Texas Property Tax Deferral Form

Texas Property Tax Deferral Form - Donotpay is here to help with information and advice on. Web (f) notwithstanding the other provisions of this section, if an individual who qualifies for a deferral or abatement of collection of taxes on property as provided by. Web to obtain a deferral, an individual must file with the chief appraiser for the appraisal district in which the property is located an affidavit stating the facts required to. This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06. Web for many senior homeowners, rising property taxes can be a threat to their financial stability, even though their mortgages may be paid off. Therefore, the law allows you to. Complete the form, have it notarized, and return it to the district; A 5% increase would have resulted in a value of $105,000. Web before using the appraisal increase deferral, homeowners should first contact the tax offices for the jurisdictions in which their property is located to determine how much tax. Web an individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled (as defined by section 11.13 (m) of the texas.

Complete the form, have it notarized, and return it to the district; Web the law allows you to defer paying property taxes on any amount of increase over 5%. Web if you move to another home and the taxes on the new residence homestead would normally be $1,000 in the first year, the new tax ceiling would be $250, or 25 percent of. The taxpayer should be able to complete the form. Web obtain the tax deferral affidavit from the appraisal district; A 5% increase would have resulted in a value of $105,000. Web to apply for a deferral, you will need to complete one or more of the following forms found in your county tax assessor collector’s office: Web for many senior homeowners, rising property taxes can be a threat to their financial stability, even though their mortgages may be paid off. Donotpay is here to help with information and advice on. Therefore, the law allows you to.

Web before using the appraisal increase deferral, homeowners should first contact the tax offices for the jurisdictions in which their property is located to determine how much tax. Web an individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled (as defined by section 11.13 (m) of the texas. Web texas offers a variety of partial or total, sometimes referred to as absolute, exemptions from appraised property values used to determine local property taxes. Complete the form, have it notarized, and return it to the district; The taxpayer should be able to complete the form. Waiver of delinquent penalty & interest: This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06. A 5% increase would have resulted in a value of $105,000. And pay the current taxes on all but the value over. The texas tax code, section.

