When Is Form 1041 Due For 2022

When Is Form 1041 Due For 2022 - Search site you are here. Web 2021 form 941 due date. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Keeping track of these dates and filing in a timely manner is the key to maintaining good. Web as this form is due to the irs quarterly, there are four deadlines to follow. Web for fiscal year estates, pay the total estimated tax by the 15th day of the 1st month following the close of the tax year, or file form 1041 by the 1st day of the 3rd month following. Web october 31, 2023. If you are located in. Get ready for tax season deadlines by completing any required tax forms today. Download, print or email irs 1041 tax form on pdffiller for free.

Web due dates in 2022 for 2021 tax reporting and 2022 tax estimates december 8, 2021 it has been a couple of strange and stressful years, with due dates that seemed. Web october 31, 2023. Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross. It’ll take only a few minutes. Download, print or email irs 1041 tax form on pdffiller for free. Web 2021 form 941 due date. For example, for a trust or. Web when is form 1041 due? And you are not enclosing a check or money order. And you are enclosing a check or money order.

The due date is april 18, instead of april 15, because of the emancipation day holiday in. Web 7 rows irs begins accepting form 1041 electronic tax returns. If you are located in. It’ll take only a few minutes. Calendar year estates and trusts must file form 1041 by april 18, 2023. If your taxes have been deposited on time and in full, the deadline is extended to the 10th. Web as this form is due to the irs quarterly, there are four deadlines to follow. Ad access irs tax forms. If the due date falls on. Download, print or email irs 1041 tax form on pdffiller for free.

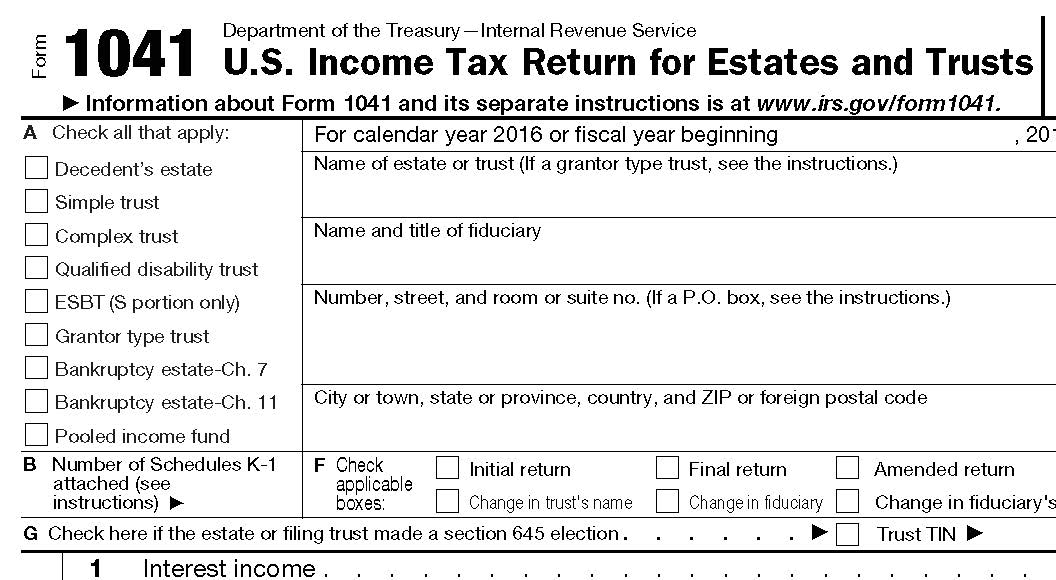

20192022 Form IRS 1041N Fill Online, Printable, Fillable, Blank

Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Web due dates in 2022 for 2021 tax reporting and 2022 tax estimates december 8, 2021 it has been a couple of strange and stressful years, with due dates that seemed. Web when is form.

Estate Tax Return When is it due?

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. For example, for a trust or. Web 2021 form 941 due date. It’ll take only a few minutes.

