What Is The Due Date For Form 1041 In 2021

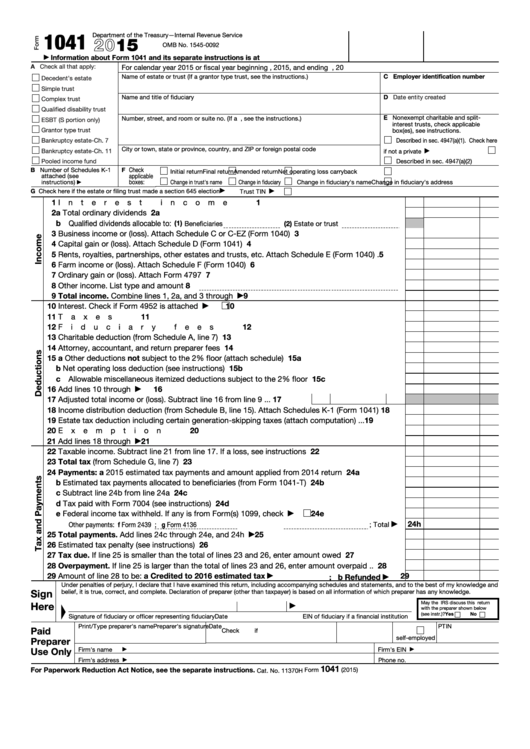

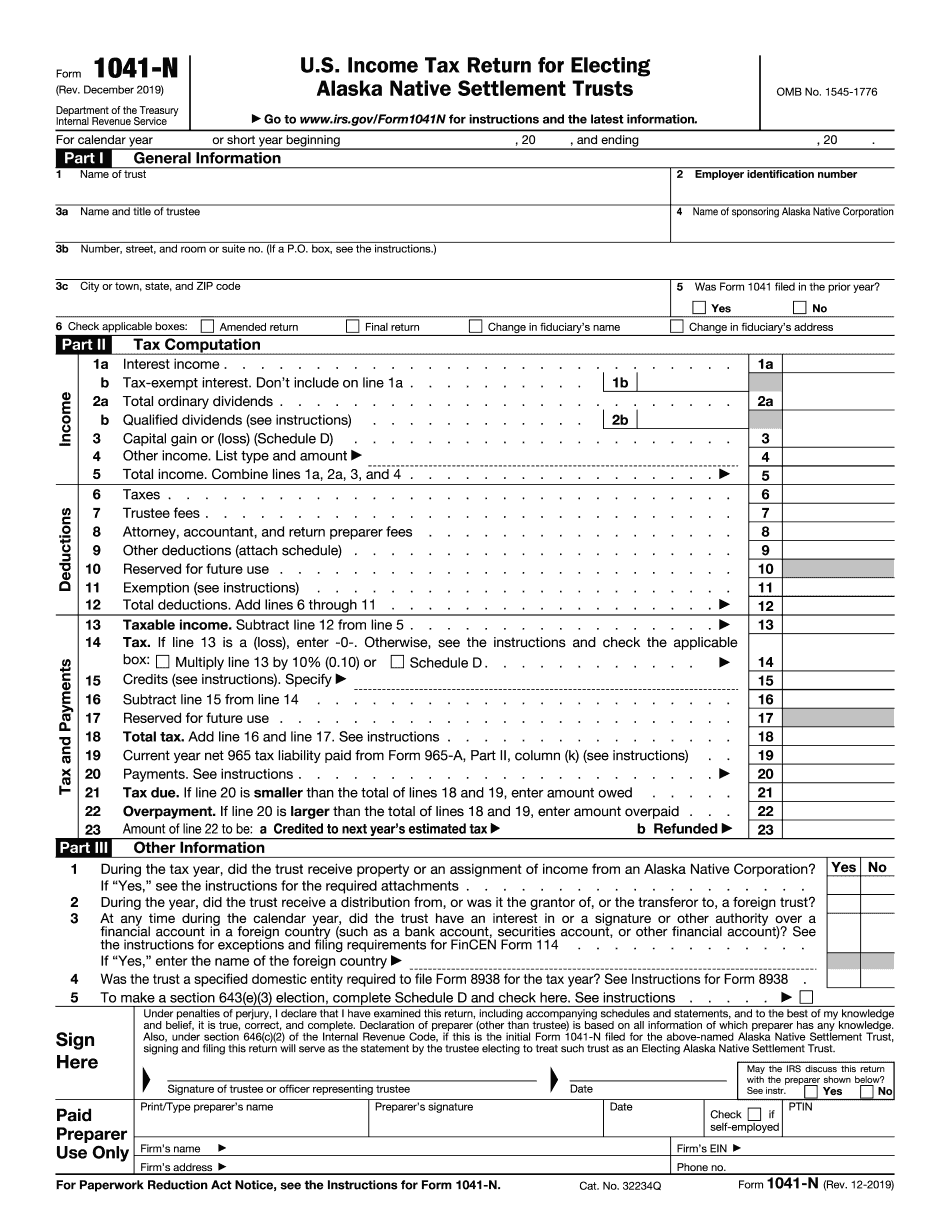

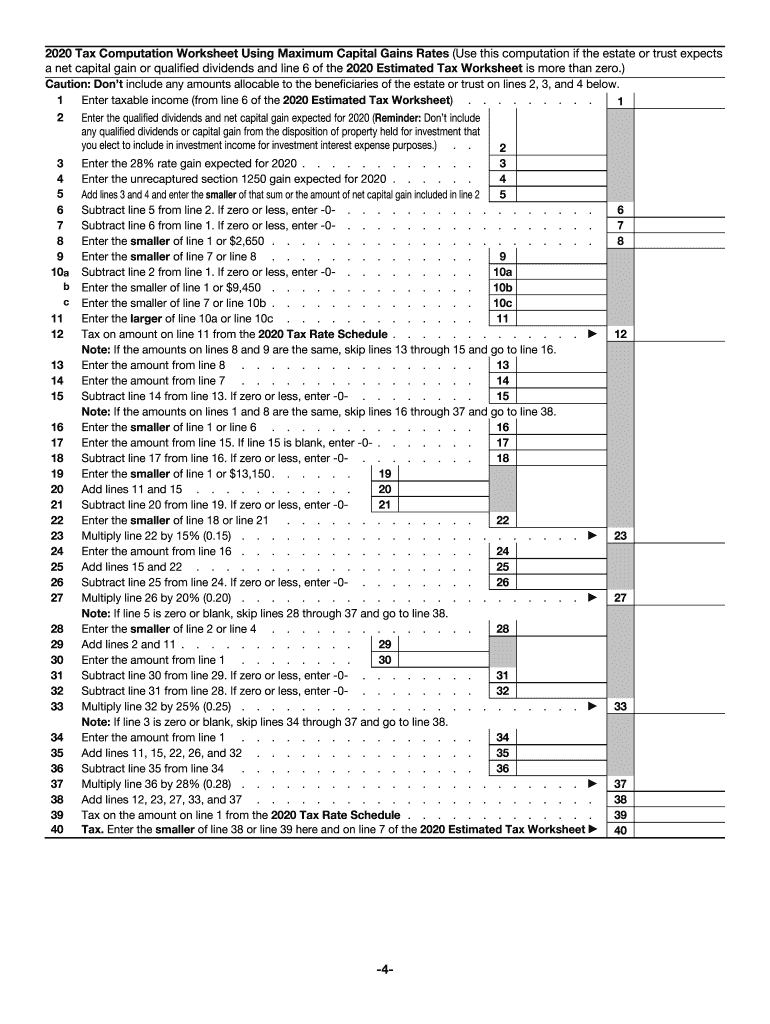

What Is The Due Date For Form 1041 In 2021 - Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. Web form 1041 on extension september 30th 5 ½ month extension from original due date form 5500 series on extension employee benefit plan on extension. Form 1120 generally shall be a six. Read on to learn the specifics… don’t file form 1041 if… form 1041 is not. March 1 st (paper file), march 31 st. Web payroll tax returns. Those returns are processed in. What's new due date of return. Web 1041 due date/extenstion the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year.

March 1 st (paper file), march 31 st. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Read on to learn the specifics… don’t file form 1041 if… form 1041 is not. Web due date for the irs form 941 for the tax year 2021. For example, an estate that has a tax year that. Partnerships (form 1065) march 15,. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Web as long as the estate exists, a form 1041 should be filed.

For example, an estate that has a tax year that. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. What's new due date of return. Web individual (form 1040) may 17, 2021: Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. Estates & trusts (form 1041) april 15, 2021: Form 1120 generally shall be a six. Web as long as the estate exists, a form 1041 should be filed. Web form 1041 on extension september 30th 5 ½ month extension from original due date form 5500 series on extension employee benefit plan on extension. Web due date for the irs form 941 for the tax year 2021.

Estate Tax Return When is it due?

Which extension form is used for form 1041? Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. The extension request will allow a 5 1/2 month. Those returns are processed in. Web individual (form 1040) may 17, 2021:

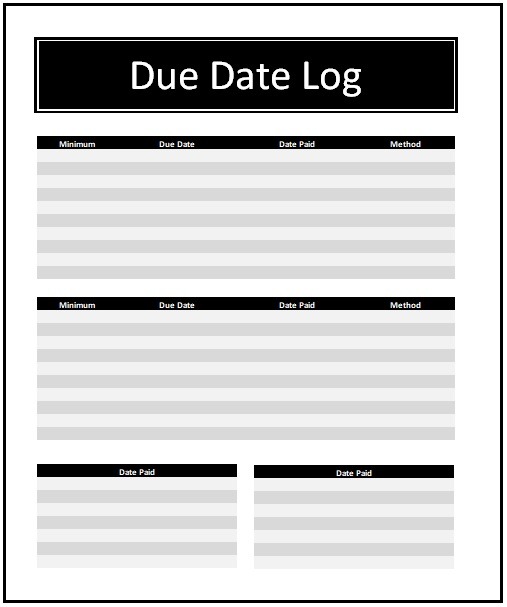

Due Date Log Templates 6+ Free Printable Word & Excel Samples

Which extension form is used for form 1041? The due date for filing a 1041 falls on tax day. Web as long as the estate exists, a form 1041 should be filed. Form 1120 generally shall be a six. Web 7 rows for filing deadlines and other information related to 1041 electronic filing, refer.

