What Is Form 8814

What Is Form 8814 - Form 8814 applies to a child’s unearned income in the form of investments, such. Benefits to using irs form 8814 the primary benefit to using this form is simplicity. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. Download this form print this form If income is reported on a parent's return, the child doesn't have to file a return. The child must be a dependent. Web it means that if your child has unearned income more than $2,200, some of it will be taxed at estate and trust tax rates (for tax years 2018 and 2019) or at the parent’s highest marginal tax rate (beginning in 2020). If you choose this election, your child may not have to file a return. Web irs form 8814 allows tax filers to pay a “kiddie tax” on their child’s unearned income, so the child does not have to file a separate tax return.

If income is reported on a parent's return, the child doesn't have to file a return. Form 8615, tax for certain children who have unearned income. Taxpayers can elect to apply the 2020 rules to tax years 2018 and 2019. The child must not have made any estimated tax payments. Web use this form if you elect to report your child’s income on your return. Web irs form 8814 allows tax filers to pay a “kiddie tax” on their child’s unearned income, so the child does not have to file a separate tax return. The child must be a dependent. Use this form if the parent elects to report their child’s income. Solved•by intuit•15•updated july 12, 2022. If you do, your child will not have to file a return.

Web irs form 8814 allows tax filers to pay a “kiddie tax” on their child’s unearned income, so the child does not have to file a separate tax return. Form 8615, tax for certain children who have unearned income. If you do, your child will not have to file a return. Form 8814 applies to a child’s unearned income in the form of investments, such. Parents use form 8814 to report their child’s income on their return, so their child will not have to file a. Download this form print this form Use this form if the parent elects to report their child’s income. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. The child must be a dependent. The child must not file a separate tax return.

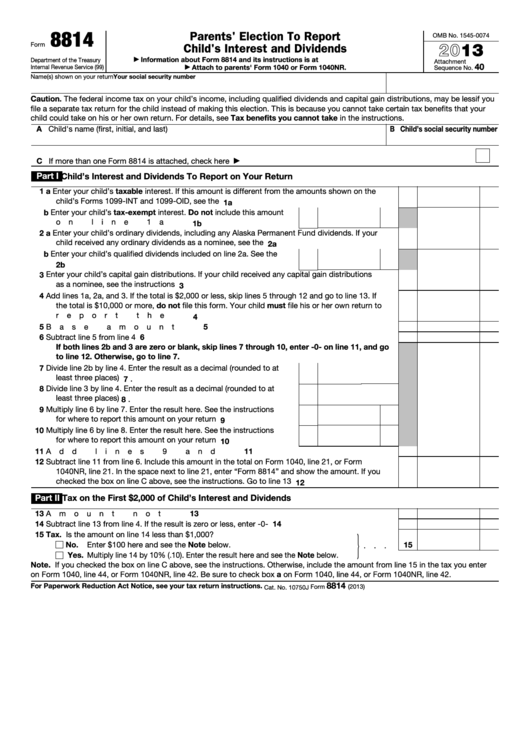

Fillable Form 8814 Parents' Election To Report Child'S Interest And

Web it means that if your child has unearned income more than $2,200, some of it will be taxed at estate and trust tax rates (for tax years 2018 and 2019) or at the parent’s highest marginal tax rate (beginning in 2020). Form 8615, tax for certain children who have unearned income. The child must not file a separate tax.