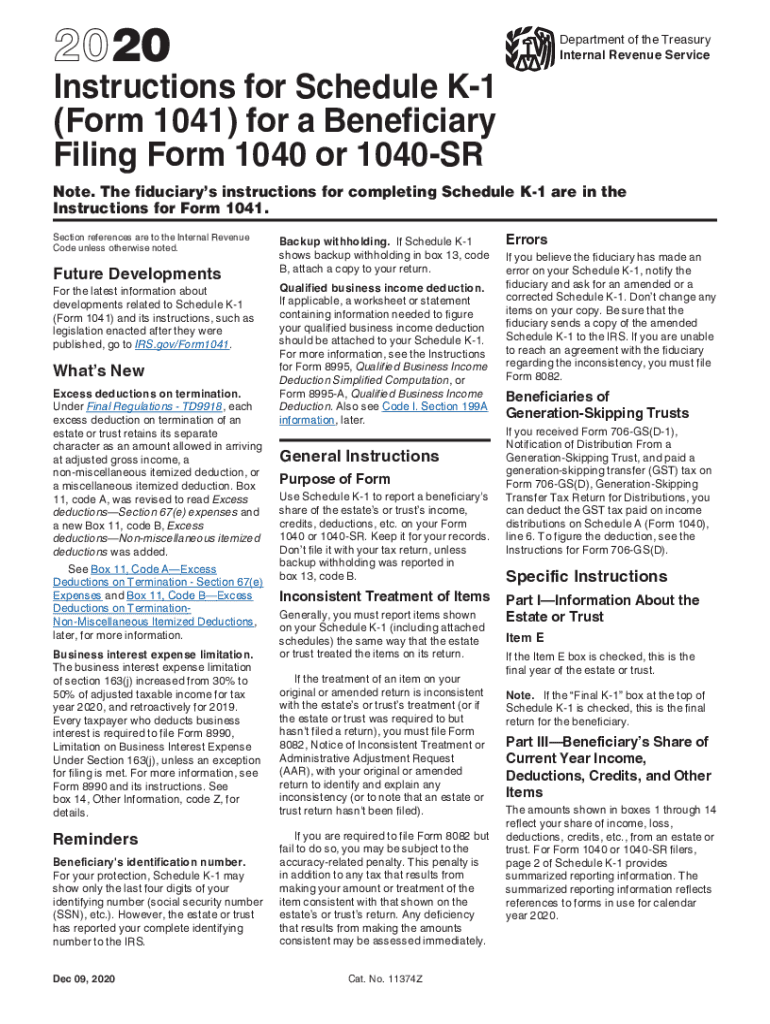

Instructions For Schedule K 1 Form 1041 For A Beneficiary Filing Form

Complete, edit or print tax forms instantly. Web october 31, 2023. For fiscal year estates and trusts,. Search site you are here. Schedule c and personal tax.

