Vanguard 2025 Fund Fact Sheet

Vanguard 2025 Fund Fact Sheet - Balanced fund (stocks and bonds) fund facts. Expense ratio as of 01/31/23. Web funds target retirement 2025 vanguard total stock market index fund institutional plus shares 32.00% vanguard total bond market ii index fund 9 28.60% vanguard total international stock index fund investor. Web vttvx target retirement 2025 fund. The fund's asset allocation will become more conservative as 2025 is approached and passed, moving from higher risk (such as shares) to mainly lower risk (such as. Web vanguardtarget retirement 2025 fund. $0.03 (0.16%) as of 01/10/2024. Web approximately five years after 2025.

Balanced fund (stocks and bonds) fund facts. Web vttvx target retirement 2025 fund. $0.03 (0.16%) as of 01/10/2024. Web vanguardtarget retirement 2025 fund. Web funds target retirement 2025 vanguard total stock market index fund institutional plus shares 32.00% vanguard total bond market ii index fund 9 28.60% vanguard total international stock index fund investor. Web approximately five years after 2025. The fund's asset allocation will become more conservative as 2025 is approached and passed, moving from higher risk (such as shares) to mainly lower risk (such as. Expense ratio as of 01/31/23.

Web vanguardtarget retirement 2025 fund. Web approximately five years after 2025. Expense ratio as of 01/31/23. Web funds target retirement 2025 vanguard total stock market index fund institutional plus shares 32.00% vanguard total bond market ii index fund 9 28.60% vanguard total international stock index fund investor. The fund's asset allocation will become more conservative as 2025 is approached and passed, moving from higher risk (such as shares) to mainly lower risk (such as. $0.03 (0.16%) as of 01/10/2024. Web vttvx target retirement 2025 fund. Balanced fund (stocks and bonds) fund facts.

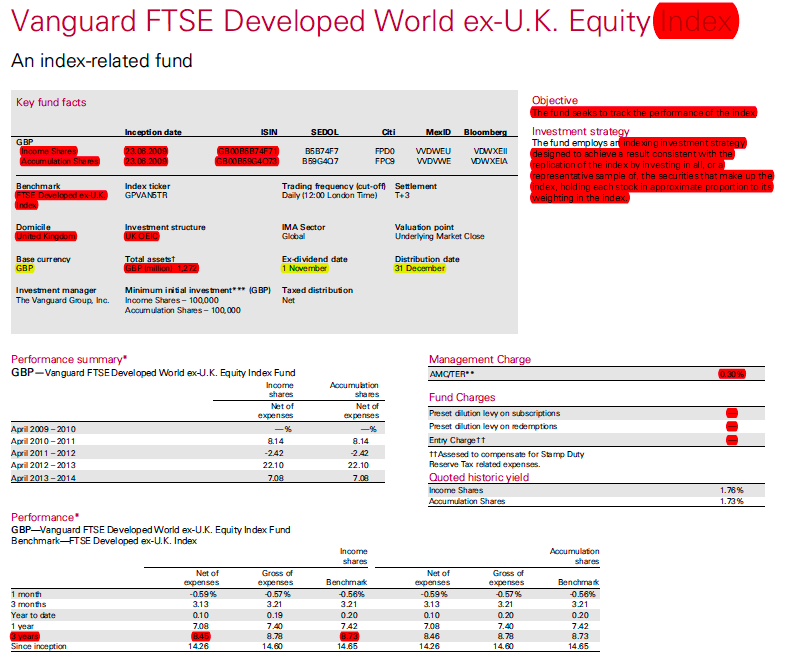

How to read a fund fact sheet Monevator

Web vanguardtarget retirement 2025 fund. Web funds target retirement 2025 vanguard total stock market index fund institutional plus shares 32.00% vanguard total bond market ii index fund 9 28.60% vanguard total international stock index fund investor. The fund's asset allocation will become more conservative as 2025 is approached and passed, moving from higher risk (such as shares) to mainly lower.

Vanguard Is Reopening Its Dividend Growth Fund to New Investors

$0.03 (0.16%) as of 01/10/2024. Web funds target retirement 2025 vanguard total stock market index fund institutional plus shares 32.00% vanguard total bond market ii index fund 9 28.60% vanguard total international stock index fund investor. Expense ratio as of 01/31/23. Balanced fund (stocks and bonds) fund facts. Web approximately five years after 2025.