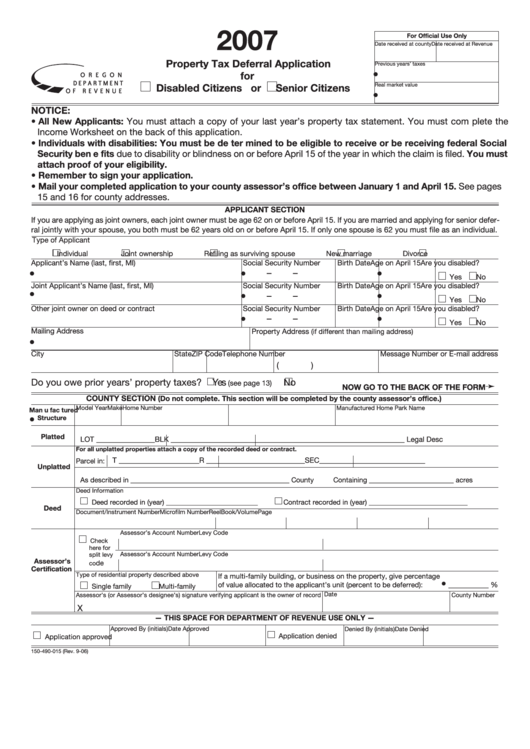

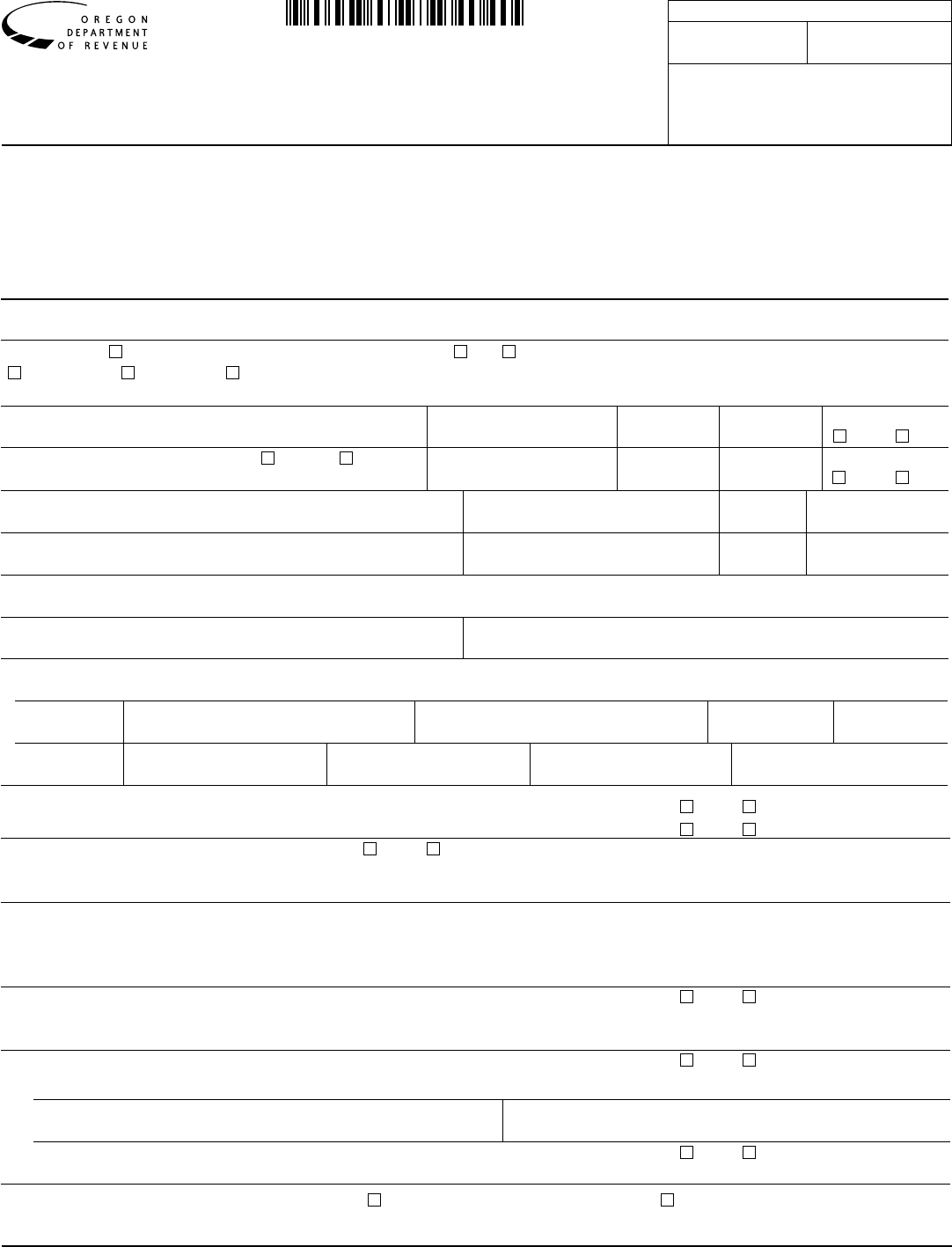

Fillable Form 150490015 Property Tax Deferral Application For

And pay the current taxes on all but the value over. Web obtain the tax deferral affidavit from the appraisal district; Web the law allows you to defer paying property taxes on any amount of increase over 5%. Web if you move to another home and the taxes on the new residence homestead would normally be $1,000 in the first.