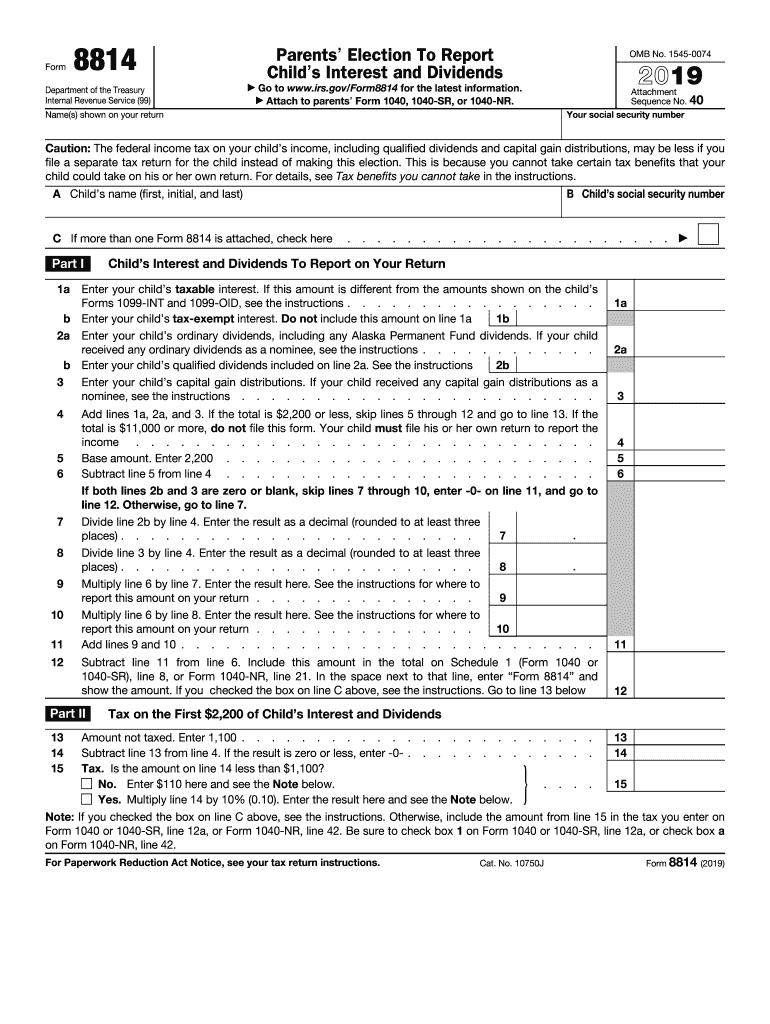

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. The child's income must be less than $10,500. Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs form 8814. The child must not file.

8814 Fill Out and Sign Printable PDF Template signNow

If you choose this election, your child may not have to file a return. The child must be a dependent. Web irs form 8814 allows tax filers to pay a “kiddie tax” on their child’s unearned income, so the child does not have to file a separate tax return. Web what is form 8814, parent's election to report child's interest/dividend.

Kish2019_8814 Dun Laoghaire Motor Yacht Club

There are benefits and drawbacks to this election. Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs form 8814. Web what is form 8814, parent's election to report child's interest/dividend earnings? If income is reported on a parent's return, the child doesn't have to file a return. The.

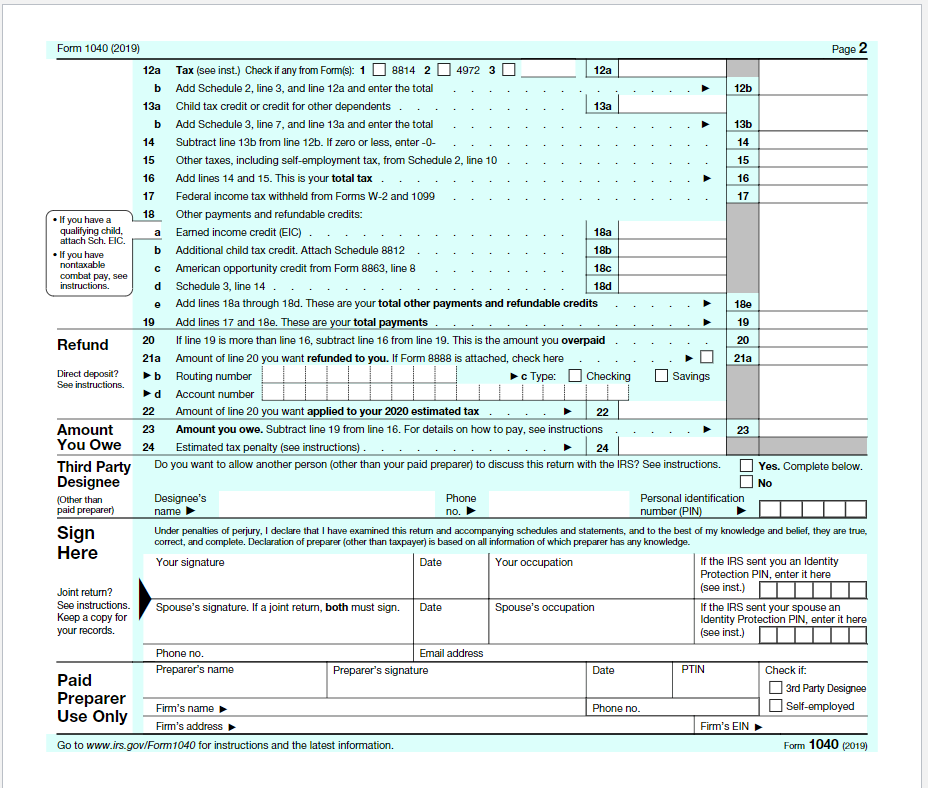

Solved This is a taxation subject but chegg didn't give a

If you do, your child will not have to file a return. If you choose this election, your child may not have to file a return. Web what is form 8814, parent's election to report child's interest/dividend earnings? The child must not have made any estimated tax payments. Web irs form 8814 allows tax filers to pay a “kiddie tax”.

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Web common questions about form 8615 and form 8814. If income is reported on a parent's return, the child doesn't have to file a return. To report a child's income, the child must meet all of the following conditions: Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs.

