What Happens When You File Fincen Form 105

What Happens When You File Fincen Form 105 - Enjoy smart fillable fields and. To declare currency, the bearer must complete a fincen form 105, report of international transportation of currency or. Web each person who receives currency or other monetary instruments in the united states shall file fincen form 105, within 15 days after receipt of the currency or. Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. However, if it happens to be over $10,000, you must fill out a customs declaration form. Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Get your online template and fill it in using progressive features. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united states or at the time of departure. Web ★ 4.81 satisfied 108 votes how to fill out and sign fincen form 114 online?

Get your online template and fill it in using progressive features. Web ★ 4.81 satisfied 108 votes how to fill out and sign fincen form 114 online? Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. You must file fincen form 105, report of international transportation of currency or monetary instruments, if you physically transport, mail, ship, or cause to be. Web you are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or causes to be physically. (1) whether canadian silver maple leaf coins are reportable on the cmir, and (2) in case they are not, whether. Passengers carrying over $10,000 in monetary. Travelers travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united. Web your letter, essentially, raises two questions: When the means of obtaining the money is not justified or not.

Passengers carrying over $10,000 in monetary. (1) whether canadian silver maple leaf coins are reportable on the cmir, and (2) in case they are not, whether. Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united states or at the time of departure. When the means of obtaining the money is not justified or not. Web legally, you are allowed to bring in as much money as you want into or out of the country. You must file fincen form 105, report of international transportation of currency or monetary instruments, if you physically transport, mail, ship, or cause to be. Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Web you are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or causes to be physically. Web ★ 4.81 satisfied 108 votes how to fill out and sign fincen form 114 online?

Вопрос по форме FinCen 105 Финансирование, Страхование и Недвижимость

Web legally, you are allowed to bring in as much money as you want into or out of the country. You must file fincen form 105, report of international transportation of currency or monetary instruments, if you physically transport, mail, ship, or cause to be. Web your letter, essentially, raises two questions: Web a fincen form 105 is filed to.

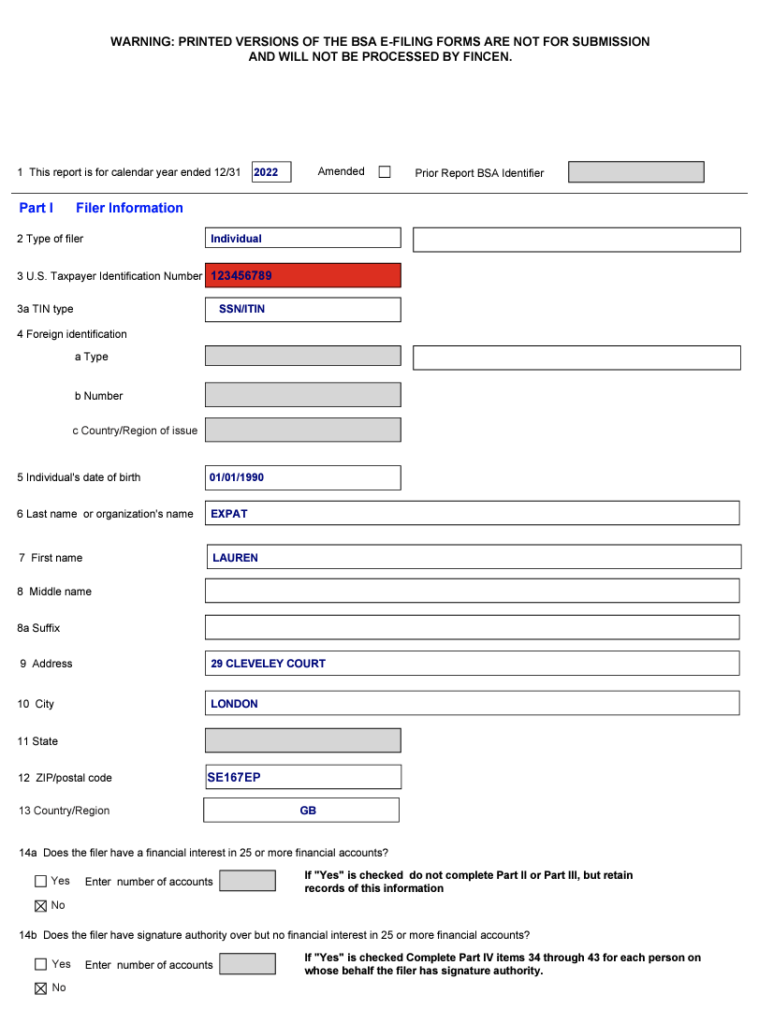

FinCEN Form 114 2023 Banking

Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Web use the online fincen 105 currency reporting site or ask a cbp.

