What Is A 8919 Tax Form

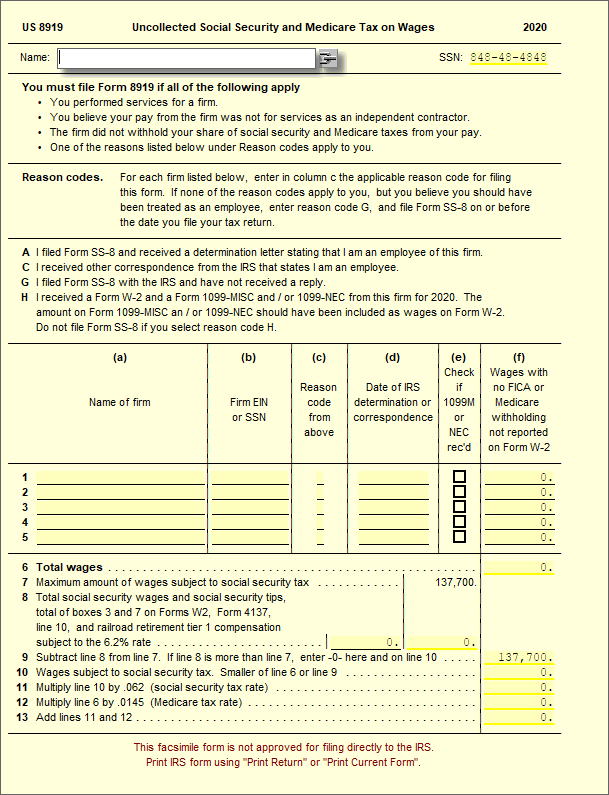

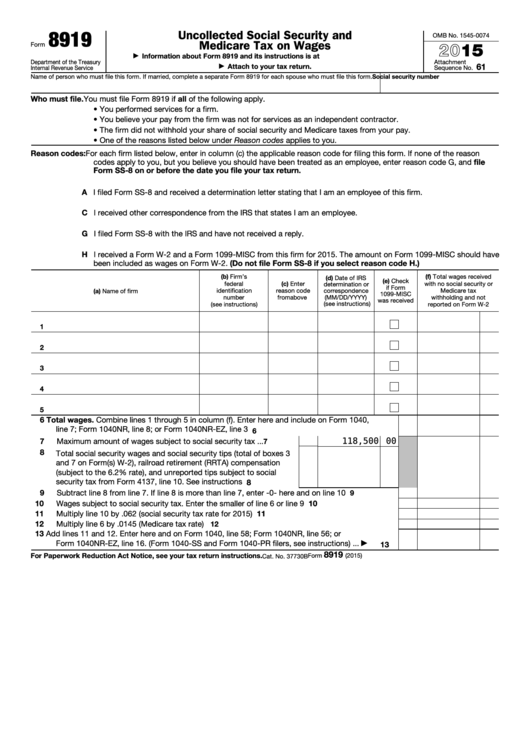

What Is A 8919 Tax Form - You can potentially reduce the taxes you owe by. A 0.9% additional medicare tax. Form 8959, additional medicare tax. An individual having salary income should collect. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. You performed services for a firm.

You can potentially reduce the taxes you owe by. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. You performed services for a firm. Form 8959, additional medicare tax. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. The taxpayer performed services for an individual or a firm. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true:

You can potentially reduce the taxes you owe by. Form 8959, additional medicare tax. You performed services for a firm. Form 8959, additional medicare tax. They must report the amount on irs form 8919. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. An individual having salary income should collect. Complete a separate line on form 8919 for each employer you’ve worked for. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were.

During 2017, Cassandra Albright, who is single, worked parttime at a

Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Form 8959, additional medicare tax. The first step of filing itr.

About Lori DiMarco CPA, PLLC

Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. A 0.9% additional medicare tax. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web in short,.

8919 Uncollected SS and Medicare Tax on Wages UltimateTax Solution

A 0.9% additional medicare tax. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. This includes their name, address, employer identification number (ein),. The first step of filing itr is to collect all the documents related to the process. They must report the.

how to fill out form 8919 Fill Online, Printable, Fillable Blank

A 0.9% additional medicare tax. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. They must report the amount on irs form 8919. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all.

Fillable Form 8919 Uncollected Social Security And Medicare Tax On

This includes their name, address, employer identification number (ein),. A 0.9% additional medicare tax. Web form 8919 is a powerful tool for misclassified workers who owe uncollected social security and medicare taxes. Web the date you file form 8919. Form 8959, additional medicare tax.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web the 1040 form is the official tax return that taxpayers.

Form 945A Edit, Fill, Sign Online Handypdf

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. This includes their name, address, employer identification number (ein),. Web information.

Form 8959 Additional Medicare Tax (2014) Free Download

Web the date you file form 8919. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Form 8959, additional medicare tax. This includes their name, address, employer identification number (ein),. Web start by filling in your name and social security.

Form 1099NEC Nonemployee Compensation (1099NEC)

They must report the amount on irs form 8919. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

A 0.9% additional medicare tax. You can potentially reduce the taxes you owe by. A 0.9% additional medicare tax. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest. An individual having salary income should collect.

Web Form 8919 Is A Powerful Tool For Misclassified Workers Who Owe Uncollected Social Security And Medicare Taxes.

A 0.9% additional medicare tax. You performed services for a firm. A 0.9% additional medicare tax. You can potentially reduce the taxes you owe by.

Web Start By Filling In Your Name And Social Security Number On The Top Section Of The Form.

Web the date you file form 8919. Form 8959, additional medicare tax. Web the date you file form 8919. The taxpayer performed services for an individual or a firm.

Web Employees Will Use Form 8919 To Determine The Amount They Owe In Social Security And Medicare Taxes.

Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. An individual having salary income should collect. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due.

Web In Short, Workers Must File Form 8919, Uncollected Social Security And Medicare Tax On Wages, If They Did Not Have Social Security And Medicare Taxes.

Complete a separate line on form 8919 for each employer you’ve worked for. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Form 8959, additional medicare tax. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed.