The Most Common Form Of Business Organization Is

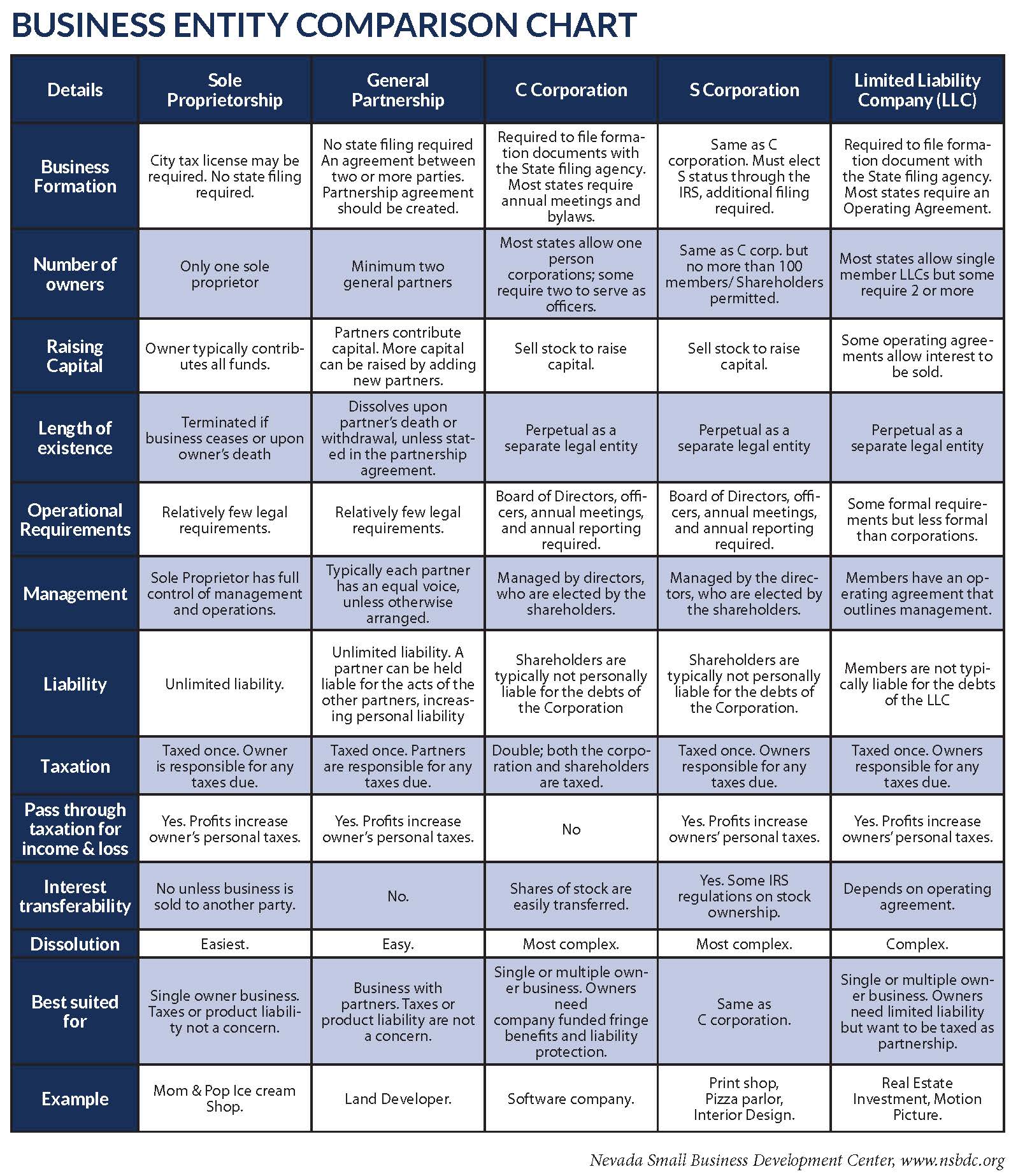

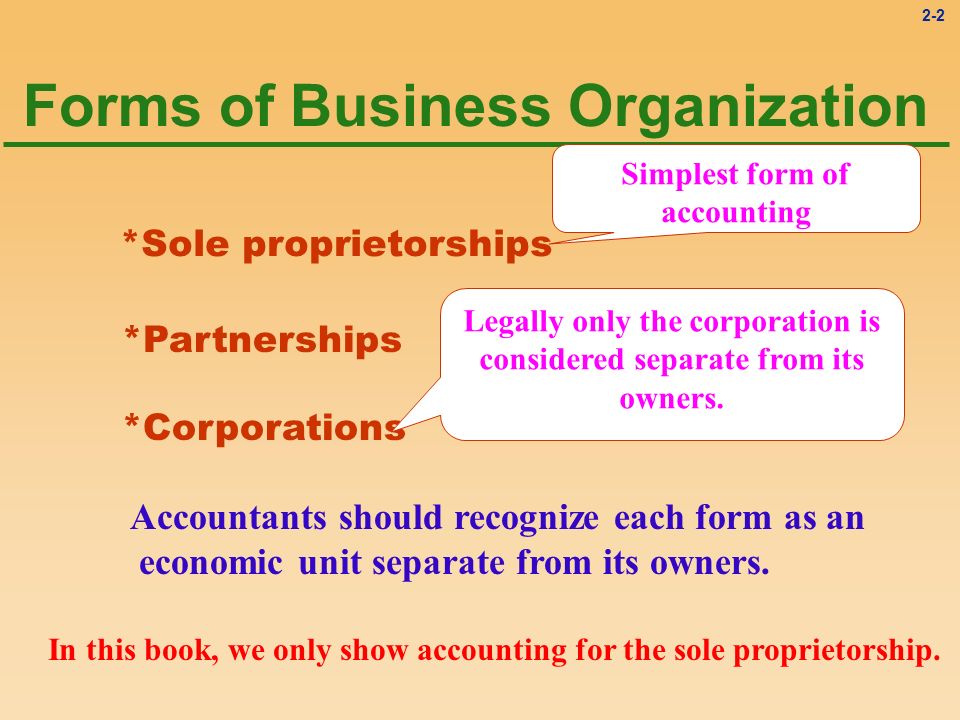

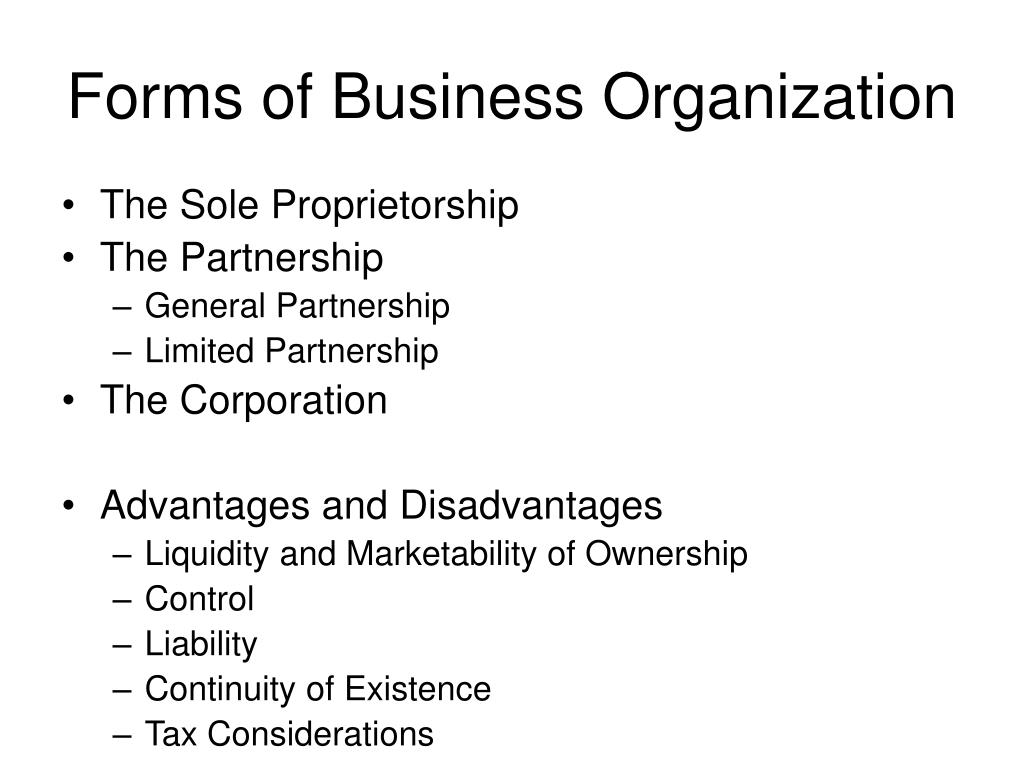

The Most Common Form Of Business Organization Is - As defined by the irs , a sole proprietor “is someone who owns an unincorporated. Web there are three forms of business organization in the united states: Web 4 types of business organizations most frequently used; Web the most common form of business organization is the: Web 5 main types/forms of business organization 1. A limited liability company (llc) is a. A corporation, a partnership, and a sole proprietorship. There are various forms of. One person conducts business for him or herself. Web a sole proprietorship is the most common type of business structure.

But the business owner is also. Web a sole proprietorship is the most common type of business structure. Web here’s what you need to know about the most common forms of business organization and how to choose the best one for you. A corporation, a partnership, and a sole proprietorship. Each type of business has advantages and. Web 5 main types/forms of business organization 1. There are various forms of. Web a nonprofit corporation can achieve this if it invests all of its generated cash flow for expansion and future operations. Web this publication provides a catalog of security and privacy controls for information systems and organizations to protect organizational operations and assets,. Web up to 10% cash back the sole proprietorship is the most common form of business organization.

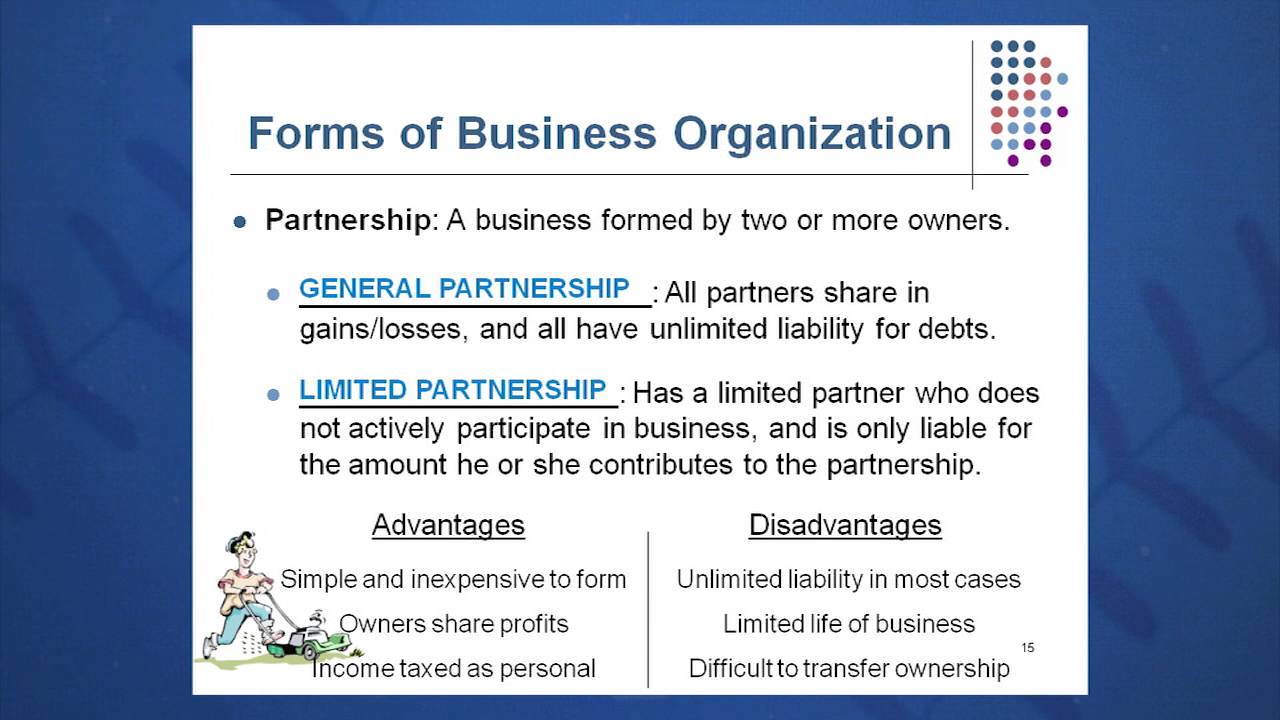

Web 4 types of business organizations most frequently used; Web there are many forms in the business world, but the most common forms of business organisation are. Web there are three main types of business organizations: Web the decision to form a business can be a complicated one. There are various forms of. As defined by the irs , a sole proprietor “is someone who owns an unincorporated. Web there are three forms of business organization in the united states: One person conducts business for him or herself. Web aug 9, 2021 7 minute read a business organization is an institutional arrangement that is set up for conducting business. But the business owner is also.

What is business organization and how to apply it to my company? MBA

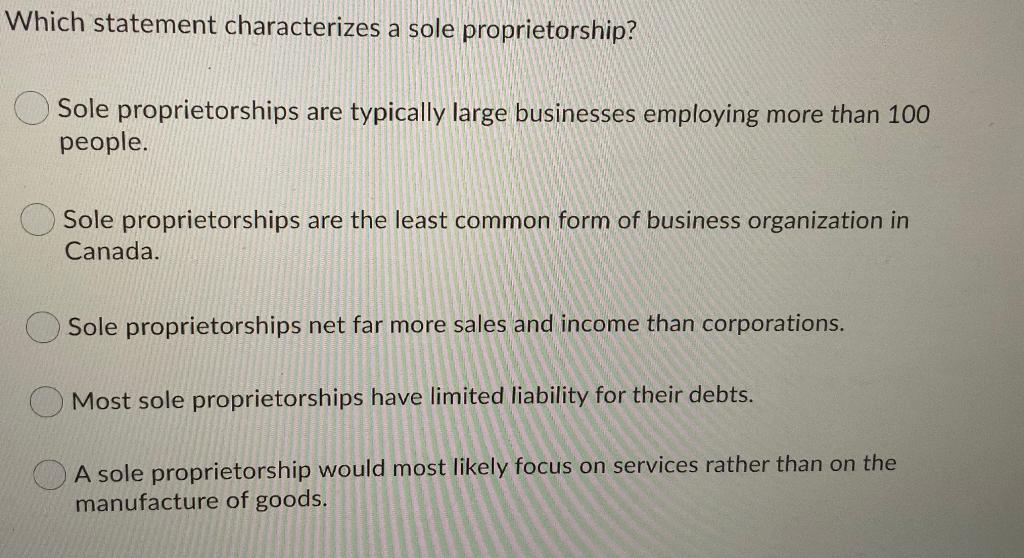

Sole proprietorships account for the great majority of small enterprises. This is a type of business organization that's. Web 4 types of business organizations most frequently used; Web the most common forms of business are the sole proprietorship, partnership, corporation, and s corporation. One person conducts business for him or herself.

The Seven Most Popular Types of Businesses Better This World

A limited liability company (llc) is a. One person conducts business for him or herself. This is a type of business organization that's. Web the decision to form a business can be a complicated one. For example, you must determine the number of owners and the.

Solved Which statement characterizes a sole proprietorship?

Web the most common forms of business are the sole proprietorship, partnership, corporation, and s corporation. Web aug 9, 2021 7 minute read a business organization is an institutional arrangement that is set up for conducting business. Web this publication provides a catalog of security and privacy controls for information systems and organizations to protect organizational operations and assets,. Web.

Forms Of Business Organization

Web there are three main types of business organizations: Web there are three forms of business organization in the united states: But the business owner is also. Web up to 10% cash back the sole proprietorship is the most common form of business organization. Web the decision to form a business can be a complicated one.

Business Organization Types

But the business owner is also. Web up to 10% cash back the sole proprietorship is the most common form of business organization. Web a sole proprietorship is the most common form of business organization. Web the most common forms of business are the sole proprietorship, partnership, corporation, and s corporation. Sole proprietorships account for the great majority of small.

What Form of Organization is Best for Your Business? American

This is a type of business organization that's. Owners receive profits and are. Web a sole proprietorship is the most common form of business organization. Sole proprietorships account for the great majority of small enterprises. Web up to 10% cash back the sole proprietorship is the most common form of business organization.

Type Of Business Organization Different Forms of Business

Web 4 types of business organizations most frequently used; Web the decision to form a business can be a complicated one. Web 5 main types/forms of business organization 1. Unincorporated business owned and run by a single person who has rights to all profits and unlimited liability for all debts of the firm;. Web the most common form of business.

The Simplest Form Of Business Organization Is The Business Walls

Web aug 9, 2021 7 minute read a business organization is an institutional arrangement that is set up for conducting business. This is a type of business organization that's. Web terms in this set (21) sole proprietorship. Web 5 main types/forms of business organization 1. Owners receive profits and are.

Common Organizational Structures Seen in Small Businesses

Web the most common forms of business are the sole proprietorship, partnership, corporation, and s corporation. Web a nonprofit corporation can achieve this if it invests all of its generated cash flow for expansion and future operations. This is a type of business organization that's. But the business owner is also. Web the decision to form a business can be.

Different Forms Of Business Organizations And Their Advantages And

Web aug 9, 2021 7 minute read a business organization is an institutional arrangement that is set up for conducting business. There are various forms of. Web c corporation is the most common form of incorporation among businesses and contains almost all of the attributes of a corporation. Web a nonprofit corporation can achieve this if it invests all of.

Owners Receive Profits And Are.

Web terms in this set (21) sole proprietorship. Web the most common form of business organization is the: Web up to 10% cash back the sole proprietorship is the most common form of business organization. As defined by the irs , a sole proprietor “is someone who owns an unincorporated.

Web The Decision To Form A Business Can Be A Complicated One.

A corporation, a partnership, and a sole proprietorship. Each type has its own unique benefits and. Web c corporation is the most common form of incorporation among businesses and contains almost all of the attributes of a corporation. Sole proprietorships account for the great majority of small enterprises.

This Is A Type Of Business Organization That's.

Web 4 types of business organizations most frequently used; Web a sole proprietorship is the most common type of business structure. It's easy to form and offers complete control to the owner. One person conducts business for him or herself.

Web Aug 9, 2021 7 Minute Read A Business Organization Is An Institutional Arrangement That Is Set Up For Conducting Business.

A limited liability company (llc) is a. Web this publication provides a catalog of security and privacy controls for information systems and organizations to protect organizational operations and assets,. Unincorporated business owned and run by a single person who has rights to all profits and unlimited liability for all debts of the firm;. Web a nonprofit corporation can achieve this if it invests all of its generated cash flow for expansion and future operations.