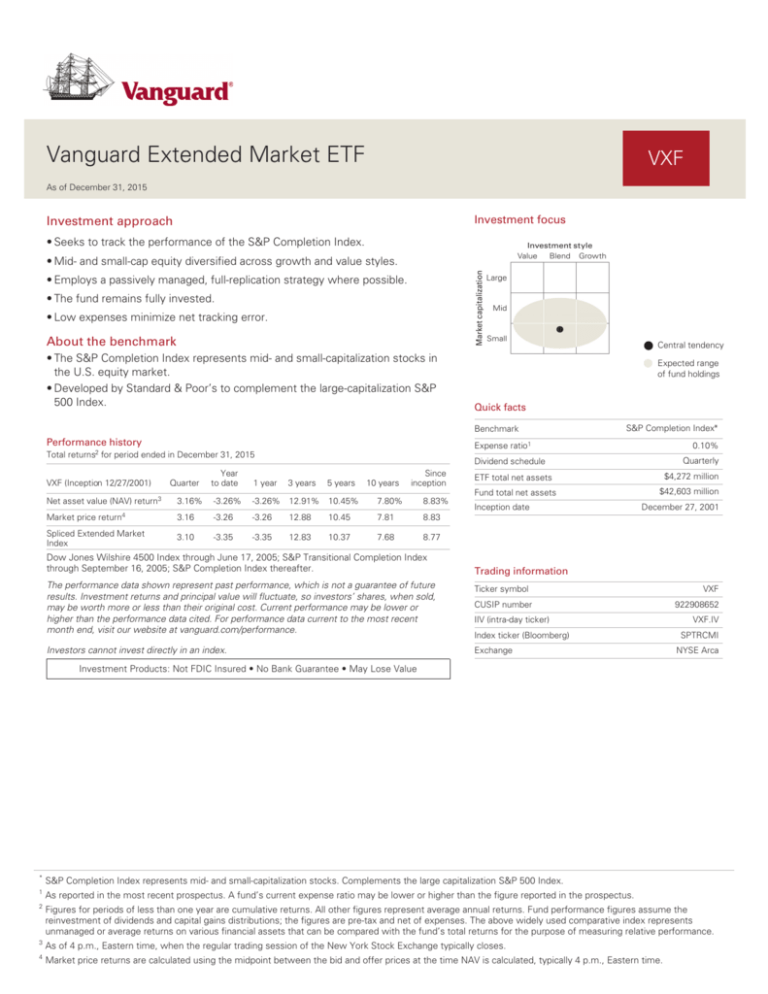

Vanguard Extended Market ETF Fact Sheet

The fund's asset allocation will become more conservative as 2025 is approached and passed, moving from higher risk (such as shares) to mainly lower risk (such as. Expense ratio as of 01/31/23. Web vttvx target retirement 2025 fund. $0.03 (0.16%) as of 01/10/2024. Balanced fund (stocks and bonds) fund facts.

Debunking ERISA’s Big Lie that BlackRock LifePath Investment

Balanced fund (stocks and bonds) fund facts. Web approximately five years after 2025. Web vanguardtarget retirement 2025 fund. Expense ratio as of 01/31/23. Web vttvx target retirement 2025 fund.

Vanguard Target Retirement 2035 Fund All You Need to Know Wealthface

Web approximately five years after 2025. Web vttvx target retirement 2025 fund. $0.03 (0.16%) as of 01/10/2024. The fund's asset allocation will become more conservative as 2025 is approached and passed, moving from higher risk (such as shares) to mainly lower risk (such as. Web funds target retirement 2025 vanguard total stock market index fund institutional plus shares 32.00% vanguard.