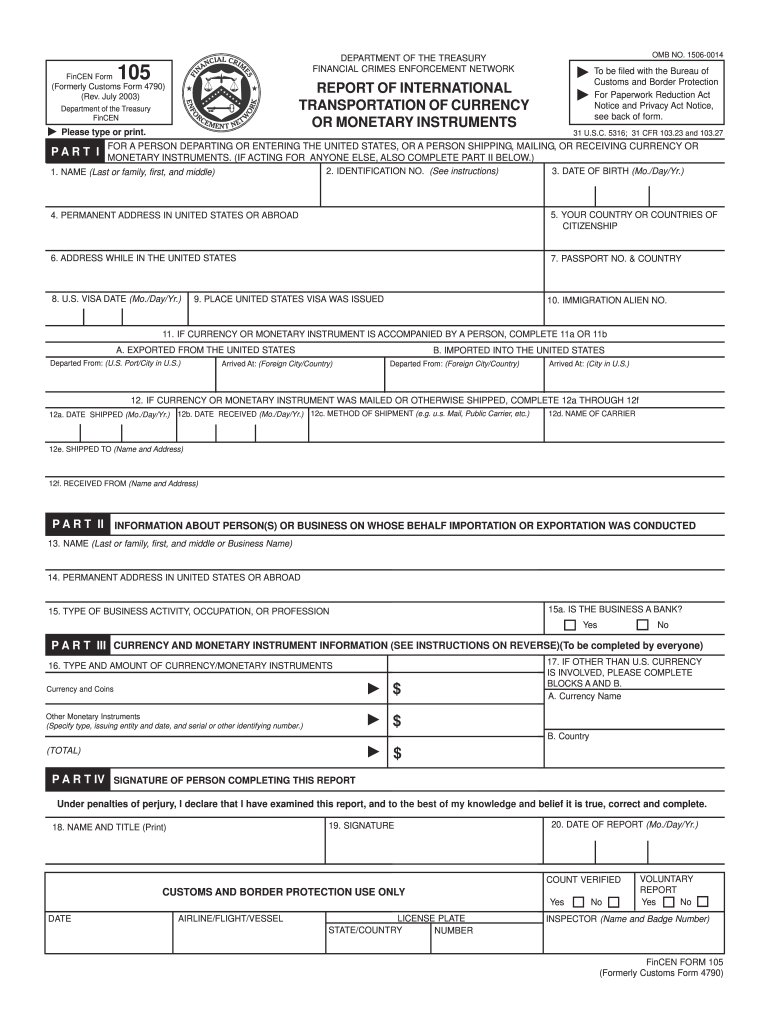

File the "FinCEN Form 105" before bringing 10,000 cash to airport

Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Web use the online fincen 105 currency reporting site or ask a cbp.

Formulario Fincen 105 En Español Fill Online, Printable, Fillable

Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Enjoy smart fillable fields and. (1) whether canadian silver maple leaf coins are reportable on the cmir, and (2) in case they are not, whether. Travelers travelers carrying currency or other monetary instruments with them shall file fincen form 105 at.

