What Is Appraisal Form 1007

What Is Appraisal Form 1007 - The 216 form is usually ordered in conjunction with the 1007 form. This form is used to provide rental comparables and estimate the rental income for the subject property. This is typically used for investment properties. It calls for information on the physical You could use 75% of it assuming you have a lease agreement or a history of rental income (tax returns). Freddie mac form 1000 (8/88) fannie mae form 1007 (8/88) Web do the 1007 as a restricted appraisal report, and include the uspap required minimum in the restricted report. The single family comparable rent schedule form 1007 is intended to provide an appraiser with a familiar format to estimate the market rent of a property. Web property appraisal report (form 1025), as applicable, and copies of the current lease agreement (s). Web j_dom_squad • 1 yr.

Web this form is intended to provide the appraiser with a familiar format to estimate the market rent of the subject property. It calls for information on the physical The mortgage lender might also order an additional estimated rent schedule appraisal on the home to support market rent, so small extra bit of cost. Web the 1007 form is used as a supplement to the 1004/2055 forms talked about above. The 1007 form doesn't contain the required information to stand alone, but if you put together a word doc that contains the minimum requirements, and paste the form in, you should be ok. This form is used to provide rental comparables and estimate the rental income for the subject property. Web j_dom_squad • 1 yr. Adjustments should be made only for items of significant difference between the comparables and the subject property. How is rental income taxed when you have a mortgage? Web the following appraisal report forms for all conventional appraisal reports are required to be submitted to the ucdp:

Adjustments should be made only for those items of significant difference between the comparables and the subject property. Web this form is intended to provide the appraiser with a familiar format to estimate the market rent of the subject property. Web j_dom_squad • 1 yr. The 216 form is usually ordered in conjunction with the 1007 form. Web the following appraisal report forms for all conventional appraisal reports are required to be submitted to the ucdp: This is typically used for investment properties. Web do the 1007 as a restricted appraisal report, and include the uspap required minimum in the restricted report. This form is used to provide rental comparables and estimate the rental income for the subject property. The single family comparable rent schedule form 1007 is intended to provide an appraiser with a familiar format to estimate the market rent of a property. The lender should retain the original of the form and the appraiser, the copy.

