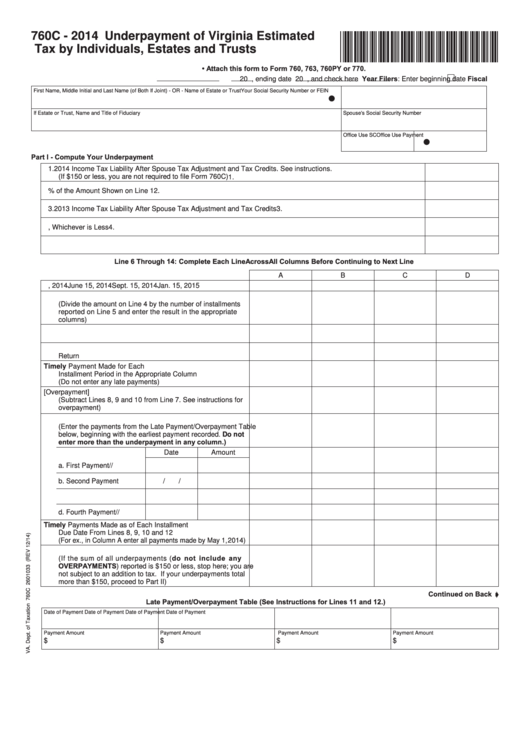

Va Form 760C

Va Form 760C - Web purpose of form 760c. Sign it in a few clicks draw your signature, type. Edit your virginia 760c tax online type text, add images, blackout confidential details, add comments, highlights and more. Our team of veterans will help you with your va disability increase start to finish. Experience all the benefits of completing and submitting legal documents online. For most people, this is done through. Quickly access top tasks for frequently downloaded va forms. We last updated the resident individual income tax return in january 2023, so. Va 23218‑1115 or (804) 367‑8031. Web 2018 instructions for form 760c underpayment of virginia estimated tax by individuals, estates and trusts general instructions.

