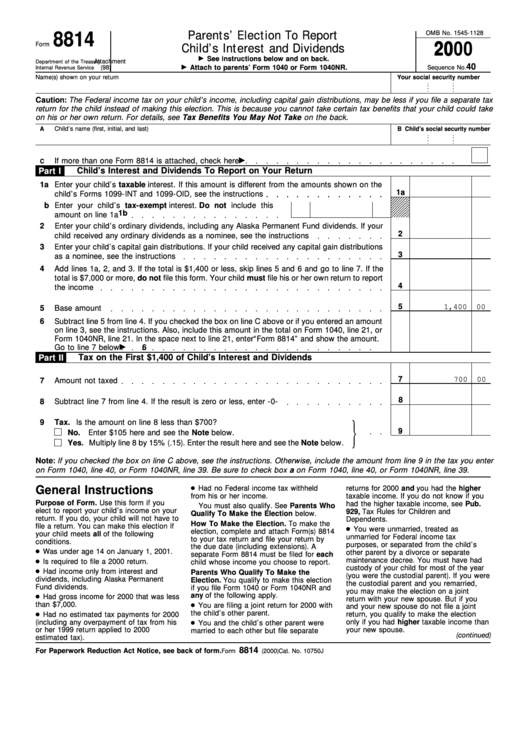

Tax Form 8814

Tax Form 8814 - This form is for income earned in tax year 2022, with tax returns due in april. 2) click on wages and income 3) click. You can make this election if your child. Find irs forms and answers to tax questions. Web what is form 8814? Complete line 7b if applicable. If your child files their own return and the kiddie tax applies, file form. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Web federal income tax forms federal form 8814 federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't. Parents may elect to include their child's income from interest, dividends, and capital gains with.

If income is reported on a. A separate form 8814 must be filed for each. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Find irs forms and answers to tax questions. A separate form 8814 must. Get ready for tax season deadlines by completing any required tax forms today. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web to make the election, complete and attach form 8814 to your tax return and file your return by the due date (including extensions). We help you understand and meet your federal tax responsibilities. Parents may elect to include their child's income from interest, dividends, and capital gains with.

Ad access irs tax forms. If you file form 8814 with your income tax return to report. You can make this election if your child. Types of unearned income in form 8814 this tax. Use this form if you elect to report your child’s income on your return. This form is for income earned in tax year 2022, with tax returns due in april. Get ready for tax season deadlines by completing any required tax forms today. A separate form 8814 must be filed for each. Complete, edit or print tax forms instantly. Employee's withholding certificate form 941;

Form 8814 Instructions 2010

Get ready for tax season deadlines by completing any required tax forms today. Web to make the election, complete and attach form 8814 to your tax return and file your return by the due date (including extensions). A separate form 8814 must. Complete, edit or print tax forms instantly. If income is reported on a.

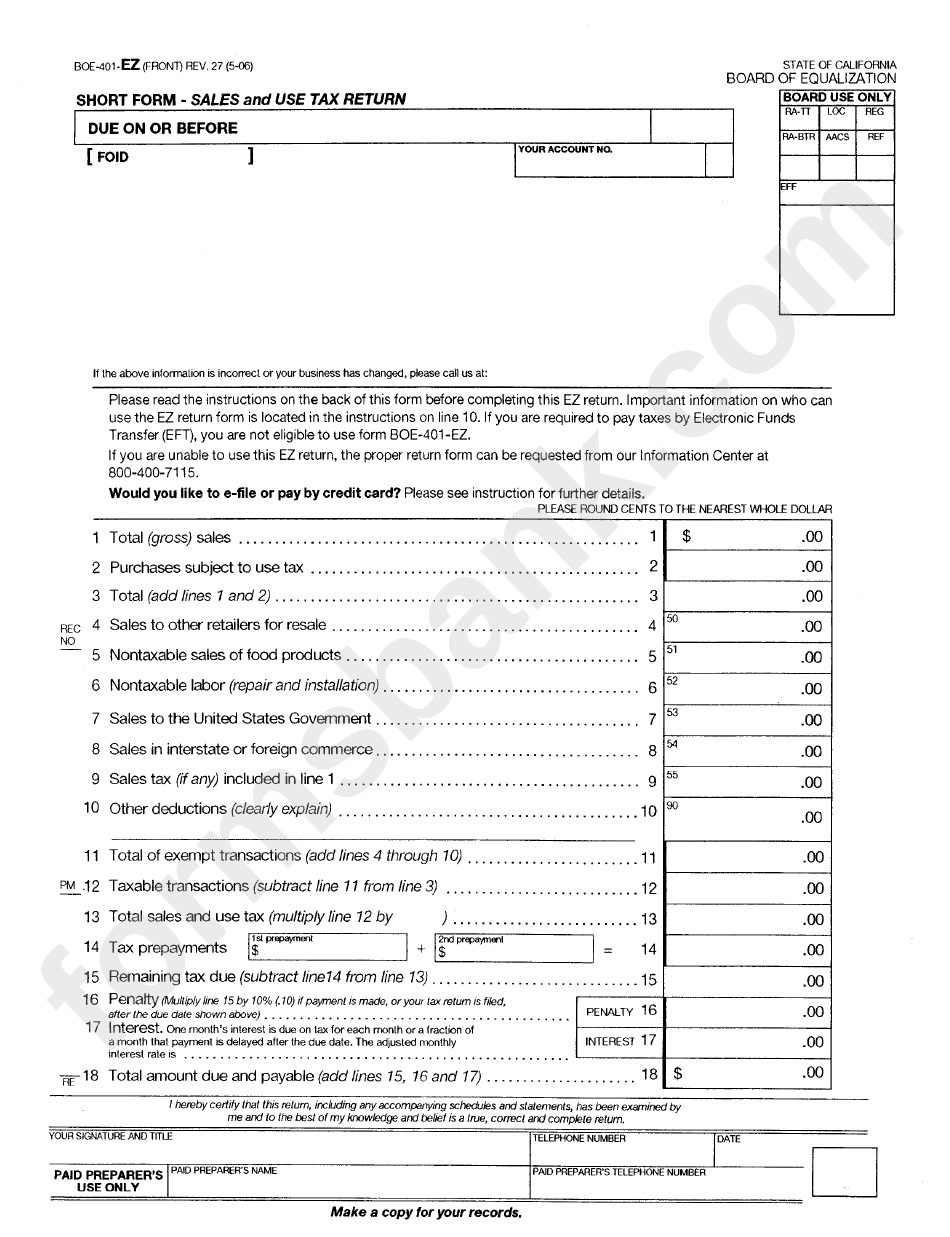

Form Boe401Ez Sales And Use Tax Return Short Form printable pdf

Web this certificate is for income tax withholding and child support enforcement purposes only. A separate form 8814 must. If you do, your child will not have to file a return. Register and subscribe now to work on your irs form 8814 & more fillable forms. Within 20 days of hiring a new employee, a copy of the.

maine tax table

Web what is form 8814? If you file form 8814 with your income tax return to report. Web you do that by attaching irs form 8814, which reports your child’s interest income on the parent’s tax return. Complete, edit or print tax forms instantly. Web this certificate is for income tax withholding and child support enforcement purposes only.

INTERESTING STUFF 21 February 2020 TIME GOES BY

Complete, edit or print tax forms instantly. If you do, your child will not have to file a return. Web you can get form 8814 by performing the following steps: Find irs forms and answers to tax questions. Employee's withholding certificate form 941;

Fillable Form 8814 Parents' Election To Report Child'S Interest And

Web if you use form 8814, your increased adjusted gross income may reduce certain deductions or credits on your return, including the following. 1) click on the personal or federal tab to the left of your screen. Ad access irs tax forms. Find irs forms and answers to tax questions. Web what is form 8814?

Printable 2290 Tax Form 2021 Printable Form 2022

Web employer's quarterly federal tax return. You can make this election if your child. Web when you report your child’s interest and dividend income on your return, file form 8814 with your return. If you choose this election, your child may not have to file a return. We help you understand and meet your federal tax responsibilities.

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Web you do that by attaching irs form 8814, which reports your child’s interest income on the parent’s tax return. Web this certificate is for income tax withholding and child support enforcement purposes only. Parents may elect to include their child's income from interest, dividends, and capital gains with. Web information about form 8814, parent's election to report child's interest.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Get ready for tax season deadlines by completing any required tax forms today. Web to make the election, complete and attach form 8814 to your tax return and file your return by the due date (including extensions). Complete line 7b if applicable. 2) click on wages and income 3) click. Web what is form 8814?

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Ad access irs tax forms. Web to make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). Web you can get form 8814 by performing the following steps: Web you do that by attaching irs form 8814, which reports your child’s interest income on the parent’s tax.

Schedule 8812 What is IRS Form Schedule 8812 & Filing Instructions

Parents may elect to include their child's income from interest, dividends, and capital gains with. You can make this election if your child. A separate form 8814 must be filed for each. Web what is form 8814? Web to make the election, complete and attach form 8814 to your tax return and file your return by the due date (including.

Web You Do That By Attaching Irs Form 8814, Which Reports Your Child’s Interest Income On The Parent’s Tax Return.

Web federal income tax forms federal form 8814 federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't. If you choose this election, your child may not have to file a return. Use this form if you elect to report your child’s income on your return. Types of unearned income in form 8814 this tax.

Web What Is Form 8814?

Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Web when you report your child’s interest and dividend income on your return, file form 8814 with your return. Ad access irs tax forms. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to.

If Your Child Files Their Own Return And The Kiddie Tax Applies, File Form.

Web employer's quarterly federal tax return. Complete, edit or print tax forms instantly. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies.

Web If You Use Form 8814, Your Increased Adjusted Gross Income May Reduce Certain Deductions Or Credits On Your Return, Including The Following.

If you do, your child will not have to file a return. Deduction for contributions to a. Web you can get form 8814 by performing the following steps: A separate form 8814 must.