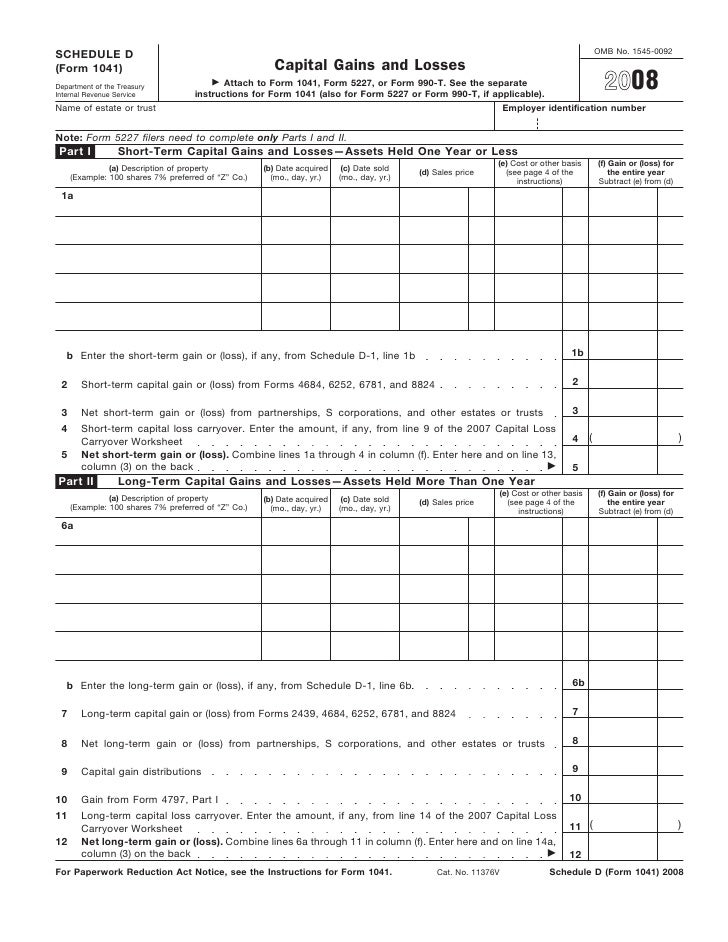

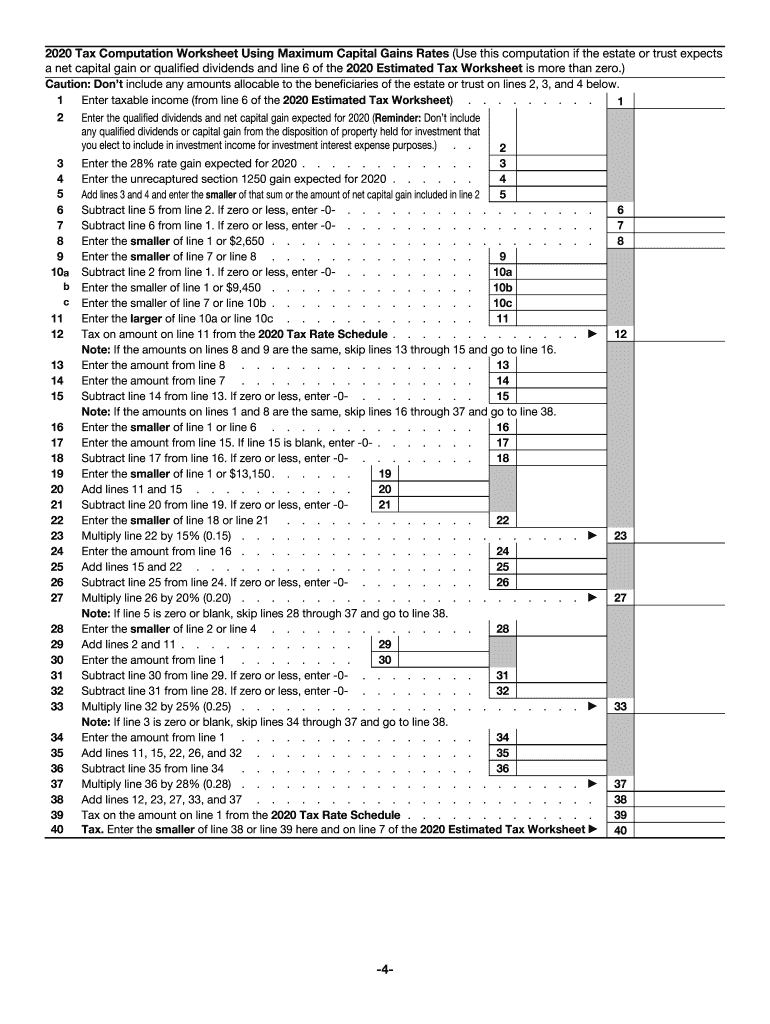

Form 1041 Schedule D

Web as this form is due to the irs quarterly, there are four deadlines to follow. Web estates and trusts irs form 1041 due on april 18, 2023; Get ready for tax season deadlines by completing any required tax forms today. Download, print or email irs 1041 tax form on pdffiller for free. Web october 31, 2023.