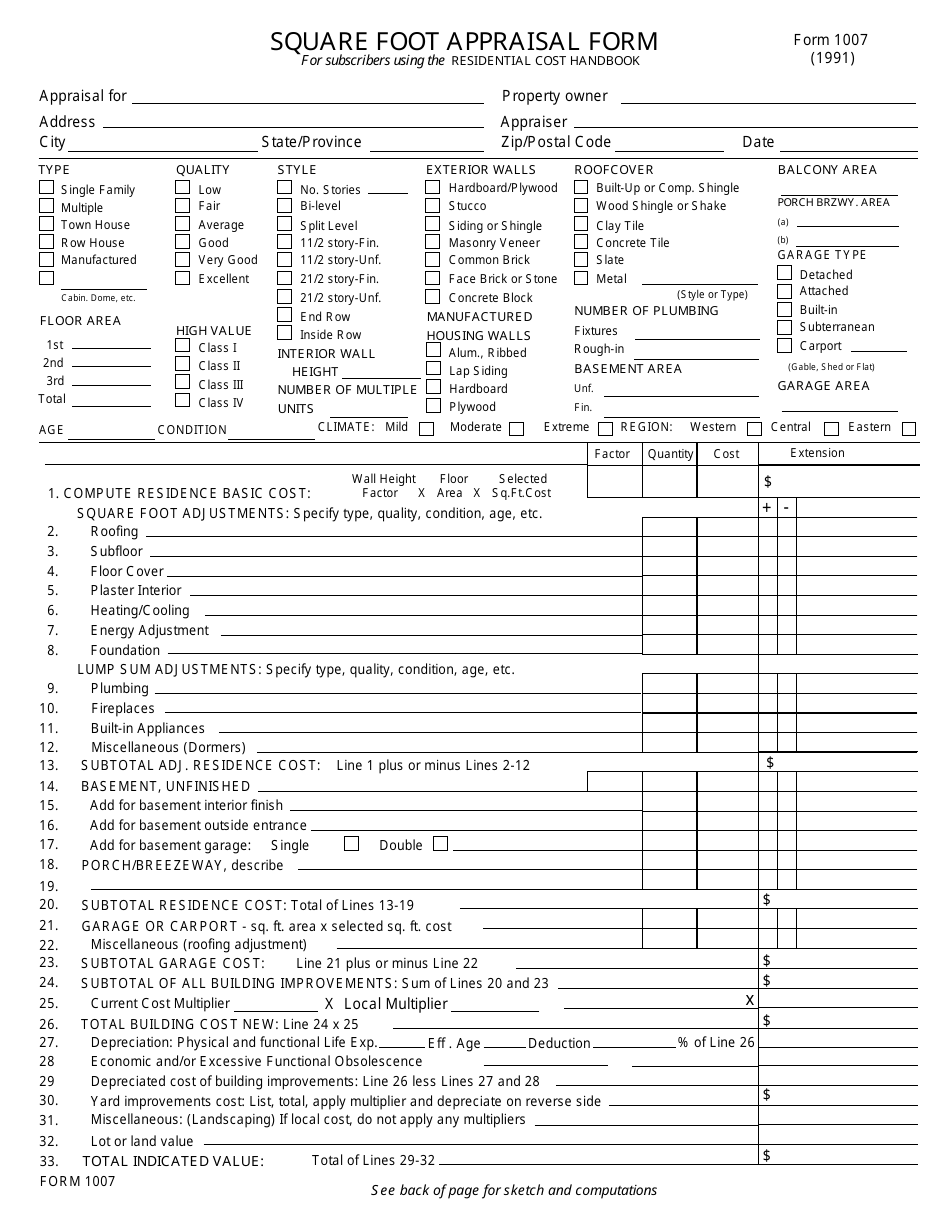

Form 1007 Fill Out, Sign Online and Download Fillable PDF

It calls for information on the physical How is rental income taxed when you have a mortgage? Web the 1007 form is used as a supplement to the 1004/2055 forms talked about above. You could use 75% of it assuming you have a lease agreement or a history of rental income (tax returns). Adjustments should be made only for those.

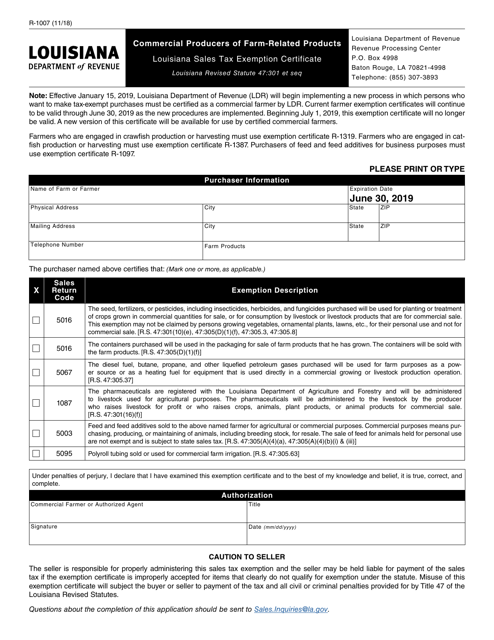

Form R1007 Download Fillable PDF or Fill Online Commercial Producers

This form must be reproduced by the seller. Web do the 1007 as a restricted appraisal report, and include the uspap required minimum in the restricted report. This form is used to provide rental comparables and estimate the rental income for the subject property. Adjustments should be made only for those items of significant difference between the comparables and the.

Real Estate Appraisal Form 216 Universal Network

The 1007 form doesn't contain the required information to stand alone, but if you put together a word doc that contains the minimum requirements, and paste the form in, you should be ok. The mortgage lender might also order an additional estimated rent schedule appraisal on the home to support market rent, so small extra bit of cost. Web this.

