What Is A 2553 Form

What Is A 2553 Form - Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. Web form 2553 is the irs election by a small business corporation form. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services. We know the irs from the inside out. Election by a small business corporation (under section 1362 of the internal revenue. Ad download or email irs 2553 & more fillable forms, register and subscribe now! Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed below. Web irs form 2553 is a form used by a business entity that would like to be treated as an s corporation by the internal revenue service for the purpose of taxes. Filing form 2553 is a requirement for corporations. The tax year to be.

Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation. Complete, edit or print tax forms instantly. Web irs form 2553 (election by a small business corporation) is the form that a corporation (or other entity eligible to be treated as a corporation) files to be treated as. Ad download or email irs 2553 & more fillable forms, register and subscribe now! Web irs form 2553 is a form used by a business entity that would like to be treated as an s corporation by the internal revenue service for the purpose of taxes. The tax year to be. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this. This form must be filed within six months of the due date for form 1120s. (see, irc section 1362 (a)) why is.

Web form 2553 serves as an s corporation election form. Filing form 2553 is a requirement for corporations. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests. The tax year to be. It must be filed when an eligible entity wishes to elect “s” corporation status under the internal revenue code. 3 reasons why you’d want to file form 2553 s corporation designation has tax benefits including a significant. Complete, edit or print tax forms instantly. (see, irc section 1362 (a)) why is.

IRS Form 2553 No Error Anymore If Following the Instructions

It must be filed when an eligible entity wishes to elect “s” corporation status under the internal revenue code. Any small business that can be treated as a corporation (llc or corporation) by the internal. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s.

BIR Form 2553 Download

Web find mailing addresses by state and date for filing form 2553. Web irs form 2553 (election by a small business corporation) is the form that a corporation (or other entity eligible to be treated as a corporation) files to be treated as. Complete, edit or print tax forms instantly. The tax year to be. Web so if you want.

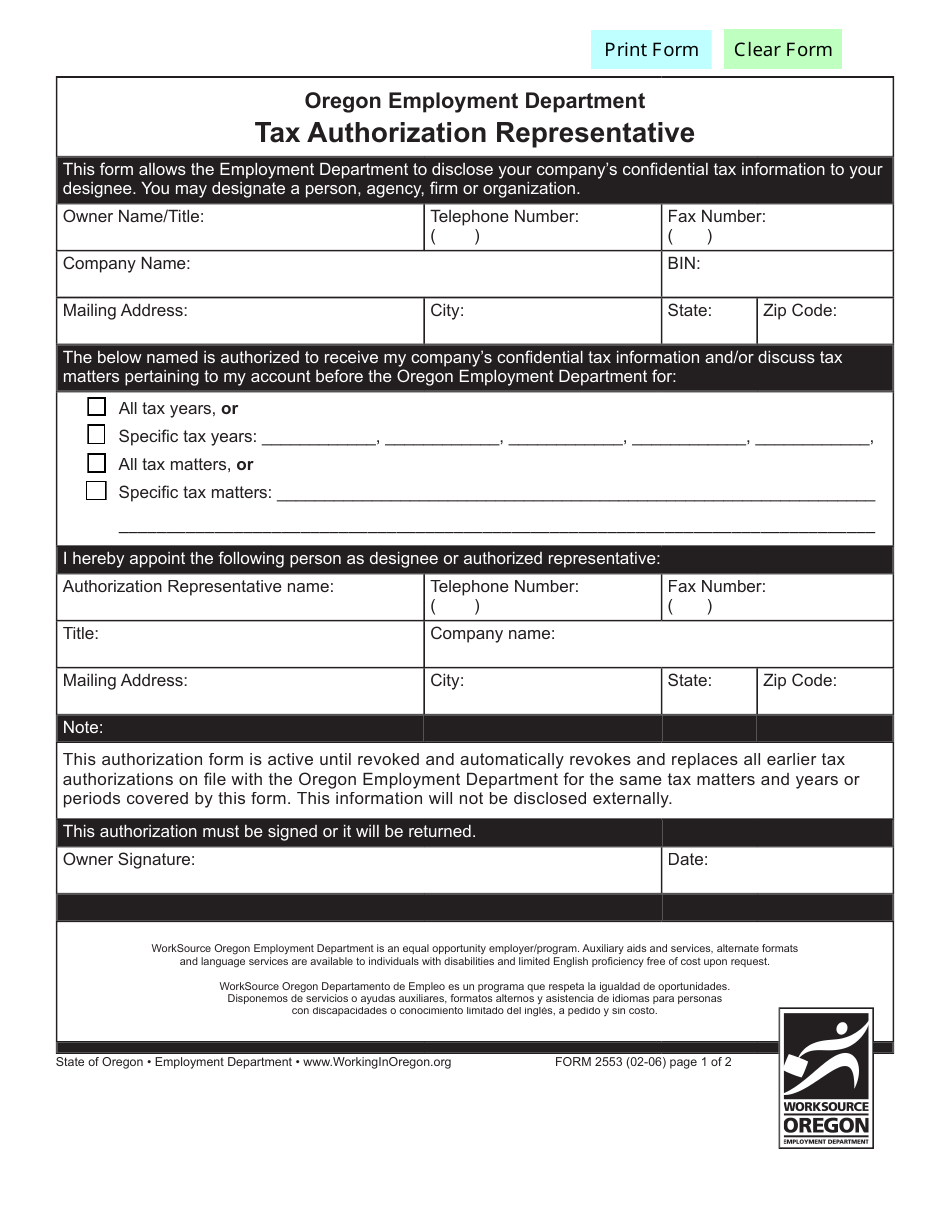

Form 2553 Download Fillable PDF or Fill Online Tax Authorization

Ad get ready for tax season deadlines by completing any required tax forms today. If the corporation's principal business, office, or agency is located in. Election by a small business corporation (under section 1362 of the internal revenue. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the.

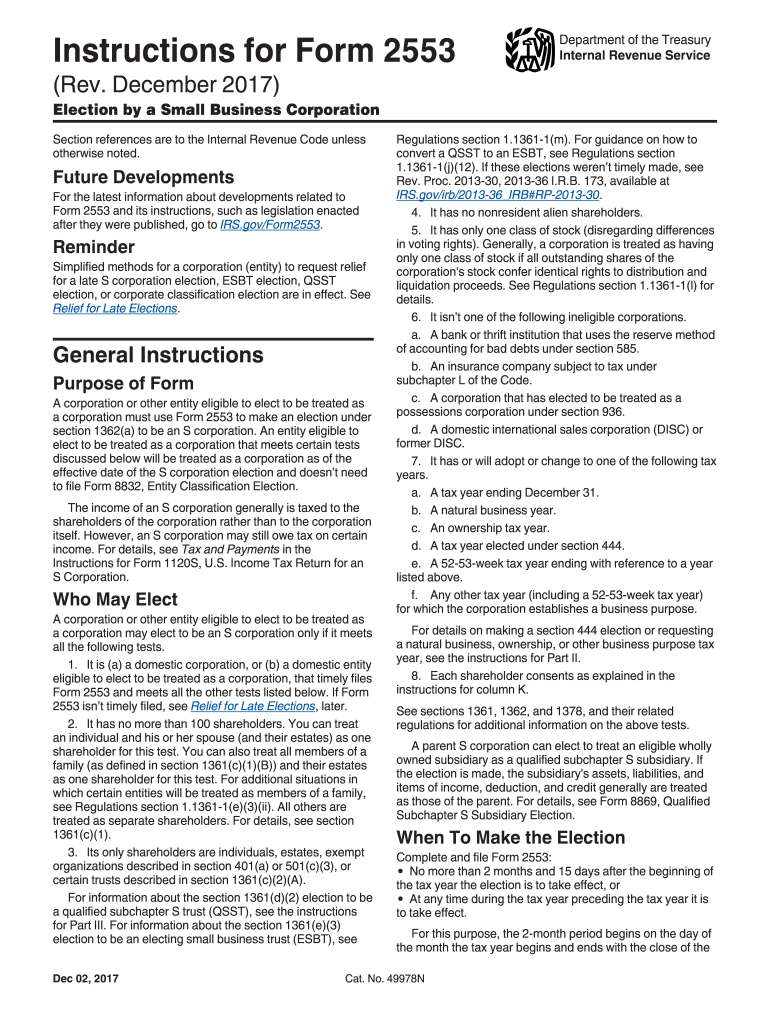

20172020 Form IRS Instruction 2553 Fill Online, Printable, Fillable

The tax year to be. If the corporation's principal business, office, or agency is located in. Web irs form 2553 is a form used by a business entity that would like to be treated as an s corporation by the internal revenue service for the purpose of taxes. Ad get ready for tax season deadlines by completing any required tax.

How To Fill Out Form 2553 YouTube

Any small business that can be treated as a corporation (llc or corporation) by the internal. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed below. Complete, edit or print tax forms instantly. Ad download or.

Form 2553 Election by a Small Business Corporation (2014) Free Download

Web form 2553 serves as an s corporation election form. Web form 2553 is an irs form. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests. It must be filed when an eligible entity wishes to elect.

How to Fill in Form 2553 Election by a Small Business Corporation S

It must be filed when an eligible entity wishes to elect “s” corporation status under the internal revenue code. The tax year to be. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed below. Web find.

Learn How to Fill the Form 2553 Election by a Small Business

December 2017) department of the treasury internal revenue service. The tax year to be. If the corporation's principal business, office, or agency is located in. This form must be filed within six months of the due date for form 1120s. Web form 2553 serves as an s corporation election form.

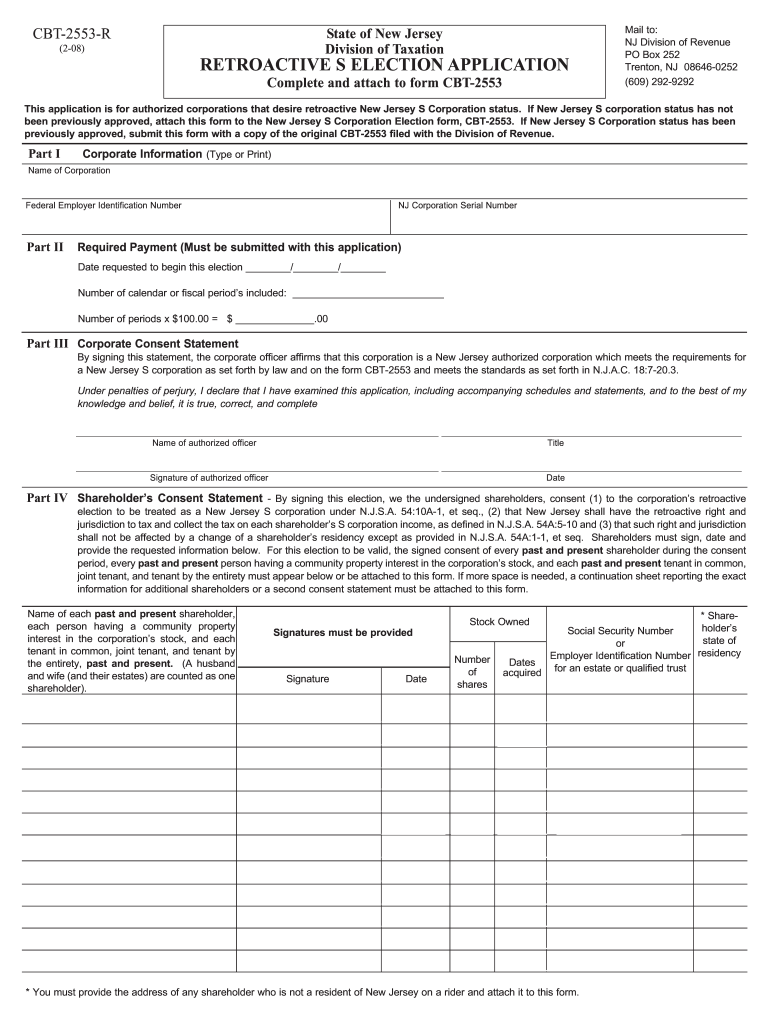

Cbt 2553 Fill Out and Sign Printable PDF Template signNow

Any small business that can be treated as a corporation (llc or corporation) by the internal. Filing form 2553 is a requirement for corporations. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation. Web so if you want.

Form 2553 Election by a Small Business Corporation (2014) Free Download

It must be filed when an eligible entity wishes to elect “s” corporation status under the internal revenue code. 3 reasons why you’d want to file form 2553 s corporation designation has tax benefits including a significant. We know the irs from the inside out. Web form 2553 is the irs election by a small business corporation form. Web find.

Web Form 2553, Election By A Small Business Corporation, Is An Internal Revenue Service Form That Can Be Filed By A Business To Elect To Be Registered As An S Corporation.

The tax year to be. Web form 2553 is the irs election by a small business corporation form. Ad download or email irs 2553 & more fillable forms, register and subscribe now! If the corporation's principal business, office, or agency is located in.

Web Form 2553 Serves As An S Corporation Election Form.

Any small business that can be treated as a corporation (llc or corporation) by the internal. This form must be filed within six months of the due date for form 1120s. (see, irc section 1362 (a)) why is. Election by a small business corporation (under section 1362 of the internal revenue.

Attach To Form 2553 A Statement Describing The Relevant Facts And Circumstances And, If Applicable, The Gross Receipts From Sales And Services.

3 reasons why you’d want to file form 2553 s corporation designation has tax benefits including a significant. Web form 2553 is an irs form. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed below. Web irs form 2553 is a form used by a business entity that would like to be treated as an s corporation by the internal revenue service for the purpose of taxes.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

It must be filed when an eligible entity wishes to elect “s” corporation status under the internal revenue code. December 2017) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this.