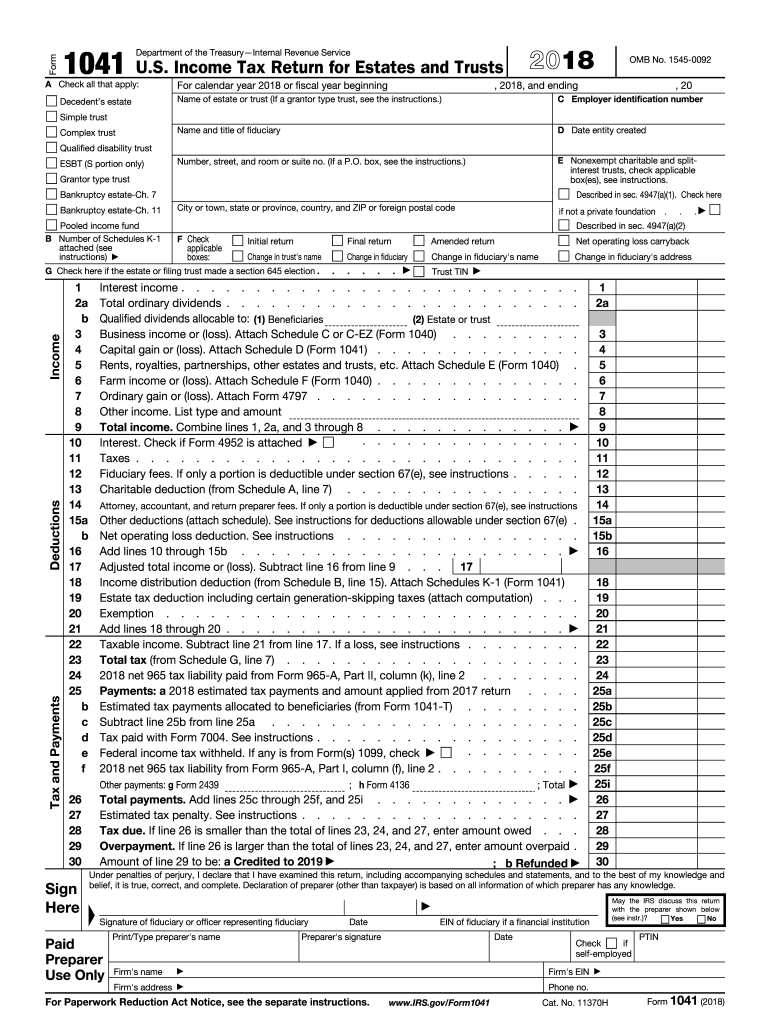

Form 1041 Fill Out and Sign Printable PDF Template signNow

Web october 31, 2023. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. For fiscal year estates and trusts,. Calendar year estates and trusts must file form 1041 by april 18, 2023. Web jan 4, 2022 | tax due dates, tax news mcb tax.

Form 1041 Extension Due Date 2019 justgoing 2020

Complete, edit or print tax forms instantly. And you are enclosing a check or money order. Search site you are here. For fiscal year estates and trusts,. And you are not enclosing a check or money order.

Form 2018 Estimated Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross. For fiscal year estates and trusts, file form 1041 and. Complete,.

U.S. Tax Return for Estates and Trusts, Form 1041

If you are located in. If your taxes have been deposited on time and in full, the deadline is extended to the 10th. If the due date falls on. Schedule c and personal tax. Calendar year estates and trusts must file form 1041 by april 18, 2023.

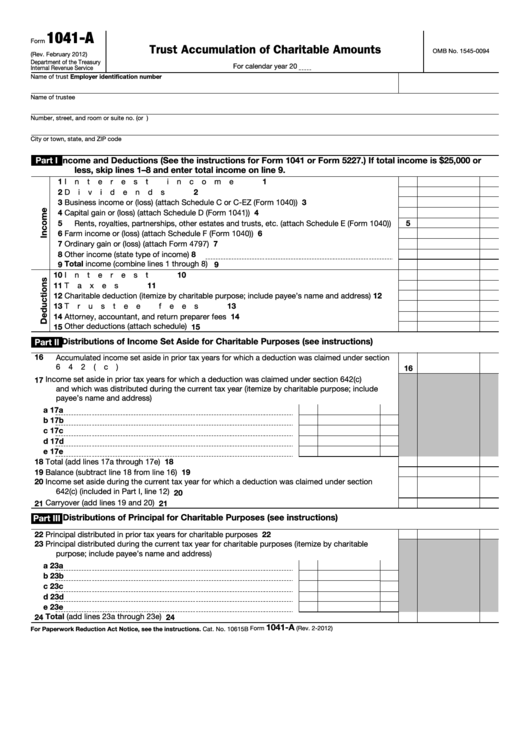

Fillable Form 1041A U.s. Information Return Trust Accumulation Of

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Complete, edit or print tax forms instantly. Business tax deadlines for federal tax returns.