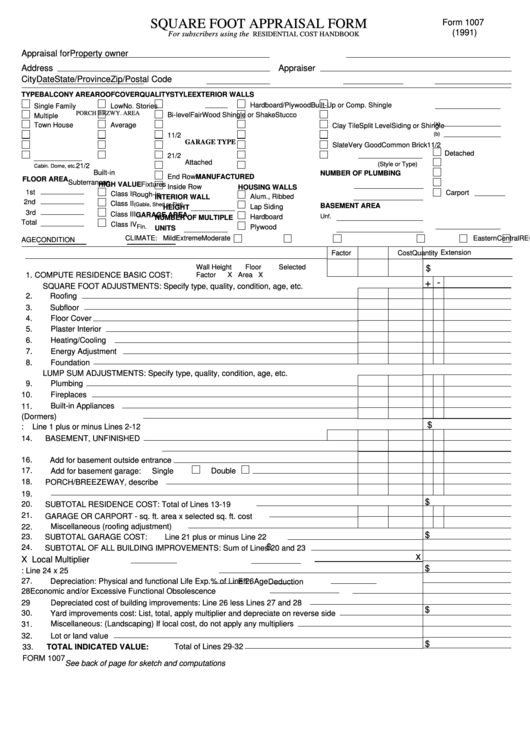

Real Estate Appraisal Form 1007 Universal Network

The 1007 form doesn't contain the required information to stand alone, but if you put together a word doc that contains the minimum requirements, and paste the form in, you should be ok. How is rental income taxed when you have a mortgage? Adjustments should be made only for those items of significant difference between the comparables and the subject.

Real Estate Appraisal Form 1007 Universal Network

This form is used to provide rental comparables and estimate the rental income for the subject property. This form must be reproduced by the seller. The 216 form is usually ordered in conjunction with the 1007 form. Web property appraisal report (form 1025), as applicable, and copies of the current lease agreement (s). The 1007 form doesn't contain the required.

Real Estate Appraisal Form 1007 Universal Network

The 1007 form doesn't contain the required information to stand alone, but if you put together a word doc that contains the minimum requirements, and paste the form in, you should be ok. Web the following appraisal report forms for all conventional appraisal reports are required to be submitted to the ucdp: Freddie mac form 1000 (8/88) fannie mae form.

Fillable Form 1007 Square Foot Appraisal Form printable pdf download

How is rental income taxed when you have a mortgage? Web j_dom_squad • 1 yr. The 216 form is usually ordered in conjunction with the 1007 form. This is typically used for investment properties. Adjustments should be made only for those items of significant difference between the comparables and the subject property.

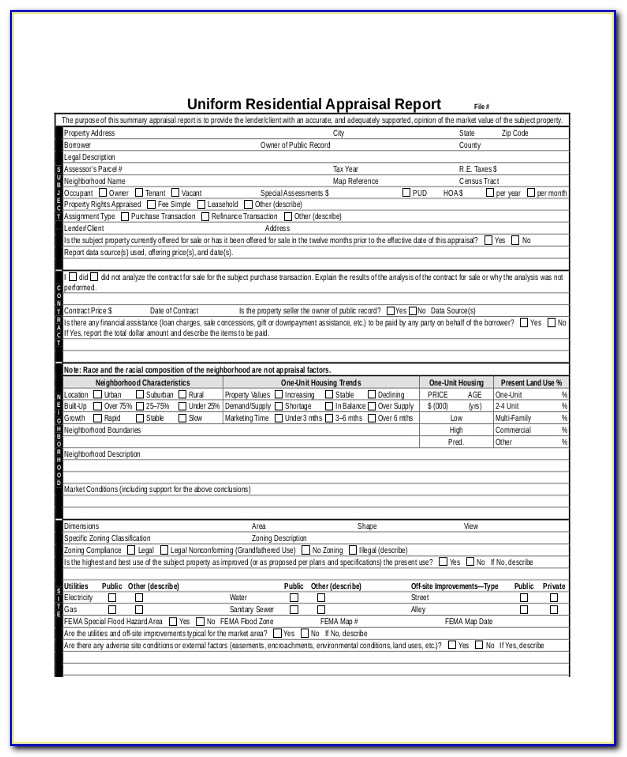

Real Estate Appraisal Format

How is rental income taxed when you have a mortgage? Adjustments should be made only for items of significant difference between the comparables and the subject property. The mortgage lender might also order an additional estimated rent schedule appraisal on the home to support market rent, so small extra bit of cost. This form must be reproduced by the seller..

