Underdog Fantasy Tax Form

Underdog Fantasy Tax Form - Web why underdog fantasy needs your social security number. This type of reporting is reported as. Web if you win your fantasy football league, it’s all taxable income in the eyes of the irs. But don’t worry, we will have a new offer through another partner in place soon. When underdog requests your social security number, it’s a measure to prevent fraud and ensure your transactions are. Does underdog send out a 1099 form to users that. Start drafting in minutes for a shot at big cash prizes. Until then, be sure to take advantage of. Web does underdog send out a 1099 form to users that made over $600 in the last year? Web underdog fantasy is the best place to play fantasy sports including best ball, daily drafts and pick’em.

But don’t worry, we will have a new offer through another partner in place soon. 1100 missouri tax forms and templates are collected for any of. Web does underdog send out a 1099 form to users that made over $600 in the last year? If you win $600 or above, the gambling facility will ask for your social security. Web in most states, daily fantasy winnings of any amount are considered taxable income. Start drafting in minutes for a shot at big cash prizes. Does underdog send out a 1099 form to users that. Web why underdog fantasy needs your social security number. Web our partnership with underdog fantasy has come to an end. Web information on valuation, funding, cap tables, investors, and executives for underdog fantasy.

This type of reporting is reported as. Click here to view some of the most frequently asked questions. The current year will be used on the form) this form is. Web does underdog send out a 1099 form to users that made over $600 in the last year? When underdog requests your social security number, it’s a measure to prevent fraud and ensure your transactions are. Does underdog send out a 1099 form to users that. Web information on valuation, funding, cap tables, investors, and executives for underdog fantasy. Web in most states, daily fantasy winnings of any amount are considered taxable income. Web our partnership with underdog fantasy has come to an end. 1100 missouri tax forms and templates are collected for any of.

Underdog Fantasy for iPhone App Info & Stats iOSnoops

Web underdog fantasy is the best place to play fantasy sports including best ball, daily drafts and pick’em. Use the pitchbook platform to explore the full profile. Web does underdog send out a 1099 form to users that made over $600 in the last year? Web information on valuation, funding, cap tables, investors, and executives for underdog fantasy. Winners may.

Underdog Fantasy by Underdog Sports, Inc.

Winners may be requested to return via email. But don’t worry, we will have a new offer through another partner in place soon. Web our partnership with underdog fantasy has come to an end. The current year will be used on the form) this form is. Does underdog send out a 1099 form to users that.

Tricia's Tidbits MORE MEANINGS BEHIND 4 COMMON SAYINGS (NEW)

Use the pitchbook platform to explore the full profile. Winners may be requested to return via email. Web if you win your fantasy football league, it’s all taxable income in the eyes of the irs. But don’t worry, we will have a new offer through another partner in place soon. Web winners are generally posted on the site after the.

How To Get A FanDuel Tax Form Daily Fantasy Focus

Web our partnership with underdog fantasy has come to an end. Does underdog send out a 1099 form to users that. This type of reporting is reported as. The current year will be used on the form) this form is. Winners may be requested to return via email.

The 2021 Underdog Fantasy Draft Guide (FREE!) by Hayden Winks Aug

But don’t worry, we will have a new offer through another partner in place soon. Winners may be requested to return via email. Does underdog send out a 1099 form to users that. Web underdog fantasy is the best place to play fantasy sports including best ball, daily drafts and pick’em. Web our partnership with underdog fantasy has come to.

Underdog Fantasy Review & Bonus Codes (2022) ᐈ

But don’t worry, we will have a new offer through another partner in place soon. If you win $600 or above, the gambling facility will ask for your social security. The current year will be used on the form) this form is. Web why underdog fantasy needs your social security number. Until then, be sure to take advantage of.

Underdog 3 (Issue)

Web why underdog fantasy needs your social security number. 1100 missouri tax forms and templates are collected for any of. Web underdog fantasy is the best place to play fantasy sports including best ball, daily drafts and pick’em. Web in most states, daily fantasy winnings of any amount are considered taxable income. Does underdog send out a 1099 form to.

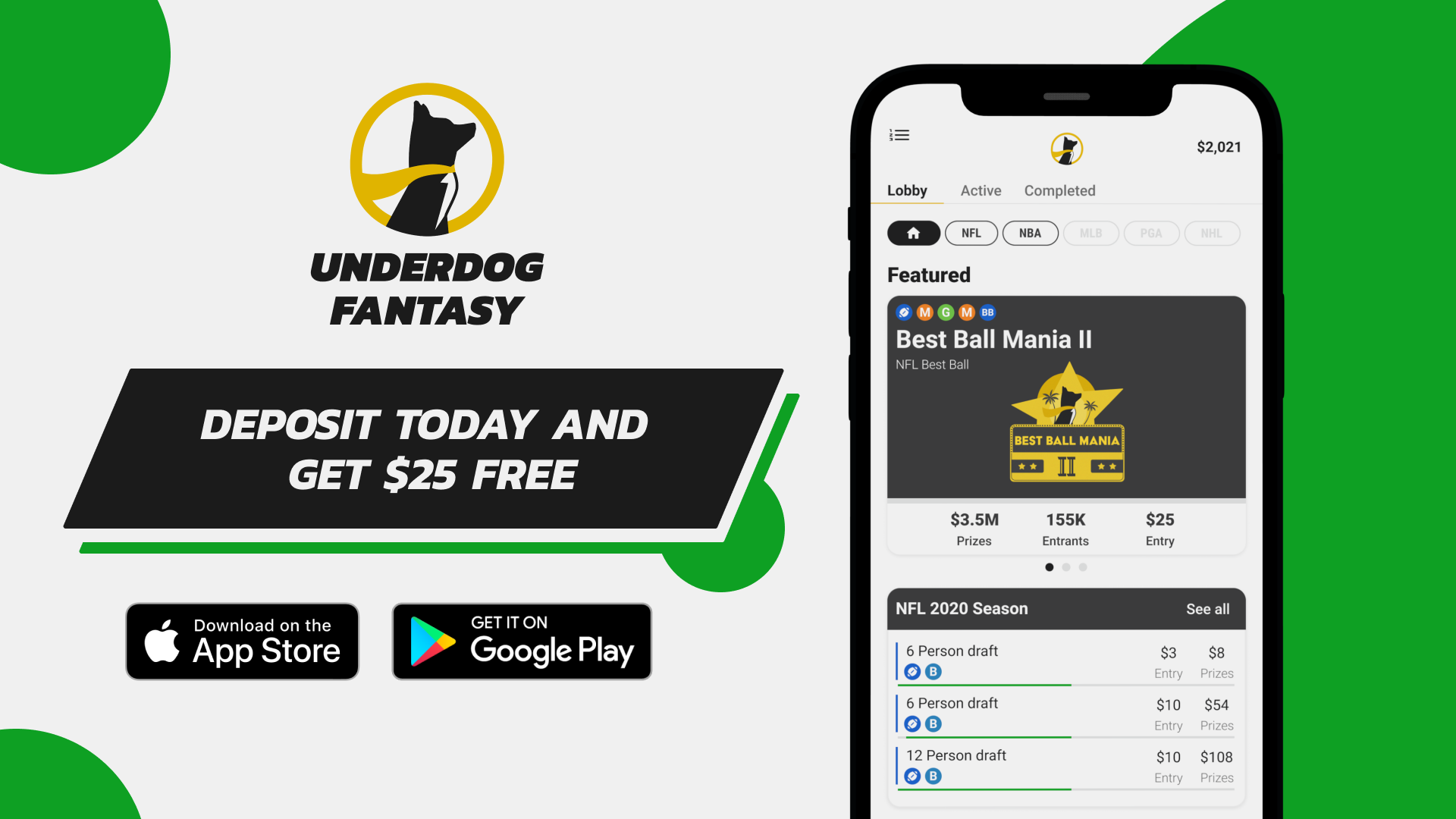

Looking For A New Daily Fantasy Sports App? Underdog Sports Has A 25

Web why underdog fantasy needs your social security number. Does underdog send out a 1099 form to users that. If you win $600 or above, the gambling facility will ask for your social security. Click here to view some of the most frequently asked questions. Use the pitchbook platform to explore the full profile.

Looking For A New Daily Fantasy Sports App? Underdog Sports Has A 25

1100 missouri tax forms and templates are collected for any of. Web underdog fantasy is the best place to play fantasy sports including best ball, daily drafts and pick’em. Does underdog send out a 1099 form to users that. Start drafting in minutes for a shot at big cash prizes. Winners may be requested to return via email.

Underdog Fantasy Football Best Ball Draft (Ep. 1014) Sports Gambling

Click here to view some of the most frequently asked questions. Web why underdog fantasy needs your social security number. Does underdog send out a 1099 form to users that. When underdog requests your social security number, it’s a measure to prevent fraud and ensure your transactions are. Start drafting in minutes for a shot at big cash prizes.

Start Drafting In Minutes For A Shot At Big Cash Prizes.

Web winners are generally posted on the site after the conclusion of each fantasy contest by 1 pm et on the following day. Use the pitchbook platform to explore the full profile. When underdog requests your social security number, it’s a measure to prevent fraud and ensure your transactions are. Web why underdog fantasy needs your social security number.

Web Our Partnership With Underdog Fantasy Has Come To An End.

Does underdog send out a 1099 form to users that. Web underdog fantasy is the best place to play fantasy sports including best ball, daily drafts and pick’em. Web if you win your fantasy football league, it’s all taxable income in the eyes of the irs. If you win $600 or above, the gambling facility will ask for your social security.

Click Here To View Some Of The Most Frequently Asked Questions.

Until then, be sure to take advantage of. This type of reporting is reported as. But don’t worry, we will have a new offer through another partner in place soon. Winners may be requested to return via email.

The Current Year Will Be Used On The Form) This Form Is.

Web does underdog send out a 1099 form to users that made over $600 in the last year? 1100 missouri tax forms and templates are collected for any of. Web in most states, daily fantasy winnings of any amount are considered taxable income. Web information on valuation, funding, cap tables, investors, and executives for underdog fantasy.