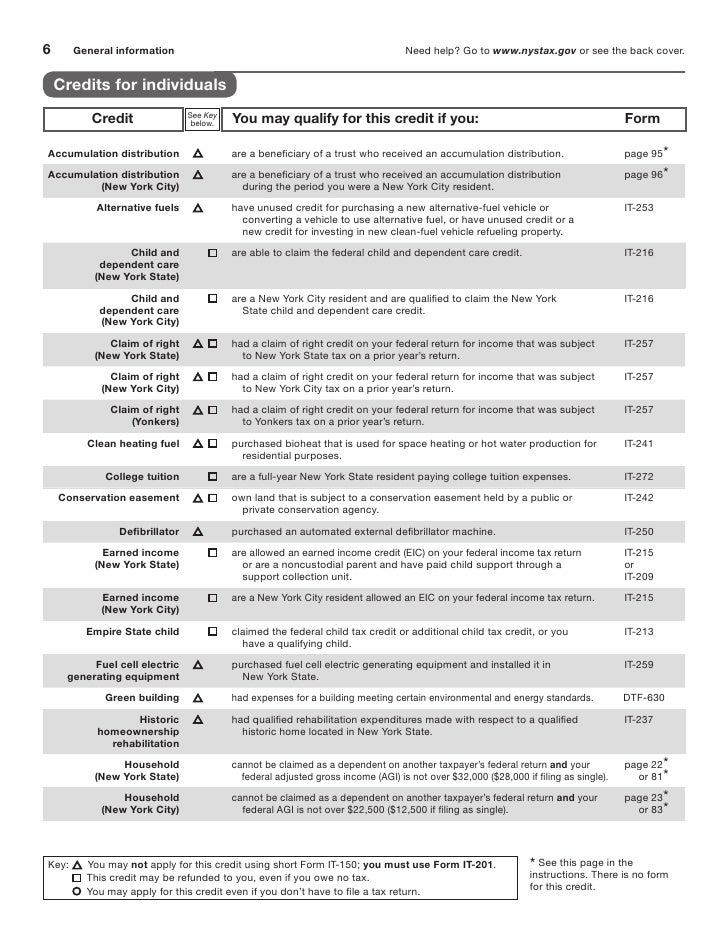

IT201 Resident Tax Return (long form) and instructions (inclu…

The child must not file a separate tax return. Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. The kiddie tax rules apply to any child who: The child's income must be less than $10,500. The child must be a dependent.

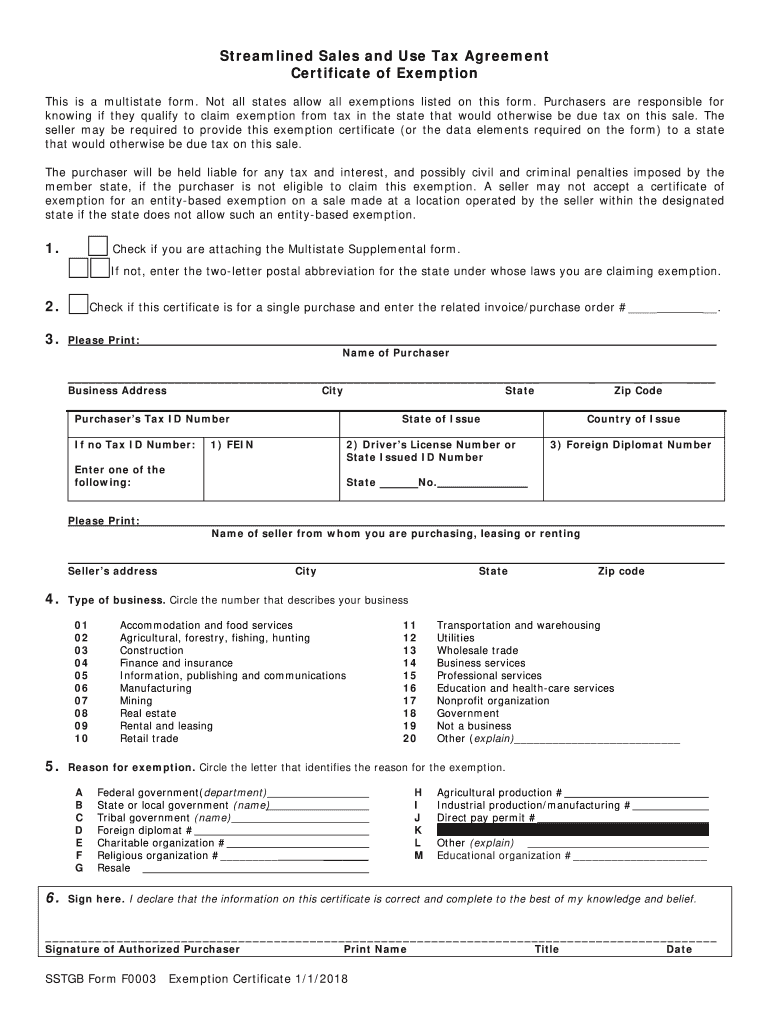

SSTGB F0003 20182021 Fill and Sign Printable Template Online US

The child's income must be less than $10,500. Web use this form if you elect to report your child’s income on your return. The child must be a dependent. There are benefits and drawbacks to this election. The child must not file a separate tax return.