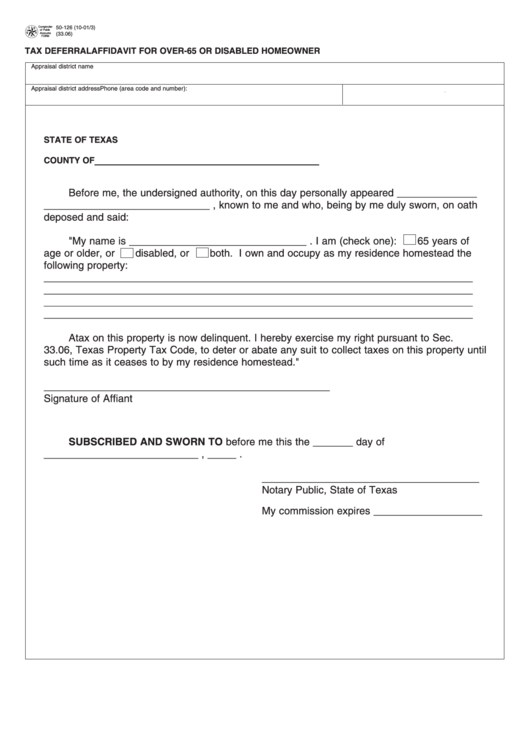

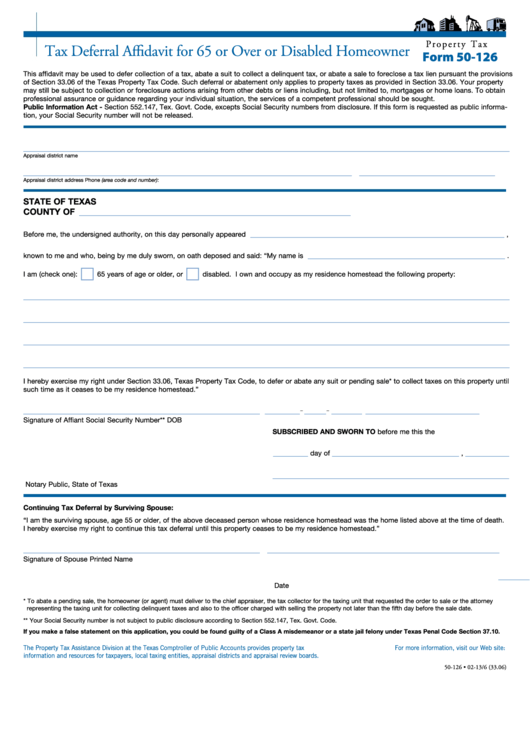

Form 50126 Tax Deferral Affidavit For Over65 Or Disabled Homeowner

A 5% increase would have resulted in a value of $105,000. Web the tax deferment, like a homestead or senior exemption, is available to qualified homeowners free of charge. Waiver of delinquent penalty & interest: The taxpayer should be able to complete the form. Web an individual is entitled to defer collection of a tax on their homestead property if.

What is the Alberta Seniors Property Tax Deferral Program Verhaeghe

The taxpayer should be able to complete the form. Web obtain the tax deferral affidavit from the appraisal district; Web before using the appraisal increase deferral, homeowners should first contact the tax offices for the jurisdictions in which their property is located to determine how much tax. Donotpay is here to help with information and advice on. Web (f) notwithstanding.

DELINQUENT TAXES Alamo Note Buyers

Web if you move to another home and the taxes on the new residence homestead would normally be $1,000 in the first year, the new tax ceiling would be $250, or 25 percent of. Web (f) notwithstanding the other provisions of this section, if an individual who qualifies for a deferral or abatement of collection of taxes on property as.