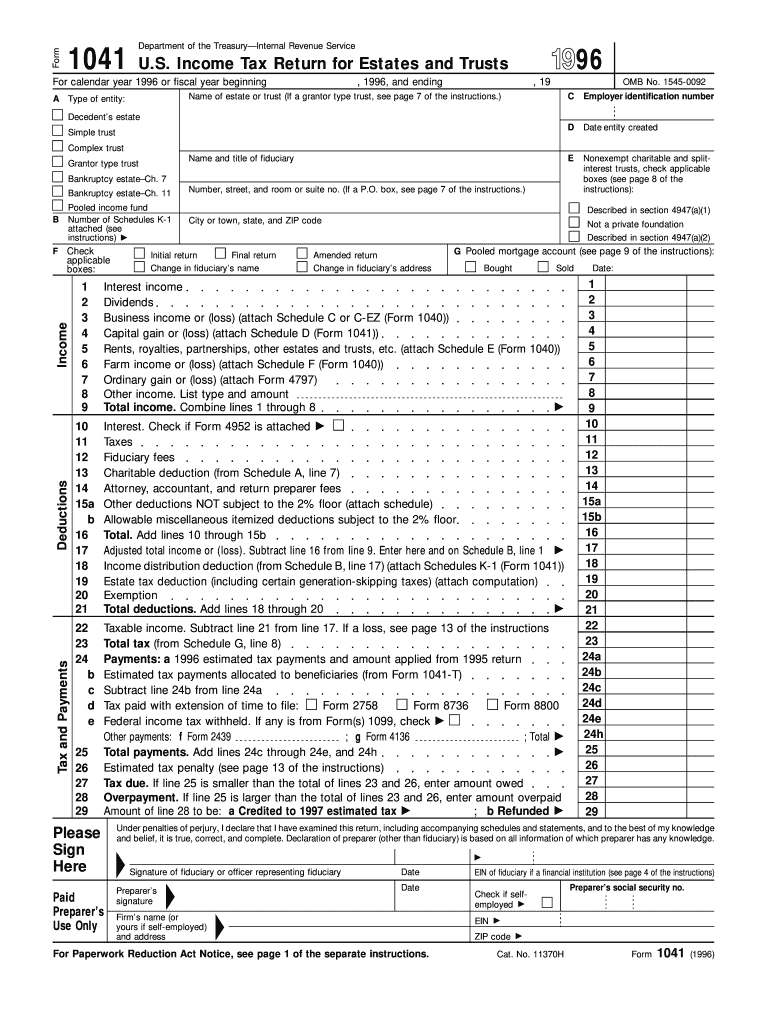

1996 Form IRS 1041 Fill Online, Printable, Fillable, Blank PDFfiller

If your taxes have been deposited on time and in full, the deadline is extended to the 10th. Web 2021 form 941 due date. Schedule c and personal tax. Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less.

Ad Access Irs Tax Forms.

If you are located in. If the due date falls on. Irs income tax forms, schedules and publications for tax year 2022: Web due date of return.

Know The Deadlines Of The Quarterly Form 941.

Web 7 rows irs begins accepting form 1041 electronic tax returns. Web when is form 1041 due? Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. For fiscal year estates and trusts,.

And You Are Not Enclosing A Check Or Money Order.

The due date is april 18, instead of april 15, because of the emancipation day holiday in. Complete, edit or print tax forms instantly. Web estates and trusts irs form 1041 due on april 18, 2023; Search site you are here.

Web As This Form Is Due To The Irs Quarterly, There Are Four Deadlines To Follow.

Business tax deadlines for federal tax returns. Complete, edit or print tax forms instantly. Keeping track of these dates and filing in a timely manner is the key to maintaining good. Web the tax shown on the 2022 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross.