When Is Form 990 Due

When Is Form 990 Due - This year, may 15 falls on a sunday, giving exempt organizations until may 16 to either get the proper version of form 990 filed with the irs or to submit form 8868 claiming an automatic. Common fiscal year ends and associated form 990 due dates are below. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. However, not all organizations operate on the same fiscal calendar. This is an annual deadline; Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's fiscal year end. Web when is form 990 due? Web upcoming form 990 deadline: Web monday, april 25, 2022 by justin d.

Web the deadline for filing form 990 is the 15th day of the 5th month after your organization's accounting period ends. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. For organizations on a calendar year, the form 990 is due on may 15th of the following year. Common fiscal year ends and associated form 990 due dates are below. Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is. If you need assistance with confirming your organization's fiscal year end. Web due date for filing returns requried by irc 6033. Web when is form 990 due? See where can i find my fiscal year end? This is an annual deadline;

Web due date for filing returns requried by irc 6033. This is an annual deadline; If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. You need to file your form 990 each year. Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's fiscal year end. Web the deadline for filing form 990 is the 15th day of the 5th month after your organization's accounting period ends. A business day is any day that isn't a saturday, sunday, or legal holiday. Web when is form 990 due? Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023.

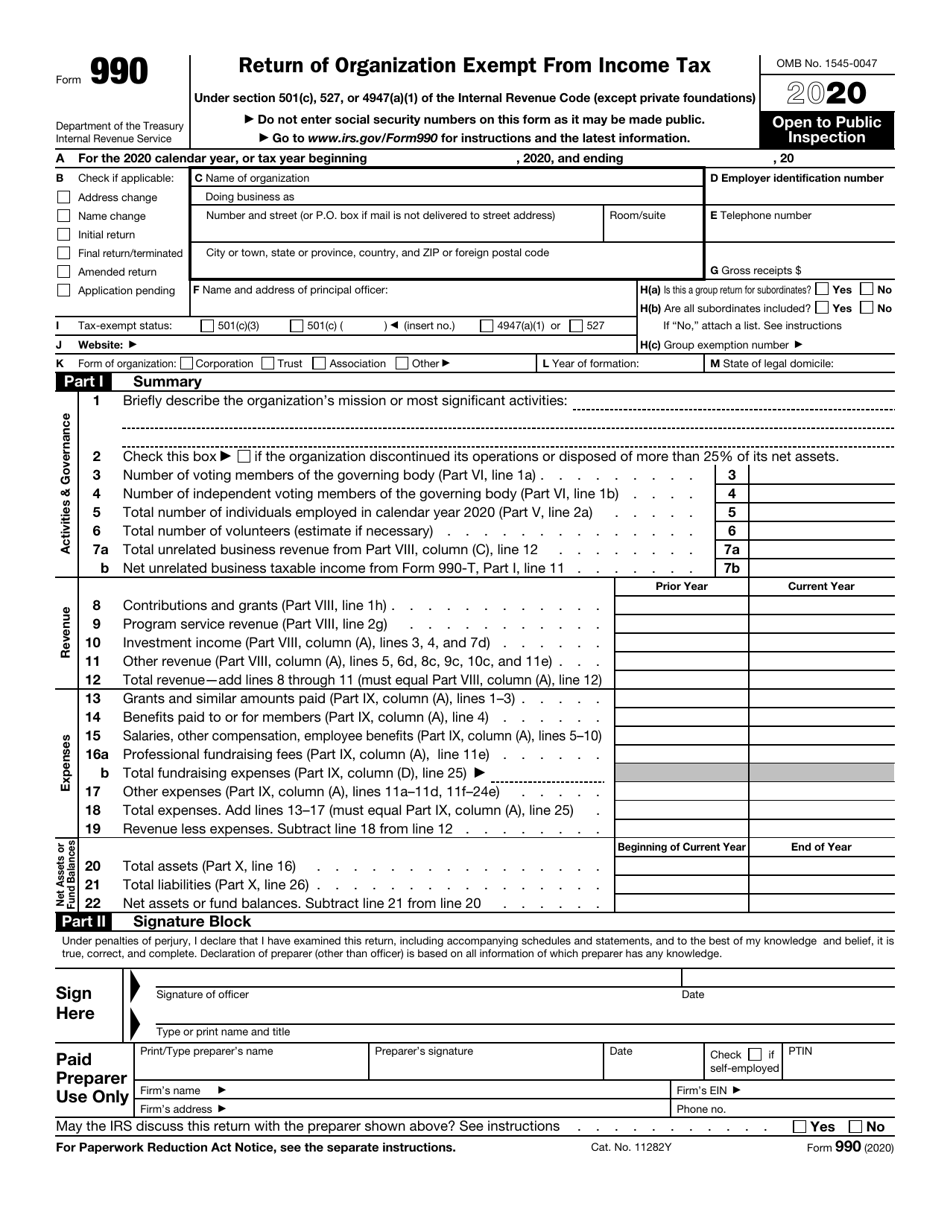

IRS Form 990 Download Fillable PDF or Fill Online Return of

Web due date for filing returns requried by irc 6033. Web when is form 990 due? For organizations on a calendar year, the form 990 is due on may 15th of the following year. Web upcoming form 990 deadline: This is an annual deadline;

Form 990 Due Today! Nonprofit Law Blog

A business day is any day that isn't a saturday, sunday, or legal holiday. You need to file your form 990 each year. For organizations on a calendar year, the form 990 is due on may 15th of the following year. Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is. Web.

Calendar Year Tax Year? Your 990 Is Due Tony

You need to file your form 990 each year. For organizations on a calendar year, the form 990 is due on may 15th of the following year. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. If you need assistance with confirming your organization's.

Form 990 Due Date for Exempt Organizations YouTube

This is an annual deadline; You need to file your form 990 each year. This year, may 15 falls on a sunday, giving exempt organizations until may 16 to either get the proper version of form 990 filed with the irs or to submit form 8868 claiming an automatic. Web the form 990 tax return is due by the 15th.

what is the extended due date for form 990 Fill Online, Printable

For organizations on a calendar year, the form 990 is due on may 15th of the following year. You need to file your form 990 each year. This is an annual deadline; If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Common fiscal year ends and associated form 990 due dates.

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

Web the deadline for filing form 990 is the 15th day of the 5th month after your organization's accounting period ends. This year, may 15 falls on a sunday, giving exempt organizations until may 16 to either get the proper version of form 990 filed with the irs or to submit form 8868 claiming an automatic. Common fiscal year ends.

form 990 due date 2018 extension Fill Online, Printable, Fillable

This is an annual deadline; Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Common fiscal year ends and associated form 990 due dates are below. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. If you need assistance with.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

Web monday, april 25, 2022 by justin d. You need to file your form 990 each year. Web due date for filing returns requried by irc 6033. A business day is any day that isn't a saturday, sunday, or legal holiday. However, not all organizations operate on the same fiscal calendar.

What You Need To Meet the Form 990 Due Date 2019 Blog TaxBandits

See where can i find my fiscal year end? If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. This year, may 15 falls on a sunday, giving exempt organizations until may 16 to either get the proper version of form 990 filed with the.

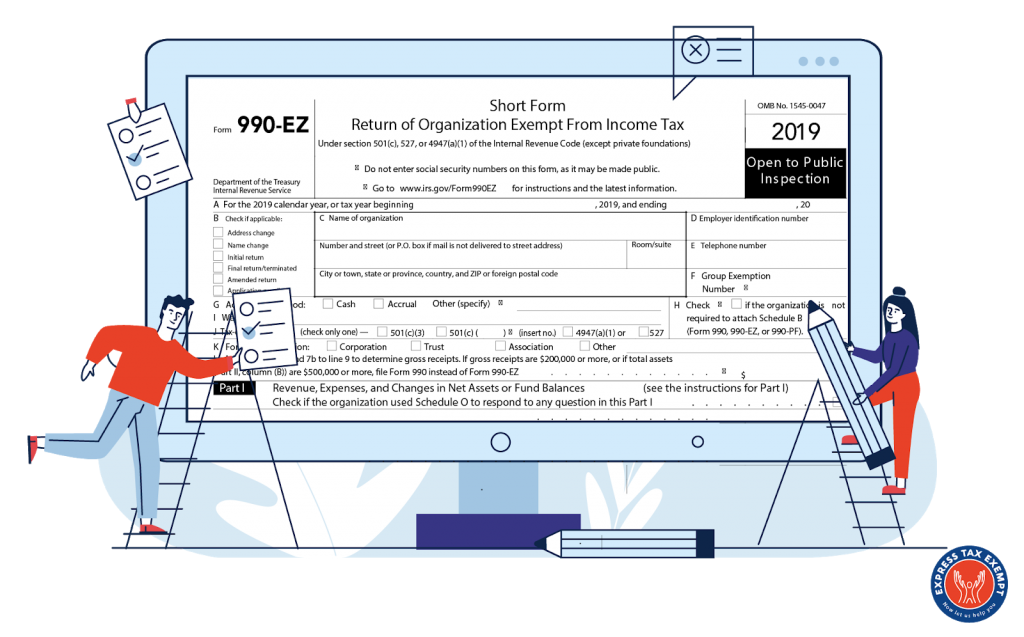

How Do I Complete The Form 990EZ?

This is an annual deadline; Web the deadline for filing form 990 is the 15th day of the 5th month after your organization's accounting period ends. Web monday, april 25, 2022 by justin d. A business day is any day that isn't a saturday, sunday, or legal holiday. Also, if you filed an 8868 extension on january 15, 2023, then.

If The Due Date Falls On A Saturday, Sunday, Or Legal Holiday, File On The Next Business Day.

Web due date for filing returns requried by irc 6033. However, not all organizations operate on the same fiscal calendar. A business day is any day that isn't a saturday, sunday, or legal holiday. Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is.

You Need To File Your Form 990 Each Year.

Common fiscal year ends and associated form 990 due dates are below. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. This year, may 15 falls on a sunday, giving exempt organizations until may 16 to either get the proper version of form 990 filed with the irs or to submit form 8868 claiming an automatic. For organizations on a calendar year, the form 990 is due on may 15th of the following year.

Web The Deadline For Filing Form 990 Is The 15Th Day Of The 5Th Month After Your Organization's Accounting Period Ends.

See where can i find my fiscal year end? Web upcoming form 990 deadline: Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's fiscal year end. Web monday, april 25, 2022 by justin d.

Web When Is Form 990 Due?

If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. If you need assistance with confirming your organization's fiscal year end. This is an annual deadline;