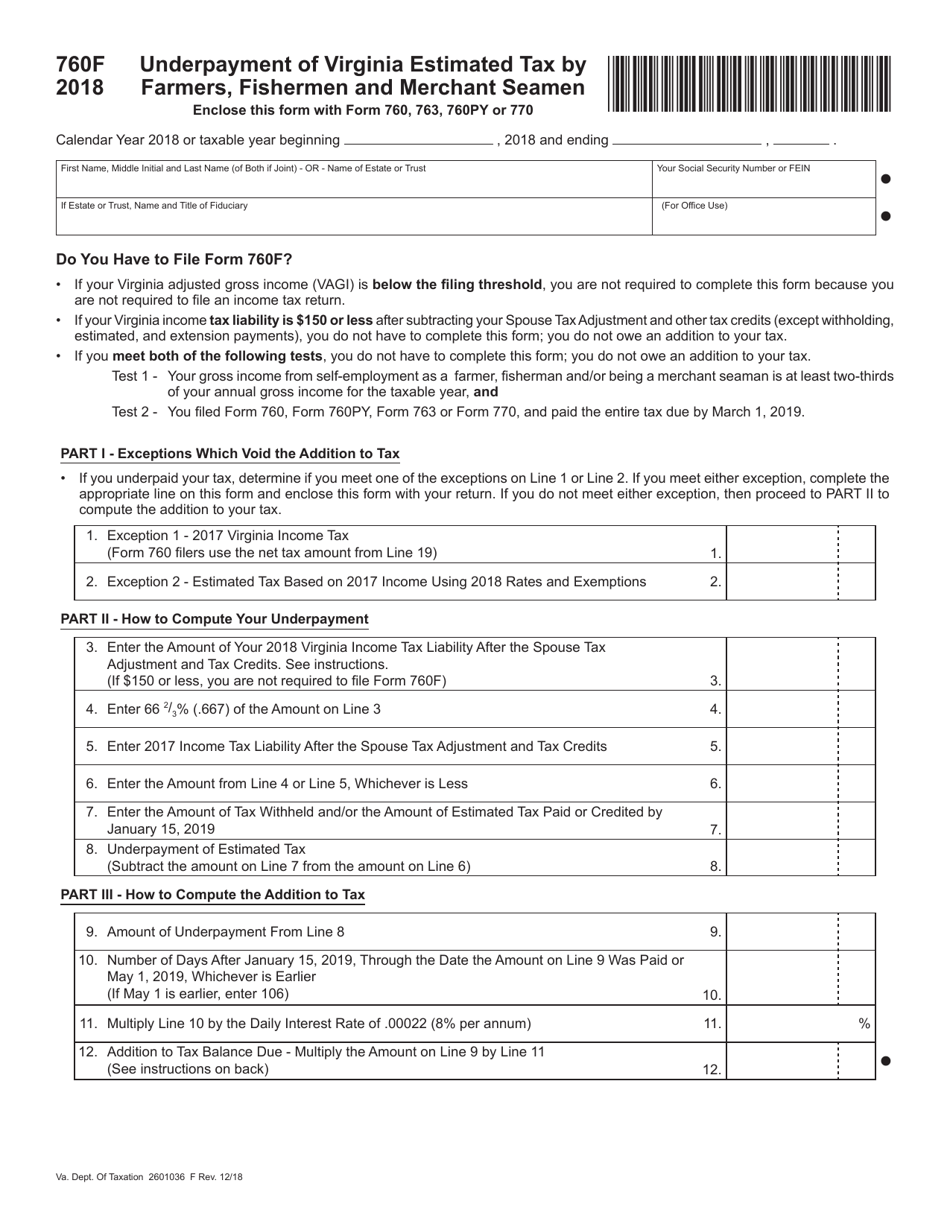

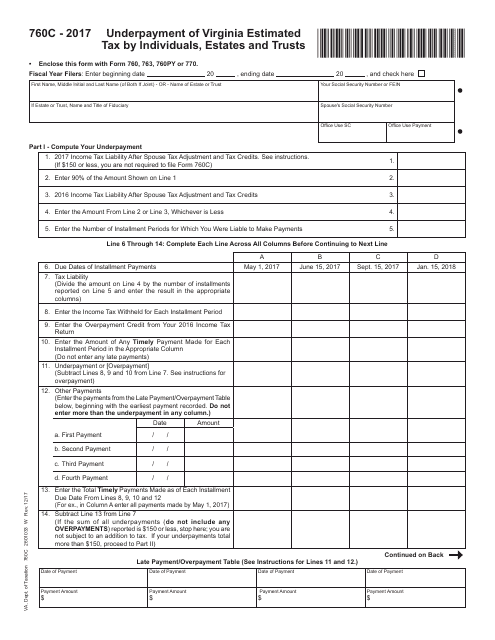

Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. For most people, this is done through. Web we last updated virginia form 760c in january 2023 from the virginia department of taxation. Tax by individuals, estates and trusts • enclose this form with form 760, 763, 760py or 770. Web how do i know if i need to complete form 760c? Throughout the year by having income tax withheld or by making payments. Use form 760f if at least 66 2/3% of your income is derived from farming, fishing. Web use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments.

Sign it in a few clicks draw your signature, type. Quickly access top tasks for frequently downloaded va forms. Save or instantly send your ready documents. If you failed to pay or underpaid your estimated taxes for the past tax year, you must file form 760c to calculate any interest or penalties. We last updated the resident individual income tax return in january 2023, so. Web search for va forms by keyword, form name, or form number. This form is for income earned in tax year 2022, with tax returns due in april. Throughout the year by having income tax withheld or by making payments. Web how do i know if i need to complete form 760c? Web we last updated virginia form 760c in january 2023 from the virginia department of taxation.

2014 Form VA 214142 Fill Online, Printable, Fillable, Blank pdfFiller

Web printable virginia income tax form 760c. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022. Easily fill out pdf blank, edit, and sign them. Web search for va forms by keyword, form name, or form number..

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Experience all the benefits of completing and submitting legal documents online. Web 2018 instructions for form 760c underpayment of virginia estimated tax by individuals, estates and trusts general instructions. Web printable virginia income tax form 760c. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax.

Va Form 4142A Form 214142 Authorization and Consent to Release

Edit your virginia 760c tax online type text, add images, blackout confidential details, add comments, highlights and more. Quickly access top tasks for frequently downloaded va forms. Easily fill out pdf blank, edit, and sign them. Va 23218‑1115 or (804) 367‑8031. Web 2018 instructions for form 760c underpayment of virginia estimated tax by individuals, estates and trusts general instructions.