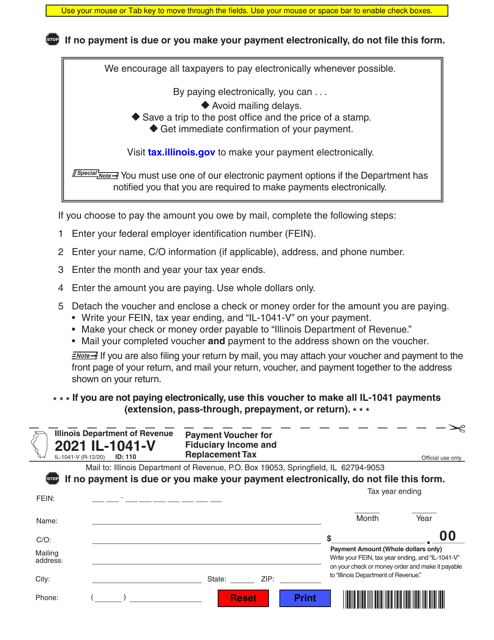

Form IL1041V Download Fillable PDF or Fill Online Payment Voucher for

The due date for filing a 1041 falls on tax day. Web what is the due date for irs form 1041? Web 1041 due date/extenstion the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. March 1 st (paper file), march 31 st. What's new due date of return.

Form 1041 U.S. Tax Return for Estates and Trusts

What's new due date of return. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Web payroll tax returns. Which extension form is used for form 1041? The extension request will allow a 5 1/2.

Fillable Form 1041 U.s. Tax Return For Estates And Trusts

Web as long as the estate exists, a form 1041 should be filed. What's new due date of return. Web 1041 due date/extenstion the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web 7 rows for filing deadlines and other information related to 1041 electronic filing, refer. Web for.

Notice for Annual Return Due Date Directorate of Investment and

The extension request will allow a 5 1/2 month. Web form 1041 on extension september 30th 5 ½ month extension from original due date form 5500 series on extension employee benefit plan on extension. Estates & trusts (form 1041) april 15, 2021: Web the original due date of april 15, 2021 was only extended for individuals, not estates or trusts.

TDS Return Due Date, Penalty and Forms GST Guntur

Web since this date falls on a holiday this year, the deadline for filing form 1041 is monday, april 18, 2022. Partnerships (form 1065) march 15,. Web 1041 due date/extenstion the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web for fiscal year estates and trusts, file form 1041.

Irs Form 1041 2021 Printable Printable Form 2022

Web since this date falls on a holiday this year, the deadline for filing form 1041 is monday, april 18, 2022. Read on to learn the specifics… don’t file form 1041 if… form 1041 is not. Web 7 rows for filing deadlines and other information related to 1041 electronic filing, refer. Web due date for the irs form 941 for.

Due dates for eform DPT3, MSME Form 1 & DIR3KYC Legality Simplified

The extension request will allow a 5 1/2 month. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. Web since this date falls on a holiday this year, the deadline for filing form 1041 is monday, april 18, 2022. Those returns are processed in. Read on.

Form 2018 Estimated Fill Out and Sign Printable PDF Template signNow

Web what is the due date for irs form 1041? Web 1041 due date/extenstion the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. March 1 st (paper file), march 31 st. Web individual (form 1040) may 17, 2021: For example, an estate that has a tax year that.

The Extension Request Will Allow A 5 1/2 Month.

Web 7 rows for filing deadlines and other information related to 1041 electronic filing, refer. Web since this date falls on a holiday this year, the deadline for filing form 1041 is monday, april 18, 2022. Web 1041 due date/extenstion the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s.

Web The Original Due Date Of April 15, 2021 Was Only Extended For Individuals, Not Estates Or Trusts Filing Form 1041.

Web as long as the estate exists, a form 1041 should be filed. Form 1120 generally shall be a six. Which extension form is used for form 1041? March 1 st (paper file), march 31 st.

Partnerships (Form 1065) March 15,.

Web payroll tax returns. The due date for filing a 1041 falls on tax day. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Read on to learn the specifics… don’t file form 1041 if… form 1041 is not.

Web Form 1041 On Extension September 30Th 5 ½ Month Extension From Original Due Date Form 5500 Series On Extension Employee Benefit Plan On Extension.

Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Form 941 is a federal tax return filed by employers in the. Estates & trusts (form 1041) april 15, 2021: What's new due date of return.

:max_bytes(150000):strip_icc()/2022Form1041-42ed301e7b3f4e1397e75fc675aea68f.jpg)