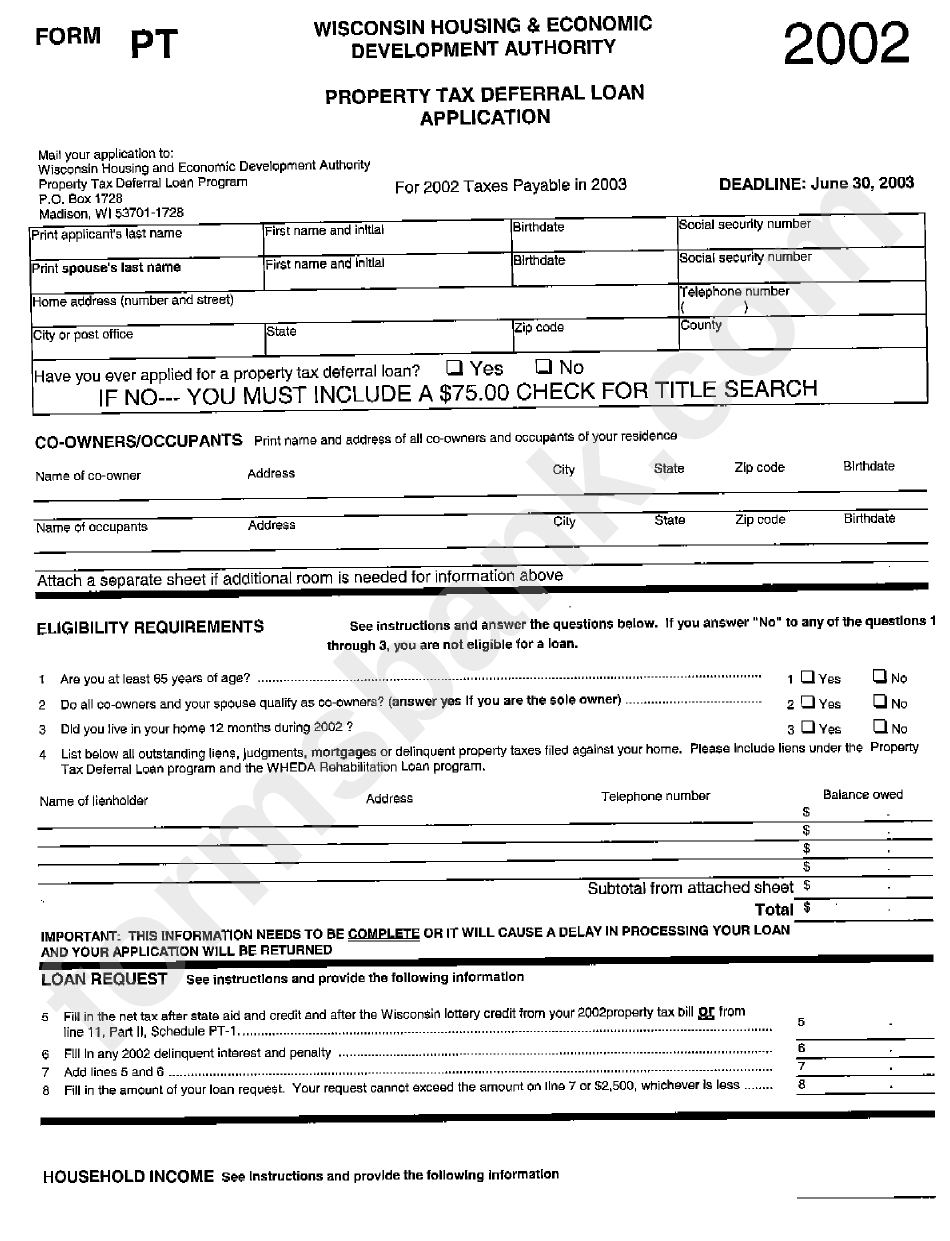

Form Pt Property Tax Deferral Loan Application 2002 printable pdf

Web the tax deferment, like a homestead or senior exemption, is available to qualified homeowners free of charge. Web this is a potential problem for senior citizens with limited income, and many may require help paying their property tax. Web if you move to another home and the taxes on the new residence homestead would normally be $1,000 in the.

What Are Property Tax Deferrals? Johnson & Starr

Web an individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled (as defined by section 11.13 (m) of the texas. Web (f) notwithstanding the other provisions of this section, if an individual who qualifies for a deferral or abatement of collection of taxes on property.

Fillable Form 50126 Tax Deferral Affidavit For 65 Or Over Or

Web the tax deferment, like a homestead or senior exemption, is available to qualified homeowners free of charge. Web an individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled (as defined by section 11.13 (m) of the texas. The texas tax code, section. And pay.

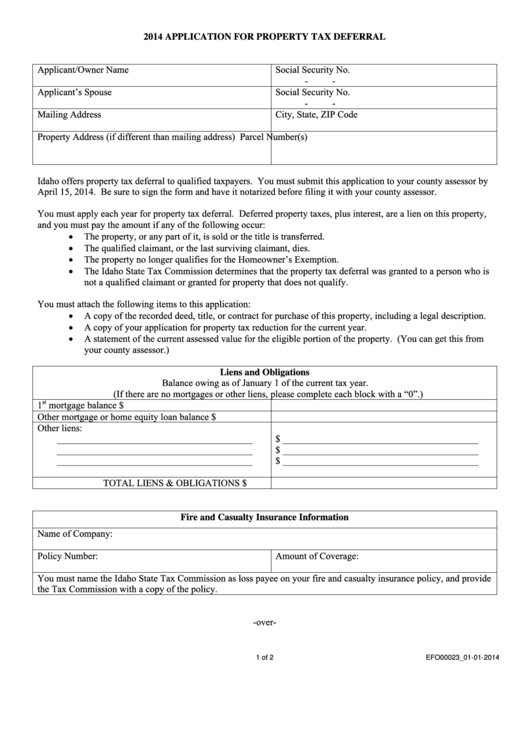

Form Efo00023 Application For Property Tax Deferral 2014 printable

The taxpayer should be able to complete the form. Waiver of delinquent penalty & interest: Web the law allows you to defer paying property taxes on any amount of increase over 5%. Web texas offers a variety of partial or total, sometimes referred to as absolute, exemptions from appraised property values used to determine local property taxes. This affidavit is.

Property Tax Deferral Application Edit, Fill, Sign Online Handypdf

And pay the current taxes on all but the value over. Waiver of delinquent penalty & interest: Web this affidavit may be used to defer collection of a tax, abate a suit to collect a delinquent tax, or abate a sale to foreclose a tax lien pursuant the provisions of section 33.06 of the. The texas tax code, section. Web.

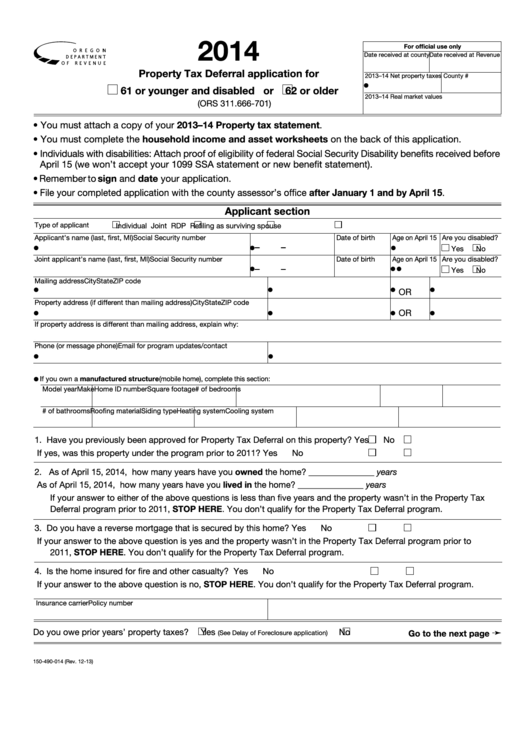

Fillable Form 150490014 Property Tax Deferral Application For 61 Or

Web obtain the tax deferral affidavit from the appraisal district; Web an individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled (as defined by section 11.13 (m) of the texas. Web this is a potential problem for senior citizens with limited income, and many may.

Web This Affidavit May Be Used To Defer Collection Of A Tax, Abate A Suit To Collect A Delinquent Tax, Or Abate A Sale To Foreclose A Tax Lien Pursuant The Provisions Of Section 33.06 Of The.

Web obtain the tax deferral affidavit from the appraisal district; Therefore, the law allows you to. Web for many senior homeowners, rising property taxes can be a threat to their financial stability, even though their mortgages may be paid off. Web before using the appraisal increase deferral, homeowners should first contact the tax offices for the jurisdictions in which their property is located to determine how much tax.

Complete The Form, Have It Notarized, And Return It To The District;

Web the tax deferment, like a homestead or senior exemption, is available to qualified homeowners free of charge. Web texas offers a variety of partial or total, sometimes referred to as absolute, exemptions from appraised property values used to determine local property taxes. The texas tax code, section. Web the law extends the tax deferral to the surviving spouse of the person who deferred taxes on the homestead if the surviving spouse was at least 55 years old when.

The Taxpayer Should Be Able To Complete The Form.

A 5% increase would have resulted in a value of $105,000. Web to obtain a deferral, an individual must file with the chief appraiser for the appraisal district in which the property is located an affidavit stating the facts required to. Web an individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled (as defined by section 11.13 (m) of the texas. Waiver of delinquent penalty & interest:

This Affidavit Is Used To Obtain A Tax Deferral On The Collection Of Residence Homestead Taxes Pursuant To Tax Code Section 33.06.

Web to apply for a deferral, you will need to complete one or more of the following forms found in your county tax assessor collector’s office: Donotpay is here to help with information and advice on. Web if you move to another home and the taxes on the new residence homestead would normally be $1,000 in the first year, the new tax ceiling would be $250, or 25 percent of. And pay the current taxes on all but the value over.