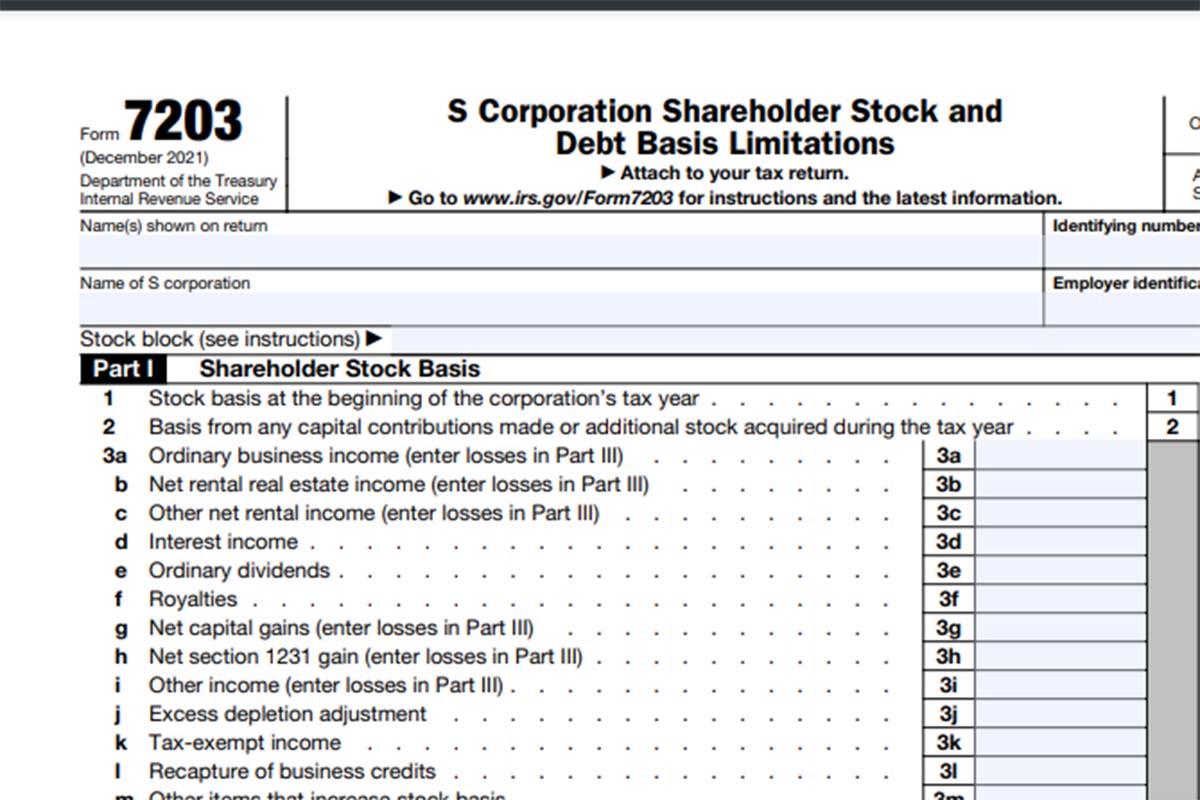

What Is Form 7203

What Is Form 7203 - Web form 7203 is filed by s corporation shareholders who: Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web s corporation shareholders use form 7203 to calculate their stock and debt basis. Web what is form 7203? Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. The irs recently released the final version of the new form 7203 to better document s corporation stock basis in connection with the. S corporation shareholders use form 7203 to figure the potential. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in.

I have read all of the instructions for form 7203,. Web by cooper melvin, jd, cpa. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web form 7203 is filed by s corporation shareholders who: Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web 1 best answer patriciav expert alumni in order to add a second form 7203, you must be in forms mode (available only in turbotax cd/download for desktop). Web form 7203 is filed by s corporation shareholders who: The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Form 7203 and the instructions are attached to this article. Web about form 7203, s corporation shareholder stock and debt basis limitations.

Web form 7203 was released by the irs in december 2021 to keep track of stock and debt basis. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. S corporation shareholders use form 7203 to figure the potential. The irs recently released the final version of the new form 7203 to better document s corporation stock basis in connection with the. Form 7203 and the instructions are attached to this article. Web 1 best answer patriciav expert alumni in order to add a second form 7203, you must be in forms mode (available only in turbotax cd/download for desktop). Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

The irs recently released the final version of the new form 7203 to better document s corporation stock basis in connection with the. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Web form 7203.

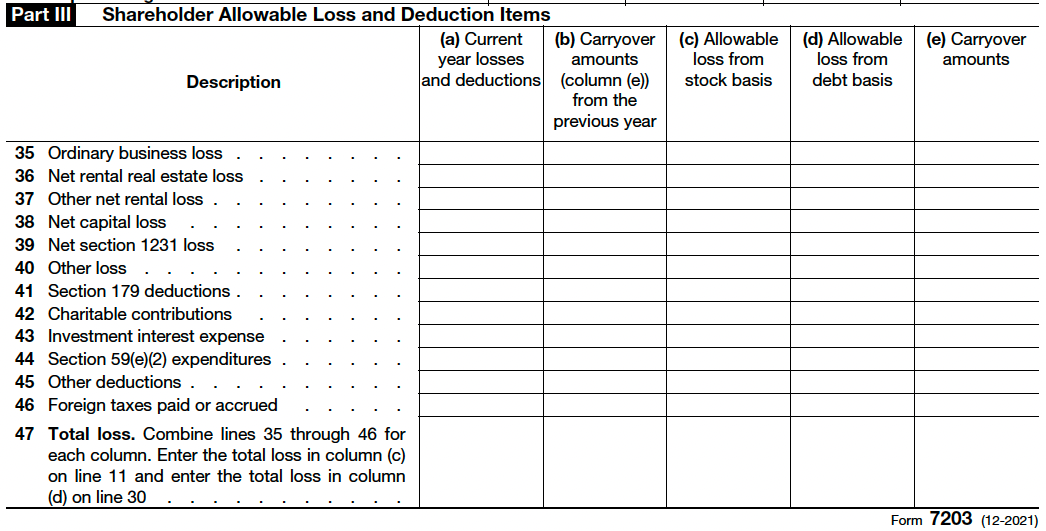

More Basis Disclosures This Year for S corporation Shareholders Need

The irs recently released the final version of the new form 7203 to better document s corporation stock basis in connection with the. View solution in original post february 23,. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. Web.

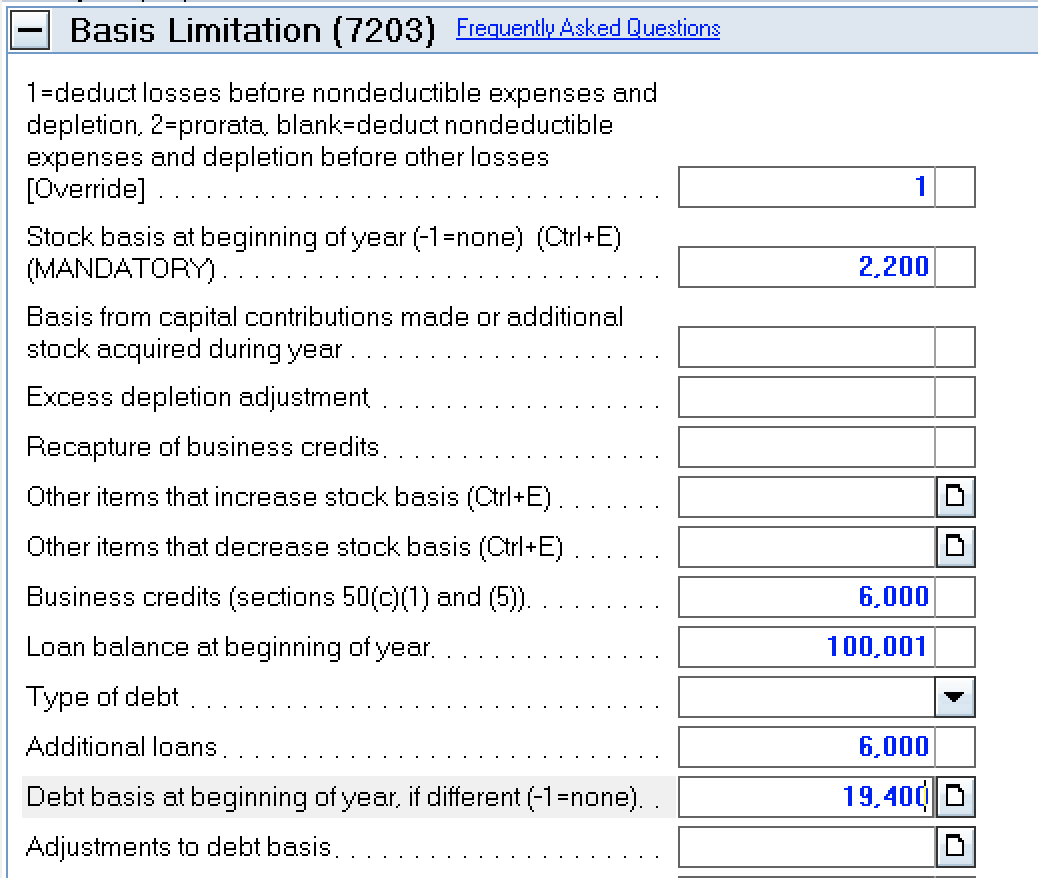

How to complete Form 7203 in Lacerte

Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web by cooper melvin, jd, cpa. The irs recently released the final version of the new form 7203 to better document s corporation stock basis in connection with the. Starting in tax year 2021, form 7203 replaces the shareholder's basis.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

View solution in original post february 23,. Form 7203 and the instructions are attached to this article. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. Claiming a deduction for their share. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a.