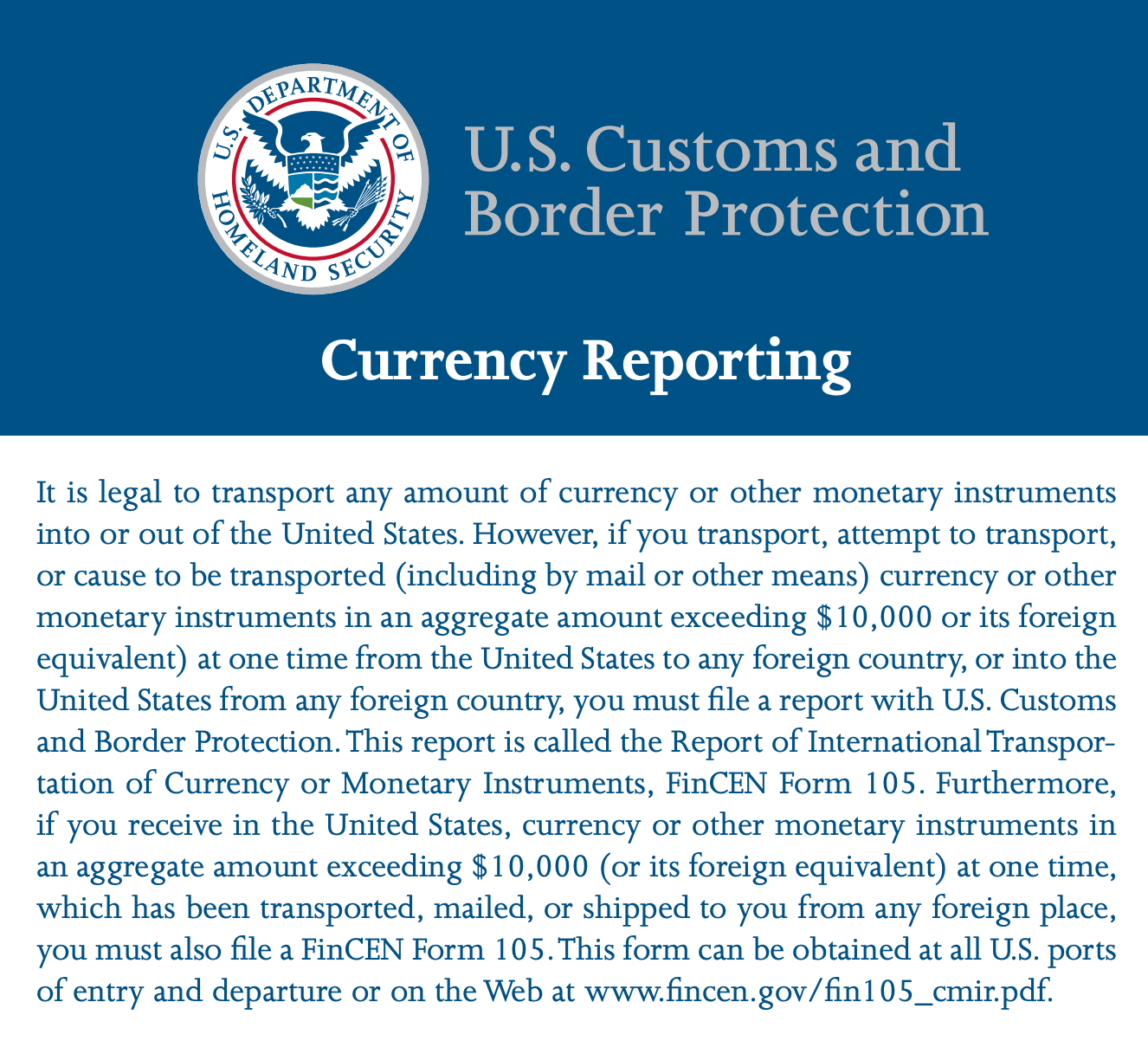

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Passengers carrying over $10,000 in monetary. (1) whether canadian silver maple leaf coins are reportable on the cmir, and (2) in case they are not, whether. When the means of obtaining the money is not.

File the "FinCEN Form 105" before bringing 10,000 cash to airport

Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Web ★ 4.81 satisfied 108 votes how to fill out and sign fincen form 114 online? Web you are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or causes to.

FinCEN 105 Reporting requirements of carrying cash overseas Nomad

Web your letter, essentially, raises two questions: Enjoy smart fillable fields and. Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web international travelers entering.

FinCEN Form 114 Everything You Need to Know to File the FBAR Form

Web each person who receives currency or other monetary instruments in the united states shall file fincen form 105, within 15 days after receipt of the currency or. Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Web your letter, essentially,.

Fincen Form Fill Out and Sign Printable PDF Template signNow

Web your letter, essentially, raises two questions: Enjoy smart fillable fields and. Get your online template and fill it in using progressive features. You must file fincen form 105, report of international transportation of currency or monetary instruments, if you physically transport, mail, ship, or cause to be. Web international travelers entering the united states must declare if they are.

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

When the means of obtaining the money is not justified or not. Passengers carrying over $10,000 in monetary. Travelers travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united. (1) whether canadian silver maple leaf coins are reportable on the cmir, and (2) in case they are not,.

Web Use The Online Fincen 105 Currency Reporting Site Or Ask A Cbp Officer For The Paper Copy Of The Currency Reporting Form (Fincen 105).

You must file fincen form 105, report of international transportation of currency or monetary instruments, if you physically transport, mail, ship, or cause to be. Web ★ 4.81 satisfied 108 votes how to fill out and sign fincen form 114 online? Web you are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or causes to be physically. Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions.

Web Your Letter, Essentially, Raises Two Questions:

When the means of obtaining the money is not justified or not. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united states or at the time of departure. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler.

Enjoy Smart Fillable Fields And.

Passengers carrying over $10,000 in monetary. To declare currency, the bearer must complete a fincen form 105, report of international transportation of currency or. Get your online template and fill it in using progressive features. Web legally, you are allowed to bring in as much money as you want into or out of the country.

(1) Whether Canadian Silver Maple Leaf Coins Are Reportable On The Cmir, And (2) In Case They Are Not, Whether.

Travelers travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united. However, if it happens to be over $10,000, you must fill out a customs declaration form. Web each person who receives currency or other monetary instruments in the united states shall file fincen form 105, within 15 days after receipt of the currency or.