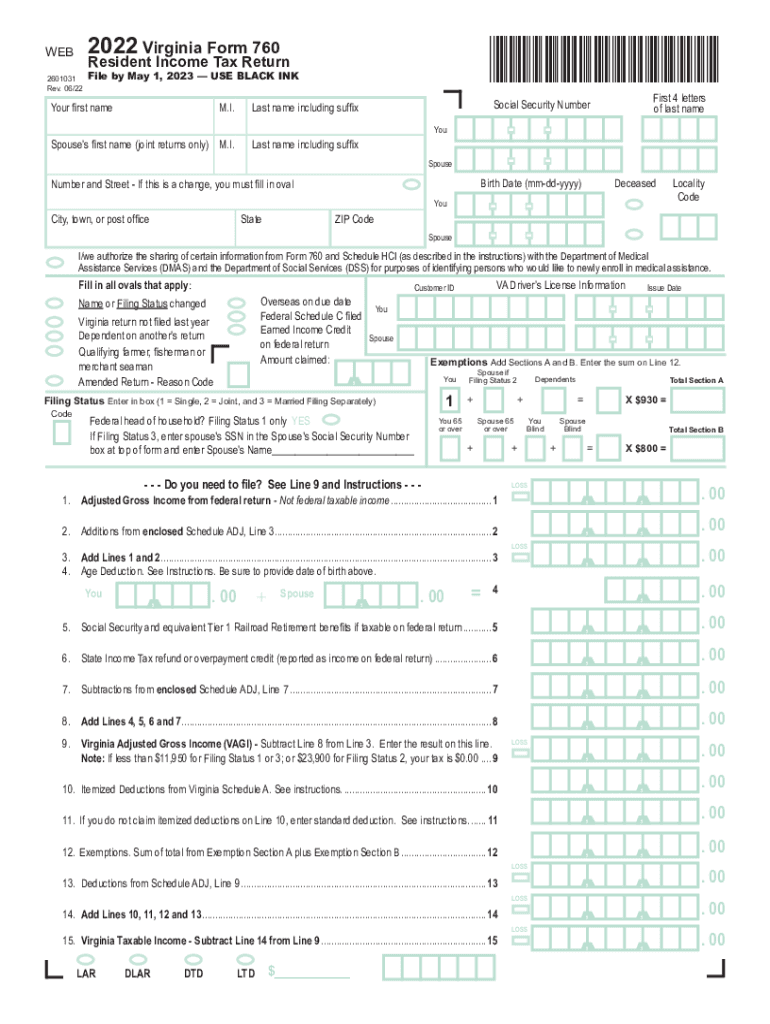

2022 Form VA DoT 760 Fill Online, Printable, Fillable, Blank pdfFiller

Virginia law requires that you pay your income tax in timely installments. Use form 760f if at least 66 2/3% of your income is derived from farming, fishing. Web form 760c reports that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated. Our team of veterans will help.

Va Form 21 0781a Fill Online, Printable, Fillable, Blank pdfFiller

Web 2018 instructions for form 760c underpayment of virginia estimated tax by individuals, estates and trusts general instructions. Save or instantly send your ready documents. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments. Web follow the simple instructions below:.

FD760C Power Tools Fujita Electric

Experience all the benefits of completing and submitting legal documents online. We last updated the resident individual income tax return in january 2023, so. Web form 760c reports that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated. Save or instantly send your ready documents. Web form 760.

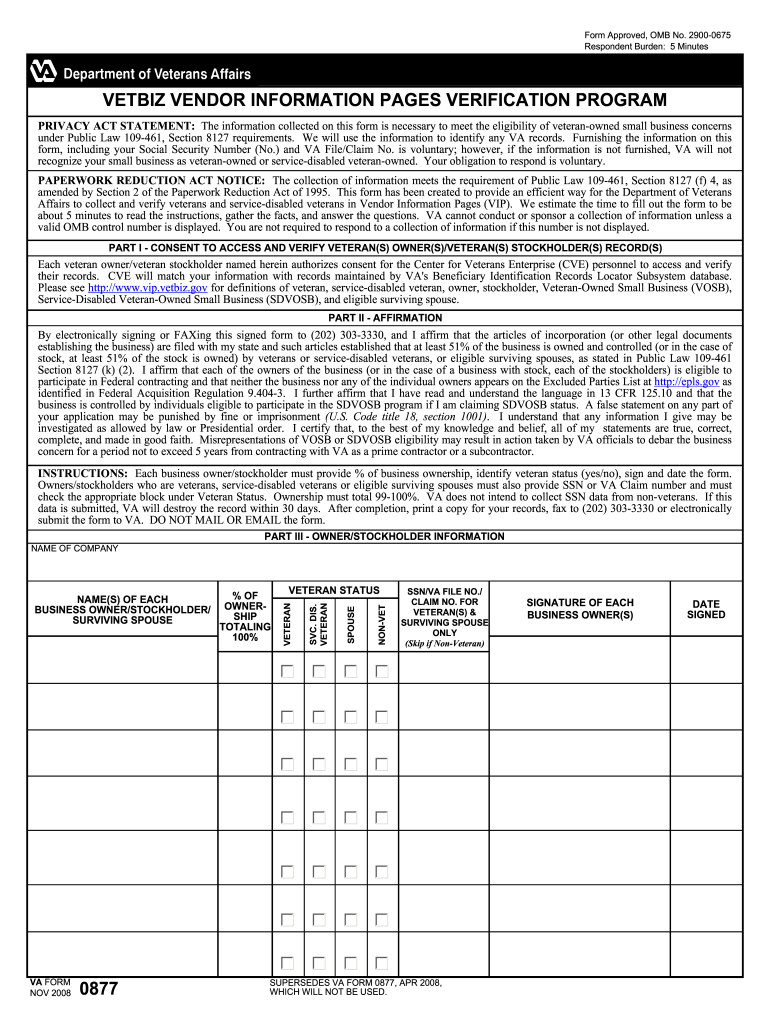

Va Form 0877 Fill Online, Printable, Fillable, Blank pdfFiller

Use form 760f if at least 66 2/3% of your income is derived from farming, fishing. If you failed to pay or underpaid your estimated taxes for the past tax year, you must file form 760c to calculate any interest or penalties. Save or instantly send your ready documents. Web purpose of form 760c virginia law requires that you pay.

Form 760F Download Fillable PDF or Fill Online Underpayment of Virginia

With our platform completing va 760c requires just a. Web how do i know if i need to complete form 760c? Va 23218‑1115 or (804) 367‑8031. Web we last updated virginia form 760c in january 2023 from the virginia department of taxation. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout.

Form 760C Download Fillable PDF or Fill Online Underpayment of Virginia

Web use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. Web printable virginia income tax form 760c. Web form 760 is the general income tax return for virginia residents; Throughout the year by having income tax withheld or by making payments. Web search for va forms by keyword, form name, or form.

Va Form 4142A Form 214142 Authorization and Consent to Release

Edit your virginia 760c tax online type text, add images, blackout confidential details, add comments, highlights and more. Both the irs and state taxing authorities require you pay your taxes throughout the year. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by.

Tax By Individuals, Estates And Trusts • Enclose This Form With Form 760, 763, 760Py Or 770.

Sign it in a few clicks draw your signature, type. For most people, this is done through. Web use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Both the irs and state taxing authorities require you pay your taxes throughout the year. Experience all the benefits of completing and submitting legal documents online. Web follow the simple instructions below: Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022.

Web 2018 Instructions For Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates And Trusts General Instructions.

Web purpose of form 760c. Web printable virginia income tax form 760c. This form is for income earned in tax year 2022, with tax returns due in april. Web form 760c reports that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated.

Our Team Of Veterans Will Help You With Your Va Disability Increase Start To Finish.

Virginia law requires that you pay your income tax in timely installments. Ad we've helped 1000s of veterans increase their va disability & we can help you file yours. Web search for va forms by keyword, form name, or form number. If you failed to pay or underpaid your estimated taxes for the past tax year, you must file form 760c to calculate any interest or penalties.