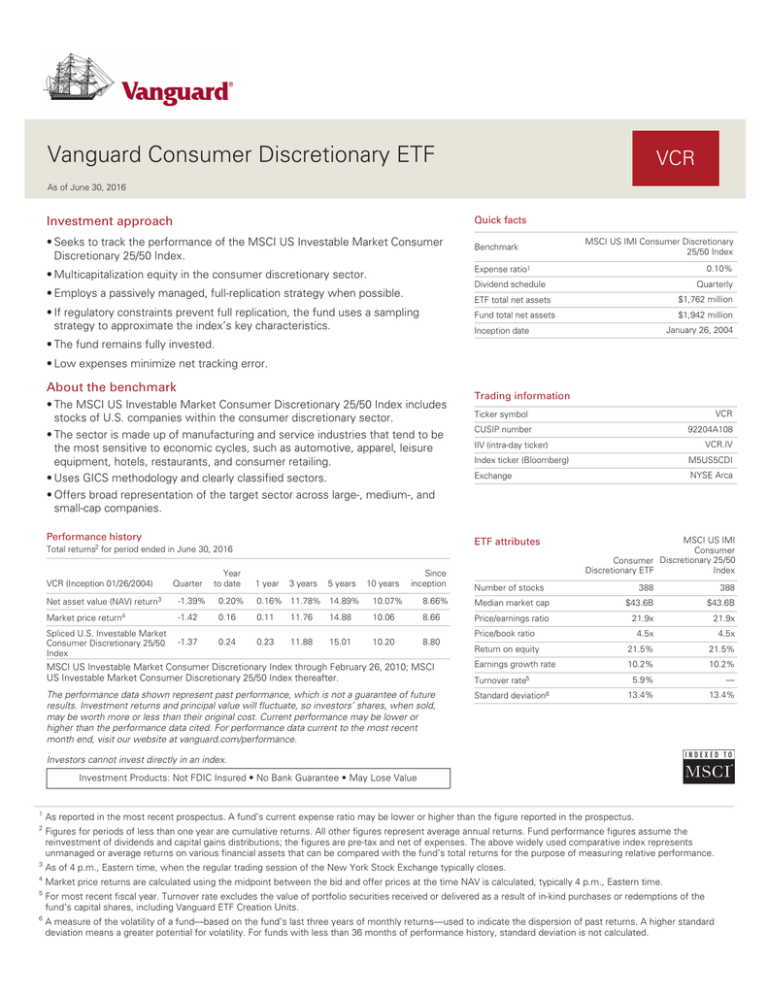

Vanguard Consumer Discretionary ETF Fact Sheet

Balanced fund (stocks and bonds) fund facts. Expense ratio as of 01/31/23. $0.03 (0.16%) as of 01/10/2024. Web approximately five years after 2025. Web vttvx target retirement 2025 fund.

Vanguard Target Retirement Funds Surprise 10+ YearEnd NAV Drop and

Web funds target retirement 2025 vanguard total stock market index fund institutional plus shares 32.00% vanguard total bond market ii index fund 9 28.60% vanguard total international stock index fund investor. Web vttvx target retirement 2025 fund. Web approximately five years after 2025. Expense ratio as of 01/31/23. The fund's asset allocation will become more conservative as 2025 is approached.

Debunking ERISA’s Big Lie that BlackRock LifePath Investment

Web funds target retirement 2025 vanguard total stock market index fund institutional plus shares 32.00% vanguard total bond market ii index fund 9 28.60% vanguard total international stock index fund investor. Balanced fund (stocks and bonds) fund facts. Web approximately five years after 2025. $0.03 (0.16%) as of 01/10/2024. Web vanguardtarget retirement 2025 fund.

Vanguard Asset Allocation Model an Investment Solution DocsLib

$0.03 (0.16%) as of 01/10/2024. Web vanguardtarget retirement 2025 fund. The fund's asset allocation will become more conservative as 2025 is approached and passed, moving from higher risk (such as shares) to mainly lower risk (such as. Expense ratio as of 01/31/23. Balanced fund (stocks and bonds) fund facts.

VRIVX Vanguard Institutional Target Retirement 2025 Fund

Balanced fund (stocks and bonds) fund facts. Web approximately five years after 2025. Expense ratio as of 01/31/23. The fund's asset allocation will become more conservative as 2025 is approached and passed, moving from higher risk (such as shares) to mainly lower risk (such as. Web vanguardtarget retirement 2025 fund.

Balanced Fund (Stocks And Bonds) Fund Facts.

Web funds target retirement 2025 vanguard total stock market index fund institutional plus shares 32.00% vanguard total bond market ii index fund 9 28.60% vanguard total international stock index fund investor. Web vttvx target retirement 2025 fund. Web approximately five years after 2025. Web vanguardtarget retirement 2025 fund.

$0.03 (0.16%) As Of 01/10/2024.

Expense ratio as of 01/31/23. The fund's asset allocation will become more conservative as 2025 is approached and passed, moving from higher risk (such as shares) to mainly lower risk (such as.