National Association of Tax Professionals Blog

Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. Web about form 7203, s corporation shareholder stock and debt basis.

Form7203PartI PBMares

Web 1 best answer patriciav expert alumni in order to add a second form 7203, you must be in forms mode (available only in turbotax cd/download for desktop). What’s new new items on form 7203. Claiming a deduction for their share. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock.

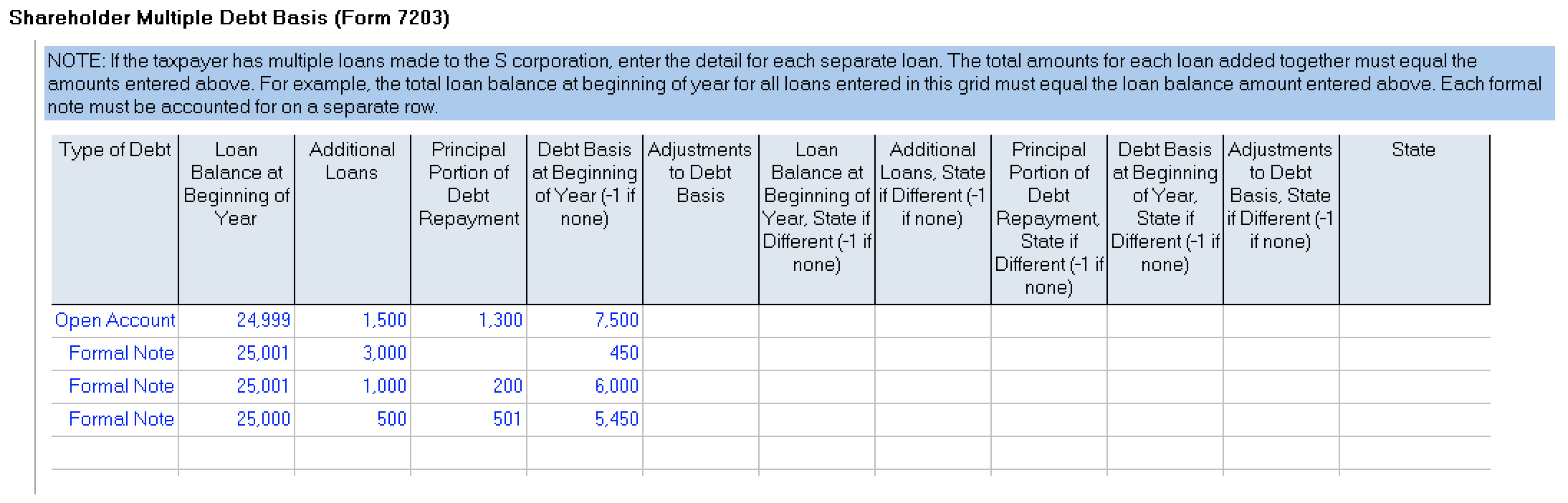

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

View solution in original post february 23,. Web s corporation shareholders use form 7203 to calculate their stock and debt basis. How do i clear ef messages 5486 and 5851? Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s. Web form.

How to complete Form 7203 in Lacerte

Web by cooper melvin, jd, cpa. Web s corporation shareholders use form 7203 to calculate their stock and debt basis. Web form 7203 is filed by s corporation shareholders who: Claiming a deduction for their share. S corporation shareholders use form 7203 to figure the potential.

IRS Issues New Form 7203 for Farmers and Fishermen

S corporation shareholders use form 7203 to figure the potential. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web form 7203 is filed by s corporation shareholders who: View solution in original post february 23,. Web community discussions taxes get your taxes done dkroc level 2 please explain.

National Association of Tax Professionals Blog

Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s. Web s corporation shareholders use form 7203 to calculate their stock and debt basis..

How Do I Clear Ef Messages 5486 And 5851?

Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web what is form 7203? Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s.

Web About Form 7203, S Corporation Shareholder Stock And Debt Basis Limitations.

Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. Web by cooper melvin, jd, cpa. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a.

The Irs Recently Released The Final Version Of The New Form 7203 To Better Document S Corporation Stock Basis In Connection With The.

Web form 7203 is filed by s corporation shareholders who: Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Form 7203 and the instructions are attached to this article. I have read all of the instructions for form 7203,.

Web Form 7203 Is Filed By S Corporation Shareholders Who:

Claiming a deduction for their share. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web form 7203 was released by the irs in december 2021 to keep track of stock and debt basis. S corporation shareholders use form 7203 to figure the potential.