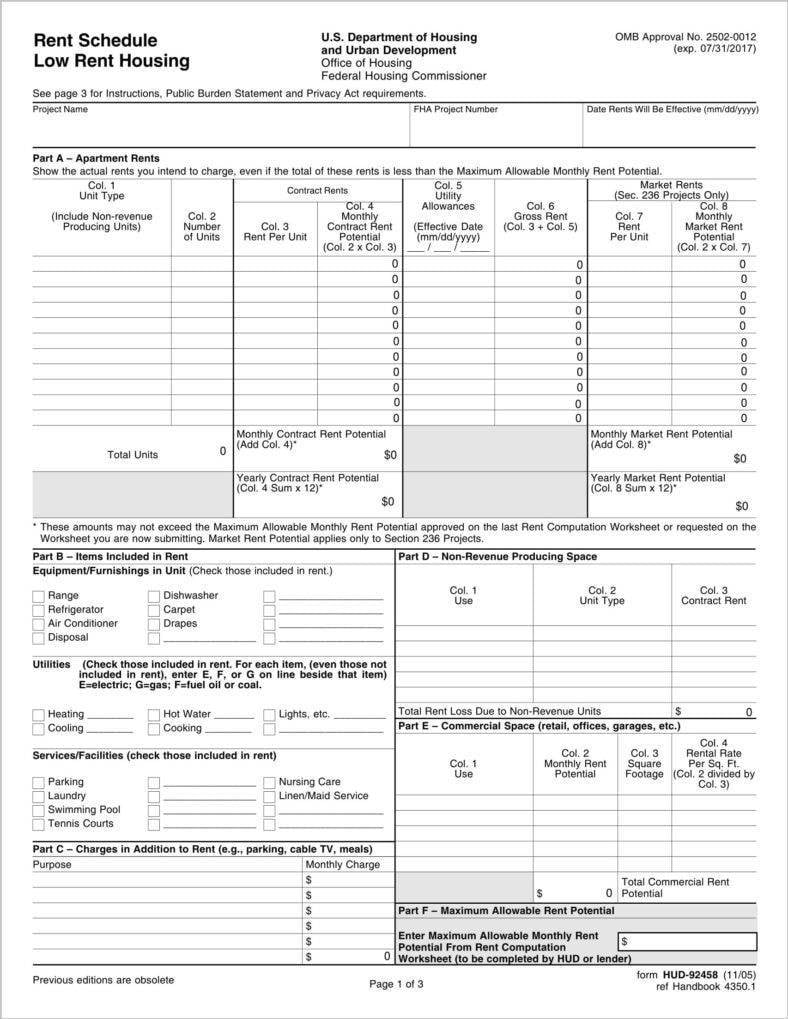

3+ Rent Schedule Templates PDF, Docs

Web j_dom_squad • 1 yr. Freddie mac form 1000 (8/88) fannie mae form 1007 (8/88) Web the 1007 form is used as a supplement to the 1004/2055 forms talked about above. Adjustments should be made only for items of significant difference between the comparables and the subject property. Web the following appraisal report forms for all conventional appraisal reports are.

A Step Toward Fairer Green Home Valuations GreenBuildingAdvisor

The 1007 form doesn't contain the required information to stand alone, but if you put together a word doc that contains the minimum requirements, and paste the form in, you should be ok. The single family comparable rent schedule form 1007 is intended to provide an appraiser with a familiar format to estimate the market rent of a property. This.

The Mortgage Lender Might Also Order An Additional Estimated Rent Schedule Appraisal On The Home To Support Market Rent, So Small Extra Bit Of Cost.

Web property appraisal report (form 1025), as applicable, and copies of the current lease agreement (s). This form must be reproduced by the seller. Web this form is intended to provide the appraiser with a familiar format to estimate the market rent of the subject property. The lender should retain the original of the form and the appraiser, the copy.

Freddie Mac Form 1000 (8/88) Fannie Mae Form 1007 (8/88)

This form is used to provide rental comparables and estimate the rental income for the subject property. The 216 form is usually ordered in conjunction with the 1007 form. Web the 1007 form is used as a supplement to the 1004/2055 forms talked about above. The single family comparable rent schedule form 1007 is intended to provide an appraiser with a familiar format to estimate the market rent of a property.

Web Do The 1007 As A Restricted Appraisal Report, And Include The Uspap Required Minimum In The Restricted Report.

Web j_dom_squad • 1 yr. Adjustments should be made only for those items of significant difference between the comparables and the subject property. It calls for information on the physical This is typically used for investment properties.

Web The Following Appraisal Report Forms For All Conventional Appraisal Reports Are Required To Be Submitted To The Ucdp:

You could use 75% of it assuming you have a lease agreement or a history of rental income (tax returns). Adjustments should be made only for items of significant difference between the comparables and the subject property. The 1007 form doesn't contain the required information to stand alone, but if you put together a word doc that contains the minimum requirements, and paste the form in, you should be ok. How is rental income taxed when you have a mortgage?