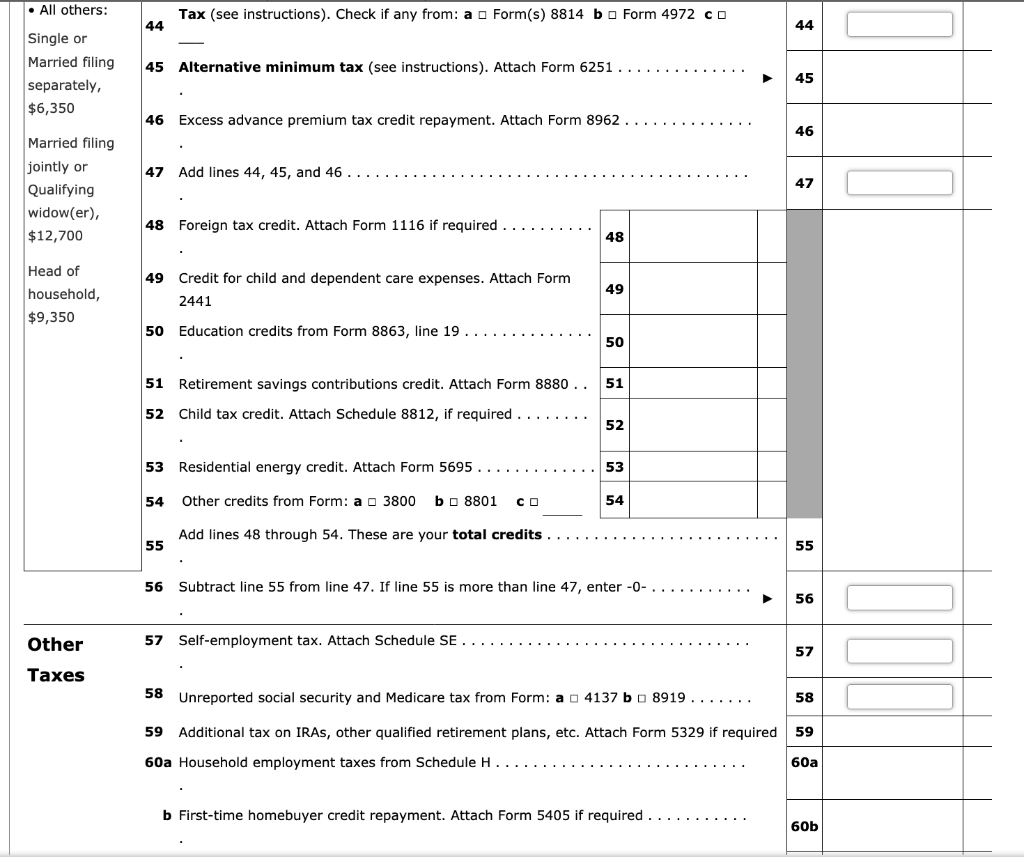

Note This Problem Is For The 2017 Tax Year. Janic...

Use this form if the parent elects to report their child’s income. If you do, your child will not have to file a return. Web common questions about form 8615 and form 8814. Web irs form 8814 allows tax filers to pay a “kiddie tax” on their child’s unearned income, so the child does not have to file a separate.

Schedule 8812 What is IRS Form Schedule 8812 & Filing Instructions

Web irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to report unearned income on behalf of certain children who meet certain criteria. Use this form if the parent elects to report their child’s income. Form 8615, tax for certain children who have unearned income. Form 8814 will be used if.

Form 8814 Applies To A Child’s Unearned Income In The Form Of Investments, Such.

Download this form print this form Web what is form 8814, parent's election to report child's interest/dividend earnings? Benefits to using irs form 8814 the primary benefit to using this form is simplicity. The child must not file a separate tax return.

Web Common Questions About Form 8615 And Form 8814.

Use this form if the parent elects to report their child’s income. Taxpayers can elect to apply the 2020 rules to tax years 2018 and 2019. Web use this form if you elect to report your child’s income on your return. The kiddie tax rules apply to any child who:

To Report A Child's Income, The Child Must Meet All Of The Following Conditions:

If income is reported on a parent's return, the child doesn't have to file a return. You can make this election if your child meets all of the following conditions. The child's income must be less than $10,500. Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs form 8814.

The Child Must Be A Dependent.

There are benefits and drawbacks to this election. If you do, your child will not have to file a return. The child must not have made any estimated tax payments. Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser.