Unemployment Fl Tax Form

Unemployment Fl Tax Form - Web if you received an overpayment for reemployment assistance benefits between march 1, 2020, and september 4, 2021, through no fault of your own, the state of florida is not. 05/21 introduction background, classification of workers, and state unemployment tax act (suta) 2 federal unemployment tax act (futa) 2 reporting. State or local income tax refunds, credits, or offsets $ 3. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Web reemployment assistance benefits, also known as unemployment compensation, provides temporary wage replacement benefits to qualified individuals who are out of work through. Web how to pay taxes for unemployment compensation. Can choose to have federal income tax withheld. Web visit the florida department of commerce's tax information webpage to view options for requesting tax documents. Reemployment tax rates under florida law, reemployment tax rates are calculated each year by the florida. Together with state unemployment tax systems, the futa tax provides.

The registration package for motor fuel and/or pollutants registrants includes: Web if you paid reemployment taxes for 10 or more employees during any quarter of the prior state fiscal year (july 1 through june 30 of a given year) you must file reports and pay. Web click here to file a new claim click here for the reemployment assistance help center. Web and last updated 5:12 am, mar 10, 2022. Web find out more about florida’s reemployment tax laws and rules. The form gives a person or agency access to provide info about unemployment taxes. Web if you paid reemployment taxes for 10 or more employees during any quarter of the prior state fiscal year (july 1 through june 30 of a given year) you must file reports and pay. State or local income tax refunds, credits, or offsets $ 3. You don't have to pay a fee to register your business for reemployment tax purposes. Web visit the florida department of commerce's tax information webpage to view options for requesting tax documents.

Web find out more about florida’s reemployment tax laws and rules. Reemployment tax rates under florida law, reemployment tax rates are calculated each year by the florida. Federal income tax withheld $ 5. The form gives a person or agency access to provide info about unemployment taxes. Can choose to have federal income tax withheld. Box 2 amount is for tax year. Click here for the employ florida help center Web how to pay taxes for unemployment compensation. Web if you paid reemployment taxes for 10 or more employees during any quarter of the prior state fiscal year (july 1 through june 30 of a given year) you must file reports and pay. You don't have to pay a fee to register your business for reemployment tax purposes.

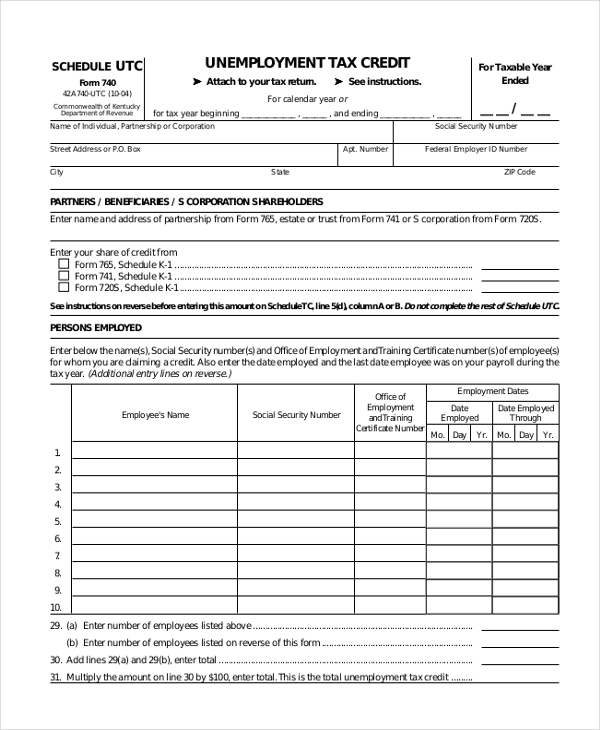

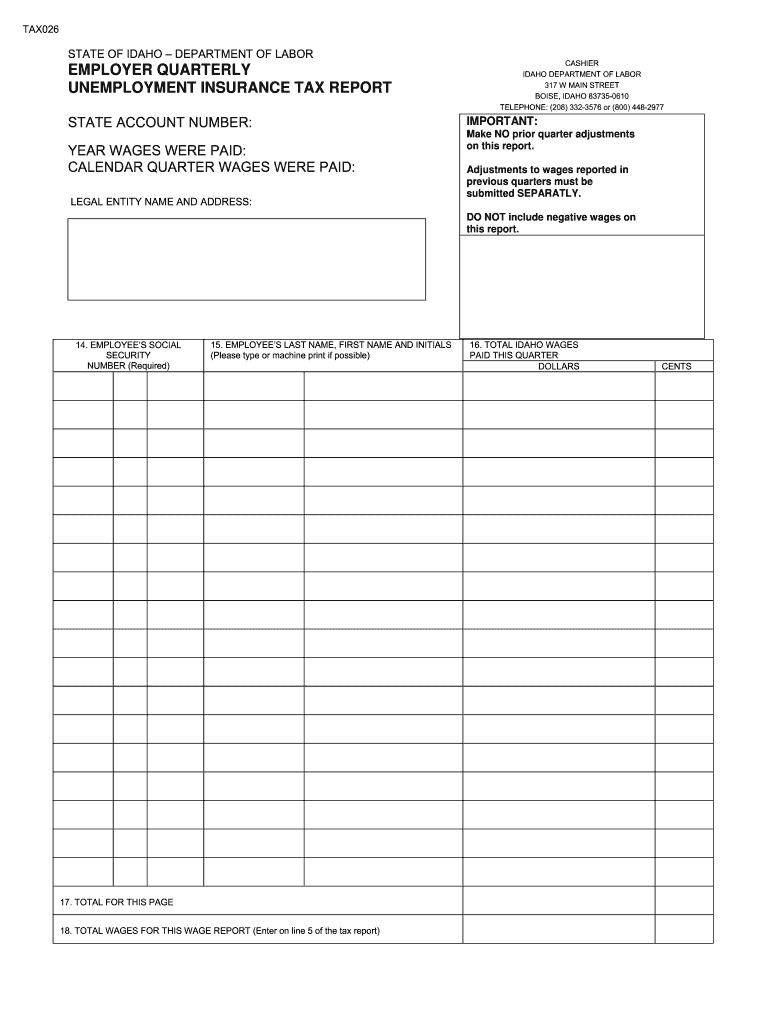

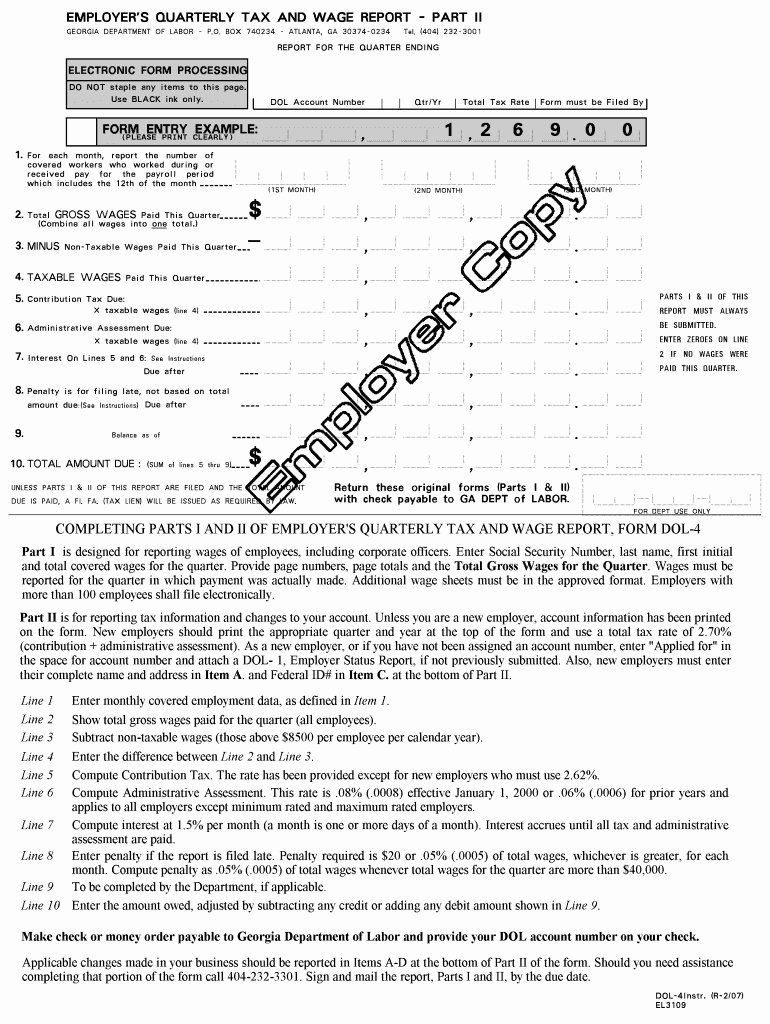

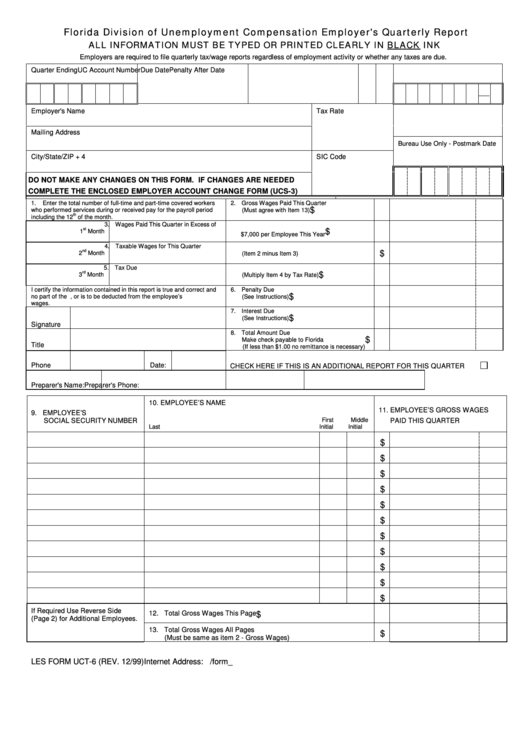

FREE 22+ Sample Tax Forms in PDF Excel MS Word

Web type of tax (corporate, sales, reemployment, formerly unemployment, etc.) year(s) / period(s) tax matter(s) (tax audits, protests, refunds, etc.) section 4. Web visit the florida department of commerce's tax information webpage to view options for requesting tax documents. Can choose to have federal income tax withheld. Together with state unemployment tax systems, the futa tax provides. Web reemployment assistance.

IRS Now Adjusting Tax Returns For 10,200 Unemployment Tax Break

Together with state unemployment tax systems, the futa tax provides. Web and last updated 5:12 am, mar 10, 2022. Web visit the florida department of commerce's tax information webpage to view options for requesting tax documents. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Web if you received an overpayment for reemployment assistance benefits.

What to do if you can't get access to your 1099G tax form ABC7

Reemployment tax rates under florida law, reemployment tax rates are calculated each year by the florida. Web visit the florida department of commerce's tax information webpage to view options for requesting tax documents. Can choose to have federal income tax withheld. Web there are three options. Box 2 amount is for tax year.

IRS to Recalculate Taxes on Unemployment Benefits; Refunds to Start in

Can choose to have federal income tax withheld. Web visit the florida department of commerce's tax information webpage to view options for requesting tax documents. Web click here to file a new claim click here for the reemployment assistance help center. Box 2 amount is for tax year. Web and last updated 5:12 am, mar 10, 2022.

Firstquarter unemployment tax payments deferred for Louisiana employers

Web if you received an overpayment for reemployment assistance benefits between march 1, 2020, and september 4, 2021, through no fault of your own, the state of florida is not. Box 2 amount is for tax year. Web up to 25% cash back blank forms are available for download on the dor website. If you received unemployment compensation, you: The.

1099G Unemployment Compensation (1099G)

Web click here to file a new claim click here for the reemployment assistance help center. Web and last updated 5:12 am, mar 10, 2022. Web type of tax (corporate, sales, reemployment, formerly unemployment, etc.) year(s) / period(s) tax matter(s) (tax audits, protests, refunds, etc.) section 4. Web find out more about florida’s reemployment tax laws and rules. Can choose.

Florida’s Unemployment Insurance System Breaks Down Under COVID19

You don't have to pay a fee to register your business for reemployment tax purposes. State or local income tax refunds, credits, or offsets $ 3. 05/21 introduction background, classification of workers, and state unemployment tax act (suta) 2 federal unemployment tax act (futa) 2 reporting. Web up to 25% cash back blank forms are available for download on the.

Unemployment Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

If you received unemployment compensation, you: Reemployment tax rates under florida law, reemployment tax rates are calculated each year by the florida. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Web click here to file a new claim click here for the reemployment assistance help center. Web if you paid reemployment taxes for 10.

√ 20 Unemployment Verification form ™ Dannybarrantes Template

Box 2 amount is for tax year. State or local income tax refunds, credits, or offsets $ 3. Web if you paid reemployment taxes for 10 or more employees during any quarter of the prior state fiscal year (july 1 through june 30 of a given year) you must file reports and pay. The registration package for motor fuel and/or.

Form Uct6 Florida Division Of Unemployment Compensation Employer'S

Web use form 940 to report your annual federal unemployment tax act (futa) tax. Web click here to file a new claim click here for the reemployment assistance help center. Can choose to have federal income tax withheld. Federal income tax withheld $ 5. Web if you paid reemployment taxes for 10 or more employees during any quarter of the.

Web Click Here To File A New Claim Click Here For The Reemployment Assistance Help Center.

Federal income tax withheld $ 5. Web how to pay taxes for unemployment compensation. Click here for the employ florida help center Reemployment tax rates under florida law, reemployment tax rates are calculated each year by the florida.

Web And Last Updated 5:12 Am, Mar 10, 2022.

Web to report unemployment compensation on your 2021 tax return: The form gives a person or agency access to provide info about unemployment taxes. Web if you paid reemployment taxes for 10 or more employees during any quarter of the prior state fiscal year (july 1 through june 30 of a given year) you must file reports and pay. State or local income tax refunds, credits, or offsets $ 3.

Web If You Paid Reemployment Taxes For 10 Or More Employees During Any Quarter Of The Prior State Fiscal Year (July 1 Through June 30 Of A Given Year) You Must File Reports And Pay.

If you received unemployment compensation, you: Web find out more about florida’s reemployment tax laws and rules. Together with state unemployment tax systems, the futa tax provides. Web up to 25% cash back blank forms are available for download on the dor website.

Web There Are Three Options.

Web if you received an overpayment for reemployment assistance benefits between march 1, 2020, and september 4, 2021, through no fault of your own, the state of florida is not. Web visit the florida department of commerce's tax information webpage to view options for requesting tax documents. Box 2 amount is for tax year. You don't have to pay a fee to register your business for reemployment tax purposes.